Concept explainers

Static budget versus flexible budget

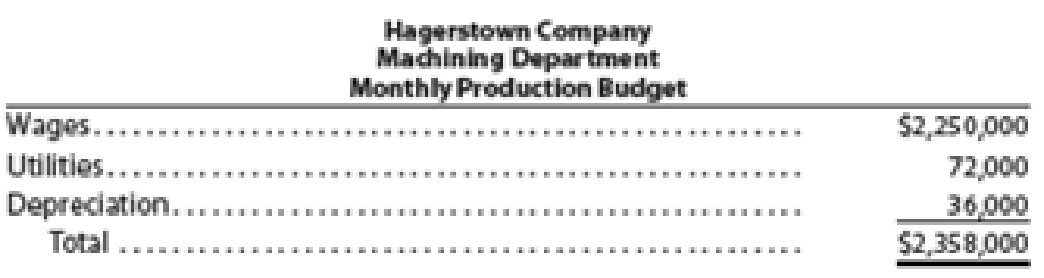

The production supervisor of the Machining Department for Hagerstown Company agreed to the following monthly static budget for the upcoming year:

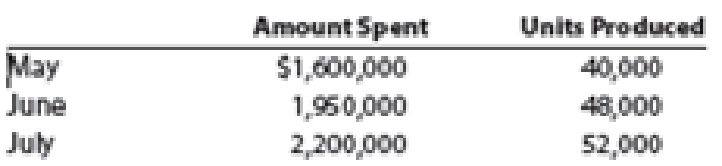

The actual amount spent and the actual units produced in the first three months in the Machining Department were as follows:

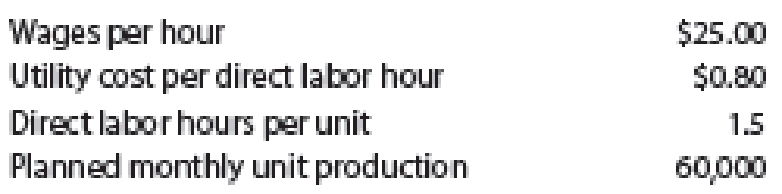

The Machining Department supervisor has been very pleased with this performance because actual expenditures for May-July have been significantly less than the monthly static budget of $2,358,000. However, the plant manager believes that the budget should not remain fixed for every month but should “flex” or adjust to the volume of work that is produced in the Machining Department. Additional budget information for the Machining Department is as follows:

- a. Prepare a flexible budget for the actual units produced for May, June, and July in the Machining Department. Assume

depreciation is a fixed cost. - b. Compare the flexible budget with the actual expenditures for the first three months. What does this comparison suggest?

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Managerial Accounting

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning