College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 7SPB

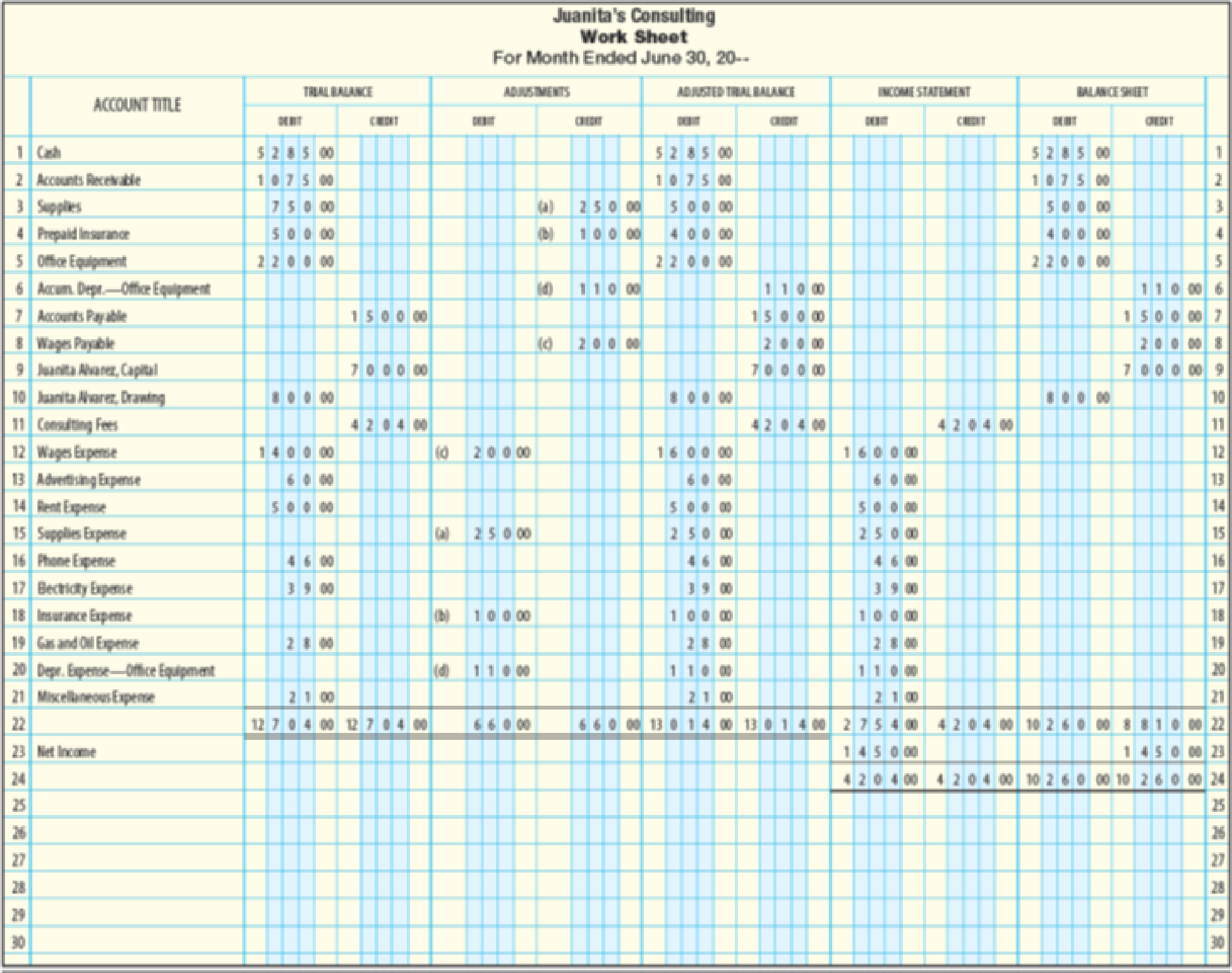

FINANCIAL STATEMENTS A work sheet for Juanita’s Consulting is shown on the following page. There were no additional investments made by the owner during the month.

REQUIRED

1. Prepare an income statement.

2. Prepare a statement of owner’s equity.

3. Prepare a

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

What is the company's plantwide overhead rate?

Need help with this financial accounting question

???

Chapter 6 Solutions

College Accounting, Chapters 1-27

Ch. 6 - Expenses are listed on the income statement as...Ch. 6 - Additional investments of capital during the month...Ch. 6 - Prob. 3TFCh. 6 - Prob. 4TFCh. 6 - Temporary accounts are closed at the end of each...Ch. 6 - Multiple choice Which of these types of accounts...Ch. 6 - Which of these accounts is considered a temporary...Ch. 6 - Which of these is the first step in the closing...Ch. 6 - The ________ is prepared after closing entries are...Ch. 6 - Steps that begin with analyzing source documents...

Ch. 6 - Joe Fisher operates Fisher Consulting. A partial...Ch. 6 - Prob. 2CECh. 6 - Prob. 3CECh. 6 - Identify the source of the information needed to...Ch. 6 - Describe two approaches to listing the expenses in...Ch. 6 - Prob. 3RQCh. 6 - If additional investments were made during the...Ch. 6 - Identify the sources of the information needed to...Ch. 6 - What is a permanent account? On which financial...Ch. 6 - Prob. 7RQCh. 6 - Prob. 8RQCh. 6 - Prob. 9RQCh. 6 - Prob. 10RQCh. 6 - List the 10 steps in the accounting cycle.Ch. 6 - Prob. 1SEACh. 6 - STATEMENT OF OWNERS EQUITY From the partial work...Ch. 6 - BALANCE SHEET From the statement of owners equity...Ch. 6 - CLOSING ENTRIES (NET INCOME) Set up T accounts for...Ch. 6 - CLOSING ENTRIES (NET INCOME) Using the following...Ch. 6 - CLOSING ENTRIES (NET LOSS) Using the following...Ch. 6 - FINANCIAL STATEMENTS Page 206 shows a work sheet...Ch. 6 - PROBLEM 6-7A CLOSING ENTRIES AND POST-CLOSING...Ch. 6 - STATEMENT OF OWNERS EQUITY The capital account for...Ch. 6 - INCOME STATEMENT From the partial work sheet for...Ch. 6 - STATEMENT OF OWNERS EQUITY From the partial work...Ch. 6 - BALANCE SHEET From the statement of owners equity...Ch. 6 - CLOSING ENTRIES (NET INCOME) Set up T accounts for...Ch. 6 - CLOSING ENTRIES (NET INCOME) Using the following...Ch. 6 - CLOSING ENTRIES (NET LOSS) Using the following...Ch. 6 - FINANCIAL STATEMENTS A work sheet for Juanitas...Ch. 6 - PROBLEM 6-7B CLOSING ENTRIES AND POST-CLOSING...Ch. 6 - STATEMENT OF OWNERS EQUITY The capital account for...Ch. 6 - MASTERY PROBLEM Elizabeth Soltis owns and operates...Ch. 6 - CHALLENGE PROBLEM This problem challenges you to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,  College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The ACCOUNTING EQUATION For BEGINNERS; Author: Accounting Stuff;https://www.youtube.com/watch?v=56xscQ4viWE;License: Standard Youtube License