Concept explainers

Completing a

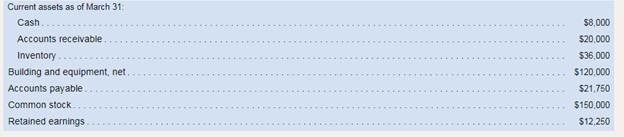

The following data relate to the operations of Shilow Company, a wholesale distributor of consumer goods

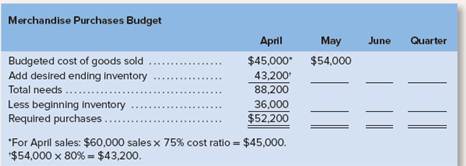

a. The gross margin is 25°o of sales.

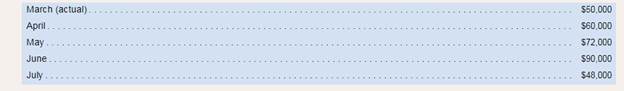

b. Actual and budgeted sales data:

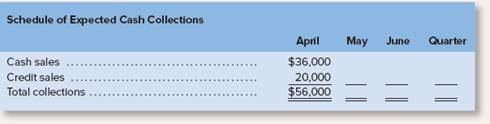

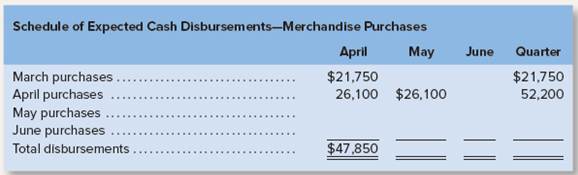

c. Sales are 609o for cash and 40% on credit. Credit sales are collected in the month following sale. The

d. Each month’s ending inventory should equal 80°ó of the following month’s budgeted cost of goods sold.

e. One-half of a month’s inventory purchases is paid for in the month of purchase; the other half is paid for in the following month. Theaccounts payable at March 31 are the result of March purchases of inventory.

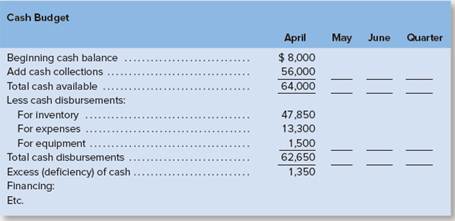

f. Monthly expenses are as follows: commissions, 12% of sales; rent, $2,500 per month; other expenses (excluding

Assume that these expenses are paid monthly. Depreciation is S900 per month (includes depreciation on new assets).

g. Equipment costing $1,500 will be purchased for cash in April.

h. Management would like to maintain a minimum cash balance of at least S4,000 at the end of each month. The company has an agreementwith a local bank that allows the company to borrow in increments of $1,000 at the beginning of each month, up to a total loan balance of $20,000. The interest rate on these loans is 1% per month and for simplicity we will assume that interest is not compounded. The companywould, as far as it is able, repay the loan plus accumulated interest at the end of the quarter.

Required:

Using the preceding data:

1. Complete the following schedule:

2. Complete the following:

3. Complete the following

4. Using Schedule 9 as your guide, prepare an absorption costing income statement for the quarter ended June 30.

5. Prepare a

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Loose Leaf For Introduction To Managerial Accounting

- QS 15-18 (Algo) Computing and recording over- or underapplied overhead LO P4 A company applies overhead at a rate of 170% of direct labor cost. Actual overhead cost for the current period is $1,081,900, and direct labor cost is $627,000. 1. Compute the under- or overapplied overhead. 2. Prepare the journal entry to close over- or underapplied overhead to Cost of Goods Sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the under- or overapplied overhead.arrow_forwardQuestion 6 During 2019, Bitsincoins Corporation had EBIT of $100,000, a change in net fixed assets of $400,000, an increase in net current assets of $100,000, an increase in spontaneous current liabilities of $400,000, a depreciation expense of $50,000, and a tax rate of 30%. Based on this information, what is Bitsincoin's free cash flow? (3 marks)arrow_forwardQuestion 4 Waterfront Inc. wishes to borrow on a short-term basis without reducing its current ratio below 1.25. At present its current assets and current liabilities are $1,600 and $1,000 respectively. How much can Waterfront Inc. borrow? (5 marks)arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning