College Accounting, Chapters 1-27

23rd Edition

ISBN: 9781337794756

Author: HEINTZ, James A.

Publisher: Cengage Learning,

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 1CE

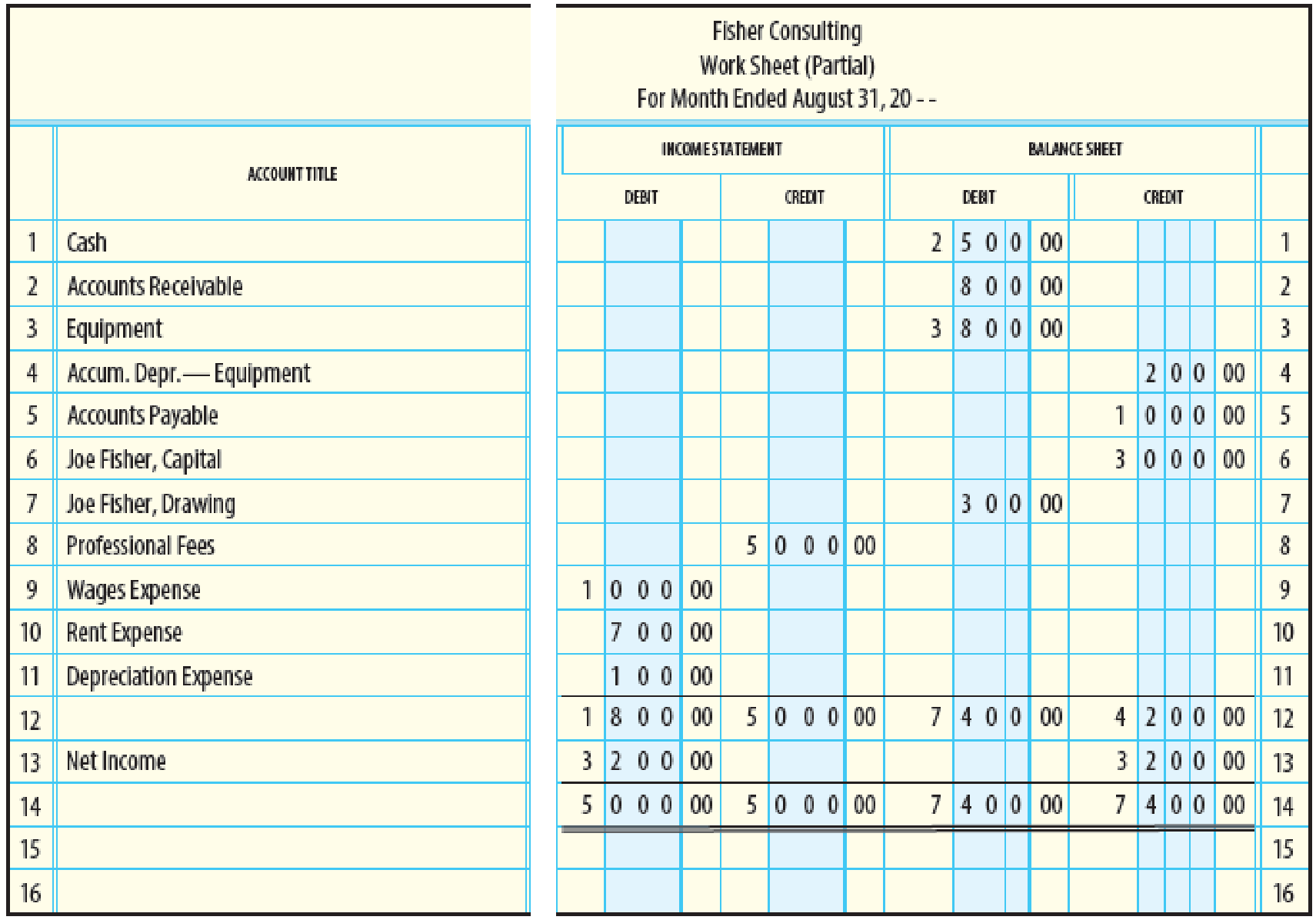

Joe Fisher operates Fisher Consulting. A partial work sheet for August 20-- is provided below. Fisher made no additional investments during the month. Prepare an income statement, statement of owner’s equity, and

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

Abc

General Account Questions

What would the firm's dividend payout ratio of this financial accounting question?

Chapter 6 Solutions

College Accounting, Chapters 1-27

Ch. 6 - Expenses are listed on the income statement as...Ch. 6 - Additional investments of capital during the month...Ch. 6 - Prob. 3TFCh. 6 - Prob. 4TFCh. 6 - Temporary accounts are closed at the end of each...Ch. 6 - Multiple choice Which of these types of accounts...Ch. 6 - Which of these accounts is considered a temporary...Ch. 6 - Which of these is the first step in the closing...Ch. 6 - The ________ is prepared after closing entries are...Ch. 6 - Steps that begin with analyzing source documents...

Ch. 6 - Joe Fisher operates Fisher Consulting. A partial...Ch. 6 - Prob. 2CECh. 6 - Prob. 3CECh. 6 - Identify the source of the information needed to...Ch. 6 - Describe two approaches to listing the expenses in...Ch. 6 - Prob. 3RQCh. 6 - If additional investments were made during the...Ch. 6 - Identify the sources of the information needed to...Ch. 6 - What is a permanent account? On which financial...Ch. 6 - Prob. 7RQCh. 6 - Prob. 8RQCh. 6 - Prob. 9RQCh. 6 - Prob. 10RQCh. 6 - List the 10 steps in the accounting cycle.Ch. 6 - Prob. 1SEACh. 6 - STATEMENT OF OWNERS EQUITY From the partial work...Ch. 6 - BALANCE SHEET From the statement of owners equity...Ch. 6 - CLOSING ENTRIES (NET INCOME) Set up T accounts for...Ch. 6 - CLOSING ENTRIES (NET INCOME) Using the following...Ch. 6 - CLOSING ENTRIES (NET LOSS) Using the following...Ch. 6 - FINANCIAL STATEMENTS Page 206 shows a work sheet...Ch. 6 - PROBLEM 6-7A CLOSING ENTRIES AND POST-CLOSING...Ch. 6 - STATEMENT OF OWNERS EQUITY The capital account for...Ch. 6 - INCOME STATEMENT From the partial work sheet for...Ch. 6 - STATEMENT OF OWNERS EQUITY From the partial work...Ch. 6 - BALANCE SHEET From the statement of owners equity...Ch. 6 - CLOSING ENTRIES (NET INCOME) Set up T accounts for...Ch. 6 - CLOSING ENTRIES (NET INCOME) Using the following...Ch. 6 - CLOSING ENTRIES (NET LOSS) Using the following...Ch. 6 - FINANCIAL STATEMENTS A work sheet for Juanitas...Ch. 6 - PROBLEM 6-7B CLOSING ENTRIES AND POST-CLOSING...Ch. 6 - STATEMENT OF OWNERS EQUITY The capital account for...Ch. 6 - MASTERY PROBLEM Elizabeth Soltis owns and operates...Ch. 6 - CHALLENGE PROBLEM This problem challenges you to...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Solve this financial accounting problemarrow_forwardWhat is the company's dividend payout ratio of this financial accounting question?arrow_forwardDuring November, 10,000 units were produced. The standard quantity of material allowed per unit was 12 pounds at a standard cost of $4 per pound. If there was an unfavorable usage variance of $25,020 for November, what amount must be the actual quantity of materials used?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

- Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage  College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY