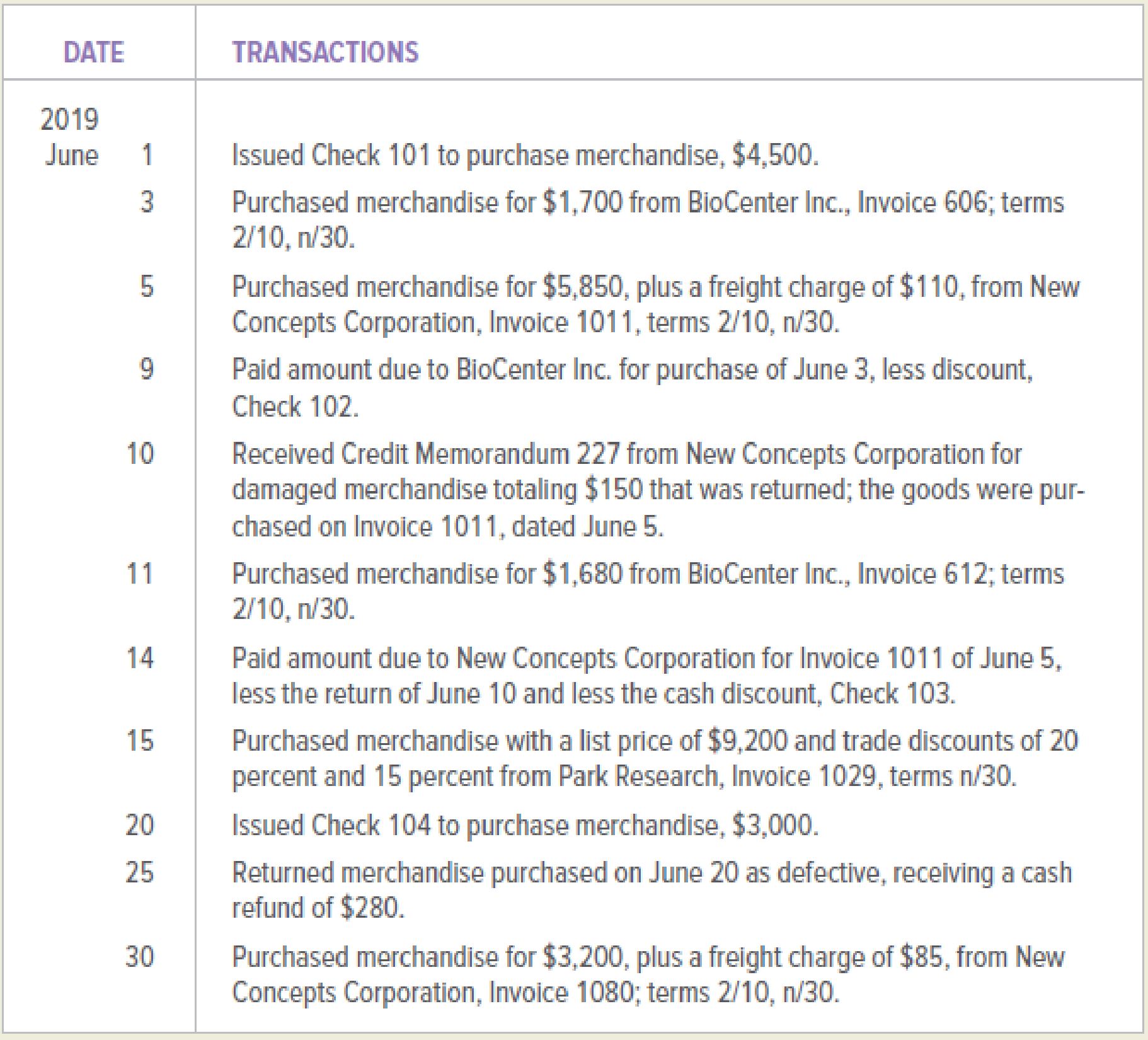

NewTech Medical Devices is a medical devices wholesaler that commenced business on June 1, 2019. NewTech Medical Devices purchases merchandise for cash and on open account. In June 2019, NewTech Medical Devices engaged in the following purchasing and cash payment activities:

INSTRUCTIONS

Journalize the transactions in a general journal. Use 1 as the journal page number.

Analyze: What was the amount of trade discounts received on the June 15 purchase from Park Research?

Record the transaction into general journal.

Explanation of Solution

Journalizing:

Journalizing refers to that process in which the transactions of an organization are recorded in a sequence. Based on the recorded entries, the accounts are posted to the relevant ledger accounts.

The general journal recording the transactions is as follows:

Recording the purchases on cash:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 1, 2019 | Purchases | 4,500 | ||

| Cash | 4,500 | |||

| (to record the inventory purchased on cash) | ||||

Table (1)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • The cash account is an asset account and account balance for cash is decreasing. Therefore, it is credited.

Recording the purchases on credit:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 3, 2019 | Purchases | 1,700 | ||

| Accounts payable/Company BC | 1,700 | |||

| (to record the inventory purchased on account with terms2/10, n/30) | ||||

Table (2)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • Since, the accounts payable is liability and account balance is increasing. Therefore, it is credited.

Recording the purchases on credit including freight charges:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 5, 2019 | Purchases | 5,850 | ||

| Freight In | 110 | |||

| Accounts payable/Company NC | 5,960 | |||

| (to record the inventory purchased on account with terms2/10, n/30) | ||||

Table (3)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • The freight-in account is debited. This is because the freight-in account is an expense account and it has normal debit balance which is increasing.

- • Accounts payable is liability and balance for accounts payable is increasing. Therefore, it is credited.

Recording the payment made:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 9, 2019 | Accounts payable/Company BC | 1,700 | ||

| Purchases discounts | 34 | |||

| Cash | 1,666 | |||

| (to record the payment made and receiving purchases discount) | ||||

Table (4)

- • The accounts payable is liability and the account balance is decreasing. Therefore, accounts payable account is debited.

- • The purchases discount account is a contra expense account. The account has the normal credit balance and its increasing. Therefore, it is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases returned and credit memorandum received:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 10, 2019 | Accounts payable/Company NC | 150 | ||

| Purchases returns and allowances | 150 | |||

| (to record the inventory returned and credit memorandum received) | ||||

Table (5)

- • The accounts payable account is a liability account. The accounts payable account has the normal credit balance and it is decreasing. Therefore, it is debited.

- • The purchase returns and allowances account is contra expenses account. The account has the normal credit balance and increasing. Therefore, it is credited.

Recording the purchases on credit:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 11, 2019 | Purchases | 1,680 | ||

| Accounts payable/Company BC | 1,680 | |||

| (to record the inventory purchased on account with terms2/10, n/30) | ||||

Table (6)

- • The purchases account is debited. This is because the purchase account is an expense account and has normal debit balance which is increasing.

- • Since, the accounts payable is liability and account balance is increasing. Therefore, it is credited.

Recording the payment made:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 14, 2019 | Accounts payable/Company NC | 5,810 | ||

| Purchases discounts | 114 | |||

| Cash | 5,696 | |||

| (to record the payment made and receiving purchases discount) | ||||

Table (7)

- • The accounts payable is liability and the account balance is decreasing. Therefore, accounts payable account is debited.

- • The purchases discount account is a contra expense account. The account has the normal credit balance and its increasing. Therefore, it is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases on credit:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 15, 2019 | Purchases | 6,256 | ||

| Accounts payable/Company PR | 6,256 | |||

| (to record the inventory purchased on account with terms n/30) | ||||

Table (8)

- • The purchases account is debited. This is because the purchase account is an expense account and has normal debit balance which is increasing.

- • Since, the accounts payable is liability and account balance is increasing. Therefore, it is credited.

Recording the purchases on cash:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 20, 2019 | Purchases | 3,000 | ||

| Cash | 3,000 | |||

| (to record the inventory purchased on cash) | ||||

Table (9)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • The cash account is credited. This is because the cash account is an asset account and account balance is decreasing.

Recording the purchases returned:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 25, 2019 | Cash | 280 | ||

| Purchases returns and allowances | 280 | |||

| (to record the inventory returned and cash received) | ||||

Table (10)

- • The cash account is debited. This is because the cash account is asset account and the account balance is increasing.

- • The purchase returns and allowances account is contra expenses account. The account has the normal credit balance and increasing. Therefore, it is credited.

Recording the purchases on credit including freight charges:

| GENERAL JOURNAL | Page 1 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| June 30, 2019 | Purchases | 3,200 | ||

| Freight In | 85 | |||

| Accounts payable/Company NC | 3,285 | |||

| (to record the inventory purchased on account with terms2/10, n/30) | ||||

Table (11)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • The freight In account is debited. This is because the freight In account is an expense account and it has normal debit balance which is increasing.

- • Since, the accounts payable is liability and account balance is increasing. Therefore, it is credited.

Calculation of total trade discount:

The formula to calculate the first trade discount is given below,

Substitute $9,200 for list price and 20 for percentage in the above formula.

The formula to calculate the second trade discount is given below,

Substitute $9,200 for list price, $1,840 for first trade discount and 15 for percentage in the above formula.

The formula to calculate the total trade discount is given below,

Substitute $1,840 for first trade discount and $1,104 for second trade discount in the above formula.

The total trade discount should be of $2,944 amount.

Working Note:

Calculation of purchases discount:

The purchases discounts are received by the buyer from the seller. The purchases discounts are received by the buyer for fulfilling the terms of timely payment to seller for purchases. The terms related to paying on timely basis with the company BC were agreed as 2/10, n/30. The terms 2/10, n/30 means the buyer is entitled to receive two percent of purchase discount on the purchases amount. The buyer will be entitled to the discount only if the payment is paid within ten days after provided invoice.

The amount calculated as purchase discount would be $34.

Calculation of purchases discount:

The purchases discounts are received by the buyer from the seller. The purchases discounts are received by the buyer for fulfilling the terms of timely payment to seller for purchases. The terms related to paying on timely basis with the company BC were agreed as 2/10, n/30. The terms 2/10, n/30 means the buyer is entitled to receive two percent of purchase discount on the purchases amount. The buyer will be entitled to the discount only if the payment is paid within ten days after provided invoice.

The amount calculated as purchase discount would be $114.

Calculations for the purchases amount:

The seller provides the trade discount of twenty percent and the fifteen percent on the list price to the buyer. The purchases amount to be recorded by the buyer would be at the invoice price.

The purchases amount that would be calculated is $6,256.

Want to see more full solutions like this?

Chapter 8 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

- NO WRONG ANSWERarrow_forwardAnjali Brewery has estimated budgeted costs of $72,600, $78,900, and $85,200 for the manufacture of 4,000, 5,000, and 6,000 gallons of beer, respectively, next quarter. What are the variable and fixed manufacturing costs in the flexible budget for Anjali Brewery? Answerarrow_forwardCalculate the labor variancearrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning