Managerial Accounting

15th Edition

ISBN: 9781337912020

Author: Carl Warren, Ph.d. Cma William B. Tayler

Publisher: South-Western College Pub

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 2E

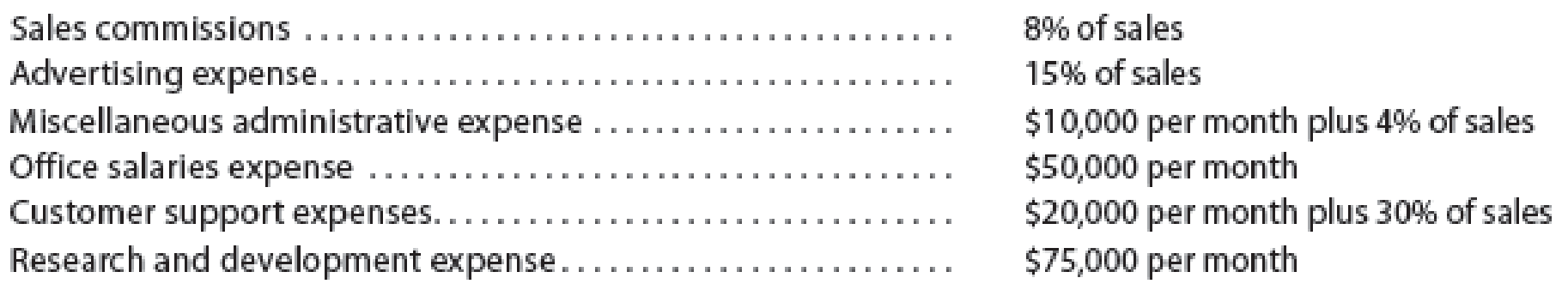

Digital Solutions Inc. uses flexible budgets that are based on the following data:

Prepare a flexible selling and administrative expenses budget for October for sales volumes of $500,000, $750,000, and $1,000,000.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Can you help me solve this financial accounting problem using the correct accounting process?

Can you solve this financial accounting question using valid financial methods?

I am searching for the accurate solution to this financial accounting problem with the right approach.

Chapter 8 Solutions

Managerial Accounting

Ch. 8 - Prob. 1DQCh. 8 - Briefly describe the type of human behavior...Ch. 8 - What behavioral problems are associated with...Ch. 8 - What behavioral problems are associated with...Ch. 8 - Under what circumstances would a static budget be...Ch. 8 - Prob. 6DQCh. 8 - Prob. 7DQCh. 8 - Why should the timing of direct materials...Ch. 8 - Prob. 9DQCh. 8 - Give an example of how the capital expenditures...

Ch. 8 - At the beginning of the period, the Fabricating...Ch. 8 - Pasadena Candle Inc. projected sales of 800,000...Ch. 8 - Pasadena Candle Inc. budgeted production of...Ch. 8 - Pasadena Candle Inc. budgeted production of...Ch. 8 - Prob. 5BECh. 8 - Cash budget Pasadena Candle Inc. pays 40% of its...Ch. 8 - At the beginning of the school year, Craig Kovar...Ch. 8 - Digital Solutions Inc. uses flexible budgets that...Ch. 8 - Static budget versus flexible budget The...Ch. 8 - Prob. 4ECh. 8 - Production budget Healthy Measures Inc. produces a...Ch. 8 - Sales and production budgets Sonic Inc....Ch. 8 - Professional foes earned budget for a service...Ch. 8 - Prob. 8ECh. 8 - Prob. 9ECh. 8 - Prob. 10ECh. 8 - Prob. 11ECh. 8 - Direct labor cost budget Ace Racket Company...Ch. 8 - Prob. 13ECh. 8 - Factory overhead cost budget Sweet Tooth Candy...Ch. 8 - Cost of goods sold budget Delaware Chemical...Ch. 8 - Prob. 16ECh. 8 - Prob. 17ECh. 8 - Prob. 18ECh. 8 - Schedule of cash payments for service company...Ch. 8 - Prob. 20ECh. 8 - Capital expenditures budget On January 1, 20Y6,...Ch. 8 - Prob. 1PACh. 8 - Sales, production, direct materials purchases, and...Ch. 8 - Budgeted income statement and supporting budgets...Ch. 8 - Budgeted income statement and supporting budgets...Ch. 8 - Cash budget The controller of Bridgeport...Ch. 8 - Budgeted income statement and balance sheet As a...Ch. 8 - Prob. 1PBCh. 8 - Sales, production, direct materials purchases, and...Ch. 8 - Budgeted income statement and supporting budgets...Ch. 8 - Prob. 4PBCh. 8 - Cash budget The controller of Mercury Shoes Inc....Ch. 8 - Budgeted income statement and balance sheet As a...Ch. 8 - Analyze Johnson Stores staffing budget for...Ch. 8 - Prob. 2MADCh. 8 - Prob. 3MADCh. 8 - Prob. 4MADCh. 8 - Ethics in Action The director of marketing for...Ch. 8 - Prob. 3TIFCh. 8 - Evaluating the budgeting system in a service...Ch. 8 - Static budget for a service company A hank manager...Ch. 8 - Objectives of the master budget Dominos Pizza LLC...Ch. 8 - When compared to static budgets, flexible budgets:...Ch. 8 - Prob. 2CMACh. 8 - Ming Company has budgeted sales at 6,300 units for...Ch. 8 - Krouse Company produces two products, forged...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Please provide the accurate answer to this financial accounting problem using valid techniques.arrow_forwardPlease provide the correct answer to this financial accounting problem using valid calculations.arrow_forwardI need help with this financial accounting question using the proper financial approach.arrow_forward

- Nicole is a calendar-year taxpayer who accounts for her business using the cash method. On average, Nicole sends out bills for about $12,000 of her services on the first of each month. The bills are due by the end of the month, and typically 70 percent of the bills are paid on time and 98 percent are paid within 60 days. a. Suppose that Nicole is expecting a 2 percent reduction in her marginal tax rate next year. Ignoring the time value of money, estimate the tax savings for Nicole if she postpones mailing the December bills until January 1 of next year.arrow_forwardGeneral accountingarrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY