Introduction To Managerial Accounting

8th Edition

ISBN: 9781259917066

Author: BREWER, Peter C., Garrison, Ray H., Noreen, Eric W.

Publisher: Mcgraw-hill Education,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 8, Problem 11E

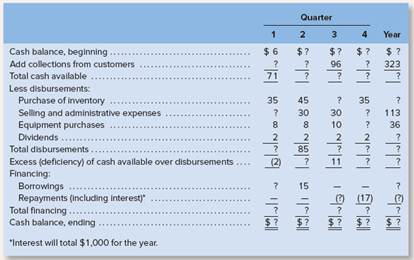

A cash budget, by quarters, is given below for a retail company (000 omitted). The company requires a minimum cash balance of at least $5,000 to start each quarter.

Required:

Fill in the missing amounts in the above table.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

The comparative balance sheets and an income statement for Raceway Corporation follow.

Balance Sheets

As of December 31

Year 2

Year 1

Assets

Cash

$ 6,300

$ 48,400

Accounts receivable

10,200

7,260

Inventory

45,200

56,000

Prepaid rent

700

2,140

Equipment

140,000

144,000

Accumulated depreciation

(73,400)

(118,000)

Land

116,000

50,000

Total assets

$ 245,000

$ 189,800

Liabilities

Accounts payable (inventory)

$ 37,200

$ 40,000

Salaries payable

12,200

10,600

Stockholders’ equity

Common stock, $50 par value

150,000

120,000

Retained earnings

45,600

19,200

Total liabilities and stockholders’ equity

$ 245,000

$ 189,800

Income Statement

For the Year Ended December 31, Year 2

Sales

$ 480,000

Cost of goods sold

(264,000)

Gross profit

216,000

Operating expenses

Depreciation expense

(11,400)

Rent expense

(7,000)

Salaries expense

(95,200)

Other operating expenses

(76,000)

Net income

$ 26,400

Other Information

Purchased…

Please help holy tamale I have been staring at this for hours.

Could you explain the steps for solving this financial accounting question accurately?

Chapter 8 Solutions

Introduction To Managerial Accounting

Ch. 8 - What is a budget? What is budgetary control?Ch. 8 - Prob. 2QCh. 8 - What is meant by the term responsibility...Ch. 8 - What is a master budget? Briefly describe its...Ch. 8 - Why is the sales forecast the starting point in...Ch. 8 - “As a practical matter, planning and control mean...Ch. 8 - Prob. 7QCh. 8 - What is a self-imposed budget? What are the major...Ch. 8 - How can budgeting assist a company in planning its...Ch. 8 - Prob. 10Q

Ch. 8 - The Excel worksheet form that appears below is to...Ch. 8 - The Excel worksheet form that appears below is to...Ch. 8 - Morganton Company makes one product and ¡t...Ch. 8 - Prob. 2F15Ch. 8 - Prob. 3F15Ch. 8 - Prob. 4F15Ch. 8 - Morganton Company makes one product and it...Ch. 8 - Prob. 6F15Ch. 8 - Prob. 7F15Ch. 8 - Prob. 8F15Ch. 8 - Morganton Company makes one product and ¡t...Ch. 8 - Morganton Company makes one product and ¡t...Ch. 8 - Prob. 11F15Ch. 8 - Morganton Company makes one product and ¡t...Ch. 8 - Morganton Company makes one product and ¡t...Ch. 8 - Morganton Company makes one product and ¡t...Ch. 8 - Morganton Company makes one product and ¡t...Ch. 8 - Schedule of Expected Cash Collections LOB-2 Silver...Ch. 8 - Down Under Products, Ltd., of Australia has...Ch. 8 - Direct Materials Budget LOB-4 Three grams of musk...Ch. 8 - Direct Labor Budget LOB-5 The production manager...Ch. 8 - Manufacturing Overhead Budget L.08—6 The direct...Ch. 8 - Weller Company’s budgeted unit sales for the...Ch. 8 - Cash Budget LOB—8 Garden Depot is a retailer that...Ch. 8 - Gig Harbor is the wholesale distributor of a small...Ch. 8 - The management of Mecca copy, a photocopying...Ch. 8 - Production and Direct Materials Budgets LO8—,...Ch. 8 - Cash Budget Analysis LOB—8 A cash budget, by...Ch. 8 - Prob. 12ECh. 8 - Schedules of Expected Cash Collections and...Ch. 8 - Sales and Production Budgets L08—2, L08—3 The...Ch. 8 - Direct Labor and Manufacturing Overhead Budgets...Ch. 8 - Direct Materials and Direct Labor Budgets LOB—4,...Ch. 8 - Cash Flows; Budgeted Income Statement and Balance...Ch. 8 - Cash Flows; Budgeted Income Statement and Balance...Ch. 8 - Cash Budget: Income Statement: Balance Sheet...Ch. 8 - Cash Budget; Income Statement: Balance Sheet;...Ch. 8 - Schedules of Expected Cash Collections and...Ch. 8 - Evaluating a Company’s Budget Procedures LOB—1...Ch. 8 - Prob. 23PCh. 8 - Cash Budget with Supporting Schedules L08-2,...Ch. 8 - Prob. 25PCh. 8 - Prob. 26PCh. 8 - Prob. 27PCh. 8 - Prob. 28PCh. 8 - Completing a Master Budget LOB—2, LO8—4, LO8—7,...Ch. 8 - Prob. 30PCh. 8 - Completing a Master Budget LOB-2, LOB-4, LOB-7,...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- I need help with this General accounting question using the proper accounting approach.arrow_forwardPlease explain the solution to this general accounting problem with accurate principles.arrow_forwardKindly help me with this General accounting questions not use chart gpt please fast given solutionarrow_forward

- I am searching for the correct answer to this Financial accounting problem with proper accounting rules.arrow_forwardI am looking for the correct answer to this Financial accounting question with appropriate explanations.arrow_forwardEcho Tone Technologies reports annual sales of $90,000, and it expects sales to increase to $135,000 next year. The company has a degree of operating leverage (DOL) of 4.2. By what percentage should net income increase? A. 70% B. 189% C. 150% D. 210%arrow_forward

- Please provide the accurate answer to this general accounting problem using valid techniques.arrow_forwardNo chatgpt Which account will appear in the post-closing trial balance?A. Rent ExpenseB. Sales RevenueC. DividendsD. Capitalarrow_forwardI need help with this financial accounting question using the proper accounting approach.arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning,

AccountingAccountingISBN:9781337272094Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.Publisher:Cengage Learning, Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning,

Accounting Information SystemsAccountingISBN:9781337619202Author:Hall, James A.Publisher:Cengage Learning, Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON

Horngren's Cost Accounting: A Managerial Emphasis...AccountingISBN:9780134475585Author:Srikant M. Datar, Madhav V. RajanPublisher:PEARSON Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education

Intermediate AccountingAccountingISBN:9781259722660Author:J. David Spiceland, Mark W. Nelson, Wayne M ThomasPublisher:McGraw-Hill Education Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Financial and Managerial AccountingAccountingISBN:9781259726705Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting PrinciplesPublisher:McGraw-Hill Education

Accounting

Accounting

ISBN:9781337272094

Author:WARREN, Carl S., Reeve, James M., Duchac, Jonathan E.

Publisher:Cengage Learning,

Accounting Information Systems

Accounting

ISBN:9781337619202

Author:Hall, James A.

Publisher:Cengage Learning,

Horngren's Cost Accounting: A Managerial Emphasis...

Accounting

ISBN:9780134475585

Author:Srikant M. Datar, Madhav V. Rajan

Publisher:PEARSON

Intermediate Accounting

Accounting

ISBN:9781259722660

Author:J. David Spiceland, Mark W. Nelson, Wayne M Thomas

Publisher:McGraw-Hill Education

Financial and Managerial Accounting

Accounting

ISBN:9781259726705

Author:John J Wild, Ken W. Shaw, Barbara Chiappetta Fundamental Accounting Principles

Publisher:McGraw-Hill Education

Responsibility Accounting| Responsibility Centers and Segments| US CMA Part 1| US CMA course; Master Budget and Responsibility Accounting-Intro to Managerial Accounting- Su. 2013-Prof. Gershberg; Author: Mera Skill; Rutgers Accounting Web;https://www.youtube.com/watch?v=SYQ4u1BP24g;License: Standard YouTube License, CC-BY