Refer to Exercise 8.29. Suppose Gene determines that next year’s Sales Division activities include the following:

Research—researching current and future conditions in the industry

Shipping—arranging for shipping of mattresses and handling calls from purchasing agents at retail stores to trace shipments and correct errors

Jobbers—coordinating the efforts of the independent jobbers who sell the mattresses

Basic ads—placing print and television ads for the Sleepeze and Plushette lines

Ultima ads—choosing and working with the advertising agency on the Ultima account

Office management—operating the Sales Division office

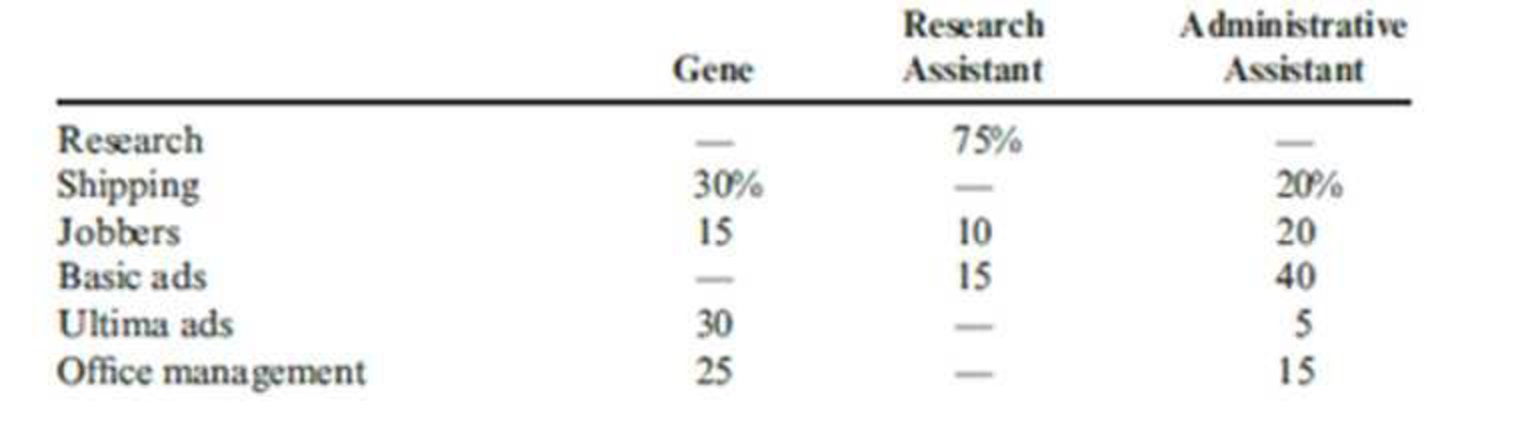

The percentage of time spent by each employee of the Sales Division on each of the above activities is given in the following table:

Additional information is as follows:

- a.

Depreciation on the office equipment belongs to the office management activity. - b. Of the $21,000 for office supplies and other expenses, $5,000 can be assigned to telephone costs which can be split evenly between the shipping and jobbers’ activities. An additional $2,400 per year is attributable to Internet connections and fees, and the bulk of these costs (80 percent) are assignable to research. The remainder is a cost of office management. All other office supplies and costs are assigned to the office management activity.

Required:

- 1. Prepare an activity-based budget for next year by activity. Use the expected level of sales activity.

- 2. On the basis of the budget prepared in Requirement 1, advise Gene regarding actions that might be taken to reduce expenses.

Olympus, Inc., manufactures three models of mattresses: the Sleepeze, the Plushette, and the Ultima.

- a. Salaries for his office (including himself at $65,000, a

marketing research assistant at $40,000, and an administrative assistant at $25,000) are budgeted for $130,000 next year. - b. Depreciation on the offices and equipment is $20,000 per year.

- c. Office supplies and other expenses total $21,000 per year.

- d. Advertising has been steady at $20,000 per year. However, the Ultima is a new product and will require extensive advertising to educate consumers on the unique features of this high-end mattress. Gene believes the company should spend 15 percent of first-year Ultima sales for a print and television campaign.

- e. Commissions on the Sleepeze and Plushette lines are 5 percent of sales. These commissions are paid to independent jobbers who sell the mattresses to retail stores.

- f. Last year, shipping for the Sleepeze and Plushette lines averaged $50 per unit sold. Gene expects the Ultima line to ship for $75 per unit sold since this model features a larger mattress.

Required:

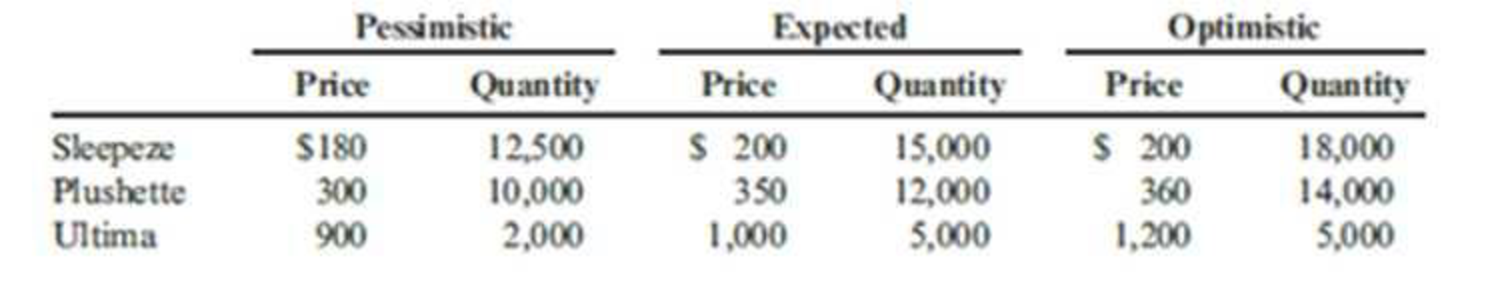

- 1. Suppose that Gene is considering three sales scenarios as follows:

Prepare a revenue budget for the Sales Division for the coming year for each scenario.

- 2. Prepare a flexible expense budget for the Sales Division for the three scenarios above.

Trending nowThis is a popular solution!

Chapter 8 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning

Essentials of Business Analytics (MindTap Course ...StatisticsISBN:9781305627734Author:Jeffrey D. Camm, James J. Cochran, Michael J. Fry, Jeffrey W. Ohlmann, David R. AndersonPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,