Reconstruct Missing Data

A tornado struck the only manufacturing plant of Toledo Farm Implements (TFI) on June 1. All work-in-process inventory was destroyed, but a few records were salvaged from the wreckage and from the company’s headquarters. If acceptable documentation is provided, the loss will be covered by insurance. The insurable value of work-in-process inventory consists of direct materials, direct labor, and applied

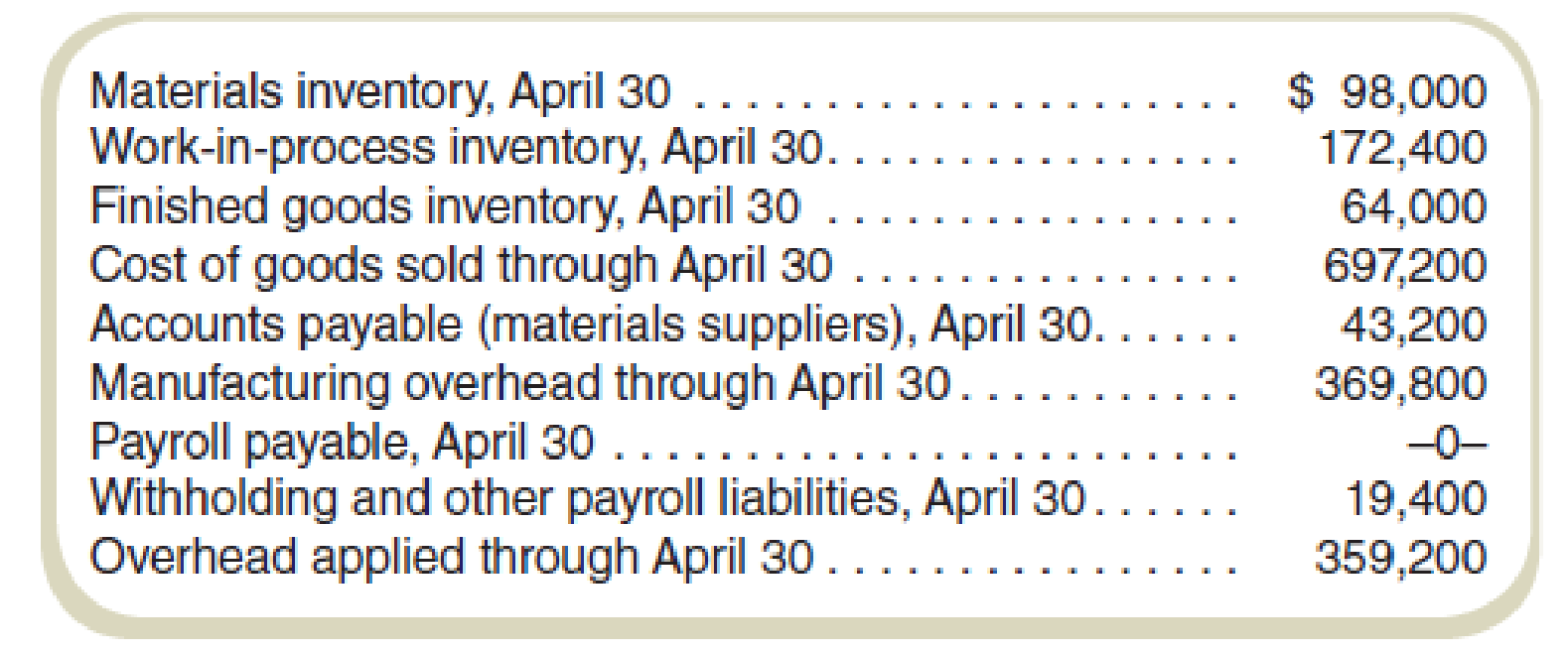

The following information about the plant appears on the April financial statements at the company’s downtown headquarters:

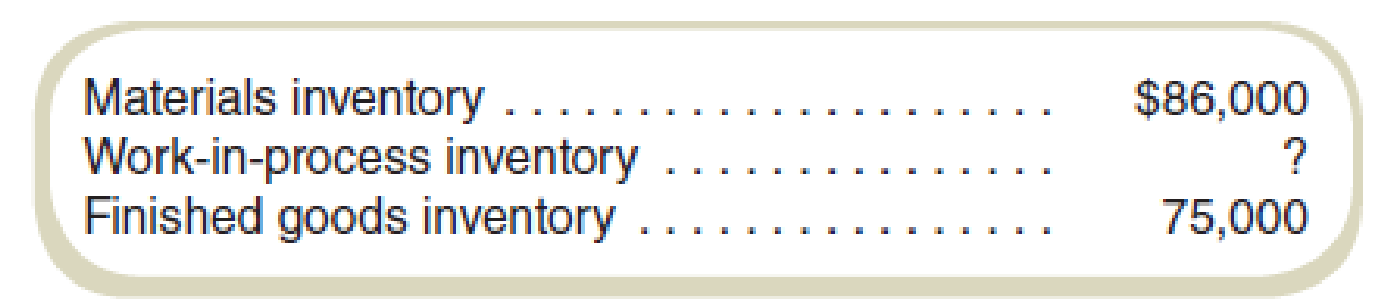

A count of the inventories on hand May 31 shows the following:

The accounts payable clerk tells you that outstanding bills to suppliers totaled $100,200 and that cash payments of $75,800 were made to them during the month. She informs you that the payroll costs last month for the manufacturing section included $164,800, of which $29,400 was indirect labor.

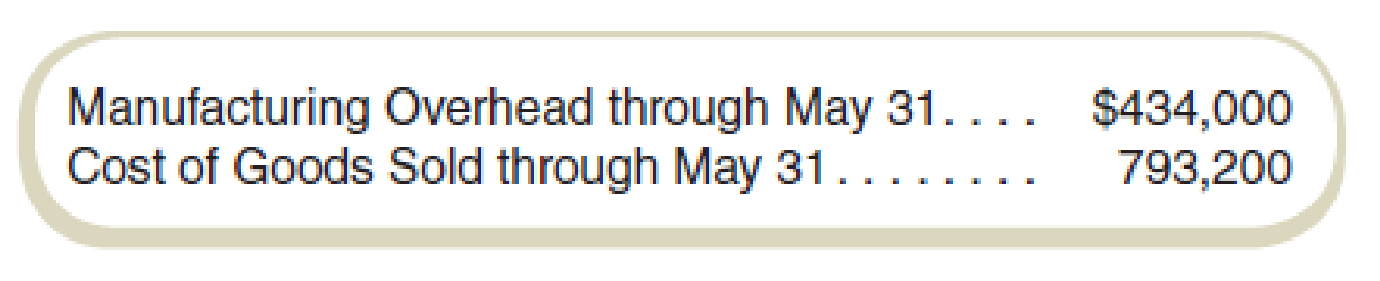

At the end of May, the following balances were available from the main office:

Recall that each month there is only one requisition for indirect materials. Among the fragments of paper, you located the following information, which you have neatly typed for your records:

From scrap found under desk: indirect materials → $4,172

You also learn that the overhead during the month was overapplied by $2,400.

Required

Determine the cost of the work-in-process inventory lost in the disaster.

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

Fundamentals of Cost Accounting

- Armour, Inc., an advertising agency, applies overhead to jobs on the basis of direct professional labor hours. Overhead was estimated to be $226,000, direct professional labor hours were estimated to be 28,000, and direct professional labor cost was projected to be $425,000. During the year, Armour incurred actual overhead costs of $205,200, actual direct professional labor hours of 23,900, and actual direct labor costs of $333,000. By year-end, the firm's overhead wasarrow_forwardWhat is the degree of opereting leverage? General accountingarrow_forwardWhat is horizon industries opereting leverage?arrow_forward

- Platz Company makes chairs and planned to sell 4,100 chairs in its master budget for the coming year. The budgeted selling price is $36 per chair, variable costs are $17 per chair, and budgeted fixed costs are $45,000 per month. At the end of the year, it was determined that Platz actually sold 4,400 chairs for $145,700. Total variable costs were $50,375 and fixed costs were $38,000. The volume variance for sales revenue was: a. $14,500 unfavorable b. $11,200 favorable c. $10,800 favorable d. $12,700 favorablearrow_forwardProvide correct answer the general accounting questionarrow_forwardHelparrow_forward

- What is the degree of opereting leverage?arrow_forwardSimba Company's standard materials cost per unit of output is $13.63 (2.35 pounds * $5.80). During July, the company purchases and uses 3,000 pounds of materials costing $17,200 in making 1,450 units of the finished product. Compute the total, price, and quantity materials variances.arrow_forwardPlease solve the general accounting question without use any ai please don'tarrow_forward

- Business Its Legal Ethical & Global EnvironmentAccountingISBN:9781305224414Author:JENNINGSPublisher:Cengage

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub