Managerial Accounting

15th Edition

ISBN: 9780078025631

Author: Ray H Garrison, Eric Noreen, Peter C. Brewer Professor

Publisher: McGraw-Hill Education

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6.A, Problem 4P

PROBLEM 6A-4 Super-Variable Costing and Variable Costing Unit Product Costs and Income Statements LO6-2. LOW

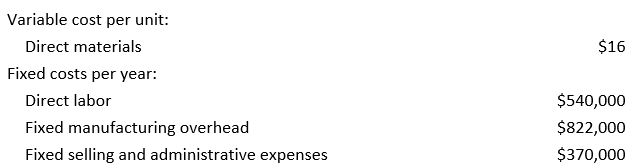

Ogilvy Company manufactures and sells one product. The following information pertains to each of the company's first three years of operations:

The company does not incur any variable

Required:

| Assume the company uses super-variable costing: |

| Compute the unit product cost for Year 1, Year 2, and Year 3. |

| Prepare an income statement for Year 1, Year 2, and Year 3. |

| Assume the company uses a variable costing system that assigns $9 of direct labor cost to each unit produced |

| Compute the unit product cost for Year 1, Year 2, and Year 3. |

| Prepare an income statement for Year 1, Year 2, and Year 3. |

| Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net operating incomes in Years 1, 2, and 3. |

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Super-Variable Costing and Variable Costing Unit Product Costs and Income Statements

Ogilvy Company manufactures and sells one product. The following information pertains to each of the company’s first three years of operations:

The company does not incur any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, Ogilvy produced 60,000 units and sold 60,000 units. During its second year of operations, it produced 60,000 units and sold 55,000 units. In its third year, Ogilvy produced 60,000 units and sold 65,000 units. The selling price of the company’s product is $45 per unit.

Required:

1. Assume the company uses super-variable costing:

a. Compute the unit product cost for Year 1, Year 2, and Year 3.

b. Prepare an income statement for Year 1, Year 2, and Year 3.

2. Assume the company uses a variable costing system that assigns $9 of direct labor cost to each unit produced:

a. Compute the unit product cost for Year 1,…

Super-Variable Costing and Variable Costing Unit Product Costs and Income Statements

Kelly Company manufactures and sells one product. The following information pertains to each of the company’s first two years of operations:

The company does not incur any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, Kelly produced 50,000 units and sold 40,000 units. During its second year of operations, it produced 50,000 units and sold 60,000 units. The selling price of the company’s product is $50 per unit.

Required:

1. Assume the company uses super-variable costing:

a. Compute the unit product cost for Year 1 and Year 2.

b. Prepare an income statement for Year 1 and Year 2.

2. Assume the company uses a variable costing system that assigns $10 of direct labor cost to each unit produced:

a. Compute the unit product cost for Year 1 and Year 2.

b. Prepare an income statement for Year 1 and Year 2.

3. Prepare a reconciliation…

A-3

Chapter 6 Solutions

Managerial Accounting

Ch. 6.A - Prob. 1ECh. 6.A - EXERCISE 6A-2 Super-Variable Costing and Variable...Ch. 6.A - Prob. 3ECh. 6.A - PROBLEM 6A-4 Super-Variable Costing and Variable...Ch. 6.A - Prob. 5PCh. 6 - Prob. 1QCh. 6 - Are selling and administrative expenses treated as...Ch. 6 - Explain how fixed manufacturing overhead costs are...Ch. 6 - What are the arguments in favor of treating fixed...Ch. 6 - What are the arguments in favor of treating fixed...

Ch. 6 - Prob. 6QCh. 6 - Prob. 7QCh. 6 - Prob. 8QCh. 6 - Under absorption costing, how is it possible to...Ch. 6 - Prob. 10QCh. 6 - Prob. 11QCh. 6 - What costs are assigned to a segment under the...Ch. 6 - Distinguish between a trace able fixed cost and a...Ch. 6 - Explain how the contribution margin differs from...Ch. 6 - Prob. 15QCh. 6 - Prob. 16QCh. 6 - Should a company allocate its common feed costs to...Ch. 6 - A B C D E 1 Chapter 6: Applying Excel 2 3 Data 4...Ch. 6 - A B C D E 1 Chapter 6: Applying Excel 2 3 Data 4...Ch. 6 - A B C D E

1 Chapter 6: Applying...Ch. 6 - Diego Company manufactures one product that is...Ch. 6 - Prob. 2F15Ch. 6 - Prob. 3F15Ch. 6 - Prob. 4F15Ch. 6 - Prob. 5F15Ch. 6 - Diego Company manufactures one product that is...Ch. 6 - Prob. 7F15Ch. 6 - Prob. 8F15Ch. 6 - Prob. 9F15Ch. 6 - Prob. 10F15Ch. 6 - Prob. 11F15Ch. 6 - Prob. 12F15Ch. 6 - Prob. 13F15Ch. 6 - Diego Company manufactures one product that is...Ch. 6 - Prob. 15F15Ch. 6 - Prob. 1ECh. 6 - Prob. 2ECh. 6 - Prob. 3ECh. 6 - Prob. 4ECh. 6 - Prob. 5ECh. 6 - EXERCISE 6-6 Variable and Absorption Costing Unit...Ch. 6 - Prob. 7ECh. 6 - Prob. 8ECh. 6 - EXERCISE 6-9 Variable and Absorption Costing Unit...Ch. 6 - Prob. 10ECh. 6 - Prob. 11ECh. 6 - Prob. 12ECh. 6 - Prob. 13ECh. 6 - Prob. 14ECh. 6 - EXERCISE 6—15 Absorption Costing Unit Product Cost...Ch. 6 - EXERCISE 6-16 Working with a Segmented Income...Ch. 6 - Prob. 17ECh. 6 - Prob. 18PCh. 6 - Prob. 19PCh. 6 - Prob. 20PCh. 6 - PROBLEM 6—21 Segment Reporting and Decision-Making...Ch. 6 - Prob. 22PCh. 6 - Prob. 23PCh. 6 - PROBLEM 6-24 Companywide and Segment Break-Even...Ch. 6 - Prob. 25PCh. 6 - Prob. 26PCh. 6 - PROBLEM 6-27 Incentives Created by Absorption...Ch. 6 - Prob. 28PCh. 6 - Prob. 29CCh. 6 - Prob. 30C

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- The following information pertains to Vladamir, Inc., for last year: There are no work-in-process inventories. Normal activity is 100,000 units. Expected and actual overhead costs are the same. Costs have not changed from one year to the next. Required: 1. How many units are in ending inventory? 2. Without preparing an income statement, indicate what the difference will be between variable-costing income and absorption-costing income. 3. Assume the selling price per unit is 29. Prepare an income statement using (a) variable costing and (b) absorption costing.arrow_forwardPlease do not give solution in image formatarrow_forwardSuper-Variable Costing and Variable Costing Unit Product Costs and Income Statements Lyons Company manufactures and sells one product. The following information pertains to the company’s first year of operations: The company does not incur any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, Lyons produced 60,000 units and sold 52,000 units. The selling price of the company’s product is $40 per unit. Required: 1. Assume the company uses super-variable costing: a. Compute the unit product cost for the year. b. Prepare an income statement for the year. 2. Assume the company uses a variable costing system that assigns $12.50 of direct labor cost to each unit produced: a. Compute the unit product cost for the year. b. Prepare an income statement for the year. 3. Prepare a reconciliation that explains the difference between the super-variable costing and variable costing net operating incomes.arrow_forward

- Super-Variable Costing, Variable Costing, and Absorption Costing Income Statements Bracey Company manufactures and sells one product. The following information pertains to the company’s first year of operations: The company does not incur any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, Bracey produced 20,000 units and sold 18,000 units. The selling price of the company’s product is $55 per unit. Required: 1. Assume the company uses super-variable costing: a. Compute the unit product cost for the year. b. Prepare an income statement for the year. 2. Assume the company uses a variable costing system that assigns $ 12.50 of direct labor cost to each unit produced: a. Compute the unit product cost for the year. b. Prepare an income statement for the year. 3. Assume the company uses an absorption costing system that assigns $12.50 of direct labor cost and $15.00 of fixed manufacturing overhead cost to each unit…arrow_forwardA-1arrow_forward.arrow_forward

- Maxwell Company manufactures and sells a single product. The following costs were incurred during the company's first year of operations Variable costs per unit: Manufacturing: Direct materials.... Direct labor Variable manufacturing overhead Variable selling and administrative ..... Fixed costs per year: Fixed manufacturing overhead. Fixed selling and administrative expenses *********** IME $18 $7 $2 $2 $200,000 $110,000 During the year, the company produced 20,000 units and sold 16,000 units. The selling price of the company's product is $50 per unit. Required: Prepare Income Statement under both Absorption Costing and Variable Costing Methodarrow_forward14 Bracey Company manufactures and sells one product. The following Information pertains to the company's first year of operations: Variable cost per unit: Direct materials Fixed costs per year: Direct labor Fixed manufacturing overhead Fixed selling and administrative expenses $19 The company does not incur any variable manufacturing overhead costs or variable selling and administrative expenses. During its first year of operations, Bracey produced 20,000 units and sold 18,000 units. The selling price of the company's product is $55 per unit. $ 250,083 $ 300,889 $ 90,000 Required: 1. Assume the company uses super-variable costing: a. Compute the unit product cost for the year. b. Prepare an Income statement for the year. 2. Assume the company uses a varlable costing system that assigns $12.50 of direct labor cost to each unit produced: a. Compute the unit product cost for the year. b. Prepare an Income statement for the year. 3. Assume the company uses an absorption costing system…arrow_forwardSubject :- Accountingarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

How to Estimate Project Costs: A Method for Cost Estimation; Author: Online PM Courses - Mike Clayton;https://www.youtube.com/watch?v=YQ2Wi3Jh3X0;License: Standard Youtube License