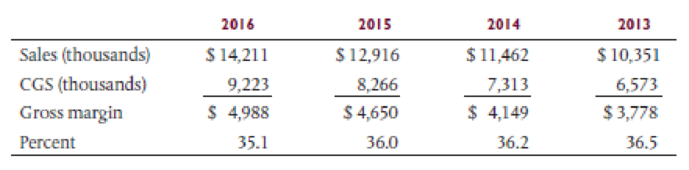

Your comparison of the gross margin percent for Jones Drugs for the years 2013 through 2016 indicates a significant decline. This is shown by the following information:

A discussion with Marilyn Adams, the controller, brings to light two possible explanations. She informs you that the industry gross profit percent in the retail drug industry declined fairly steadily for three years, which accounts for part of the decline. A second factor was the declining percent of the total volume resulting from the pharmacy part of the business. The pharmacy sales represent the most profitable portion of the business, yet the competition from discount drugstores prevents it from expanding as fast as the nondrug items such as magazines, candy, and many other items sold. Adams feels strongly that these two factors are the cause of the decline.

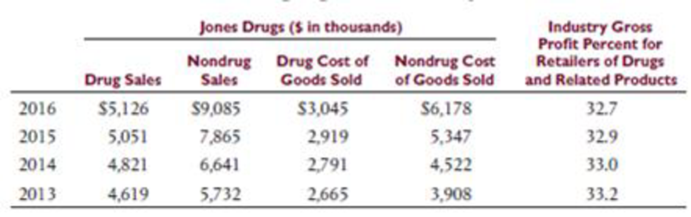

The following additional information is obtained from independent sources and the client's records as a means of investigating the controller's explanations:

Required

- a. Evaluate the explanation provided by Adams. Show calculations to support your conclusions.

- b. Which specific aspects of the client's financial statements require intensive investigation in this audit?

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Auditing and Assurance Services (16th Edition)

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning

Intermediate Financial Management (MindTap Course...FinanceISBN:9781337395083Author:Eugene F. Brigham, Phillip R. DavesPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning

Cornerstones of Financial AccountingAccountingISBN:9781337690881Author:Jay Rich, Jeff JonesPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub