Concept explainers

Find Missing Data

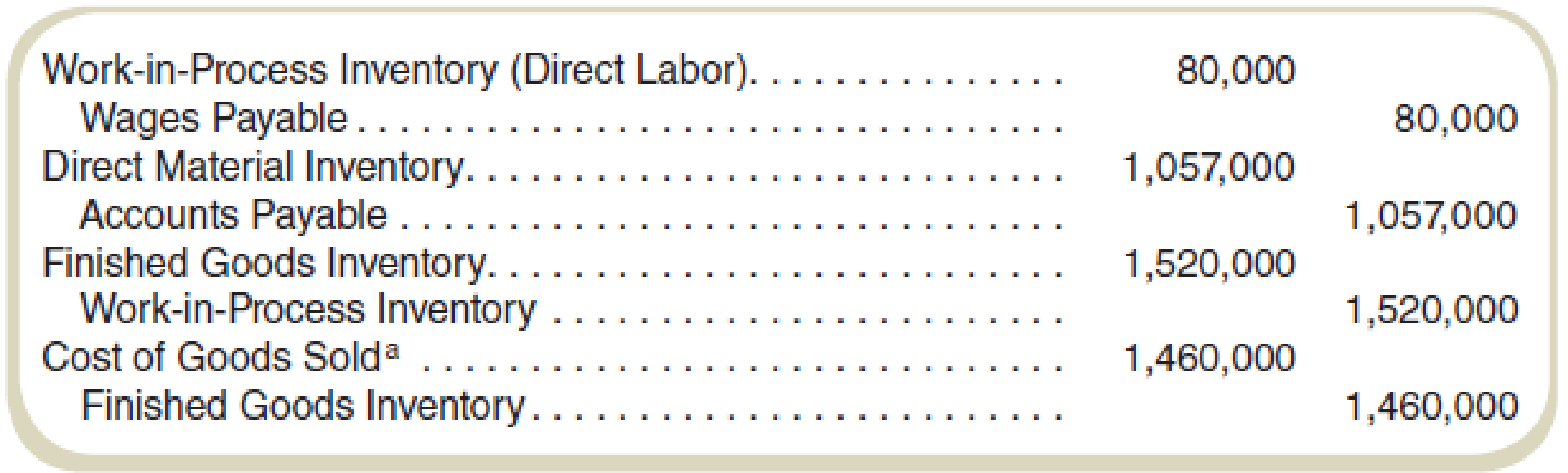

Accounting records for NIC Enterprises (NICE) for September show the following (each entry is the total of the actual entries for the account for the month):

a This entry does not include any over- or underapplied

The Work-in-Process ending account balance on September 30 was 125 percent of the beginning balance. The Direct Material ending inventory balance on September 30 was $25,000 less than the beginning balance. The Finished Goods beginning balance on September 1 was $148,000. The September income statement shows revenues of $2,300,000 and a gross profit of $850,000.

Required

- a. What was the Finished Goods inventory on September 30?

- b. How much manufacturing overhead was applied for September?

- c. What was the manufacturing overhead rate for September?

- d. How much manufacturing overhead was incurred for September?

- e. What was the Work-in-Process beginning inventory balance?

- f. What was the Work-in-Process ending inventory balance?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Fundamentals of Cost Accounting

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning