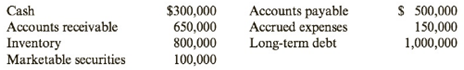

NWA’s financial statements contain the following information:

Note: Round answers to two decimal places.

Required:

1. What is its

2. What is its quick ratio?

3. What is its cash ratio?

4. Discuss NWA’s liquidity using these ratios.

Concept introduction:

Current Ratio:

Current Ratio is measure of the company’s ability to pay off its current liabilities using its current assets. It is calculated by dividing the total current assets by total current liabilities. The formula of the current ratio is as follows:

Acid test ratio:

Acid test ration is also called Quick ratio. This ratio is calculated by dividing the quick assets (Cash, Cash equivalents, Short term investments and current receivables) by total current liabilities for the year. The formula for Acid test ratio is as follows:

Cash ratio:

Cash ratio is calculated by dividing and cash and cash equivalents by the total current liabilities. The formula for Cash ratio is as follows:

Cash Ratio = Cash and cash equivalents/ Current liabilities

Requirement 1:

To calculate:

The Current Ratio.

Answer to Problem 33CE

The Current Ratio is 2.85.

Explanation of Solution

The Current Ratio is calculated as follows:

| Cash | $ 300,000 |

| Marketable Securities | $ 650,000 |

| Accounts Receivables | $ 800,000 |

| Inventory | $ 100,000 |

| Total Current Assets (A) | $ 1,850,000 |

| Accounts Payable | $ 500,000 |

| Accrued Expenses | $ 150,000 |

| Total Current Liabilities (B) | $ 650,000 |

| Current Ratio (A/B) | 2.85 |

Concept introduction:

Current Ratio:

Current Ratio is measure of the company’s ability to pay off its current liabilities using its current assets. It is calculated by dividing the total current assets by total current liabilities. The formula of the current ratio is as follows:

Acid test ratio:

Acid test ration is also called Quick ratio. This ratio is calculated by dividing the quick assets (Cash, Cash equivalents, Short term investments and current receivables) by total current liabilities for the year. The formula for Acid test ratio is as follows:

Cash ratio:

Cash ratio is calculated by dividing and cash and cash equivalents by the total current liabilities. The formula for Cash ratio is as follows:

Cash Ratio = Cash and cash equivalents/ Current liabilities

Requirement 2:

To calculate:

The Quick Ratio.

Answer to Problem 33CE

The Quick Ratio is 2.69.

Explanation of Solution

The Quick Ratio is calculated as follows:

| Cash | $ 300,000 |

| Marketable Securities | $ 650,000 |

| Accounts Receivables | $ 800,000 |

| Total Quick Assets (A) | $ 1,750,000 |

| Accounts Payable | $ 500,000 |

| Accrued Expenses | $ 150,000 |

| Total Current Liabilities (B) | $ 650,000 |

| Quick Ratio (A/B) | 2.69 |

Concept introduction:

Current Ratio:

Current Ratio is measure of the company’s ability to pay off its current liabilities using its current assets. It is calculated by dividing the total current assets by total current liabilities. The formula of the current ratio is as follows:

Acid test ratio:

Acid test ration is also called Quick ratio. This ratio is calculated by dividing the quick assets (Cash, Cash equivalents, Short term investments and current receivables) by total current liabilities for the year. The formula for Acid test ratio is as follows:

Cash ratio:

Cash ratio is calculated by dividing and cash and cash equivalents by the total current liabilities. The formula for Cash ratio is as follows:

Cash Ratio = Cash and cash equivalents/ Current liabilities

Requirement 3:

To calculate:

The Cash Ratio.

Answer to Problem 33CE

The Cash Ratio is 1.46.

Explanation of Solution

The Cash Ratio is calculated as follows:

| Cash | $ 300,000 |

| Marketable Securities | $ 650,000 |

| Cash and Cash Equivalents (A) | $ 950,000 |

| Accounts Payable | $ 500,000 |

| Accrued Expenses | $ 150,000 |

| Total Current Liabilities (B) | $ 650,000 |

| Cash Ratio (A/B) | 1.46 |

Concept introduction:

Current Ratio:

Current Ratio is measure of the company’s ability to pay off its current liabilities using its current assets. It is calculated by dividing the total current assets by total current liabilities. The formula of the current ratio is as follows:

Acid test ratio:

Acid test ration is also called Quick ratio. This ratio is calculated by dividing the quick assets (Cash, Cash equivalents, Short term investments and current receivables) by total current liabilities for the year. The formula for Acid test ratio is as follows:

Cash ratio:

Cash ratio is calculated by dividing and cash and cash equivalents by the total current liabilities. The formula for Cash ratio is as follows:

Cash Ratio = Cash and cash equivalents/ Current liabilities

Requirement 4:

To discuss:

Liquidity of the company.

Answer to Problem 33CE

The Current, Quick and Cash ratio shows that company has a good liquidity position.

Explanation of Solution

The Current, Quick and Cash ratio shows that company has a good liquidity position as follows:

| Cash | $ 300,000 |

| Marketable Securities | $ 650,000 |

| Accounts Receivables | $ 800,000 |

| Inventory | $ 100,000 |

| Total Current Assets (A) | $ 1,850,000 |

| Accounts Payable | $ 500,000 |

| Accrued Expenses | $ 150,000 |

| Total Current Liabilities (B) | $ 650,000 |

| Current Ratio (A/B) | 2.85 |

| Cash | $ 300,000 |

| Marketable Securities | $ 650,000 |

| Accounts Receivables | $ 800,000 |

| Total Quick Assets (A) | $ 1,750,000 |

| Accounts Payable | $ 500,000 |

| Accrued Expenses | $ 150,000 |

| Total Current Liabilities (B) | $ 650,000 |

| Quick Ratio (A/B) | 2.69 |

| Cash | $ 300,000 |

| Marketable Securities | $ 650,000 |

| Cash and Cash Equivalents (A) | $ 950,000 |

| Accounts Payable | $ 500,000 |

| Accrued Expenses | $ 150,000 |

| Total Current Liabilities (B) | $ 650,000 |

| Cash Ratio (A/B) | 1.46 |

Want to see more full solutions like this?

Chapter 8 Solutions

Cornerstones of Financial Accounting - With CengageNow

- If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forwardWhich of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- No chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardWhat type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenueneed helparrow_forwardno ai What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersno aiarrow_forward

- Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customerhelo mearrow_forwardHelp Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forward

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning