Old Port Shipyards does work for both the U.S. Navy and private shipping companies. Old Port’s major business is renovating ships, which it does at one of two company dry docks referred to by the names of the local towns: Olde Town and Newton.

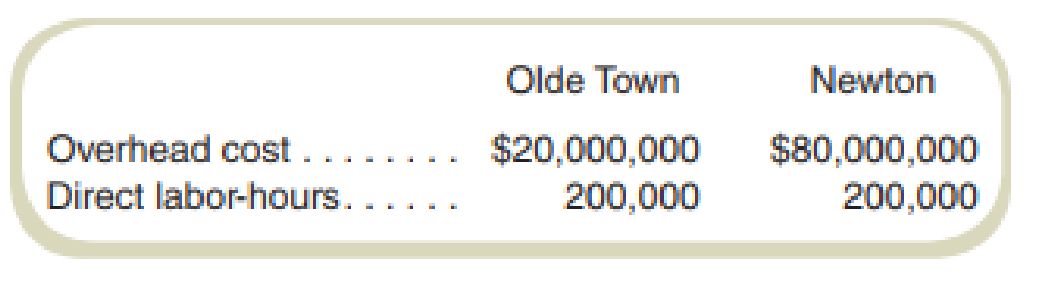

Data on operations and costs for the two dry docks follow:

Virtually all dry dock costs consist of

Old Port is about to start two jobs, one for the Navy under a cost-plus contract and one for a private shipping company for a fixed fee. Both jobs will require the same number of hours. You have been asked to prepare some costing information. Your supervisor tells you that she is sure the Navy job will be done at Newton and the private job will be done at Olde Town.

Required

- a. Compute the overhead rate at the two shipyards.

- b. Why do you think your supervisor says that the Navy job will be done at Newton?

- c. Is the choice of the production location ethical? Why?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Fundamentals of Cost Accounting

- Outline three (3) ways that conflicts of interest should be managed by tax agents. In relation to the two (2) conflict examples that you identified in question 1, explain how each one of these conflicts should be managed.arrow_forwardNovak Company has the following stockholders' equity accounts at December 31, 2025. Common Stock ($100 par value, authorized 7,600 shares) $459,100 Retained Earnings 266,700 a. Prepare entries in journal form to record the following transactions, which took place during 2026 1. 290 shares of outstanding stock were purchased at $97 per share. (These are to be accounted for using the cost method.) 2. A $22 per share cash dividend was declared. 3. The dividend declared in (2) above was paid. 4. The treasury shares purchased in (1) above were resold at $101 per share. 5. 500 shares of outstanding stock were purchased at $103 per share. 6. 380 of the shares purchased in (5) above were resold at $96 per share. b. Prepare the stockholders' equity section of Novak Company's balance sheet after giving effect to these transactions, assuming that the net income for 2026 was $86,300. State law requires restriction of retained earnings for the amount of treasury stock.arrow_forwardResearch and Explain the current academic qualifications and relevant experience requirements, for tax agents to be to be registered under the Tax Agent Services Regulations 2009. (150 words)arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub  Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,