Concept explainers

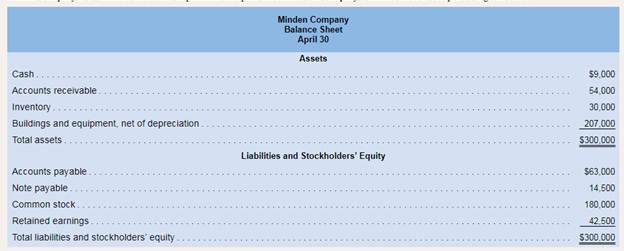

Minden Company is a wholesale distributor of premium European chocolates. The company’s balance sheet as of April 30 is given below:

The company is in the process of preparing a budget for May and has assembled the following data:

a. Sales are budgeted at $200, 000 for May. Of these sales, $60,000 will be for cash; the remainder will be credit sales. One-half of a month’s credit sales are collected in the month the sales are made, and the remainder is collected in the following month. All of the April 30

b. Purchases of inventory are expected to total Si 20,000 during May .These purchases will all be on account. Forty percent of all purchases are paid for in the month of purchase; the remainder are paid in the following month. All of the April 30 accounts payable to suppliers will be paid during May.

c. The May 31 inventory balance is budgeted at $40,000.

d. Selling and administrative expenses for May are budgeted at $72,000, exclusive of

Depreciation is budgeted at $2,000 for the month.

e. The note payable on the April 30 balance sheet will be paid during May, with S 100 in interest. (All of the interest relates to May.)

f New refrigerating equipment costing $6,500 will be purchased for cash during May.

g. During Ma, the company will borrow $20,000 from its bank by giving a new note payable to the bank for that amount. The new note will be due in one year.

Required:

1. Calculate the expected cash collections for May.

2. Calculate the expected cash disbursements for merchandise purchases for May.

3. Prepare a cash budget for May.

4. Using Schedule 9 as your guide, prepare a

5. Prepare a budgeted balance sheet as of May 31.

Trending nowThis is a popular solution!

Chapter 8 Solutions

Loose Leaf For Introduction To Managerial Accounting

- Can you help me solve this general accounting question using the correct accounting procedures?arrow_forwardCan you solve this general accounting question with accurate accounting calculations?arrow_forwardPlease provide the correct answer to this general accounting problem using accurate calculations.arrow_forward

- I need help solving this general accounting question with the proper methodology.arrow_forwardI need help finding the accurate solution to this general accounting problem with valid methods.arrow_forwardPlease provide the answer to this financial accounting question using the right approach.arrow_forward

- I am looking for a reliable way to solve this financial accounting problem using accurate principles.arrow_forwardI need help with this financial accounting problem using proper accounting guidelines.arrow_forwardCan you demonstrate the accurate steps for solving this financial accounting problem with valid procedures?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning