Concept explainers

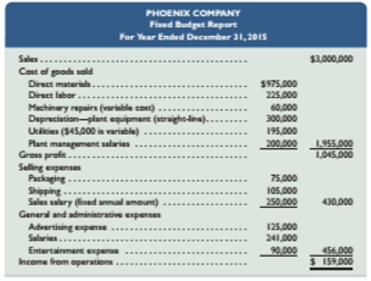

Phoenix Company’s 2015

Required

- Classify all items listed in the fixed budget as variable or fixed. Also determine their amounts per unit or their amounts for the year, as appropriate.

- Prepare flexible budgets (See Exhibit 8.3) for the company at sales volumes of 14,000 and 16,000 units.

- The company’s business conditions are improving. One possible result is a sales volume of 18,000 units. The company president in confident that this volume is within the relevant range of existing capacity. How much would operating income increase over the 2015 budgeted amount of $159,000 if this level is reached without increasing capacity?

- An unfavorable change in business is remotely possible; in this case, production and sales volume for 2015 could fall to 12,000 units. How much income (or loss) from operations would occurs if sales volume falls to this level?

Concept introduction:

Fixed Budget:

A fixed budget, also known as static budget does not adjust throughout the budget period and is prepared on the assumption that specific amount of goods would be sold in the concerned period.

Requirement 1:

Classification of items of fixed budget as fixed or variable and their amounts per unit or their amounts for the year.

Answer to Problem 1PSA

Classification of fixed budget items as fixed or variable:

| Particulars | Total amount (In $) | Amount per unit (In $) |

| Variable costs: | ||

| Direct materials | 9, 75, 000 | 65 |

| Direct labor | 2, 25, 000 | 15 |

| Machinery repairs | 60, 000 | 4 |

| Utilities | 45, 000 | 3 |

| Packaging | 75, 000 | 5 |

| Shipping | 1, 05, 000 | 7 |

| Total variable costs | 99 | |

| Fixed costs: | ||

| Depreciation- Plant equipment | 3, 00, 000 | |

| Utilities | 1, 50, 000 | |

| Plant management salaries | 2, 00, 000 | |

| Sales salaries | 2, 50, 000 | |

| Advertising expense | 1, 25, 000 | |

| Salaries | 2, 41, 000 | |

| Entertainment expense | 90, 000 | |

| Total fixed costs | 13, 56, 000 |

Explanation of Solution

The items laid in fixed budget of the company in the given problem can be classified into variable or fixed based on their nature i.e. on the basis of their behavior and traceability as explained below:

Variable costs vary directly with the production level i.e. company’s variable cost increases as the production increases and vice-a-versa. Therefore, following costs would be classified as Variable:

- Direct materials: The direct materials would be relate to the amount paid for procurement of materials which would vary

- Direct labor: The payment made to direct labor would vary depending on the production

- Machinery repairs: The repairs done on machinery would be varied depending upon the usage of machinery for production of output

- Utilities: Utilities would be acquired depending on their requirement which would vary

- Packaging: The amount spent on packaging would be in relation to products produced which would vary

- Shipping: Expenses incurred on shipping would be incurred based on the number of products produced

Fixed costs do not vary with the level of production. They do not change with the amount of goods or services a company produces. Therefore, those costs which are fixed in nature would be covered under fixed costs as given below:

- Depreciation- Plant equipment: The depreciation charged on plants equipment would remain fixed and would not change with the level of production

- Utilities: Utilities other than variable in nature would be covered under fixed cost

- Plant management salaries: The salaries paid for managing would be fixed in nature

- Sales salaries: Salaries paid to sales staff would remain fixed in nature

- Advertising expense: The expenses on advertising would be covered under fixed cost

- Salaries: Salaries paid to staff would remain fixed in nature and would not change with the level of production

- Entertainment expense: Expenses on entertainment are fixed irrespective of the level of production

Further, it is given in the problem that sales volume is 15, 000 units and Sales are $3, 000, 0000. Therefore, calculation of Variable cost per unit has been calculated using the following formula:

Following would be the per unit amounts:

Thus, the total variable costs would be the following:

Also, fixed costs would include the following;

Therefore, classification of fixed budget items as asked in the given problem is shown below in the tabular manner:

Classification of fixed budget items as fixed or variable:

| Particulars | Total amount (In $) | Amount per unit (In $) |

| Variable costs: | ||

| Direct materials | 9, 75, 000 | 65 |

| Direct labor | 2, 25, 000 | 15 |

| Machinery repairs | 60, 000 | 4 |

| Utilities | 45, 000 | 3 |

| Packaging | 75, 000 | 5 |

| Shipping | 1, 05, 000 | 7 |

| Total variable costs | 99 | |

| Fixed costs: | ||

| Depreciation- Plant equipment | 3, 00, 000 | |

| Utilities | 1, 50, 000 | |

| Plant management salaries | 2, 00, 000 | |

| Sales salaries | 2, 50, 000 | |

| Advertising expense | 1, 25, 000 | |

| Salaries | 2, 41, 000 | |

| Entertainment expense | 90, 000 | |

| Total fixed costs | 13, 56, 000 |

Concept introduction:

Flexible Budget:

A flexible budget, also known as variation budget adjusts to changes in volume or activity. Flexible budgets are prepared for comparing actual to budgeted performances at many levels of activity during the previous year. In order to accurately predict the changes in costs, management identifies them into fixed or variable costs.

Fixed cost:

These costs do not vary with the level of production. They do not change with the amount of goods or services a company produces. They remain same even if the company does not produce any product or provide any service during an accounting period.

Variable cost:

These costs vary with the level of production. They are usually shown in the budget as either a percentage of total revenue or at a constant rate per unit produced.

Requirement 2:

Flexible budget for the company at sales volume of 14, 000 units and 16, 000 units.

Answer to Problem 1PSA

Flexible budget for the company for the year ended December 31, 2015 (Amount in $):

| Company | ||||

| Flexible budget | ||||

| For year ended December 31, 2015 | ||||

| Particulars | Flexible budget | Flexible budget for 14, 000 units sold | Flexible budget for 16, 000 units sold | |

| Variable amount per unit | Total fixed cost | |||

| Sales | 200 | 28, 00, 000 | 32, 00, 000 | |

| Variable costs: | ||||

| Direct materials | 65 | 9, 10, 000 | 10, 40, 000 | |

| Direct labor | 15 | 2, 10, 000 | 2, 40, 000 | |

| Machinery repairs | 4 | 56, 000 | 64, 000 | |

| Utilities | 3 | 42, 000 | 48, 000 | |

| Packaging | 5 | 70, 000 | 80, 000 | |

| Shipping | 7 | 98, 000 | 1, 12, 000 | |

| Total variable costs | 99 | 13, 86, 000 | 15, 84, 000 | |

| Contribution margin | 101 | 14, 14, 000 | 16, 16, 000 | |

| Fixed costs: | ||||

| Depreciation- Plant equipment | 3, 00, 000 | 3, 00, 000 | 3, 00, 000 | |

| Utilities | 1, 50, 000 | 1, 50, 000 | 1, 50, 000 | |

| Plant management salaries | 2, 00, 000 | 2, 00, 000 | 2, 00, 000 | |

| Sales salary | 2, 50, 000 | 2, 50, 000 | 2, 50, 000 | |

| Advertising expense | 1, 25, 000 | 1, 25, 000 | 1, 25, 000 | |

| Salaries | 2, 41, 000 | 2, 41, 000 | 2, 41, 000 | |

| Entertainment expense | 90, 000 | 90, 000 | 90, 000 | |

| Total fixed costs | 13, 56, 000 | 13, 56, 000 | 13, 56, 000 | |

| Income from operations | 58, 000 | 2, 60, 000 | ||

Explanation of Solution

For preparation of flexible budget of the company, following formulas would be used:

In the given problem, it is given that sales are $30, 00, 000 and sales volume is 15, 000 units.

Flexible budget has to be prepared at sales volume of 14, 000 and 16, 000 units. We have already calculated variable cost per unit of all the items. Now, calculations for variable cost have been made in the following manner:

| Particulars | Variable amount per unit (Amount in $) | For 14, 000 units sold | For 16, 000 units sold |

| Sales | 200 | $200*14, 000 = 28, 00, 000 | $200*16, 000 = 32, 00, 000 |

| Variable costs: | |||

| Direct materials | 65 | $65*14, 000 = 9, 10, 000 | $65*16, 000 = 10, 40, 000 |

| Direct labor | 15 | $15*14, 000 = 2, 10, 000 | $15*16, 000 = 2, 40, 000 |

| Machinery repairs | 4 | $4*14, 000 = 56, 000 | $4*16, 000 = 64, 000 |

| Utilities | 3 | $3*14, 000 = 42, 000 | $3*16, 000 = 48, 000 |

| Packaging | 5 | $5*14, 000 = 70, 000 | $5*16, 000 = 80, 000 |

| Shipping | 7 | $7*14, 000 = 98, 000 | $7*16, 000 = 1, 12, 000 |

| Total variable costs | 99 | 13, 86, 000 | 15, 84, 000 |

Further, contribution margin can be calculated using the below- mentioned formulas:

Thus, contribution margin would be:

Fixed costs would remain same irrespective of the changes in sales volume. Also, Income from operations can be computed using the following formula:

Therefore, flexible budget asked in the given problem at 14, 000 and 16, 000 units is given below:

Flexible budget for the company for the year ended December 31, 2015 (Amount in $):

| Company | ||||

| Flexible budget | ||||

| For year ended December 31, 2015 | ||||

| Particulars | Flexible budget | Flexible budget for 14, 000 units sold | Flexible budget for 16, 000 units sold | |

| Variable amount per unit | Total fixed cost | |||

| Sales | 200 | 28, 00, 000 | 32, 00, 000 | |

| Variable costs: | ||||

| Direct materials | 65 | 9, 10, 000 | 10, 40, 000 | |

| Direct labor | 15 | 2, 10, 000 | 2, 40, 000 | |

| Machinery repairs | 4 | 56, 000 | 64, 000 | |

| Utilities | 3 | 42, 000 | 48, 000 | |

| Packaging | 5 | 70, 000 | 80, 000 | |

| Shipping | 7 | 98, 000 | 1, 12, 000 | |

| Total variable costs | 99 | 13, 86, 000 | 15, 84, 000 | |

| Contribution margin | 101 | 14, 14, 000 | 16, 16, 000 | |

| Fixed costs: | ||||

| Depreciation- Plant equipment | 3, 00, 000 | 3, 00, 000 | 3, 00, 000 | |

| Utilities | 1, 50, 000 | 1, 50, 000 | 1, 50, 000 | |

| Plant management salaries | 2, 00, 000 | 2, 00, 000 | 2, 00, 000 | |

| Sales salary | 2, 50, 000 | 2, 50, 000 | 2, 50, 000 | |

| Advertising expense | 1, 25, 000 | 1, 25, 000 | 1, 25, 000 | |

| Salaries | 2, 41, 000 | 2, 41, 000 | 2, 41, 000 | |

| Entertainment expense | 90, 000 | 90, 000 | 90, 000 | |

| Total fixed costs | 13, 56, 000 | 13, 56, 000 | 13, 56, 000 | |

| Income from operations | 58, 000 | 2, 60, 000 | ||

Thus, the income from operations of company at sales volume of 14, 000 and 16, 000 units are $58, 000 and $2, 60, 000 respectively.

Concept introduction:

Fixed cost:

These costs do not vary with the level of production. They do not change with the amount of goods or services a company produces. They remain same even if the company does not produce any product or provide any service during an accounting period.

Variable cost:

These costs vary with the level of production. They are usually shown in the budget as either a percentage of total revenue or at a constant rate per unit produced.

Requirement 3:

Increase in operating income at 18, 000 units without increasing capacity.

Answer to Problem 1PSA

Increase in operating income at 18, 000 units without increasing capacity = $3, 03, 000

Explanation of Solution

Sales volume has been increased to 18, 000 units from 15, 000 units, thereby increasing 3, 000 units sold (18, 000 units- 15, 000 units). For calculating increase in operating income with existing capacity and fixed costs, firstly total contribution margin would be calculated using the following formula:

Contribution margin per unit has already been calculated as $101 per unit. Thus,

Total fixed costs are calculated as $13, 56, 000. Therefore, all the calculations have been shown in the table below:

| Particulars | Amount |

| Total contribution margin | $101* 18, 000 units = $18, 18, 000 |

| Less: Fixed costs | ($13, 56, 000) |

| Potential operating loss | $4, 62, 000 |

| Budgeted income of 2015 | ($1, 59, 000) |

| Increase in operational income | $3, 03, 000 |

Therefore, Increase in operating income at 18, 000 units without increasing capacity is coming out to be $3, 03, 000.

Concept introduction:

Fixed cost:

These costs do not vary with the level of production. They do not change with the amount of goods or services a company produces. They remain same even if the company does not produce any product or provide any service during an accounting period.

Variable cost:

These costs vary with the level of production. They are usually shown in the budget as either a percentage of total revenue or at a constant rate per unit produced.

Requirement 4:

Income (or loss) from operations if sales volume fall to 12, 000 units.

Answer to Problem 1PSA

Potential operating loss at sales volume of 12, 000 units = $1, 44, 000

Explanation of Solution

Sales volume has fallen to 12, 000 units from 15, 000 units, thereby decreasing 3, 000 units sold (15, 000 units- 12, 000 units). For calculating income (or loss) from operations, firstly total contribution margin would be calculated using the following formula:

Contribution margin per unit has already been calculated as $101 per unit. Thus,

Total fixed costs are calculated as $13, 56, 000. Therefore, all the calculations have been shown in the table below:

| Particulars | Amount |

| Total contribution margin | $101* 12, 000 units = $12, 12, 000 |

| Less: Fixed costs | ($13, 56, 000) |

| Potential operating loss | $1, 44, 000 |

Therefore, the potential operating loss at 12, 000 units is coming out to be $1, 44, 000.

Want to see more full solutions like this?

Chapter 8 Solutions

MANAGERIAL ACCOUNTING FUND. W/CONNECT

- The Coyle Shirt Company manufactures shirts in two departments: Cutting and Sewing. The company allocates manufacturing overhead using a single plantwide rate with direct labor hours as the allocation base. Estimated overhead costs for the year are $630,000, and estimated direct labor hours are 210,000. In June, the company incurred 18,200 direct labor hours. 1. 2. Compute the predetermined overhead allocation rate. Determine the amount of overhead allocated in June. The Coyle Shirt Company has refined its allocation system by separating manufacturing overhead costs into two cost pools-one for each department. (Click the icon to view the estimated costs and allocation data for each department.) 3. Compute the predetermined overhead allocation rates for each department. 4. Determine the total amount of overhead allocated in June. 1. Compute the predetermined overhead allocation rate. Begin by selecting the formula to calculate the predetermined overhead (OH) allocation rate. Then enter…arrow_forwardDecentralized businesses can have three responsibility centers that must be evaluated differently because of their functions. • Describe the three responsibility centers and give an example of each from your work. • Give an explanation about how each is evaluated. • Tell us why you would prefer to work in a centralized or decentralized organization. • Discuss which type of responsibility center you would prefer to manage and why.arrow_forwardDo fast this question answer general Accountingarrow_forward

- 12. Identify the following costs as preveron, appraisal, internal failure, or external failure: a. Inspection of final products b. Sales returns of defective products c. Employee training d. Reworking defective products e. Working with suppliers to ensure delivery of high-quality raw materials f. Costs of warranty repairs g. Product testing Type of cost Prevention Appraisal Internal failure External failurearrow_forwardYou invest $1,500 today to purchase a new machine that is expected to generate the following revenues over the next 4 years: Year 0 1 2 3 4 Cash flow -1500 300 475 680 490 Find the internal rate of return (IRR) from this investment. What would be the net present value (NPV) if the interest rate is 10%? An investment project provides cash inflows of $560 per year for 10 years. What is the project’s payback period if the initial cost is $2,500? What if the initial cost is $3,250? An investment project has annual cash inflows of $2,000, $2,500, $3,000, and $4,000, and a discount rate of 11%. What is the discounted payback period for these cash flows if the initial cost is $4,800? What if the initial cost is $5,600?arrow_forwardHow does the treatment of costs differ in ABC systems as opposed to traditional cost systems?arrow_forward

- Hii ticher please given correct answer general accountingarrow_forwardFinancial accountingarrow_forwardOn October 1, 2019, Ball Company issued 10% bonds dated October 1, 2019, with a face amount of $380,000. The bonds mature in 10 years. Interest is paid semiannually on March 31 and September 30. The proceeds from the bond issuance were $384,776.05 to yield 9.80%. Ball Company has a December 31 fiscal year-end and does not use reversing entries. Required: 1. Prepare journal entries to record the issuance of the bonds and the interest payments for 2019 and 2020 using the effective interest method. 2. Prepare journal entries to record the issuance of the bonds and the interest payments for 2019 and 2020 using the straight-line method.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning