Concept explainers

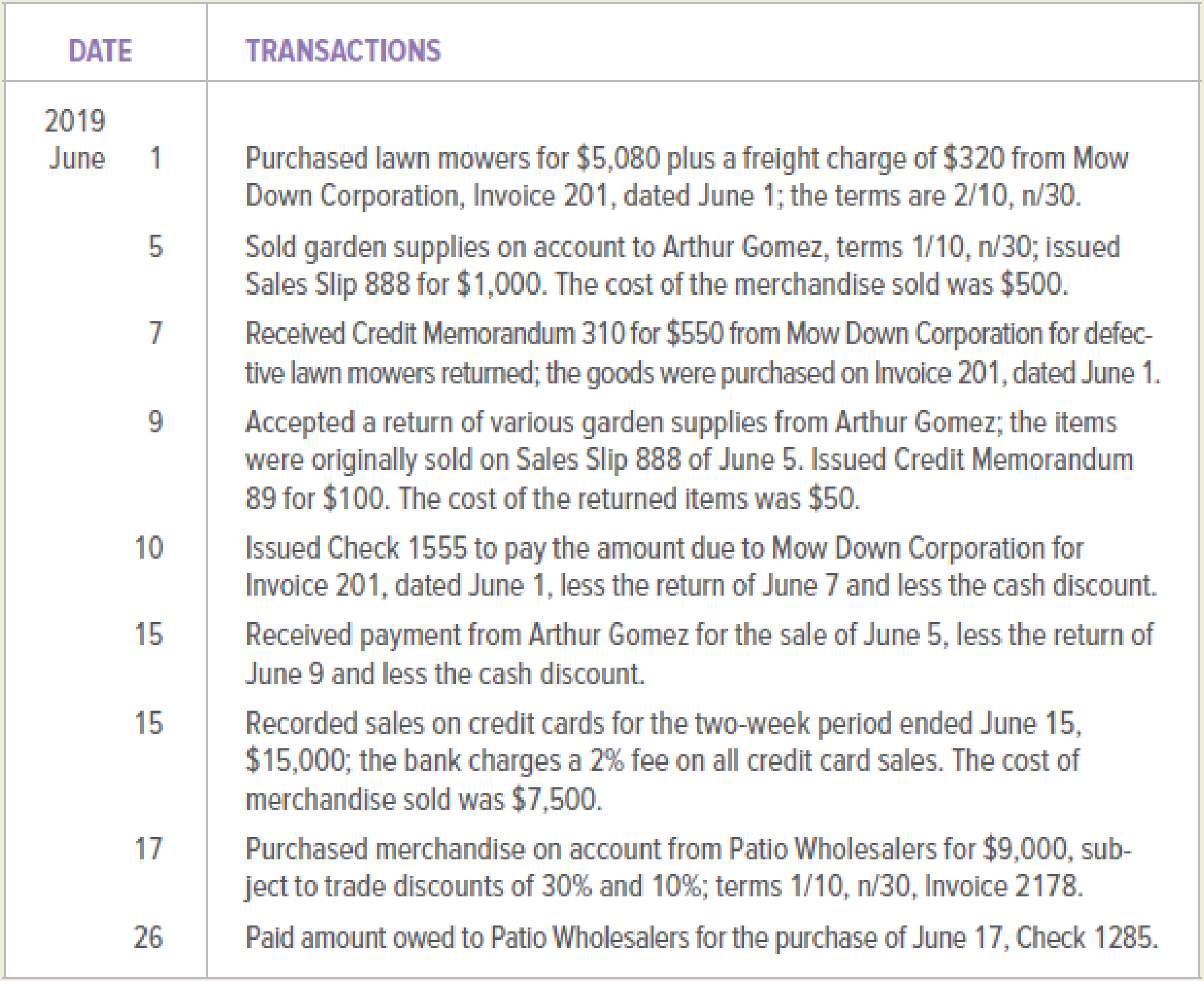

The following transactions took place at The Garden Center during June 2019. The Garden Center uses a perpetual inventory system. Record the transactions in a general journal. Use 10 as the page number for the general journal.

Analyze: Assume 20 lawn mowers were purchased from Mow Down Corporation on June 1. What was the average cost per lawn mower? (Hint: Include the freight charges as part of the cost of the lawn mowers.)

Post the transactions in the general journal using perpetual inventory system.

Explanation of Solution

Perpetual Inventory System:

The perpetual inventory systems are used for the management of the inventory which provides the latest information about inventory records. The transactions are recorded in inventory ledger correspondingly with each inventory purchase, inventory sale and inventory returns under the perpetual inventory system. The general ledger merchandise inventory account is also updated by the system.

The transactions are posted to general journal as follows:

Merchandise purchased on credit including freight charges:

| GENERAL JOURNAL | Page 10 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 1, 2019 | Merchandise inventory | 5,400 | ||

| Accounts payable/Company MDC | 5,400 | |||

| (to record the merchandise purchased on credit with 2/10, n/30 terms) | ||||

Table (1)

- • The merchandise inventory account is an asset account and the account balance is increasing. Therefore, it is debited. The freight charges are included within merchandise inventory account. No separate account is prepared for the freight charges under perpetual inventory system.

- • Accounts payable is liability and the account balance is increasing. Therefore, it is credited.

Recording of the merchandise sold:

| GENERAL JOURNAL | Page 10 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 5, 2019 | Accounts Receivable/ Company AG | 1000 | ||

| Sales | 1000 | |||

| (to record the merchandise sold on credit on terms 1/10,n/30) | ||||

Table (2)

- • The accounts receivables account is an asset account and the account balance is increasing. Therefore, the accounts receivables account is debited.

- • The sales account is credited. This because the sales account is identified as the revenue account and the revenue is generated from selling merchandise.

Recording of the cost of merchandise sold:

| GENERAL JOURNAL | Page 10 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 5, 2019 | Cost of goods sold | 500 | ||

| Merchandise inventory | 500 | |||

| (to record the cost of merchandise sold) | ||||

Table (3)

- • The cost of goods sold account is an expense account and the account balance is increasing. Therefore, the cost of goods sold account is debited.

- • The merchandise inventory account is an asset account and the account balance is increasing. Therefore, it is debited.

Record the receiving of credit memorandum and merchandise returned:

| GENERAL JOURNAL | Page 10 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 7, 2019 | Accounts payable/Company MDC | 550 | ||

| Merchandise inventory | 550 | |||

| (to record the merchandise returned and receiving credit memorandum) | ||||

Table (4)

- • Accounts payable is liability and the account balance is decreasing. Therefore, it is debited.

- • The merchandise inventory is an asset account and the account balance is decreasing. Therefore, its balance is credited.

Recording the returned merchandise sold and the credit memorandum:

| GENERAL JOURNAL | Page 10 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 9, 2019 | Sales returns and allowances | 100 | ||

| Accounts Receivable/ Company AG | 100 | |||

| (to record the merchandise returned plus sales tax) | ||||

Table (5)

- • The sales returns and allowances account is identified as contra revenue account with debit normal balance and increasing. Therefore, it is debited.

- • The account receivable account is an asset account and the account balance is decreasing. Therefore, the accounts payable account is credited.

Recording the cost of returned merchandise sold:

| GENERAL JOURNAL | Page 10 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 9, 2019 | Merchandise inventory | 50 | ||

| Cost of goods sold | 50 | |||

| (to record the cost of returned merchandise sold) | ||||

Table (6)

- • The merchandise inventory account is an asset account and the account balance is increasing. Therefore, it is debited.

- • The cost of goods sold is an expense account and the account balance is decreasing. Therefore, it is credited.

Recording the payment made with purchase discount:

| GENERAL JOURNAL | Page 10 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 10, 2019 | Accounts payable/Company MDC | 4,850 | ||

| Merchandise inventory | 90.6 | |||

| Cash | 4,759.4 | |||

| (to record the payment made and taking purchase discount ) | ||||

Table (7)

- • The accounts payable is liability and the account balance is decreasing. Therefore, accounts payable account is debited. The amount in accounts payable accounts is calculated after subtracting the purchase returns amount.

- • The purchase discount is received of the payment made and there is reduction is merchandise purchases cost. Therefore, merchandise inventory account is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the payment received from the accounts receivable:

| GENERAL JOURNAL | Page 10 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 15, 2019 | Sales discount | 9 | ||

| Cash | 891 | |||

| Accounts Receivable/Company AG | 900 | |||

| (to record the payment received from the account receivable) |

Table (8)

- • The sales discount account is identified as contra revenue account and it has debit normal balance which is increasing. Therefore, it is debited.

- • The cash account is an asset account and the account balance is increasing. Therefore, the cash account is debited.

- • The accounts receivable account is asset account and the account balance is decreasing. Therefore, it is credited.

Recording of the merchandise sold using credit card:

| GENERAL JOURNAL | Page 10 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 15, 2019 | Credit card expense | 300 | ||

| Cash | 14,700 | |||

| Sales | 15,000 | |||

| (to record the merchandise sold on credit) | ||||

Table (9)

- • The credit card expense is the expense account which has normal debit balance. The balance is increasing. Therefore, it is debited.

- • The cash account is an asset account and the account balance is increasing. Therefore, the cash account is debited.

- • The sales account is identified as the revenue account and the revenue is generated from selling merchandise. Therefore, sales account is credited.

Recording of the cost of merchandise sold:

| GENERAL JOURNAL | Page 10 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 15, 2019 | Cost of goods sold | 7,500 | ||

| Merchandise inventory | 7,500 | |||

| (to record the cost of merchandise sold) | ||||

Table (10)

- • The cost of goods sold account is an expense account and the account balance is increasing. Therefore, the cost of goods sold account is debited.

- • The merchandise inventory account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases on credit:

| GENERAL JOURNAL | Page 10 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 17, 2019 | Merchandise inventory | 5,670 | ||

| Accounts payable/Company PW | 5,670 | |||

| (to record the inventory purchased on account with terms 1/10,n/30) | ||||

Table (11)

- • The merchandise inventory account is an asset account and the account balance is increasing. Therefore, it is debited.

- • Accounts payable is liability and account balance is increasing. Therefore, it is credited.

Recording the payment made with purchase discount:

| GENERAL JOURNAL | Page 10 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 26, 2019 | Accounts payable/Company PW | 5,670 | ||

| Merchandise inventory | 56.7 | |||

| Cash | 5,613.3 | |||

| (to record the payment made and taking purchase discount ) | ||||

Table (12)

- • The accounts payable is liability and the account balance is decreasing. Therefore, accounts payable account is debited. The amount in accounts payable accounts is calculated after subtracting the purchase returns amount.

- • The purchase discount is received of the payment made and there is reduction is merchandise purchases cost. Therefore, merchandise inventory account is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Calculations for determining the cost per item purchased from company MDC are as follows:

The total cost incurred on purchasing 20 items is given as $5,400 including freight charges.

The formula for calculating cost per item is as follows:

Substitute $5,400 for the total cost incurred on purchasing of items and 20 for number of items.

The cost per item is calculated as $270.

Working Note:

Calculating purchase discount:

Under the perpetual inventory system, the purchase discount is represented by the merchandise inventory account. The purchased discount is calculated on the merchandise purchases cost excluding purchase returns and the freight charges. The purchase discount is given as two percent of the merchandise purchase.

The amount of purchase discount would be $90.6.

Calculations for sales discount:

The sales discount is provided to the customer by the seller fulfilling the terms of making the payments as per 1/10, n/30 terms. The customer is entitled to receive the one percent of sales discount on the merchandise sold if the payment is made with ten days of invoice provided.

The amount calculated as per given information would be $9.

Calculations for the credit card expense:

The fee is charged for availing the services of credit card. The bank fee to be charged as credit card is given as two percent for all credit card sales.

The expense would amount to be $300.

Calculations for the purchases amount:

The seller provides the trade discount of thirty percent and the ten percent on the list price to the buyer. The purchases amount to be recorded by the buyer would be the invoice price.

The purchases amount that would be calculated is $5,670.

Calculating purchase discount:

Under the perpetual inventory system, the purchase discount is represented by the merchandise inventory account. The purchased discount is calculated on the merchandise purchases cost excluding trade discount. The purchase discount is given as one percent of the merchandise purchase.

The amount of purchase discount would be $56.7.

Want to see more full solutions like this?

Chapter 8 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning