Concept explainers

Find Missing Data

IYF Corporation manufactures miscellaneous parts for building construction and maintenance. IYF uses a normal

14. You are given the following

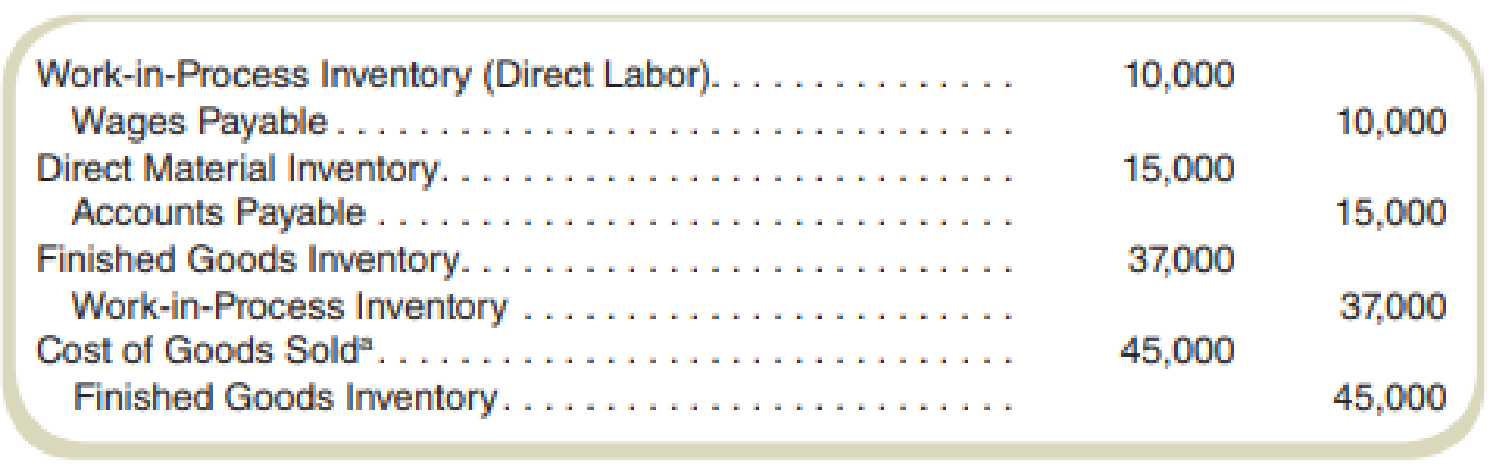

a This entry does not include any over- or underapplied overhead. Over- or underapplied overhead is written off to Cost of Goods Sold once for the month. For June, the amount written off was 5 percent of overhead applied for June.

The Work-in-Process ending account balance on June 30 was twice the beginning balance. The Direct Material Ending Inventory balance on June 30 was $7,000 less than the beginning balance. The Finished Goods ending balance on June 30 was $3,000.

The June income statement shows Cost of Goods Sold of $45,400.

Required

- a. What was the Finished Goods beginning inventory on June 1?

- b. How much manufacturing overhead was applied for June?

- c. Overhead is applied on the basis of direct labor costs. What was the manufacturing overhead rate for June?

- d. How much manufacturing overhead was incurred for June?

- e. What was the Work-in-Process beginning inventory balance?

- f. What was the Work-in-Process ending inventory balance?

Want to see the full answer?

Check out a sample textbook solution

Chapter 7 Solutions

FUNDAMENTALS OF COST ACCOUNTING IA

- nonearrow_forwardI want to correct answer general accountingarrow_forwardQuestion 1. Pearl Leasing Company agrees to lease equipment to Martinez Corporation on January 1, 2025. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2 The cost of the machinery is $541,000, and the fair value of the asset on January 1, 2025, is $760,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $45,000, Martinez estimates that the expected residual value at the end of the lease term will be $45,000. Martinez amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2025. 5. The collectibility of the lease payments is probable. 6. Pearl desires a 10% rate of return on its investments. Martinez's incremental borrowing rate is 11%, and the lessor's implicit rate is unknown. Annual rental payment is…arrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,