Concept explainers

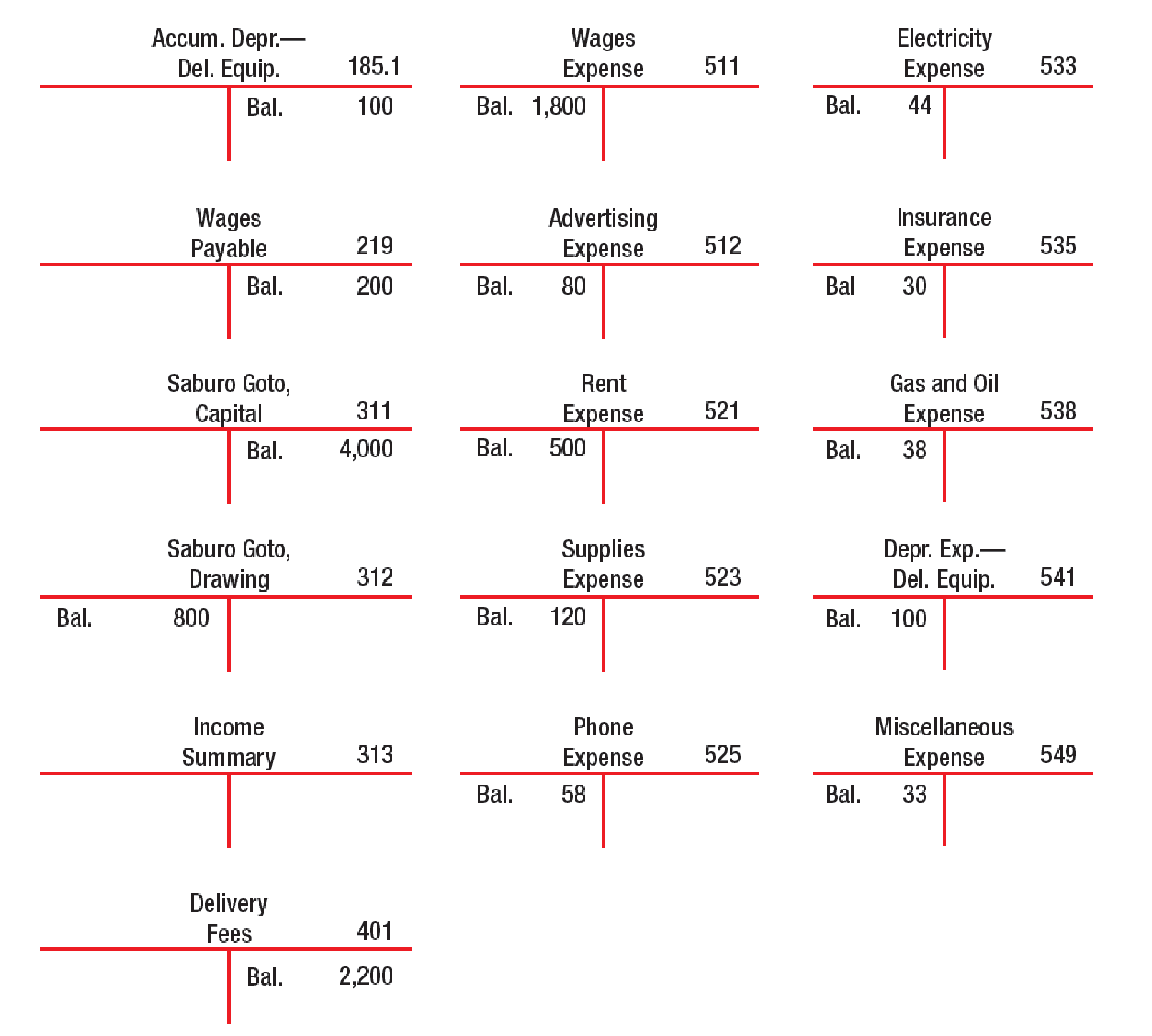

CLOSING ENTRIES (NET LOSS) Using the following partial listing of T accounts, prepare closing entries in general journal form dated January 31, 20--. Then

Prepare closing journal entries in general journal form and post those entries to the T accounts.

Explanation of Solution

Closing entries: The journal entries prepared to close the temporary accounts to permanent account are referred to as closing entries. The revenue, expense, and dividends accounts are referred to as temporary accounts because the information and figures in these accounts is held temporarily and consequently transferred to permanent account at the end of accounting year.

Prepare the closing entries.

| Date | Accounts and Explanation |

Account Number |

Debit ($) | Credit ($) |

| June 30 | Referral fees (SE–) | 401 | 2,813 | |

| Income Summary (SE+) | 313 | 2,813 | ||

| (To close the revenue account.) | ||||

| June 30 | Income summary (SE–) | 313 | 2,987 | |

| Wages expense (SE+) | 511 | 1,080 | ||

| Advertising expense (SE+) | 512 | 34 | ||

| Rent expense (SE+) | 521 | 900 | ||

| Supplies expense (SE+) | 523 | 322 | ||

| Phone expense (SE+) | 525 | 133 | ||

| Utilities expense (SE+) | 533 | 102 | ||

| Insurance expense (SE+) | 535 | 120 | ||

| Gas and oil expense (SE+) | 538 | 88 | ||

| Depreciation expense (SE+) | 541 | 110 | ||

| Miscellaneous expense (SE+) | 549 | 98 | ||

| (To close the expense accounts.) | ||||

| June 30 | RZ, Capital (SE+) | 313 | 174 | |

| Income Summary (SE–) | 313 | 174 | ||

| (To close the income summary accounts) | ||||

| June 30 | RZ, Capital (SE–) | 311 | 2,000 | |

| RZ, Drawings (SE+) | 312 | 2,000 | ||

| (To close withdrawals account.) |

Table (1)

Working Note:

Calculate the amount of RZ capital (transferred).

Revenue account: In this closing entry, the referral fees account is closed by transferring the amount of referral fees account to Income summary account in order to bring the revenue account balance to zero. Hence, debit referral fees account and credit Income summary account.

Expense account: In this closing entry, all expense accounts are closed by transferring the amount of total expense to the Income summary account in order to bring the expense account balance to zero. Hence, debit the Income summary account and credit all expenses account.

Income summary account: Income summary account is a temporary account. This account is debited to close the net income value to RZ capital account.

RZ capital is a component of stockholders’ equity account. The value of RZ capital increased because net income is transferred. Therefore, it is credited.

Withdrawals account: RZ capital is a component of owner’s equity. Thus, owners ‘equity is debited since the capital is decreased on owners’ drawings.

RZ withdrawals are a component of owner’s equity. It is credited because the balance of owners’ withdrawals account is transferred to owners ‘capital account.

T-account: The condensed form of a ledger is referred to as T-account. The left-hand side of this account is known as debit, and the right hand side is known as credit.

Posting the closing entries to the T- account:

| Accumulated Depreciation | Account No – 181.1 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Ending balance | 110 | Beginning balance | 110 | |||

| Beginning balance | 110 | |||||

Table (2)

| Wages Payable | Account No - 219 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Ending balance | 260 | Beginning balance | 260 | |||

| Beginning balance | 260 | |||||

Table (3)

| RZ Capital | Account No – 311 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Income summary | 174 | Beginning balance | 6,000 | |||

| RZ Drawings | 2,000 | |||||

| Ending balance | 3,826 | |||||

| Beginning balance | 3,826 | |||||

Table (4)

| SG Drawings | Account No - 312 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 2,000 | RZ Capital | 2,000 | |||

| Total | 2,000 | Total | 2,000 | |||

Table (5)

| Income Summary | Account No - 313 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Total expense | 2,987 | Referral fees | 2,813 | |||

| RZ Capital | 174 | |||||

| Total | 2,987 | Total | 2,987 | |||

Table (6)

| Referral Fees | Account No - 401 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Income summary | 2,813 | Beginning balance | 2,813 | |||

| Total | 2,813 | Total | 2,813 | |||

Table (7)

| Wages Expense | Account No - 511 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 1,080 | Income summary | 1,080 | |||

| Total | 1,080 | Total | 1,080 | |||

Table (8)

| Advertising Expense | Account No - 512 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 34 | Income summary | 34 | |||

| Total | 34 | Total | 34 | |||

Table (9)

| Rent Expense | Account No - 521 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 900 | Income summary | 900 | |||

| Total | 900 | Total | 900 | |||

Table (10)

| Supplies Expense | Account No - 524 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 322 | Income summary | 322 | |||

| Total | 322 | Total | 322 | |||

Table (11)

| Phone Expense | Account No - 525 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 133 | Income summary | 133 | |||

| Total | 133 | Total | 133 | |||

Table (12)

| Utilities Expense | Account No - 533 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 102 | Income summary | 102 | |||

| Total | 102 | Total | 102 | |||

Table (13)

| Insurance Expense | Account No - 535 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 120 | Income summary | 120 | |||

| Total | 120 | Total | 120 | |||

Table (14)

| Gas and Oil Expense | Account No - 538 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 88 | Income summary | 88 | |||

| Total | 88 | Total | 88 | |||

Table (15)

| Depreciation Expense | Account No - 541 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 110 | Income summary | 110 | |||

| Total | 110 | Total | 110 | |||

Table (16)

| Miscellaneous Expense | Account No - 549 | |||||

| Date | Details | Debit ($) | Date | Details | Credit ($) | |

| Beginning balance | 98 | Income summary | 98 | |||

| Total | 98 | Total | 98 | |||

Table (17)

Want to see more full solutions like this?

Chapter 6 Solutions

College Accounting, Chapters 1-27

- Please explain the correct approach for solving this financial accounting question.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forwardI am looking for the correct answer to this general accounting question with appropriate explanations.arrow_forward

- Can you solve this general accounting problem with appropriate steps and explanations?arrow_forwardPlease explain the solution to this financial accounting problem with accurate principles.arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forward

- Please help me solve this general accounting problem with the correct financial process.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forwardCan you help me solve this general accounting question using the correct accounting procedures?arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning

Financial Accounting: The Impact on Decision Make...AccountingISBN:9781305654174Author:Gary A. Porter, Curtis L. NortonPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,