Auditing and Assurance Services (16th Edition)

16th Edition

ISBN: 9780134065823

Author: Alvin A. Arens, Randal J. Elder, Mark S. Beasley, Chris E. Hogan

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 8, Problem 38DQP

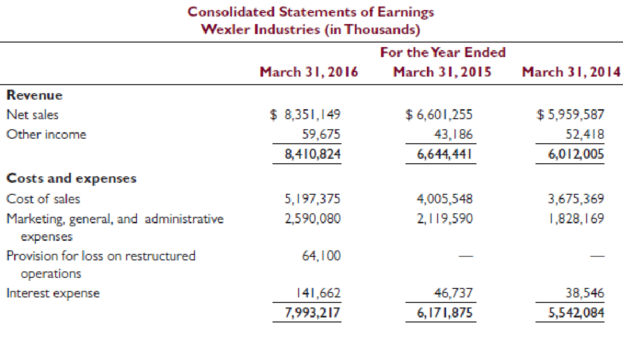

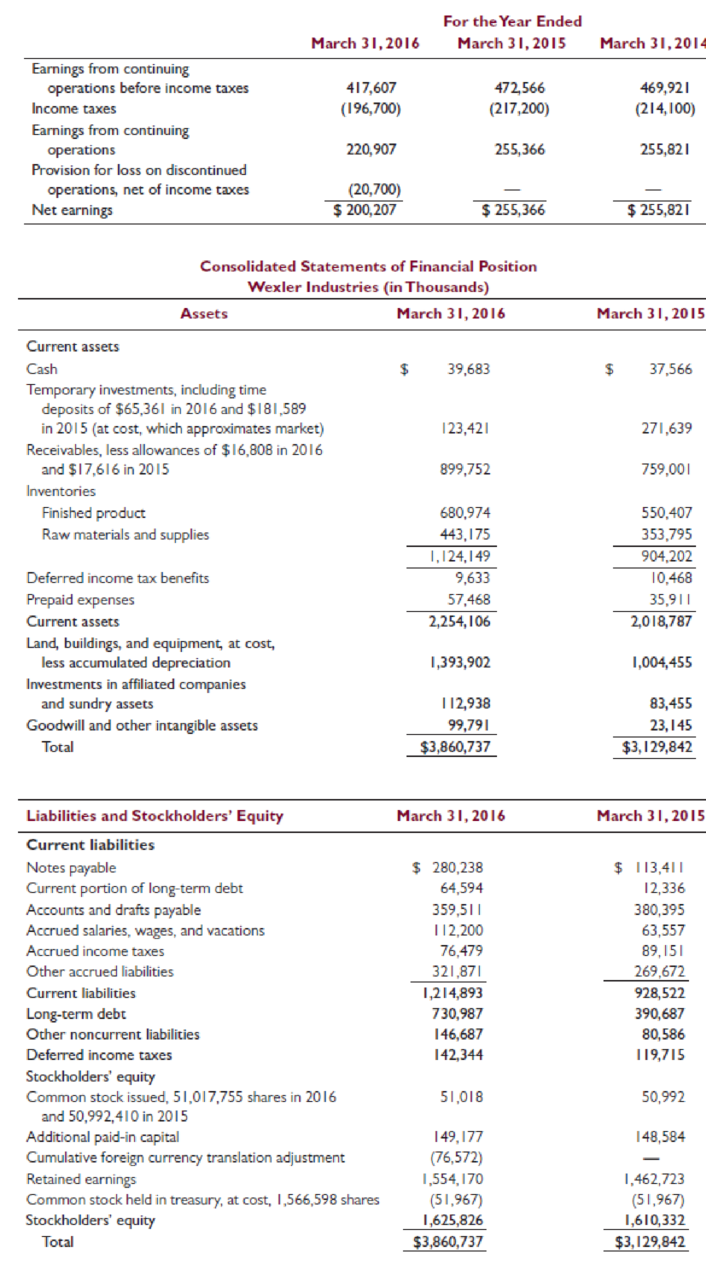

Following are statements of earnings and financial position for Wexler Industries.

Required

- a. Use professional judgment in deciding on the preliminary judgment about materiality for earnings, current assets, current liabilities, and total assets. Your conclusions should be stated in terms of percents and dollars.

- b. Assume that you define materiality for the financial statements as a whole as a combined misstatement of earnings from continuing operations before income taxes of 5%. Also assume that you believe there is an equal likelihood of a misstatement of every account in the financial statements, and each misstatement is likely to result in an overstatement of earnings. Allocate materiality to these financial statements as you consider appropriate.

- c. As discussed in part b., net earnings from continuing operations before income taxes was used as a base for calculating materiality for the Wexler Industries audit. Discuss why most auditors use before-tax net earnings instead of after-tax net earnings when calculating materiality based on the income statement.

- d. Now assume that you have decided to allocate 75% of your preliminary judgment to

accounts receivable , inventories, and accounts payable because you believe all other accounts have a low risk of material misstatement. How does this affect evidence accumulation on the audit? - e. Assume that you complete the audit and conclude that your preliminary judgment about materiality for current assets, current liabilities, and total assets has been met. The actual estimate of misstatements in earnings exceeds your preliminary judgment. What should you do?

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

hello tutor please help me

What is the gross margin percentage of this financial accounting question?

managerial accoun

Chapter 8 Solutions

Auditing and Assurance Services (16th Edition)

Ch. 8 - Prob. 1RQCh. 8 - Prob. 2RQCh. 8 - Prob. 3RQCh. 8 - Prob. 4RQCh. 8 - Prob. 5RQCh. 8 - Prob. 6RQCh. 8 - Prob. 7RQCh. 8 - Prob. 8RQCh. 8 - Prob. 9RQCh. 8 - Prob. 10RQ

Ch. 8 - Prob. 11RQCh. 8 - Prob. 12RQCh. 8 - Prob. 13RQCh. 8 - Prob. 14RQCh. 8 - Prob. 15RQCh. 8 - Your client, Harper Company, has a contractual...Ch. 8 - Prob. 17RQCh. 8 - Prob. 18RQCh. 8 - Prob. 19RQCh. 8 - Prob. 20RQCh. 8 - Prob. 21RQCh. 8 - Prob. 22RQCh. 8 - Prob. 23RQCh. 8 - Prob. 24RQCh. 8 - Prob. 25.1MCQCh. 8 - Prob. 25.2MCQCh. 8 - Prob. 25.3MCQCh. 8 - Prob. 26.1MCQCh. 8 - Prob. 26.2MCQCh. 8 - Prob. 26.3MCQCh. 8 - Which one of the following statements is correct...Ch. 8 - Prob. 27.2MCQCh. 8 - Prob. 27.3MCQCh. 8 - Prob. 28.1MCQCh. 8 - Prob. 28.2MCQCh. 8 - Prob. 28.3MCQCh. 8 - Prob. 29DQPCh. 8 - Prob. 30DQPCh. 8 - Prob. 31DQPCh. 8 - Your comparison of the gross margin percent for...Ch. 8 - Prob. 33DQPCh. 8 - Prob. 34DQPCh. 8 - Prob. 35DQPCh. 8 - Prob. 36DQPCh. 8 - Prob. 37DQPCh. 8 - Following are statements of earnings and financial...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub  Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Cornerstones of Financial Accounting

Accounting

ISBN:9781337690881

Author:Jay Rich, Jeff Jones

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

How To Analyze an Income Statement; Author: Daniel Pronk;https://www.youtube.com/watch?v=uVHGgSXtQmE;License: Standard Youtube License