a.

To calculate: The effective monthly interest rate for the saving account at XYZ savings.

a.

Answer to Problem 18PFA

So, then the effective monthly interest rate is 0.15%.

Explanation of Solution

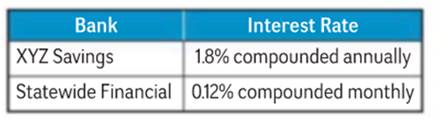

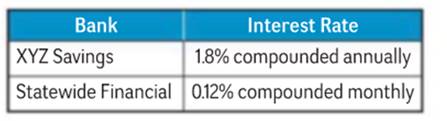

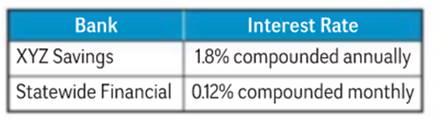

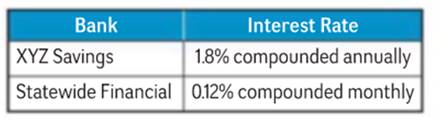

Given: Sharonda is comparing the saving account that are offered at the two banks.

Concept Used:

Use the compound interest formula:

Where P is the initial investment, r is the interest rate , n is the number of times the interest compounds each year ,and t is the number of years

Calculation:

Here substitute

The effective monthly interest rate is then 1.0015-1=0.0015=0.15%.

So, then the effective monthly interest rate is 0.15%.

b.

To find: The bank which offer a better deal.

b.

Answer to Problem 18PFA

The bank which offer a better deal is XYZ Savings.

Explanation of Solution

Given: Sharonda is comparing the saving account that are offered at the two banks.

Calculation:

It is given that Statewide Financial has a monthly interest rate of 0.12% . From part (a). XYZ savings has an effective monthly interest of 0.15%. XYZ saving then offers a better deal since it has a higher monthly interest rate.

c.

To calculate: The effective annual interest rate for the saving account at Statewide Financial.

c.

Answer to Problem 18PFA

The effective annual interest rate is 1.4%.

Explanation of Solution

Given: Sharonda is comparing the saving account that are offered at the two banks.

Concept Used:

Use the compound interest formula:

Where P is the initial investment, r is the interest rate, n is the number of times the interest compounds each year ,and t is the number of years

Calculation:

Here substitute

The effective annual interest rate is then 1.014-1=0.014=1.4%.

Conclusion:

The effective annual interest rate is 1.4%.

d.

To identify: The bank out of three given banks Sharonda should choose.

d.

Answer to Problem 18PFA

Capital Street.

Explanation of Solution

Given: Sharonda is comparing the saving account that are offered at the two banks.

Use the compound interest formula:

Where P is the initial investment, r is the interest rate , n is the number of times the interest compounds each year ,and t is the number of years

Calculation:

Here, substitute

The effective annual interest rate is then 1.022-1=0.022=2.2%.

Conclusion:

This is higher than the annual interest of 1.8% for XYZ Savings and the effective annual interest rate of 1.4% for Statewide Financial so Capital Street is the bank she should choose.

Chapter 7 Solutions

Glencoe Algebra 1, Student Edition, 9780079039897, 0079039898, 2018

Additional Math Textbook Solutions

Elementary Statistics

University Calculus: Early Transcendentals (4th Edition)

Elementary Statistics (13th Edition)

Pre-Algebra Student Edition

A First Course in Probability (10th Edition)

College Algebra (7th Edition)

- Use the graph of the polynomial function of degree 5 to identify zeros and multiplicity. Order your zeros from least to greatest. -6 3 6+ 5 4 3 2 1 2 -1 -2 -3 -4 -5 3 4 6 Zero at with multiplicity Zero at with multiplicity Zero at with multiplicityarrow_forwardUse the graph to identify zeros and multiplicity. Order your zeros from least to greatest. 6 5 4 -6-5-4-3-2 3 21 2 1 2 4 5 ૪ 345 Zero at with multiplicity Zero at with multiplicity Zero at with multiplicity Zero at with multiplicity པ་arrow_forwardUse the graph to write the formula for a polynomial function of least degree. -5 + 4 3 ♡ 2 12 1 f(x) -1 -1 f(x) 2 3. + -3 12 -5+ + xarrow_forward

- Use the graph to identify zeros and multiplicity. Order your zeros from least to greatest. 6 -6-5-4-3-2-1 -1 -2 3 -4 4 5 6 a Zero at with multiplicity Zero at with multiplicity Zero at with multiplicity Zero at with multiplicityarrow_forwardUse the graph to write the formula for a polynomial function of least degree. 5 4 3 -5 -x 1 f(x) -5 -4 -1 1 2 3 4 -1 -2 -3 -4 -5 f(x) =arrow_forwardWrite the equation for the graphed function. -8 ง -6-5 + 5 4 3 2 1 -3 -2 -1 -1 -2 4 5 6 6 -8- f(x) 7 8arrow_forward

- Write the equation for the graphed function. 8+ 7 -8 ง A -6-5 + 6 5 4 3 -2 -1 2 1 -1 3 2 3 + -2 -3 -4 -5 16 -7 -8+ f(x) = ST 0 7 8arrow_forwardThe following is the graph of the function f. 48- 44 40 36 32 28 24 20 16 12 8 4 -4 -3 -1 -4 -8 -12 -16 -20 -24 -28 -32 -36 -40 -44 -48+ Estimate the intervals where f is increasing or decreasing. Increasing: Decreasing: Estimate the point at which the graph of ƒ has a local maximum or a local minimum. Local maximum: Local minimum:arrow_forwardFor the following exercise, find the domain and range of the function below using interval notation. 10+ 9 8 7 6 5 4 3 2 1 10 -9 -8 -7 -6 -5 -4 -3 -2 -1 2 34 5 6 7 8 9 10 -1 -2 Domain: Range: -4 -5 -6 -7- 67% 9 -8 -9 -10-arrow_forward

- 1. Given that h(t) = -5t + 3 t². A tangent line H to the function h(t) passes through the point (-7, B). a. Determine the value of ẞ. b. Derive an expression to represent the gradient of the tangent line H that is passing through the point (-7. B). c. Hence, derive the straight-line equation of the tangent line H 2. The function p(q) has factors of (q − 3) (2q + 5) (q) for the interval -3≤ q≤ 4. a. Derive an expression for the function p(q). b. Determine the stationary point(s) of the function p(q) c. Classify the stationary point(s) from part b. above. d. Identify the local maximum of the function p(q). e. Identify the global minimum for the function p(q). 3. Given that m(q) = -3e-24-169 +9 (-39-7)(-In (30-755 a. State all the possible rules that should be used to differentiate the function m(q). Next to the rule that has been stated, write the expression(s) of the function m(q) for which that rule will be applied. b. Determine the derivative of m(q)arrow_forwardSafari File Edit View History Bookmarks Window Help Ο Ω OV O mA 0 mW ర Fri Apr 4 1 222 tv A F9 F10 DII 4 F6 F7 F8 7 29 8 00 W E R T Y U S D பட 9 O G H J K E F11 + 11 F12 O P } [arrow_forwardSo confused. Step by step instructions pleasearrow_forward

Algebra and Trigonometry (6th Edition)AlgebraISBN:9780134463216Author:Robert F. BlitzerPublisher:PEARSON

Algebra and Trigonometry (6th Edition)AlgebraISBN:9780134463216Author:Robert F. BlitzerPublisher:PEARSON Contemporary Abstract AlgebraAlgebraISBN:9781305657960Author:Joseph GallianPublisher:Cengage Learning

Contemporary Abstract AlgebraAlgebraISBN:9781305657960Author:Joseph GallianPublisher:Cengage Learning Linear Algebra: A Modern IntroductionAlgebraISBN:9781285463247Author:David PoolePublisher:Cengage Learning

Linear Algebra: A Modern IntroductionAlgebraISBN:9781285463247Author:David PoolePublisher:Cengage Learning Algebra And Trigonometry (11th Edition)AlgebraISBN:9780135163078Author:Michael SullivanPublisher:PEARSON

Algebra And Trigonometry (11th Edition)AlgebraISBN:9780135163078Author:Michael SullivanPublisher:PEARSON Introduction to Linear Algebra, Fifth EditionAlgebraISBN:9780980232776Author:Gilbert StrangPublisher:Wellesley-Cambridge Press

Introduction to Linear Algebra, Fifth EditionAlgebraISBN:9780980232776Author:Gilbert StrangPublisher:Wellesley-Cambridge Press College Algebra (Collegiate Math)AlgebraISBN:9780077836344Author:Julie Miller, Donna GerkenPublisher:McGraw-Hill Education

College Algebra (Collegiate Math)AlgebraISBN:9780077836344Author:Julie Miller, Donna GerkenPublisher:McGraw-Hill Education