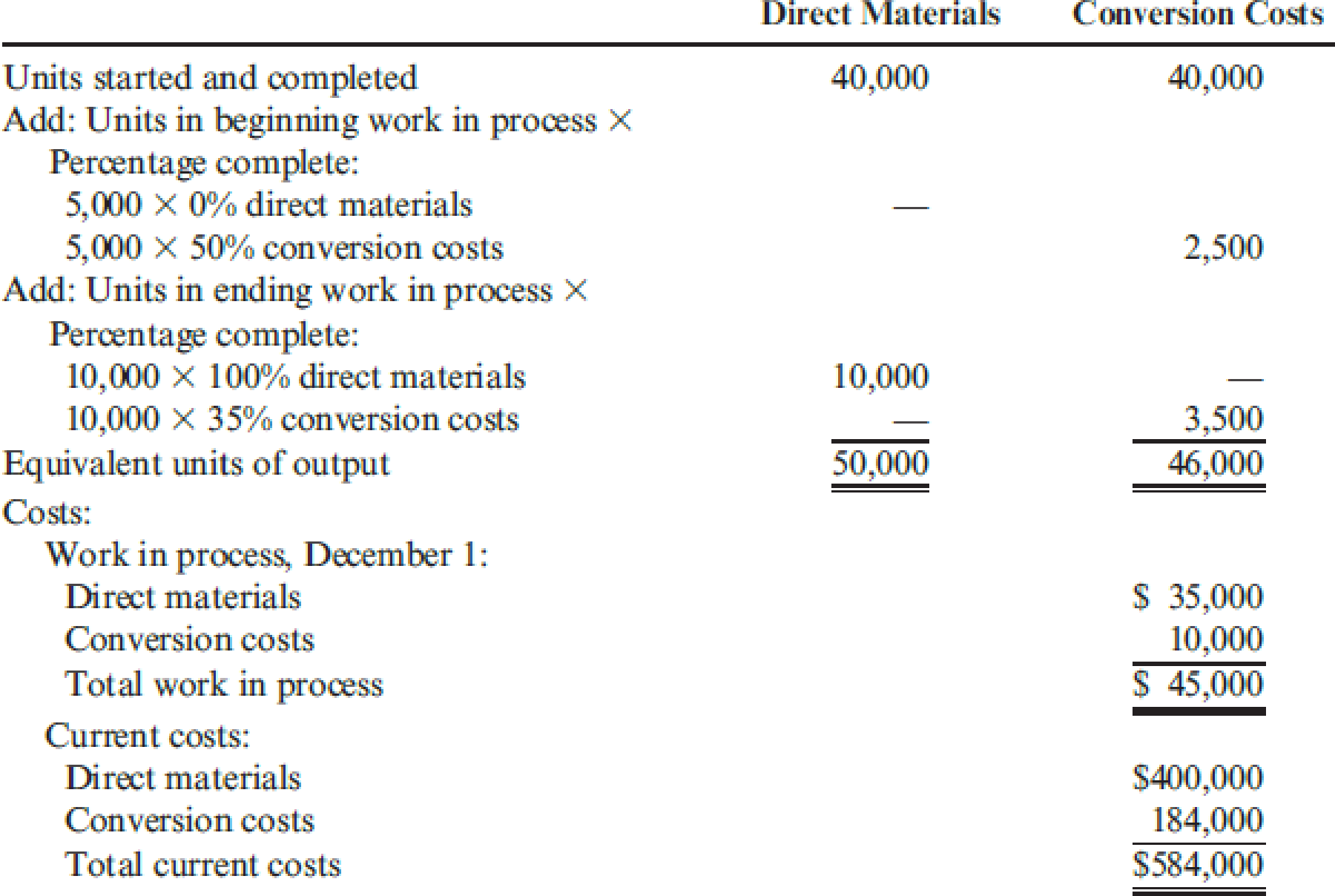

Gunnison Company had the following equivalent units schedule and cost information for its Sewing Department for the month of December:

Required:

- 1. Calculate the unit cost for December, using the FIFO method.

- 2. Calculate the cost of goods transferred out, calculate the cost of EWIP, and reconcile the costs assigned with the costs to account for.

- 3. What if you were asked for the unit cost from the month of November? Calculate November’s unit cost and explain why this might be of interest to management.

1.

Ascertain the unit cost for December using First-in-first-out (FIFO) method for company G.

Explanation of Solution

Cost per unit: Total unit cost is the cost incurred by the company to produce one unit of product. The unit cost is calculated by dividing the units produced with the total cost.

Compute unit cost using FIFO method:

Thus, the cost per equivalent unit for company G is $12 per equivalent unit.

2.

Determine the cost of EWIP, compute the cost of goods transferred out, and reconcile the cost assigned with the costs to account for.

Explanation of Solution

Ascertain the cost of EWIP (Ending Work-In Process):

Calculate the cost of goods transferred out:

| Particulars | Amount ($) |

| From BWIP | $ 45,000 |

| To complete BWIP | |

| $ 10,000 | |

| Started and completed | |

| $ 480,000 | |

| Total cost of goods transferred out | $ 535,000 |

Table (1)

Determine the total cost assigned.

Reconcile the cost assigned with the costs to account for:

| Particulars | Amount ($) |

| Cost to account for: | |

| BWIP | $ 45,000 |

| Current (December) | $ 584,000 |

| Total | $ 629,000 |

Table (2)

3.

Determine the unit cost for November and determine in what manner it might be of interest to management.

Explanation of Solution

There are 5,000 equivalent units of materials (100% complete) and 2,500

Therefore, November unit cost will be,

The managers can obtain the trends in cost and thereby they can implement better control over costs by recognizing last month’s unit cost. If costs are diminishing, it may disclose that continuous development effort is succeeding. If increasing, it may show obstacles that can be corrected.

Want to see more full solutions like this?

Chapter 6 Solutions

Cornerstones of Cost Management (Cornerstones Series)

- Novak Company has the following stockholders' equity accounts at December 31, 2025. Common Stock ($100 par value, authorized 7,600 shares) $459,100 Retained Earnings 266,700 a. Prepare entries in journal form to record the following transactions, which took place during 2026 1. 290 shares of outstanding stock were purchased at $97 per share. (These are to be accounted for using the cost method.) 2. A $22 per share cash dividend was declared. 3. The dividend declared in (2) above was paid. 4. The treasury shares purchased in (1) above were resold at $101 per share. 5. 500 shares of outstanding stock were purchased at $103 per share. 6. 380 of the shares purchased in (5) above were resold at $96 per share. b. Prepare the stockholders' equity section of Novak Company's balance sheet after giving effect to these transactions, assuming that the net income for 2026 was $86,300. State law requires restriction of retained earnings for the amount of treasury stock.arrow_forwardAssignment Financial Accountingarrow_forwardSub: financial accountingarrow_forward

- Calculate the present value of the lease .arrow_forwardQuestion 1. Pearl Leasing Company agrees to lease equipment to Martinez Corporation on January 1, 2025. The following information relates to the lease agreement. 1. The term of the lease is 7 years with no renewal option, and the machinery has an estimated economic life of 9 years. 2 The cost of the machinery is $541,000, and the fair value of the asset on January 1, 2025, is $760,000. 3. At the end of the lease term, the asset reverts to the lessor and has a guaranteed residual value of $45,000, Martinez estimates that the expected residual value at the end of the lease term will be $45,000. Martinez amortizes all of its leased equipment on a straight-line basis. 4. The lease agreement requires equal annual rental payments, beginning on January 1, 2025. 5. The collectibility of the lease payments is probable. 6. Pearl desires a 10% rate of return on its investments. Martinez's incremental borrowing rate is 11%, and the lessor's implicit rate is unknown. Annual rental payment is…arrow_forwardWhat characterizes the faithful representation principle in accounting?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,