Cornerstones of Cost Management (Cornerstones Series)

4th Edition

ISBN: 9781305970663

Author: Don R. Hansen, Maryanne M. Mowen

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 14CE

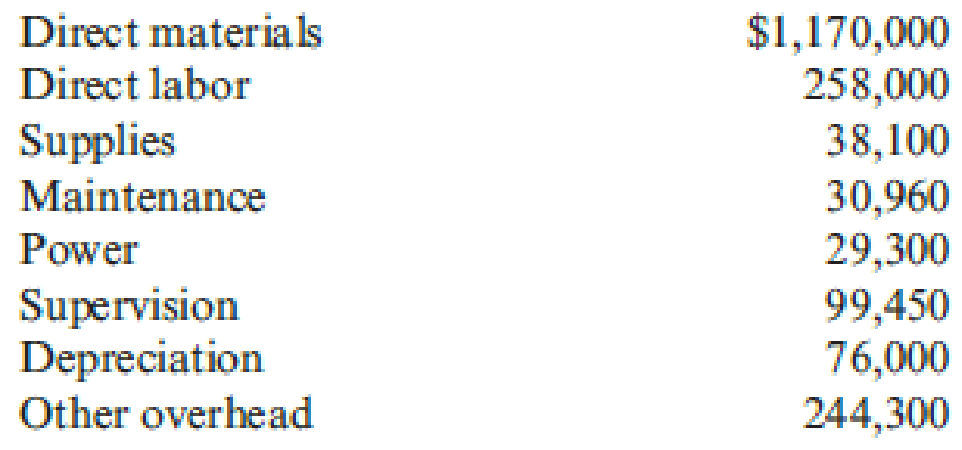

Refer to Cornerstone Exercise 8.13. In March, Nashler Company produced 163,200 units and had the following actual costs:

Required:

- 1. Prepare a performance report for Nashler Company comparing actual costs with the flexible budget for actual units produced.

- 2. What if Nashler Company’s actual direct materials cost were $1,175,040? How would that affect the variance for direct materials? The total cost variance?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Please provide solution this financial accounting question

Financial Accounting Question

Need help with this general accounting question

Chapter 8 Solutions

Cornerstones of Cost Management (Cornerstones Series)

Ch. 8 - Define budget. How are budgets used in planning?Ch. 8 - Prob. 2DQCh. 8 - Prob. 3DQCh. 8 - What is the master budget? An operating budget? A...Ch. 8 - Explain the role of a sales forecast in budgeting....Ch. 8 - All budgets depend on the sales budget. Is this...Ch. 8 - What is an accounts receivable aging schedule? Why...Ch. 8 - Suppose that the vice president of sales is a...Ch. 8 - Suppose that the controller of your companys...Ch. 8 - Prob. 10DQ

Ch. 8 - Prob. 11DQCh. 8 - Discuss the shortcomings of the traditional master...Ch. 8 - Define static budget. Give an example that shows...Ch. 8 - What are the two meanings of a flexible budget?...Ch. 8 - What are the steps involved in building an...Ch. 8 - FlashKick Company manufactures and sells soccer...Ch. 8 - Refer to Cornerstone Exercise 8.1, through...Ch. 8 - Refer to Cornerstone Exercise 8.2 for the...Ch. 8 - Prob. 4CECh. 8 - Johnston Company cleans and applies powder coat...Ch. 8 - Play-Disc makes Frisbee-type plastic discs. Each...Ch. 8 - Refer to Cornerstone Exercise 8.6. Required: 1....Ch. 8 - Timothy Donaghy has developed a unique formula for...Ch. 8 - Green Earth Landscaping Company provides monthly...Ch. 8 - Coral Seas Jewelry Company makes and sells costume...Ch. 8 - Shalimar Company manufactures and sells industrial...Ch. 8 - Khloe Company imports gift items from overseas and...Ch. 8 - Nashler Company has the following budgeted...Ch. 8 - Refer to Cornerstone Exercise 8.13. In March,...Ch. 8 - Palmgren Company produces consumer products. The...Ch. 8 - Prob. 16ECh. 8 - Crescent Company produces stuffed toy animals; one...Ch. 8 - Audio-2-Go, Inc., manufactures MP3 players. Models...Ch. 8 - Tiger Drug Store carries a variety of health and...Ch. 8 - Rosita Flores owns Rositas Mexican Restaurant in...Ch. 8 - Prob. 21ECh. 8 - Janet Wooster owns a retail store that sells new...Ch. 8 - Historically, Ragman Company has had no...Ch. 8 - Del Spencer is the owner and founder of Del...Ch. 8 - Refer to Exercise 8.24. Del Spencers purchases...Ch. 8 - Ingles Corporation is a manufacturer of tables...Ch. 8 - In an attempt to improve budgeting, the controller...Ch. 8 - Refer to Exercise 8.27. At the end of the year,...Ch. 8 - Olympus, Inc., manufactures three models of...Ch. 8 - Refer to Exercise 8.29. Suppose Gene determines...Ch. 8 - Trumbull Co. plans to produce 100,000 toy cars...Ch. 8 - Which of the following describes the order in...Ch. 8 - A companys controller is adjusting next years...Ch. 8 - A companys sales for the coming months are as...Ch. 8 - The budget that adjusts unit sales for beginning...Ch. 8 - Ponderosa, Inc., produces wiring harness...Ch. 8 - Bernard Creighton is the controller for Creighton...Ch. 8 - Greiner Company makes and sells high-quality glare...Ch. 8 - Prob. 39PCh. 8 - The controller for Muir Companys Salem plant is...Ch. 8 - Refer to Problem 8.40 for data. Required: 1. Run a...Ch. 8 - Norton Company, a manufacturer of infant furniture...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial Accountingarrow_forwardMason (single) is a 50 percent shareholder in Angels Corporation (an S Corporation). Mason receives a $184,500 salary working full time for Angels Corporation. Angels Corporation reported $418,000 of taxable business income for the year. Before considering his business income allocation from Angels and the self-employment tax deduction (if any), Mason's adjusted gross income is $184,500 (all salary from Angels Corporation). Mason claims $59,000 in itemized deductions. Answer the following questions for Mason. c. b. Assuming the business income allocated to Mason is income from a specified service trade or business, except that Angels Corporation reported $168,000 of taxable business income for the year. What is Mason's deduction for qualified business income? Ignore the wage-based limitation when computing the deduction.arrow_forwardPlease give me true answer this financial accounting questionarrow_forward

- You are the owner of Veiled Wonders, a firm that makes window treatments. Some merchandise is custom-made to customer specifications, and some are mass-produced in standardized measurements. There are production workers who work primarily on standardized blinds and some employees who work on custom products on an as-needed basis. How should you structure the pay methods for these production workers?arrow_forwardGeneral Accounting questionarrow_forwardWilson Corporation acquires Greatbatch Company for $80 million cash in a merger. The balance sheets of both companies at the date of acquisition are as follows: Balance Sheet (in millions) Wilson Greatbatch Current assets $96 $8 Property and equipment 800 144 Intangibles 32 4.8 Total assets $928 $156.8 Current liabilities $40 $3.2 Long-term debt 640 104 Capital stock 80 19.2 Retained earnings 192 24 Accumulated other comprehensive income (loss) (24) 6.4 Total liabilities and equity $928 $156.8 Greatbatch's property and equipment is overvalued by $48 million, its reported intangibles are undervalued by $32 million, and it has unreported intangibles, in the form of customer databases and marketing agreements, valued at $11.2 million. Required Prepare Wilson's balance sheet immediately following the merger. Use a negative sign with your answer for AOCI if the balance is a loss.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

What is variance analysis?; Author: Corporate finance institute;https://www.youtube.com/watch?v=SMTa1lZu7Qw;License: Standard YouTube License, CC-BY