Concept explainers

Direct Labor Budget LOB-5

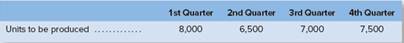

The production manager of Rordan Corporation has submitted the following quarterly production

Each unit requires 0.35 direct labor-hours, and direct laborers are paid S12.00 per hour.

Required:

1. Using Schedule 4 as your guide, prepare the company’s direct labor budget for the upcoming fiscal year. Assume that the direct labor workforce is adjustedeach quarter to match the number of hours required to produce the forecasted number of units produced.

2. Prepare the company’s direct labor budget for the upcoming fiscal year, assuming that the direct labor workforce is not adjusted each quarter. Instead,assume that the company’s direct labor workforce consists of permanent employees who are guaranteed to be paid for at least 2,600 hours of work eachquarter. If the number of required direct labor-hours is less than this number, the workers are paid for 2,600 hours anyway. Any hours worked in excess of2,600 hours in a quarter are paid at the rate of 1.5 times the normal hourly rate for direct labor.

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Loose Leaf For Introduction To Managerial Accounting

- No Chatgpt When a company collects cash from a customer in advance, it should:A. Recognize revenue immediatelyB. Record a liabilityC. Record it as equityD. Ignore it until revenue is earnedarrow_forwardPlease don't use ai 5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividendarrow_forwardDon't use ChatGPT! 5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividendarrow_forward

- No chatgpt 5. What is the normal balance of the Dividends account?A. DebitB. CreditC. Zero balanceD. Depends on the type of dividendarrow_forwardNo chatgpt Which of the following transactions decreases stockholders' equity?A. Issuing sharesB. Paying dividendsC. Earning net incomeD. Receiving customer paymentsarrow_forwardNo chatgpt Which of the following is an adjusting entry?A. Payment of salariesB. Depreciation expenseC. Purchase of suppliesD. Payment of rent in advancearrow_forward

- No chatgpt Which financial statement reports cash inflows and outflows?A. Balance SheetB. Statement of Cash FlowsC. Income StatementD. Statement of Retained Earningsarrow_forwardNo chatgpt 2. When a company collects cash from a customer in advance, it should:A. Recognize revenue immediatelyB. Record a liabilityC. Record it as equityD. Ignore it until revenue is earnedarrow_forwardWhich financial statement reports cash inflows and outflows?A. Balance SheetB. Statement of Cash FlowsC. Income StatementD. Statement of Retained Earningsneed helparrow_forward

- Which account is not closed at the end of the accounting period?A. RevenueB. ExpenseC. DividendsD. Suppliesno aiarrow_forward2. When a company collects cash from a customer in advance, it should:A. Recognize revenue immediatelyB. Record a liabilityC. Record it as equityD. Ignore it until revenue is earned No Aiarrow_forwardCan you explain the correct approach to solve this general accounting question?arrow_forward

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,