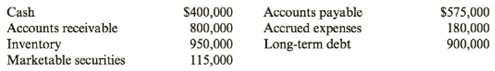

JRL’s financial statements contain the following information:

Required:

1. What is its

2. What is its quick ratio?

3. What is its cash ratio?

4. Discuss JRL’s liquidity using these ratios.

Concept introduction:

Current Ratio:

Current Ratio is measure of the company’s ability to pay off its current liabilities using its current assets. It is calculated by dividing the total current assets by total current liabilities. The formula of the current ratio is as follows:

Acid test ratio:

Acid test ration is also called Quick ratio. This ratio is calculated by dividing the quick assets (Cash, Cash equivalents, Short term investments and current receivables) by total current liabilities for the year. The formula for Acid test ratio is as follows:

Cash ratio:

Cash ratio is calculated by dividing and cash and cash equivalents by the total current liabilities. The formula for Cash ratio is as follows:

Cash Ratio = Cash and cash equivalents/ Current liabilities

Requirement 1:

To calculate:

The Current Ratio.

Answer to Problem 58BE

The Current Ratio is 3.

Explanation of Solution

The Current Ratio is calculated as follows:

| Cash | $ 400,000 |

| Marketable Securities | $ 115,000 |

| Accounts Receivables | $ 800,000 |

| Inventory | $ 950,000 |

| Total Current Assets (A) | $ 2,265,000 |

| Accounts Payable | $ 575,000 |

| Accrued Expenses | $ 180,000 |

| Total Current Liabilities (B) | $ 755,000 |

| Current Ratio (A/B) | 3.00 |

Concept introduction:

Current Ratio:

Current Ratio is measure of the company’s ability to pay off its current liabilities using its current assets. It is calculated by dividing the total current assets by total current liabilities. The formula of the current ratio is as follows:

Acid test ratio:

Acid test ration is also called Quick ratio. This ratio is calculated by dividing the quick assets (Cash, Cash equivalents, Short term investments and current receivables) by total current liabilities for the year. The formula for Acid test ratio is as follows:

Cash ratio:

Cash ratio is calculated by dividing and cash and cash equivalents by the total current liabilities. The formula for Cash ratio is as follows:

Cash Ratio = Cash and cash equivalents/ Current liabilities

Requirement 2:

To calculate:

The Quick Ratio.

Answer to Problem 58BE

The Quick Ratio is 1.74.

Explanation of Solution

The Quick Ratio is calculated as follows:

| Cash | $ 400,000 |

| Marketable Securities | $ 115,000 |

| Accounts Receivables | $ 800,000 |

| Total Quick Assets (A) | $ 1,315,000 |

| Accounts Payable | $ 575,000 |

| Accrued Expenses | $ 180,000 |

| Total Current Liabilities (B) | $ 755,000 |

| Quick Ratio (A/B) | 1.74 |

Concept introduction:

Current Ratio:

Current Ratio is measure of the company’s ability to pay off its current liabilities using its current assets. It is calculated by dividing the total current assets by total current liabilities. The formula of the current ratio is as follows:

Acid test ratio:

Acid test ration is also called Quick ratio. This ratio is calculated by dividing the quick assets (Cash, Cash equivalents, Short term investments and current receivables) by total current liabilities for the year. The formula for Acid test ratio is as follows:

Cash ratio:

Cash ratio is calculated by dividing and cash and cash equivalents by the total current liabilities. The formula for Cash ratio is as follows:

Cash Ratio = Cash and cash equivalents/ Current liabilities

Requirement 3:

To calculate:

The Cash Ratio.

Answer to Problem 58BE

The Cash Ratio is 0.68.

Explanation of Solution

The Cash Ratio is calculated as follows:

| Cash | $ 400,000 |

| Marketable Securities | $ 115,000 |

| Cash and Cash Equivalents (A) | $ 515,000 |

| Accounts Payable | $ 575,000 |

| Accrued Expenses | $ 180,000 |

| Total Current Liabilities (B) | $ 755,000 |

| Cash Ratio (A/B) | 0.68 |

Concept introduction:

Current Ratio:

Current Ratio is measure of the company’s ability to pay off its current liabilities using its current assets. It is calculated by dividing the total current assets by total current liabilities. The formula of the current ratio is as follows:

Acid test ratio:

Acid test ration is also called Quick ratio. This ratio is calculated by dividing the quick assets (Cash, Cash equivalents, Short term investments and current receivables) by total current liabilities for the year. The formula for Acid test ratio is as follows:

Cash ratio:

Cash ratio is calculated by dividing and cash and cash equivalents by the total current liabilities. The formula for Cash ratio is as follows:

Cash Ratio = Cash and cash equivalents/ Current liabilities

Requirement 4:

To discuss:

Liquidity of the company.

Answer to Problem 58BE

The Cash ratio shows that company does not have a good liquidity position.

Explanation of Solution

The Current, Quick and Cash ratio shows liquidity position as follows:

| Cash | $ 400,000 |

| Marketable Securities | $ 115,000 |

| Accounts Receivables | $ 800,000 |

| Inventory | $ 950,000 |

| Total Current Assets (A) | $ 2,265,000 |

| Accounts Payable | $ 575,000 |

| Accrued Expenses | $ 180,000 |

| Total Current Liabilities (B) | $ 755,000 |

| Current Ratio (A/B) | 3.00 |

| Cash | $ 400,000 |

| Marketable Securities | $ 115,000 |

| Accounts Receivables | $ 800,000 |

| Total Quick Assets (A) | $ 1,315,000 |

| Accounts Payable | $ 575,000 |

| Accrued Expenses | $ 180,000 |

| Total Current Liabilities (B) | $ 755,000 |

| Quick Ratio (A/B) | 1.74 |

| Cash | $ 400,000 |

| Marketable Securities | $ 115,000 |

| Cash and Cash Equivalents (A) | $ 515,000 |

| Accounts Payable | $ 575,000 |

| Accrued Expenses | $ 180,000 |

| Total Current Liabilities (B) | $ 755,000 |

| Cash Ratio (A/B) | 0.68 |

Want to see more full solutions like this?

Chapter 8 Solutions

Cornerstones of Financial Accounting - With CengageNow

- Calculate the return on equity on these financial accounting questionarrow_forwardRight Answerarrow_forwardMonk Enterprises had accounts receivable of $9,500 at the beginning of the month and $4,200 at the end of the month. Credit sales totaled $52,000 during the month. Calculate the cash collected from customers during the month, assuming that all sales were made on account.arrow_forward

- Last year, Jenson Enterprises earned an operating income of $27,800 with a contribution margin ratio of 0.30. Actual revenue was $250,000. Calculate the total fixed cost. Round your answer to the nearest dollar, if required.arrow_forwardWhat is the target price to obtain profit margin on sales?arrow_forwardWhat is your margin loan amount ?arrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning