Assigning Costs: Missing Data

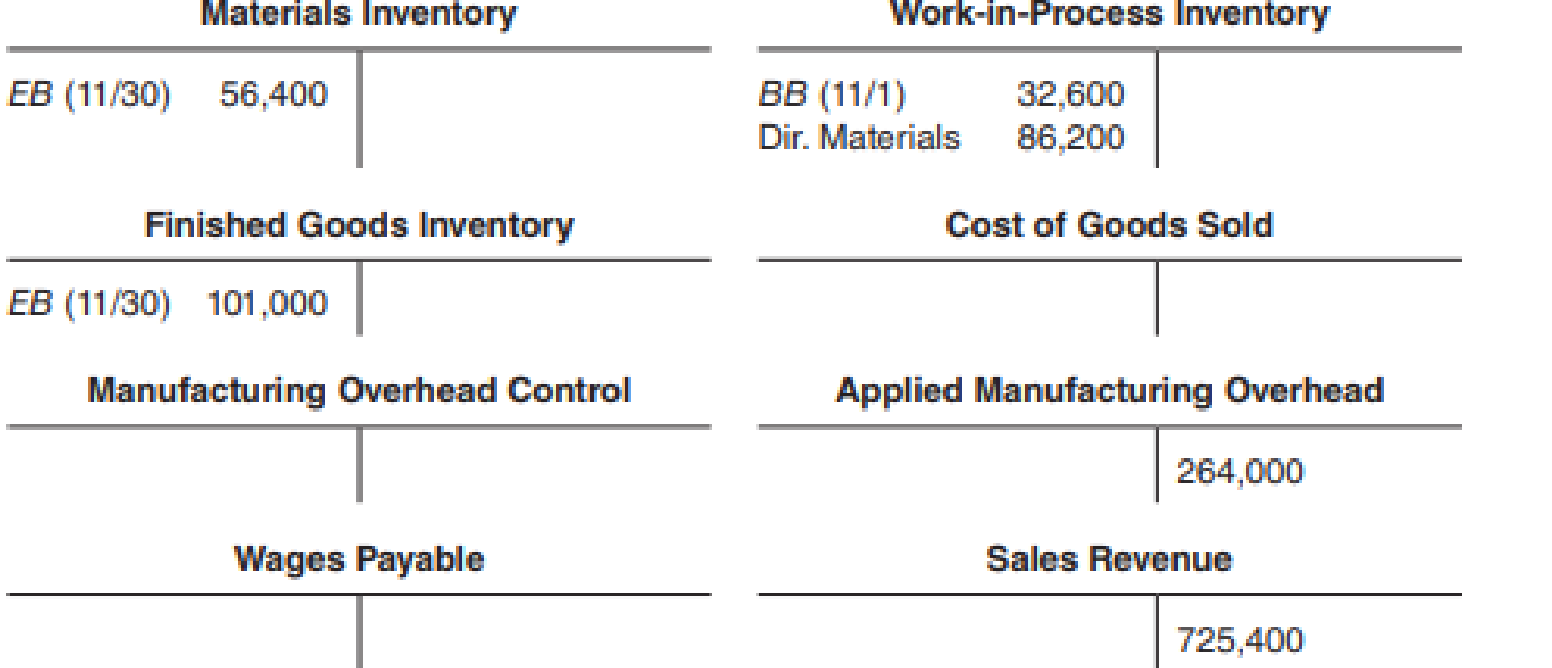

The following T-accounts represent November activity:

Additional Data

- Materials of $113,600 were purchased during the month, and the balance in the Materials Inventory account increased by $11,000.

Overhead is applied at the rate of 150 percent of direct labor cost.- Sales are billed at 180 percent of cost of goods sold before the over- or underapplied overhead is prorated.

- The balance in the Finished Goods Inventory account decreased by $28,600 during the month before any proration of under- or overapplied overhead.

- Total credits to the Wages Payable account amounted to $202,000 for direct and indirect labor.

- Factory

depreciation totaled $48,200. - Overhead was underapplied by $25,080. Overhead other than indirect labor, indirect materials, and depreciation was $198,480, which required payment in cash. Underapplied overhead is to be allocated.

- The company has decided to allocate 25 percent of underapplied overhead to Work-in-Process Inventory, 15 percent to Finished Goods Inventory, and the balance to Cost of Goods Sold. Balances shown in T-accounts are before any allocation.

Required

Complete the T-accounts.

Complete the T-accounts given in the question.

Explanation of Solution

The T-accounts with complete information:

T-accounts in job costing: The ledger accounts are also termed as T-accounts which are prepared after the recording of the journal entry of the transactions. The balances of raw materials, work-in-process, finished goods inventory and overheads from the journal book are transferred to the respective T-accounts.

Journal entries (job costing): The journal entries are prepared in order to record the day to day transactions of the entity. The journal entries in job costing are prepared by starting from the materials inventory. The balances are then transferred to work-in-process inventory and after that to finished goods inventory.

T-account of materials inventory:

| Materials inventory | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| BB | $ 45,500 | $ 86,200 | ||||

| Purchases | $ 113,600 | $ 16,400 (1) | ||||

| EB | $ 56,400 | |||||

Table: (1)

T-account of work-in-process inventory:

| Work-in-process inventory | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| BB | $ 32,600 | $ 374,400 (5) | ||||

| Direct materials | $ 86,200 | |||||

| Direct labor | $ 176,000 (2) | |||||

| Overhead applied | $ 264,000 | |||||

| Balance | $ 184,400 (6) | |||||

| Proration | $ 6,270 (8) | |||||

| Balance | $ 190,670 | |||||

Table: (2)

T-account of finished goods inventory:

| Finished goods inventory | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| Balance | $ 129,600 (4) | |||||

| Overhead applied | $ 374,400 (5) | $ 403,000 (3) | ||||

| EB | $ 101,000 | |||||

| Proration | $ 3,762 (9) | |||||

| Balance | $ 104,762 | |||||

Table: (3)

T-account of the cost of goods sold:

| Cost of goods sold | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| Finished goods inventory | $ 403,000 (3) | |||||

| Proration | $ 15,048 (10) | |||||

Table: (4)

T-account of manufacturing overhead control:

| Manufacturing overhead control | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| $ 16,400 (1) | ||||||

| $ 26,000 (7) | ||||||

| $ 48,200 | ||||||

| $ 198,480 | $ 289,080 | |||||

Table: (5)

T-account of applied overhead control:

| Applied overhead control | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| $ 264,000 | $ 264,000 | |||||

Table: (6)

T-account of wages payable:

| Wages payable | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| $ 176,000 (2) | ||||||

| $ 26,000 (7) | ||||||

Table: (7)

T-account of sales revenue:

| Sales revenue | ||||||

| Date | Particular | Amount | Date | Particular | Amount | |

| $ 725,400 | ||||||

Table: (8)

Working note 1:

Amount of $86,200 has been taken from the direct materials used.

Compute the unaccounted balance:

Working note 2:

Overheads applied are 150% of direct labor cost.

Compute the direct labor costs:

Assume X to be direct labor costs.

Working note 3:

Compute the cost of goods sold:

Assume X to be the cost of goods sold.

Working note 4:

Compute the beginning balance of finished goods:

Working note 5:

Compute the cost of goods manufactured:

Working note 6:

Compute the work-in-process ending balance:

Working note 7:

Compute the indirect labor:

Working note 8:

Compute the proration of work-in-process:

Working note 9:

Compute the proration of finished goods:

Working note 10:

Compute the proration of the cost of goods sold:

Want to see more full solutions like this?

Chapter 7 Solutions

FUNDAMENTALS OF COST ACCOUNTING IA

- Question 1. Pearl Leasing Company agrees to lease equipment to Martinez Corporation on January 1, 2025. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2 The cost of the machinery is $541,000, and the fair value of the asset on January 1, 2025, is $760,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $45,000, Martinez estimates that the expected residual value at the end of the lease term will be $45,000. Martinez amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2025. 5. The collectibility of the lease payments is probable. 6. Pearl desires a 10% rate of return on its investments. Martinez's incremental borrowing rate is 11%, and the lessor's implicit rate is unknown. Annual rental payment is…arrow_forwardFinancial accountingarrow_forwardWhat the required return for the market? ? Solve question general Accountingarrow_forward

- Answer? ? Financial accounting questionarrow_forwardGiven answer general Accounting questionarrow_forward3 Read the text below. Choose a word that best fits each gap. Summer is a popular time for vacations, and while some people decide to take a , others plan their trip months in advance. The beginning of the year is a good time for people to start looking at holiday Travel agencies and tour operators both ... a wealth of information on vacation... and different types of holidays. Make sure you have all of your travel... before taking any form of international holiday. Check if your passport is... and, if necessary, that you have a visa. As your departure date gets closer, you can start to plan the details of your journey. If you don't know the language well, it might be... to get a phrase book or a ... Some people enjoy doing extensive... on their destinations, learning about the places of interest and "must-sees".... It's also fun to make a list, so you don't ... important clothes or toiletries. It's also a good idea to buy local ... in advance. Make sure your home and pets are ...…arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning