Concept explainers

Production and Direct Materials Budgets LO8—, L08—4

Pearl Products Limited of Shenzhen, China, manufactures and distributes toys throughout Southeast Asia. Three cubic centimeters (cc) of solvent H300 arerequired to manufacture each unit of Supermix,one of the company’s products. The company now is planning raw materials needs for the third quarter, thequarter in which peak sales of Supermix occur. To keep production and sales moving smoothly, the company has the following inventory requirements:

a. The finished goods inventory on hand at the end of each month must equal 3,000 units of Supermix plus 20% of the next month’s sales. Thefinished goods inventory on June 30 is budgeted to be 10,000 units.

b. The raw materials inventory on hand at the end of each month must equal one-half of the following month’s production needs for rawmaterials. The raw materials inventory on June 30 is budgeted to be 54,000 cc of solvent H300.

c. The company maintains no work in process inventories.

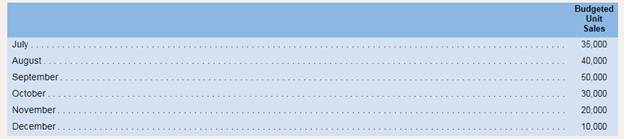

A monthly sales budget for Supermix for the third and fourth quarters of the year follows.

Required:

1. Prepare a production budget for Supermix for the months July, August, September, and October.

2. Examine the production budget that you prepared in (1) above. Why will the company produce more units than it sells in July and August, and fewer unitsthan it sells in September and October?

3. Prepare a direct materials budget showing the quantity of solvent H300 to be purchased for July, Aust. and September, and for the quarter in total.

To Examine:

Why will the company produce more units than it sells in July and August, and fewer units than it sells in September and October?

Answer to Problem 10E

Solution:

The sales are expected to be higher in September, thus, the company is planning to produce more in July and August for September and October sales. In the September and October, the production is less as it is expected to sell less units in the end months of the year.

Explanation of Solution

The above answer can be explained as the company is anticipating higher sales in September and October, so the company is planning in advance for these months’ sales. Thus, it has produced more finished goods in July and August so that the demand of September meets with the demand.

In October and September, the goods from next months will be produced, but there will not be much demand for the finished goods in the year end, thus less goods are produced in September and October.

Thus,the reasons for why will the company produce more units than it sells in July and August, and fewer units than it sells in September and October has been discussed.

Requirement 3

To prepare:

Direct Materials purchase budget for the solvent H300 for July, August, and September and in total.

Answer to Problem 10E

Solution:

| Direct Material Purchase Budget | ||||

| July | August | September | Total | |

| Budgeted Production | 36,000 | 42,000 | 46,000 | 1,24,000 |

| Per unit requirement | 3 | 3 | 3 | |

| Total requirement for requirement | 108,000 | 126,000 | 138,000 | 372,000 |

| Add: Ending desired raw material | 63000 | 69000 | 42000 | 174,000 |

| Total requirements | 171,000 | 195,000 | 180,000 | 546,000 |

| Less: Beginning Inventory | 54,000 | 63000 | 69000 | 186,000 |

| Budgeted Purchases | 117,000 | 132,000 | 111,000 | 360,000 |

Explanation of Solution

The above direct materials purchase budget is prepared as under −

The direct material budgeted purchases are calculated as −

For July −

Given,

- Budgeted production = 36,000 units

- Per unit requirement = 3 CC per unit

- Total requirement for production = 108,000 CC (i.e. 36,000 units X 3 cc)

- Ending desired raw material −

- Beginning raw material = 54,000 cc

For August −

Given,

- Budgeted production = 42,000 units

- Per unit requirement = 3 CC per unit

- Total requirement for production = 126,000 CC (i.e. 42,000 units X 3 cc)

- Ending desired raw material −

- Beginning raw material = 63,000 cc

For September −

Given,

- Budgeted production = 46,000 units

- Per unit requirement = 3 CC per unit

- Total requirement for production = 138,000 CC (i.e. 46,000 units X 3 cc)

- Ending desired raw material −

- Beginning raw material = 69,000 cc

Thus, the direct Materials purchase budget for the solvent H300 for July, August, and September and in total has been prepared.

Want to see more full solutions like this?

Chapter 8 Solutions

Introduction To Managerial Accounting

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forward(1) prepare the december 31 entry for bramble corporation to record amortization of intangibles. the trademark has an estimated useful life of 4 years with a residual value of $3,520 [it is not $3,460]arrow_forwardPlease provide the solution to this general accounting question with accurate financial calculations.arrow_forward

- Please provide the solution to this general accounting question using proper accounting principles.arrow_forwardCan you solve this general accounting question with the appropriate accounting analysis techniques?arrow_forwardJournal entry for July 1 to record the purchase of Steve Young by Bramble Corporation: A B C D 1 01-07-2025 Cash $51,800 2 Accounts receivable $91,200 3 Inventory $125,700 4 Land $64,600 5 Buildings (net) $75,400 6 Equipment (net) $69,700 7 Trademarks $17,360 8 Goodwill $65,340 9 Accounts payable $202,500 10 Cash $256,600 11 Notes payable $102,000 12 (To record the purchase of Young Company) 13 01-07-2025 Investment in Young compan $358,600 14 Cash $256,600 15 Notes payable $102,000 16 (To record investment in Young Company) (a) prepare the december 31 entry for bramble corporation to record amortization of intangibles. the trademark has an estimated…arrow_forward

- Journal entry for July 1 to record the purchase of Steve Young by Bramble Corporation: A B C D 1 01-07-2025 Cash $51,800 2 Accounts receivable $91,200 3 Inventory $125,700 4 Land $64,600 5 Buildings (net) $75,400 6 Equipment (net) $69,700 7 Trademarks $17,360 8 Goodwill $65,340 9 Accounts payable $202,500 10 Cash $256,600 11 Notes payable $102,000 12 (To record the purchase of Young Company) 13 01-07-2025 Investment in Young compan $358,600 14 Cash $256,600 15 Notes payable $102,000 16 (To record investment in Young Company) (a)arrow_forwardI am searching for the correct answer to this general accounting problem with proper accounting rules.arrow_forwardPlease explain the solution to this general accounting problem with accurate explanations.arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning