Concept explainers

Using an Aging Schedule to Estimate

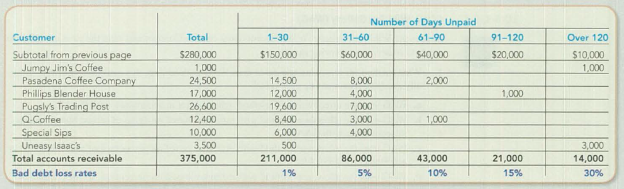

Assume you were recently hired by Caffe D’Amore, the company that formulated the world’s first flavored instant cappuccino and now manufactures several lines of flavored cappuccino mixes. Given the company’s tremendous sales growth, Caffe D’Amore’s receivables also have grown. Your job is to evaluate and improve collections of the company’s receivables.

By analyzing collections of

Required:

- 1. Enter the above totals in a spreadsheet and then insert formulas to calculate the total estimated uncollectible balance.

- 2. Prepare the year-end

adjusting journal entry to adjust the Allowance for Doubtful Accounts to the balance you calculated above. Assume the allowance account has an unadjusted credit balance of $8,000. - 3. Of the customer account balances shown above on the last page of the aged listing, which should be your highest priority for contacting and pursuing collection?

- 4. Assume Jumpy Jim’s Coffee account is determined to be uncollectible. Prepare the journal entry to write off the entire account balance.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

FUNDAMENTALS OF FINANCIAL ACCOUNTING

- To measure controllable production inefficiencies, which of the following is the best basis for a company to use in establishing the standard hours allowed for the output of one unit of product? a) Average historical performance for the last several years. b) Engineering estimates based on ideal performance. c) Engineering estimates based on attainable performance. d) The hours per unit that would be required for the present workforce to satisfy expected demand over the long run.arrow_forwardNeed general account solutionarrow_forwardFinancial Account information is presented below: Operating expenses $ 54,000 Sales returns and allowances 6,000 Sales discounts 8,000 Sales revenue 1,78,000 Cost of goods sold 92,000 Gross Profit would be: a. $92,000. b. $80,000. c. $86,000. d. $72,000.arrow_forward

- Which of the following statements is true? A. In a standard costing system, standard costs can only be used for cost control. B. In a standard costing system, standard costs can only be used for product costing. C. In a standard costing system, standard costs are used for both cost control and product costing. D. In a normal costing system, standard costs are used for cost control, and normal costs are used for product costing.arrow_forwardWhich of the following is not a correct expression of the accounting equation? a. Assets Liabilities + Owners Equity. b. Assets Liabilities Owners Equity. c. Assets Liabilities + Paid-In Capital + Retained Earnings. d. Assets = Liabilities + Paid-In Capital + Revenues Expenses. e. Assets Liabilities = Owners Equity.arrow_forwardOn January 1, 2017, Christel Madan Corporation had inventory of $54,500. At December 31, 2017, Christel Madan had the following account balances. Freight-in Purchases Purchase discounts Purchase returns and allowances Sales revenue $ 4,500 $5,10,000 $7,350 $ 3,700 $ 8,08,000 $ 5,900 $ 11,100 Sales discounts Sales returns and allowances At December 31, 2017, Christel Madan determines that its ending inventory is $64,500. Compute Christel Madan's 2017 gross profit.arrow_forward

- General Accountingarrow_forwardFinancial Accountingarrow_forwardBlue Corporation's standards call for 3,000 direct labor-hours to produce 1,200 units of product. During May 1,000 units were produced and the company worked 1,100 direct labor-hours. The standard hours allowed for May production would be: A. 3,000 hours. B. 1,100 hours. C. 2,500 hours. D. 2,000 hours.arrow_forward

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT