Concept explainers

Incomplete Data:

Chelsea Household Renovations (CHR) is a rapidly growing company that has not been profitable despite increases in sales. It has hired you as a consultant to find ways to improve profitability. You believe that the problem results from poor cost control and inaccurate cost estimation on jobs. The company has essentially no accounting system from which to collect data. You are able, however, to piece together the following information for June:

- Production

-

- 1. Completed Job 61.

- 2. Started and completed Job 62.

- 3. Started Job 63.

- Inventory values

-

- 1. Work-in-process inventory (excluding applied

overhead ):

- 1. Work-in-process inventory (excluding applied

- Each job in work-in-process inventory was exactly 50 percent completed as to labor-hours; however, all direct materials necessary to do the entire job were charged to each job as soon as it was started.

- There were no direct materials inventories or finished goods inventories at either May 31 or June 30.

- Actual overhead was $80,000.

- Cost of goods sold (before adjustment for over- or underapplied overhead):

- Overhead was applied to jobs using a predetermined rate per labor dollar that has been used since the company began operations.

- All direct materials were purchased for cash and charged directly to Work-in-Process Inventory when purchased. Direct materials purchased in June amounted to $18,400.

- Direct labor costs charged to jobs in June were $128,000. All labor costs were the same per hour for all laborers for June.

Required

Write a report to management to show:

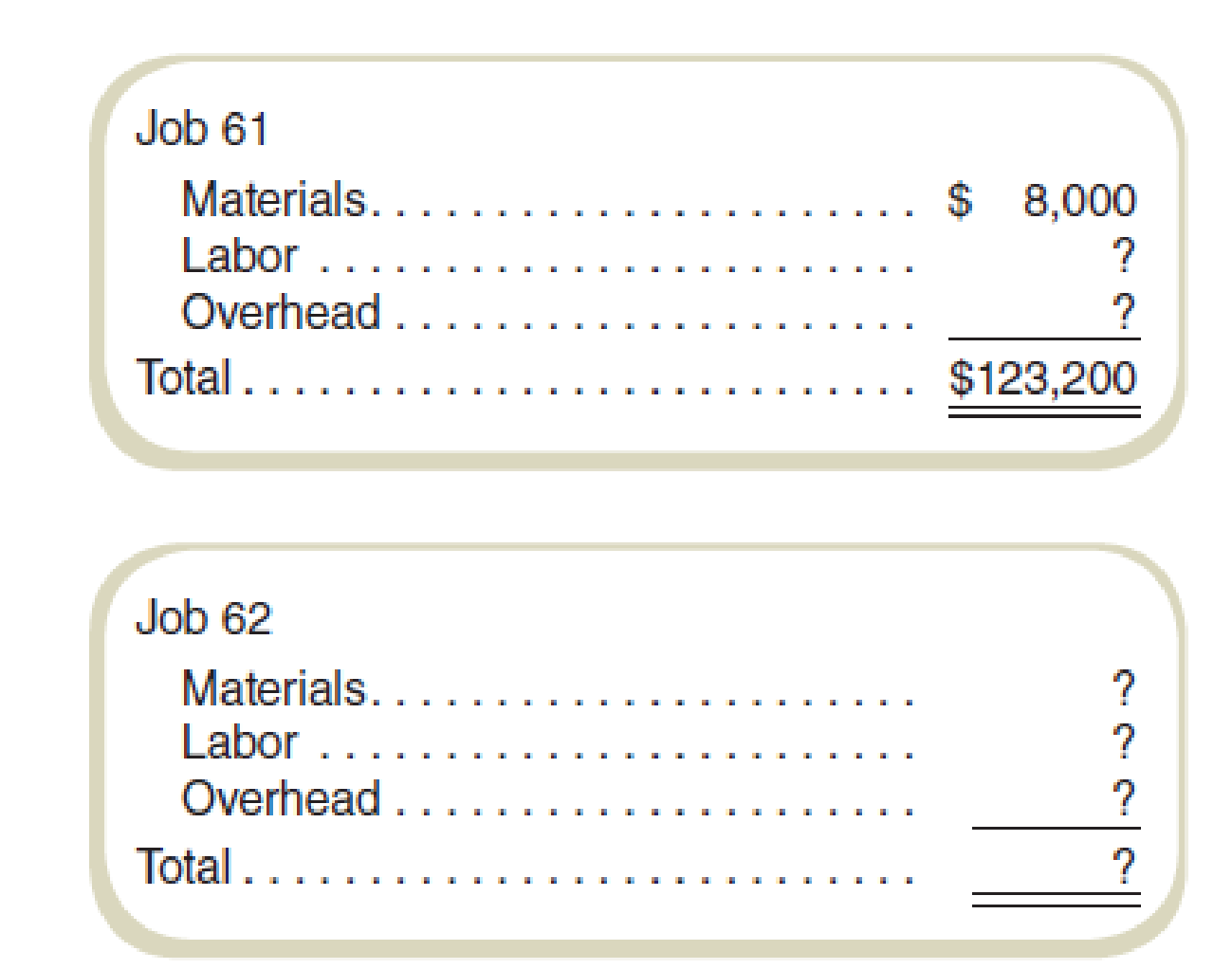

- a. The cost elements (material, labor, and overhead) of cost of goods sold before adjustment for over- or underapplied overhead for each job sold.

- b. The value of each cost element (material, labor, and overhead) for each job in work-in-process inventory at June 30.

- c. Over- or underapplied overhead for June.

a.

Determine cost elements (material, labor, and overhead) of the cost of goods sold before adjustment for over-or under-applied overhead for each job sold.

Explanation of Solution

T-accounts in job costing: The ledger accounts are also termed as T-accounts which are prepared after the recording of the journal entry of the transactions. The balances of raw materials, work-in-process, finished goods inventory and overheads from the journal book are transferred to the respective T-accounts.

Under-applied overheads: It is the amount of overhead cost which is not applied to the jobs during the period. Under-applied overheads occur when the actual overheads are more than the applied overheads.

Over-applied overheads: This is the amount of overhead which arises when the amount of actual overheads is less than the amount of overheads applied.

Unadjusted cost of goods: It means the cost of goods determined without taking under applied costs or over-applied cost into consideration.

Adjusted cost of goods: It means the cost of goods determined by taking under-applied costs or over-applied cost into consideration.

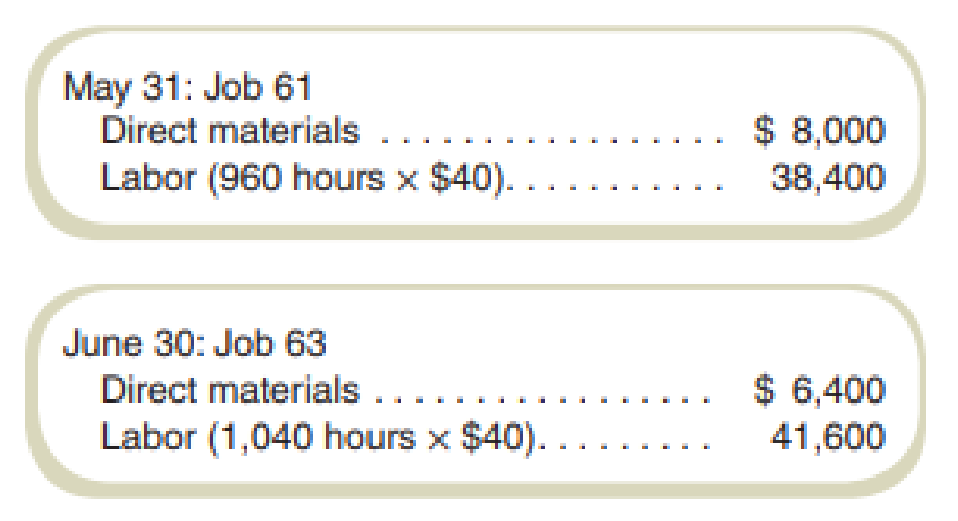

T-account for work-in-process for job no. 61:

| Cost of goods sold job no. 61 | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| Materials | $ 8,000 | ||||

| Labor | $ 76,800 (1) | ||||

| Applied overhead | $ 38,400 (2) | ||||

| $ 123,200 | |||||

T-account for work-in-process for the job no. 62:

| Cost of goods sold job no. 62 | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| Materials | $ 12,000 (3) | ||||

| Labor | $ 48,000 (4) | ||||

| Applied overhead | $ 24,000 (5) | ||||

| $ 84,000 | |||||

Working note 1:

Compute the labor for job number 61:

Working note 2:

Compute the applied overhead for job number 61:

Working note 3:

Compute the materials for job number 62:

Working note 4:

Compute the labor for job number 62:

Working note 5:

Compute the overhead applied for job number 62:

b.

Determine the value of each cost element (material, labor, and overhead) for each job in work-in-process inventory.

Explanation of Solution

Work-in-process: Work-in-process refers to those units which are incomplete in respect or materials cost or conversion cost or both. These units are not complete enough to treat as completed goods.

T-account of work-in-process for job number 61:

| Work-in-process job no. 61 | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| Materials | $ 8,000 | $ 8,000 | |||

| Labor | $ 38,400 | $ 76,800 | |||

| Overhead | $ 19,200 (6) | $ 38,400 | |||

| Balance | $ 65,600 | ||||

| Labor | $ 38,400 | ||||

| Overhead | $ 19,200 | ||||

T-account of work-in-process for job number 62:

| Work-in-process job no. 62 | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| Material | $ 12,000 (7) | $ 12,000 | |||

| Labor | $ 48,000 (8) | $ 48,000 | |||

| Overhead | $ 24,000 (9) | $ 24,000 | |||

T-account of work-in-process for job number 63:

| Work-in-process job no. 63 | |||||

| Date | Particulars | Amount | Date | Particulars | Amount |

| Material | $ 6,400 | ||||

| Labor | $ 41,600 | ||||

| Overhead | $ 20,800 (10) | ||||

| $ 68,800 | |||||

Working note 6:

Compute the overhead beginning inventory for job number 61:

Working note 7:

Compute the materials for job number 62:

Working note 8:

Compute the labor for job number 62:

Working note 9:

Compute the overhead for job number 62:

Working note 10:

Compute the overhead for job number 63:

c.

Determine the over- or under-applied overhead for June.

Explanation of Solution

Under-applied overheads: It is the amount of overhead cost which is not applied to the jobs during the period. Under-applied overheads occur when the actual overheads are more than the applied overheads.

Over-applied overheads: This is the amount of overhead which arises when the amount of actual overheads is less than the amount of overheads applied.

Compute the value of under-applied overhead for June:

Thus, the value of under-applied overhead for June is $16,000.

Working note 11:

Compute the applied overhead:

Want to see more full solutions like this?

Chapter 7 Solutions

FUNDAMENTALS OF COST ACCOUNTING IA

- financial accountingarrow_forwardA copy machine cost $78,000 when new and has accumulated depreciation of $72,000. Suppose Print and Photo Center sold the machine for $6,000. What is the result of this disposal transaction? Nonearrow_forwardWhat was regal enterprises average collection period?arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,