Concept explainers

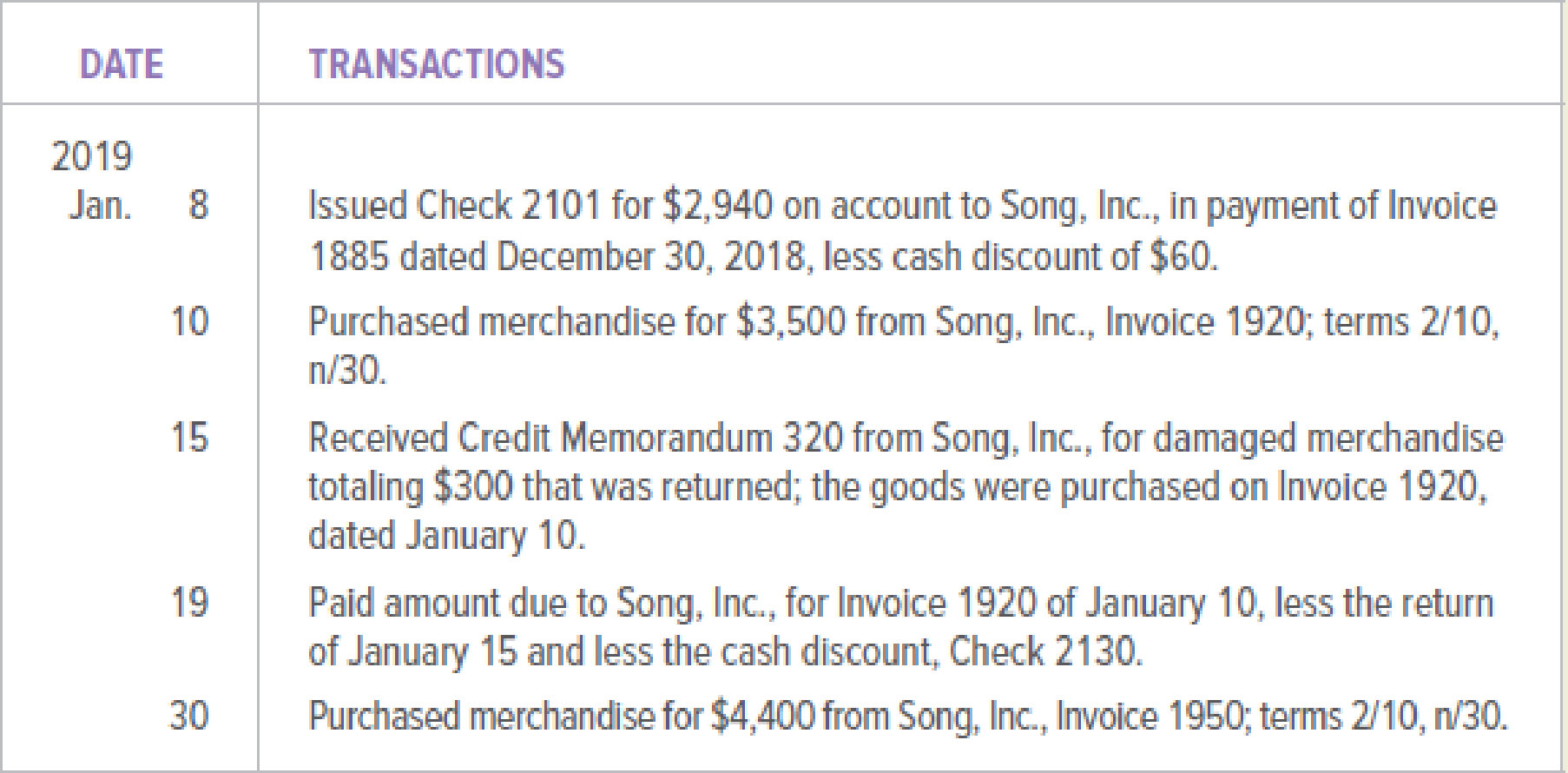

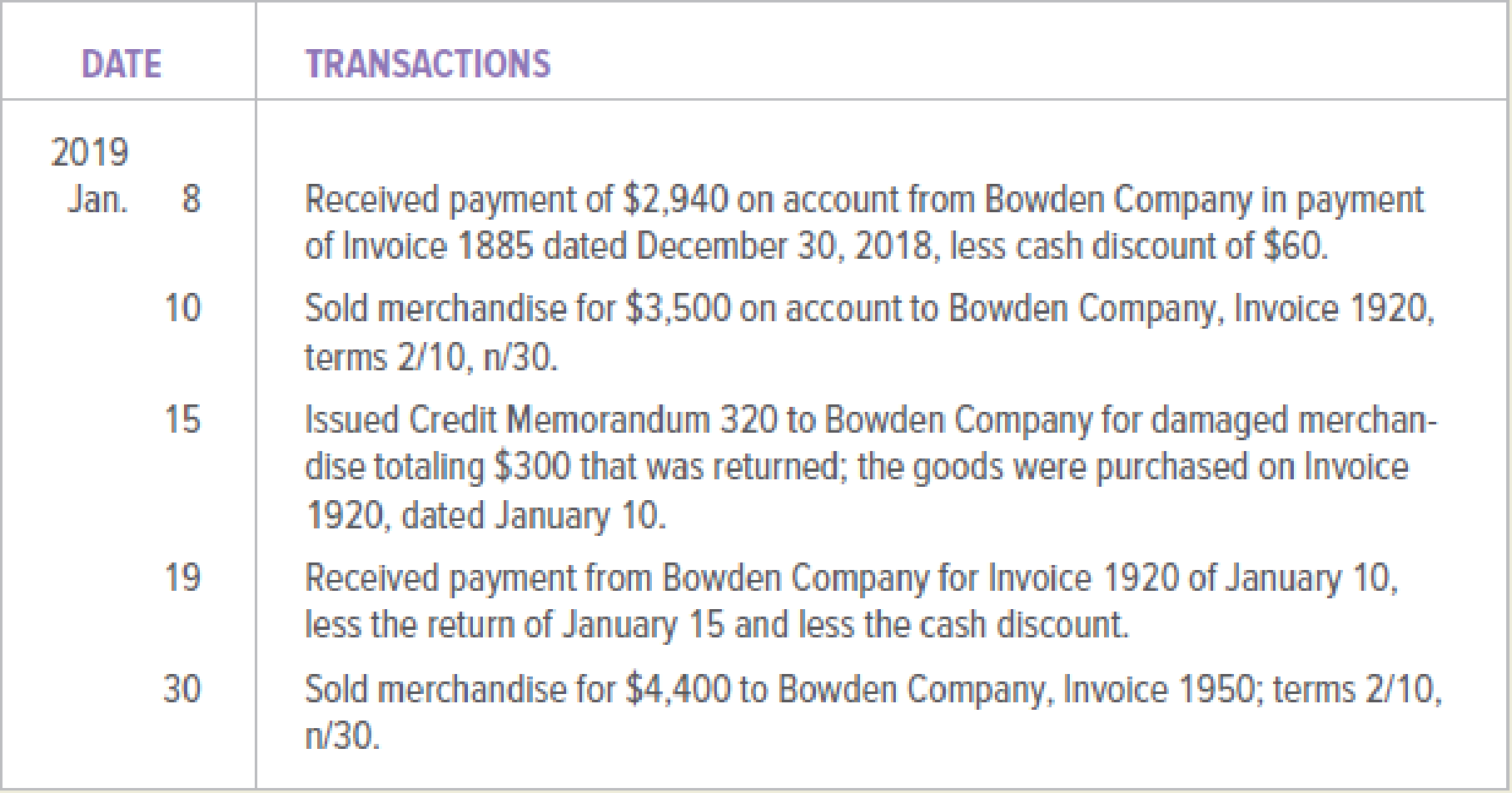

Bowden Company (buyer) and Song, Inc. (seller), engaged in the following transactions during January 2019:

Bowden Company

Song, Inc.

INSTRUCTIONS

- 1. Open the accounts payable ledger account and

accounts receivable ledger account indicated below for both Bowden Company and Song, Inc. Enter the balances as of January 1, 2019. - 2. Journalize the transactions above in a general journal for both Bowden Company and Song, Inc. Begin the journals for both companies with page 21.

- 3.

Post the transactions to the appropriate accounts in the general ledger and the accounts payable subsidiary ledger for Bowden Company. - 4. Post the transactions to the appropriate accounts in the general ledger and the accounts receivable subsidiary ledger for Song, Inc.

GENERAL LEDGER ACCOUNTS—BOWDEN COMPANY

201 Accounts Payable, $3,000 Cr.

ACCOUNTS PAYABLE LEDGER ACCOUNT—BOWDEN COMPANY

Song, Inc., $3,000

GENERAL LEDGER ACCOUNTS—SONG, INC.

111 Accounts Receivable, $3,000 Dr.

ACCOUNTS RECEIVABLE LEDGER ACCOUNT—SONG, INC.

Bowden Company, $3,000

Analyze: What is the balance of the accounts payable for Song, Inc., in the Bowden Company accounts payable subsidiary ledger? What is the balance of the accounts receivable for Bowden Company in the Song, Inc., accounts receivable subsidiary ledger?

1.

Create the accounts payable ledger account and accounts receivable ledger account of company B and company SI indicating the balances on given date.

Explanation of Solution

Ledgers:

Ledgers are T accounts to which journal entries are posted. Ledgers are used to ascertain transactions of a particular account and its closing balance for the period. The day-to-day transactions of the business are recorded in their respective ledgers.

The accounts payable ledger account of company B is as follows:

| Accounts Payable | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| January 1, 2019 | Balance | 3,000 | ||

Table (1)

The accounts receivable ledger account of company SI is as follows:

| Accounts Receivable | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| January 1, 2019 | Balance | 3,000 | ||

Table (2)

2.

Record the entries into the general journal of the company B and the company SI.

Explanation of Solution

The recording of entries in the general journal for company B is as follows:

Recording the payment made:

| GENERAL JOURNAL | Page 21 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 8, 2019 | Accounts payable/Company SI | 3,000 | ||

| Purchases discounts | 60 | |||

| Cash | 2,940 | |||

| (to record the payment made and receiving purchases discount) | ||||

Table (3)

- • The accounts payable account is liability and the account balance is decreasing. Therefore, accounts payable account is debited.

- • The purchases discount account is a contra expense account. The account has the normal credit balance and it is increasing. Therefore, it is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases on credit:

| GENERAL JOURNAL | Page 21 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 10, 2019 | Purchases | 3,500 | ||

| Accounts payable/Company SI | 3,500 | |||

| (to record the inventory purchased on account with terms2/10, n/30) | ||||

Table (4)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • Accounts payable is liability and the account balance is increasing. Therefore, it is credited.

Recording the purchases returned and credit memorandum received:

| GENERAL JOURNAL | Page 21 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 15, 2019 | Accounts payable/Company SI | 300 | ||

| Purchases returns and allowances | 300 | |||

| (to record the inventory returned and credit memorandum received) | ||||

Table (5)

- • The accounts payable account is a liability account. The accounts payable account has the normal credit balance and it is decreasing. Therefore, it is debited.

- • The purchase returns and allowances account is contra expenses account. The account has the normal credit balance and it is increasing. Therefore, it is credited.

Recording the payment made:

| GENERAL JOURNAL | Page 21 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 19, 2019 | Accounts payable/Company SI | 3,200 | ||

| Purchases discounts | 64 | |||

| Cash | 3,136 | |||

| (to record the payment made and receiving purchases discount) | ||||

Table (6)

- • The accounts payable account is liability and the account balance is decreasing. Therefore, accounts payable account is debited.

- • The purchases discount account is a contra expense account. The account has the normal credit balance and it is increasing. Therefore, it is credited.

- • The cash account is an asset account and the account balance is decreasing. Therefore, it is credited.

Recording the purchases on credit:

| GENERAL JOURNAL | Page 21 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 30, 2019 | Purchases | 4,400 | ||

| Accounts payable/Company SI | 4,400 | |||

| (to record the inventory purchased on account with terms2/10, n/30) | ||||

Table (7)

- • The purchases account is an expense account. The purchases account has normal debit balance and the balance is increasing. Therefore, it is debited.

- • Accounts payable is liability and the account balance is increasing. Therefore, it is credited.

The recording of entries in the general journal for company SI is as follows:

Recording the payment received from the buyer:

| GENERAL JOURNAL | Page 21 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 8, 2019 | Sales Discount | 60 | ||

| Cash | 2,940 | |||

| Accounts Receivable/Company B | 3,000 | |||

| (to record the payment received and discount provided) | ||||

Table (8)

- • The sales discount account is identified as contra revenue account and it has normal debit balance which is increasing. Therefore, it is debited.

- • The cash account is asset account and the account balance is increasing. Therefore, cash account is debited. The amount in cash account would be calculated by subtracting the merchandise returned by the buyer and the sales discount provided.

- • The accounts receivable account is asset account and the account balance is decreasing. Therefore, it is credited.

Recording of the merchandise sold:

| GENERAL JOURNAL | Page 21 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 10, 2019 | Accounts Receivable/ Company B | 3,500 | ||

| Sales | 3,500 | |||

| (to record the merchandise sold on credit on terms of 2/10, n/30) | ||||

Table (9)

- • The accounts receivables account is an asset account and the account balance is increasing. Hence, accounts receivable is debited.

- • The sales account is identified as the revenue account and the revenue is generated. Hence, sales account is credited.

Recording the returned merchandise sold and the credit memorandum:

| GENERAL JOURNAL | Page 21 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 15, 2019 | Sales returns and allowances | 300 | ||

| Accounts Receivable/ Company B | 300 | |||

| (to record the merchandise returned and issued credit memorandum) | ||||

Table (10)

- • The sales returns and allowances account is identified as contra revenue account with normal debit balance and it is increasing. Therefore, it is debited.

- • The account receivable account is an asset account and the account balance is decreasing. Therefore, the accounts receivable account is credited.

Recording the payment received from the buyer:

| GENERAL JOURNAL | Page 21 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 19, 2019 | Sales Discount | 64 | ||

| Cash | 3,136 | |||

| Accounts Receivable/Company B | 3,200 | |||

| (to record the timely payment received from the account receivable) | ||||

Table (11)

- • The sales discount account is identified as contra revenue account and it has normal debit balance which is increasing. Therefore, it is debited.

- • The cash account is debited. This is because the cash account is asset account and the account balance is increasing. The amount in cash account would be calculated by subtracting the merchandise returned by the buyer and the sales discount provided.

- • The accounts receivable account is asset account and the account balance is decreasing. Therefore, it is credited.

Recording of the merchandise sold and sales tax payable:

| GENERAL JOURNAL | Page 21 | |||

| Date | Account Title and Explanation | Post Ref. |

Debit ($) |

Credit ($) |

| January 30, 2019 | Accounts Receivable/ Company B | 4,400 | ||

| Sales | 4,400 | |||

| (to record the merchandise sold on credit on terms of 2/10, n/30) | ||||

Table (12)

- • The accounts receivables account is an asset account and the account balance is increasing. Therefore, accounts receivables account is debited.

- • The sales account is identified as the revenue account and the revenue is generated. Hence, sales account is credited.

Working Note:

Calculation of purchases discount:

The purchases discounts are received by the buyer for fulfilling the terms of timely payment to seller for purchases. The terms related to paying on timely basis with the company SI was agreed as 2/10, n/30. The terms 2/10, n/30 means the buyer is entitled to receive two percent of purchase discount on the purchases amount. The buyer will be entitled to the discount only if the payment is paid within ten days after provided invoice.

The amount calculated as purchase discount would be $64.

Calculation for sales discount:

The sales discount is provided to the customer by the seller fulfilling the terms of making the timely payments as per 2/10, n/30 terms. The customer is entitled to receive the one percent of sales discount on the merchandise sold if the payment is made with ten days of invoice provided.

The amount calculated as per given information would be $64.

3.

Record the transactions to the appropriate accounts in the general ledger and the accounts payable subsidiary ledger for company B.

Explanation of Solution

The posting of general journal in the appropriate accounts in the general ledger and the accounts payable subsidiary ledger is as follows:

| Cash | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| January 1, 2019 | Balance | - | ||

| January 8, 2019 | 2,940 | (2,940) | ||

| January 19, 2019 | 3,136 | (6,076) | ||

Table (13)

| Accounts Payable/Company SI | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| January 1, 2019 | Balance | 3,000 | ||

| January 8, 2019 | 3,000 | - | ||

| January 10, 2019 | 3,500 | 3,500 | ||

| January 15, 2019 | 300 | 3,200 | ||

| January 19, 2019 | 3,200 | - | ||

| January 30, 2019 | 4,400 | 4,400 | ||

Table (14)

| Accounts Payable | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| January 1, 2019 | Balance | 3,000 | ||

| January 8, 2019 | 3,000 | - | ||

| January 10, 2019 | 3,500 | 3,500 | ||

| January 15, 2019 | 300 | 3,200 | ||

| January 19, 2019 | 3,200 | - | ||

| January 30, 2019 | 4,400 | 4,400 | ||

Table (15)

| Purchases | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| January 1, 2019 | Balance | - | ||

| January 10, 2019 | 3,500 | 3,500 | ||

| January 30, 2019 | 4,400 | 7,900 | ||

Table (16)

| Purchases Returns and Allowances | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| January 1, 2019 | Balance | - | ||

| January 15, 2019 | 300 | 300 | ||

Table (17)

| Purchases Discounts | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| January 1, 2019 | Balance | - | ||

| January 8, 2019 | 60 | 60 | ||

| January 19, 2019 | 64 | 124 | ||

Table (18)

4.

Record the transactions to the appropriate accounts in the general ledger and the accounts payable subsidiary ledger for company SI.

Explanation of Solution

| Cash | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| January 1, 2019 | Balance | - | ||

| January 8, 2019 | 2,940 | 2,940 | ||

| January 19, 2019 | 3,136 | 6,076 | ||

Table (19)

| Accounts Receivable/Company B | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| January 1, 2019 | Balance | 3,000 | ||

| January 8, 2019 | 3,000 | - | ||

| January 10, 2019 | 3,500 | 3,500 | ||

| January 15, 2019 | 300 | 3,200 | ||

| January 19, 2019 | 3,200 | - | ||

| January 30, 2019 | 4,400 | 4,400 | ||

Table (20)

| Accounts Receivable | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| January 1, 2019 | Balance | 3,000 | ||

| January 8, 2019 | 3,000 | - | ||

| January 10, 2019 | 3,500 | 3,500 | ||

| January 15, 2019 | 300 | 3,200 | ||

| January 19, 2019 | 3,200 | - | ||

| January 30, 2019 | 4,400 | 4,400 | ||

Table (21)

| Sales | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| January 1, 2019 | Balance | - | ||

| January 10, 2019 | 3,500 | 3,500 | ||

| January 30, 2019 | 4,400 | 7,900 | ||

Table (22)

| Sales Returns and Allowances | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| January 1, 2019 | Balance | - | ||

| January 15, 2019 | 300 | 300 | ||

Table (23)

| Sales Discounts | ||||

| Date | Particular |

Debit ($) |

Credit ($) |

Balance ($) |

| January 1, 2019 | Balance | - | ||

| January 8, 2019 | 60 | 60 | ||

| January 19, 2019 | 64 | 124 | ||

Table (24)

The balance of accounts payable account for company SI in company B’s subsidiary ledger is $4,400 credit balance. The balance of accounts receivable account for company B in company SL’s subsidiary ledger is $4,400 debit balance.

Want to see more full solutions like this?

Chapter 8 Solutions

COLLEGE ACCOUNTING (LL)W/ACCESS>CUSTOM<

- Please provide the answer to this financial accounting question with proper steps.arrow_forwardWhat are the three sections of the statement of cash flows, and what does each section report?no aiarrow_forwardWhat are the three sections of the statement of cash flows, and what does each section report? I need helparrow_forward

- Can you show me the correct approach to solve this financial accounting problem using suitable standards?arrow_forwardI am trying to find the accurate solution to this financial accounting problem with the correct explanation.arrow_forwardWhat are the three sections of the statement of cash flows, and what does each section report?need helparrow_forward

- Please provide the solution to this general accounting question with accurate financial calculations.arrow_forwardWhat are the three sections of the statement of cash flows, and what does each section report? Helparrow_forwardI need assistance with this general accounting question using appropriate principles.arrow_forward

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage