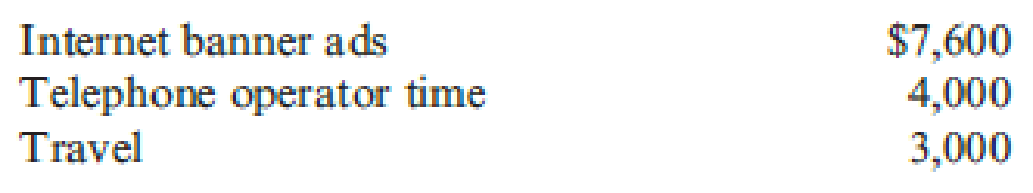

Timothy Donaghy has developed a unique formula for growing hair. His proprietary lotion, used regularly for 45 days, will grow hair in bald spots (with varying degrees of success). Timothy calls his lotion Hair-Again and is selling it via the telephone and Internet. His major form of marketing is through 15-minute infomercials and Internet advertising. Timothy sells each 16- ounce bottle of Hair-Again for $15 and pays a commission of 3 percent of sales to telephone operators who field the 1-800 phone calls from potential customers. Fixed marketing expenses for each quarter of the coming year include:

In addition, early next year Timothy intends to film and show infomercials on television. He expects the cost to be $10,000 in quarters 1 and 2, and that the cost will rise to $25,000 in each of quarters 3 and 4. Timothy expects the following unit sales of Hair-Again:

Required:

- 1. Construct a marketing expense budget for Hair-Again for the coming year. Show total amounts by quarter and in total for the year.

- 2. What if the cost of Internet ads rises to $15,000 in Quarters 2 through 4? How would that affect variable marketing expense? Fixed marketing expense? Total marketing expense?

Trending nowThis is a popular solution!

Chapter 8 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Solve this financial accounting problemarrow_forwardFinancial Accounting Questionarrow_forwardSilvar Manufacturing applies overhead using a normal costing approach based on machine-hours. The budgeted factory overhead was $315,000, and the budgeted machine-hours were 21,000. The actual factory overhead was $348,750, and the actual machine-hours were 22,100. How much overhead would be applied to production?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning