Concept explainers

The budget director of Birding Homes & Feeders Inc., with the assistance of the controller, treasurer, production manager, and sales manager, has gathered the following data for use in developing the budgeted income statement for January:

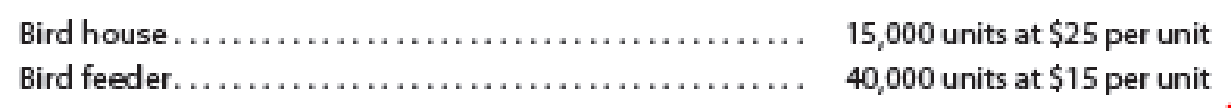

Estimated sales for January:

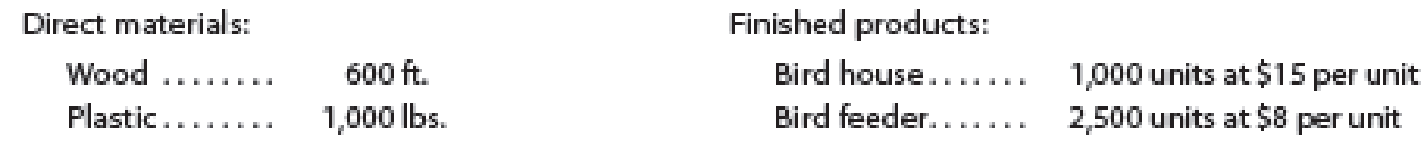

Estimated inventories at January 1:

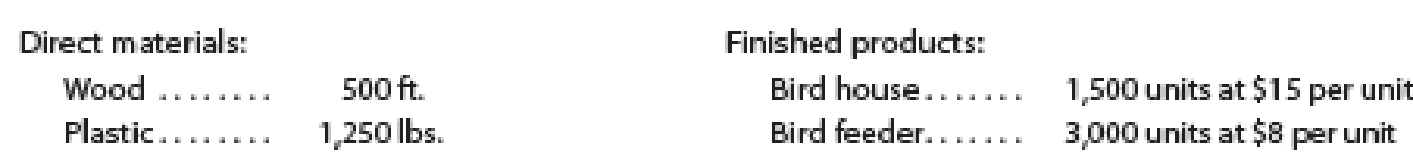

Desired inventories at January 31:

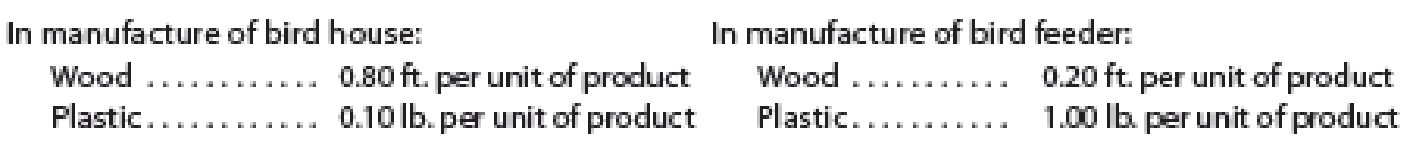

Direct materials used in production:

Anticipated cost of purchases and beginning and ending inventory of direct materials:

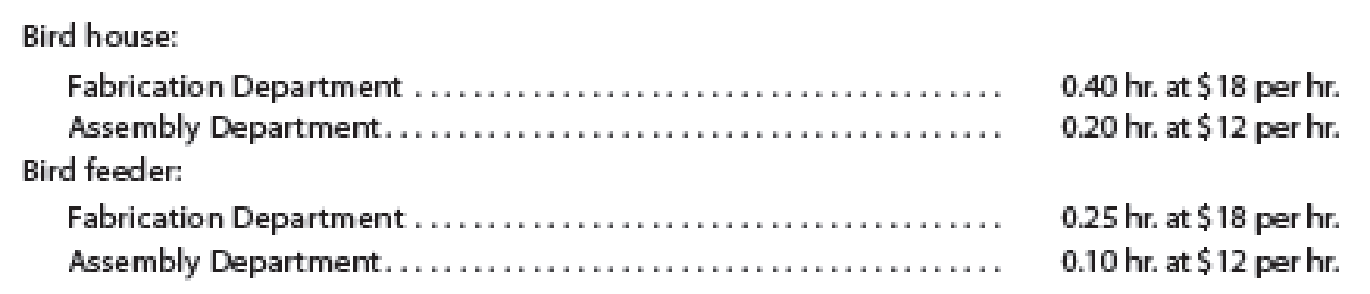

Direct labor requirements:

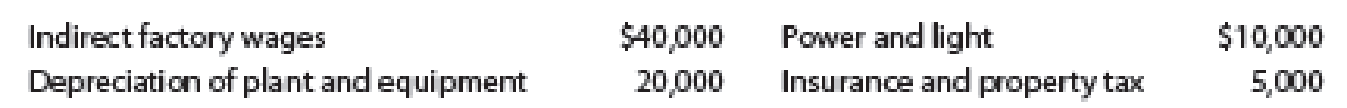

Estimated factory

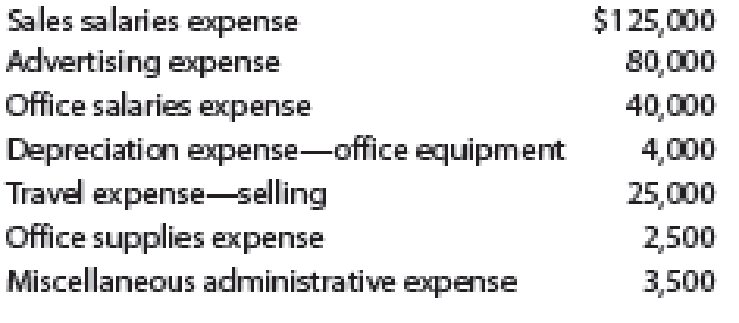

Estimated operating expenses for January:

Estimated other revenue and expense for January:

Estimated tax rate: 25%

Instructions

Prepare a sales budget for January.

Prepare a production budget for January.

Prepare a direct materials purchases budget for January.

Prepare a direct labor cost budget for January.

Prepare a

Prepare a cost of goods sold budget for January. Work in process at the beginning of January is estimated to be $9,000, and work in process at the end of January is estimated to be $10,500.

Prepare a selling and administrative expenses budget for January.

Prepare a budgeted income statement for January.

1.

Prepare the sales budget for the month ending January 31.

Explanation of Solution

Budgeting is a process to prepare the financial statement by the manager to estimate the organization’s future actions. It is also helpful to satisfy the everyday activities.

The following table shows the sales budget.

|

Company B Sales Budget For the Month Ending January 31 | |||

| Product and Area | Unit Sales Volume | Unit Selling Price ($) | Total Sales ($) |

| (A) | (B) | ||

| Birdhouse | 15,000 | $25.00 | $375,000 |

| Bird feeder | 40,000 | $15.00 | $600,000 |

| Total Revenue from Sales | $975,000 | ||

Table (1)

2.

Prepare the production budget for the month ending January 31.

Explanation of Solution

Production Budget shows the quantities of units that a company must produce to meet the budgeted sales and inventory.

The following table shows the production budget.

|

Company B Production Budget For the Month Ending January 31 | ||

| Details | Units | |

| Birdhouse | Bird Feeder | |

| Expected Units to be Sold | 15,000 | 40,000 |

| Add: Desired Inventory, January 31 | 1,500 | 3,000 |

| Total Units Required | 16,500 | 43,000 |

| Less: Estimated Inventory, January 1 | (1,000) | (2,500) |

| Total Units to be Produced | 15,500 | 40,500 |

Table (2)

3.

Prepare the direct materials purchase budget for the month ending January 31.

Explanation of Solution

The following table shows the direct materials purchase budget.

|

Company B Direct Materials Purchase Budget For the Month Ending January 31 | ||

| Details | Units | |

| Wood | Plastic | |

| Required units for production: | ||

| Birdhouse | 12,400 (1) | 3,020 (2) |

| Bird Feeder | 8,100 (3) | 3,345 (4) |

| Add: Desired inventory, January 31 | 500 | 210 |

| Total units required | 21,000 | 43,300 |

| Less: Estimated inventory, January 1 | (600) | (1,000) |

| Total units to be purchased (A) | 20,400 | 42,300 |

| Unit price (B) | $2.50 | $0.80 |

| Total | $51,000 | $33,840 |

| Total direct materials to be purchased | 84,840 | |

Table (3)

Working Note (1):

Calculate the direct material (wood) for birdhouse.

Working Note (2):

Calculate the direct material (plastic) for birdhouse.

Working Note (3):

Calculate the direct material (wood) for bird feeder.

Working Note (4):

Calculate the direct material (plastic) for bird feeder.

4.

Prepare the direct labor cost budget of Company B.

Explanation of Solution

The following table shows the direct labor cost budget for fabrication and assembly department.

| Company B | ||

| Direct Labor Cost Budget | ||

| For the Month Ending January 31 | ||

| Particulars |

Fabrication Department |

Assembly Department |

| Hours Required for Production: | ||

| Birdhouse | 6,200 (5) | 3,100 (6) |

| Bird feeder | 10,125 (7) | 4,050 (8) |

| Total Hours Required (A) | 16,350 | 7,150 |

| Hourly Rate (B) | $18 | $12 |

| Total Cost | $293,850 | $85,800 |

| Total Direct Labor Cost | $379,650 | |

Table (4)

Working Note (5):

Calculate the hours required for the production of birdhouse in fabrication department.

Working Note (6):

Calculate the hours required for the production of birdhouse in assembly department.

Working Note (7):

Calculate the hours required for the production of bird feeder in fabrication department.

Working Note (8):

Calculate the hours required for the production of bird feeder in assembly department.

5.

Prepare a factory overhead cost budget of Company B.

Explanation of Solution

The following table shows the factory overhead cost budget.

| Company B | |

| Factory Overhead Cost Budget | |

| For the Month Ending January 31 | |

| Particulars | Amount ($) |

| Indirect factory wages | 40,000 |

| Depreciation of plant and equipment | 20,000 |

| Power and light | 10,000 |

| Insurance and property tax | 5,000 |

| Total | 75,000 |

Table (5)

6.

Prepare the cost of goods sold budget of Company B.

Explanation of Solution

The following table shows the cost of goods sold budget.

| B Company | |||

| Cost of Goods Sold Budget | |||

| For the month ending January 31 | |||

| Particulars |

Amount ($) |

Amount ($) |

Amount ($) |

| Finished goods inventory, January 1 | 35,000 (9) | ||

| Work-in-process inventory, January 1 | 9,000 | ||

| Direct material: | |||

| Direct materials inventory, January 1 | 2,300(10) | ||

| Direct materials purchases | 84,840 | ||

| Cost of direct materials available for use | 87,140 | ||

| Less: Direct materials inventory, January 31 |

(2,250) (11) | ||

| Cost of direct materials placed in production | 84,890 | ||

| Direct labor | 379,650 | ||

| Factory overhead | 75,000 | ||

| Total manufacturing cost | 539,540 | ||

| Total work-in-process during the period | 548,540 | ||

| Less: Work-in-process inventory, January 30 | (10,500) | ||

| Cost of goods manufactures | 538,040 | ||

| Cost of finished goods available for sale | 573,040 | ||

| Less: Finished goods inventory, January 30 |

(64,500) (12) | ||

| Cost of Goods Sold | 526,540 | ||

Table (6)

Working Note (9):

Calculate the beginning finished goods inventory.

Working Note (10):

Calculate the beginning direct material.

Working Note (11):

Calculate the ending direct material.

Working Note (12):

Calculate the ending finished goods inventory.

7.

Prepare the selling and administrative expenses budget of Company B.

Explanation of Solution

The following table shows the selling and administrative expenses budget.

| Company B | ||

| Selling and Administrative Budget | ||

| For the Month Ending January 31 | ||

| Particulars | Amount ($) | Amount ($) |

| Selling expense: | ||

| Sales salaries expense | 125,000 | |

| Advertising expense | 80,000 | |

| Travel expense | 25,000 | |

| Total selling expense | 230,000 | |

| Administrative expense: | ||

| Office salaries expense | 40,000 | |

| Depreciation expense – office equipment | 4,000 | |

| Office supplies expense | 2,500 | |

| Miscellaneous administrative expense | 3,500 | |

| Total administrative expenses | 50,000 | |

| Total Operating Expenses | 280,000 | |

Table (7)

8.

Prepare the budgeted income statement of Company B.

Explanation of Solution

Prepare the budgeted income statement of Company B.

| Company B | ||

| Budgeted Income Statement | ||

| For the Month Ending January 31 | ||

| Particulars | Amount ($) | Amount ($) |

| Revenue from sales | 975,000 | |

| Less: Cost of goods sold | (526,540) | |

| Gross profit | 448,460 | |

| Operating expenses: | ||

| Selling expenses | 230,000 | |

| Administrative expenses | 50,000 | |

| Total operating expenses | (280,000) | |

| Income from operations | 168,460 | |

| Other revenue and expenses: | ||

| Interest revenue | 4,540 | |

| Interest expense | (3,300) | 1,540 |

| Income before income tax | 170,000 | |

| Income tax expense (30%) | (42,500) | |

| Net Income | 127,500 | |

Table (7)

Want to see more full solutions like this?

Chapter 8 Solutions

Managerial Accounting

- If total debits exceed total credits on a trial balance, the difference is most likely:A. A net lossB. A recording errorC. A net incomeD. An overstatement of assetsarrow_forwardWhich of the following accounts would be found on the post-closing trial balance?A. Service RevenueB. Salaries ExpenseC. Retained EarningsD. Dividendsarrow_forwardNeed answer What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- No chatgpt What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardWhat type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenueneed helparrow_forwardno ai What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forward

- What type of account is Service Revenue?A. AssetB. LiabilityC. EquityD. Revenuearrow_forwardNo chatgpt Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersno aiarrow_forward

- Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customerhelo mearrow_forwardHelp Which of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forwardWhich of the following would be found in the investing activities section of the cash flow statement?A. Cash received from issuing sharesB. Cash paid for dividendsC. Cash paid for new equipmentD. Cash received from customersarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning