Old Port Shipyards does work for both the U.S. Navy and private shipping companies. Old Port’s major business is renovating ships, which it does at one of two company dry docks referred to by the names of the local towns: Olde Town and Newton.

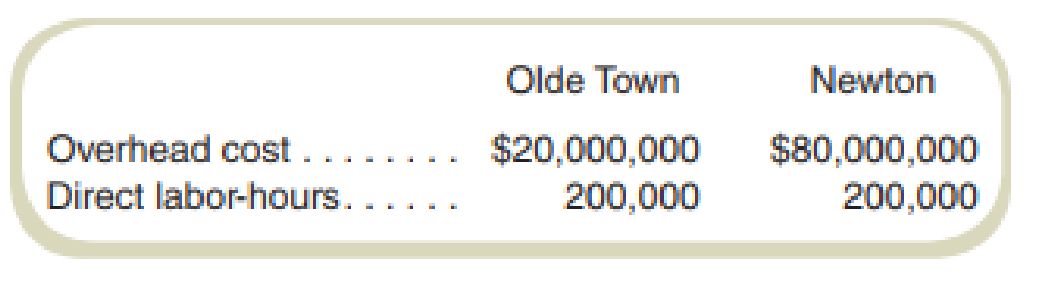

Data on operations and costs for the two dry docks follow:

Virtually all dry dock costs consist of

Old Port is about to start two jobs, one for the Navy under a cost-plus contract and one for a private shipping company for a fixed fee. Both jobs will require the same number of hours. You have been asked to prepare some costing information. Your supervisor tells you that she is sure the Navy job will be done at Newton and the private job will be done at Olde Town.

Required

- a. Compute the overhead rate at the two shipyards.

- b. Why do you think your supervisor says that the Navy job will be done at Newton?

- c. Is the choice of the production location ethical? Why?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

COST ACCOUNTING W/CONNECT

- solve carefully. If image is blurr or data is unclear then plz comment i will write values or upload a new image. i will give unhelpful if you will use incorrect data.arrow_forwardHi expert please give me answer general accounting questionarrow_forwardGive correct Answer! If image is blurr or data is unclear then plz comment i will write values or upload a new image. i will give unhelpful if you will use incorrect data.arrow_forward

- Abbott Company uses the allowance method of accounting for uncollectible receivables. Abbott estimates that 3% of credit sales will be uncollectible. On January 1, Allowance for Doubtful Accounts had a credit balance of $3,300. During the year, Abbott wrote off accounts receivable totaling $2,100 and made credit sales of $113,000. After the adjusting entry, the December 31 balance in Bad Debt Expense will be .... a. 3300 b. 3390 c. 4590 d. 6690arrow_forwardDo fast answer of this accounting questionsarrow_forwardNeed help with this question solution general accountingarrow_forward

- Sunshine Blender Company sold 7,000 units in October at a sales price of $40 per unit. The variable cost is $25 per unit. Calculate the total contribution margin. OA. $280,000 OB. $105,000 OC. $87,500 OD. $175,000arrow_forwardI want to correct answer general accounting questionarrow_forwardFive I + Beginning Work-in-Process Inventory Cost of Goods Manufactured Cost of Goods Sold Direct Labor Direct Materials Used Ending Work-in-Process Inventory Finished Goods Inventory 4 of 35 > manufactured. Use the followin Process Inventory, $32,800; an Total Manufacturing Costs Incurred during Period Total Manufacturing Costs to Account Forarrow_forward

- Don't use ai given answer accounting questionsarrow_forwardRequirement 1. For a manufacturing company, identify the following as either a product cost or a period cost: Period cost Product cost a. Depreciation on plant equipment Depreciation on salespersons' automobiles Insurance on plant building Marketing manager's salary Direct materials used Manufacturing overhead g. Electricity bill for human resources office h. Production employee wagesarrow_forwardI want to correct answer general accounting questionarrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,