Concept explainers

Cash Flows;

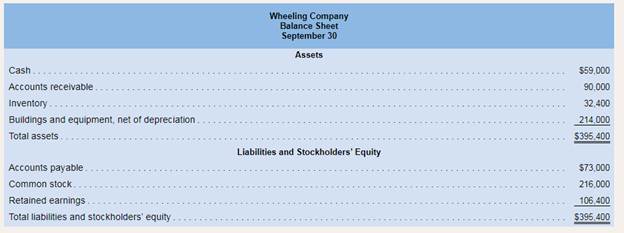

Wheeling Company is a merchandiser that provided a balance sheet as of September 30 as shown below:

The company is in the process of preparing a budget for October and has assembled the following data:

1. Sales are budgeted at $240,000 for October and $250,000 for November. Of these sales, 35% will be for cash; the remainder will be credit sales. Fortypercent of a month’s credit sales are collected in the month the sales are made, and the remaining 60% is collected in the following month. Allof the September 30

2. The budgeted cost of goods sold is always 45% of sales and the ending merchandise inventory is always 30% of the following month’s cost of goods sold.

3. All merchandise purchases are on account. Thirty percent of all purchases are paid for in the month of purchase and 70% are paid for in the followingmonth. All of the September 30 accounts payable to suppliers will be paid during October.

4. Selling and administrative expenses for October are budgeted at $78,000, exclusive of

Required:

Using the information provided, calculate or prepare the following:

a. The

b. The budgeted merchandise purchases for October.

c. The budgeted cash disbursements for merchandise purchases for October.

d. The budgeted net operating income for October.

e. A budgeted balance sheet at October 31.

2. Assume the following changes to the underlying budgeting assumptions: (1) 50% of a month’s credit sales are collected in the month the sales are made and

the remaining 500 o is collected in the following month, (2) the ending merchandise inventory is always 10% of the following month’s cost of goods sold,and (3) 20% of all purchases are paid for in the month of purchase and S0°o aie paid for in the following month. Using these new assumptions, calculate orprepare the following:

a. The budgeted cash collections for October.

b. The budgeted merchandise purchases for October.

c. The budgeted cash disbursements for merchandise purchases for October.

d. Net operating income for the month of October.

e. A budgeted balance sheet at October 31.

3. Compare your answers in requirement 1 to those that you obtained in requirement 2. If ‘heeling Company is able to achieve the budgeted projectionsdescribed in requirement 2, will it improve the company’s financial performance relative to the projections that you derived in requirement 1?

Want to see the full answer?

Check out a sample textbook solution

Chapter 8 Solutions

Introduction To Managerial Accounting

- No AI The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forwardWhich item would appear on the statement of retained earnings?A. DividendsB. InventoryC. Prepaid RentD. Notes Payablearrow_forwardWhat does a classified balance sheet do that an unclassified one does not?A. Uses the cash basis of accountingB. Categorizes assets and liabilities into current and long-termC. Shows only owner’s equityD. Omits depreciationarrow_forward

- 4. The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetno aiarrow_forward4. The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetneed helparrow_forward4. The normal balance of an asset account is:A. CreditB. DebitC. ZeroD. It depends on the assetarrow_forward

- A contingent liability should be recorded only when:A. It is possible and the amount is estimableB. It is probable and the amount is estimableC. It is certain to occurD. Management decides it’s importantDont use AIarrow_forwardA contingent liability should be recorded only when:A. It is possible and the amount is estimableB. It is probable and the amount is estimableC. It is certain to occurD. Management decides it’s important need helparrow_forwardA contingent liability should be recorded only when:A. It is possible and the amount is estimableB. It is probable and the amount is estimableC. It is certain to occurD. Management decides it’s importantarrow_forward

- No chatgpt 6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Landarrow_forwardNeed help hi 6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Landarrow_forward6. Which of the following is not an intangible asset?A. GoodwillB. PatentC. TrademarkD. Land i need helparrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,  Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning

Fundamentals Of Financial Management, Concise Edi...FinanceISBN:9781337902571Author:Eugene F. Brigham, Joel F. HoustonPublisher:Cengage Learning Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning

Survey of Accounting (Accounting I)AccountingISBN:9781305961883Author:Carl WarrenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning