Financial Accounting

15th Edition

ISBN: 9781337272124

Author: Carl Warren, James M. Reeve, Jonathan Duchac

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 6E

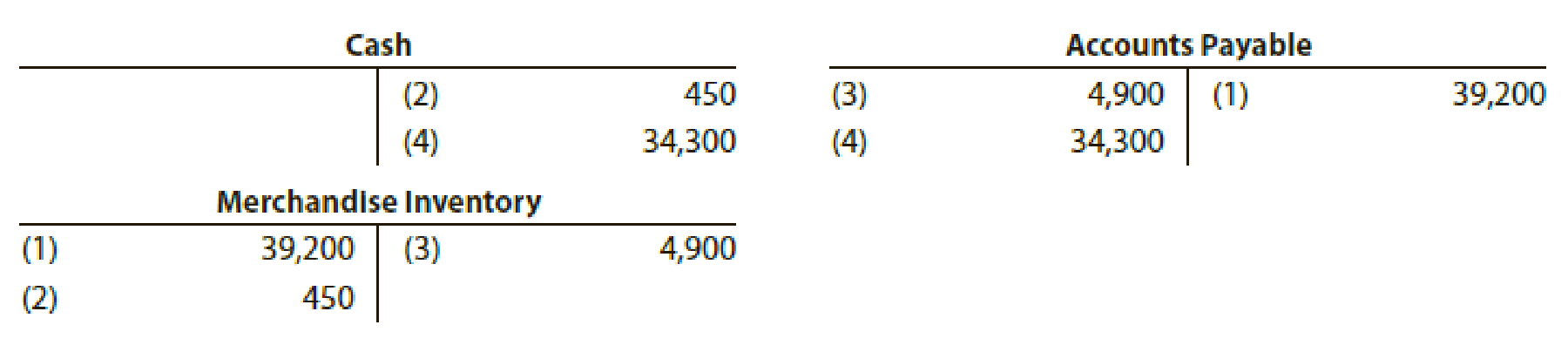

The debits and credits for four related entries for a purchase of $40,000, terms 2/10, n/30, are presented in the following T accounts. Describe each transaction.

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

hi expert please help me

answer plz

choose best answer

Chapter 6 Solutions

Financial Accounting

Ch. 6 - Prob. 1DQCh. 6 - Can a business earn a gross profit but incur a net...Ch. 6 - The credit period during which the buyer of...Ch. 6 - What is the meaning of (a) 1/15, n/60; (b) n/30;...Ch. 6 - Prob. 5DQCh. 6 - Prob. 6DQCh. 6 - Prob. 7DQCh. 6 - Name four accounts that would normally appear in...Ch. 6 - Prob. 9DQCh. 6 - Assume that Audio Outfitter Inc. in Discussion...

Ch. 6 - Prob. 1PEACh. 6 - Prob. 1PEBCh. 6 - Halibut Company purchased merchandise on account...Ch. 6 - Hoffman Company purchased merchandise on account...Ch. 6 - Journalize the following merchandise transactions:...Ch. 6 - Journalize the following merchandise transactions:...Ch. 6 - Prob. 4PEACh. 6 - Journalize the following merchandise transactions:...Ch. 6 - Prob. 5PEACh. 6 - Prob. 5PEBCh. 6 - Prob. 6PEACh. 6 - Journalize the following merchandise transactions:...Ch. 6 - Assume the following data for Lusk Inc. before its...Ch. 6 - PE 6-7B Customer allowances and returns

Assume the...Ch. 6 - Financial statement data for years ending December...Ch. 6 - Financial statement data for years ending December...Ch. 6 - During the current year, merchandise is sold for...Ch. 6 - For a recent year, Best Buy reported sales of...Ch. 6 - Monet Paints Co. is a newly organized business...Ch. 6 - Prob. 4ECh. 6 - A retailer is considering the purchase of 500...Ch. 6 - The debits and credits for four related entries...Ch. 6 - Prob. 7ECh. 6 - Prob. 8ECh. 6 - Journalize the entries for the following...Ch. 6 - After the amount due on a sale of 28,000, terms...Ch. 6 - The debits and credits for four related entries...Ch. 6 - Prob. 12ECh. 6 - Prob. 13ECh. 6 - Showcase Co., a furniture wholesaler, sells...Ch. 6 - Prob. 15ECh. 6 - Prob. 16ECh. 6 - Journalize the entries to record the following...Ch. 6 - What is the normal balance of the following...Ch. 6 - Paragon Tire Co.s perpetual inventory records...Ch. 6 - Assume the following data for Oshkosh Company...Ch. 6 - Zell Company had sales of 1,800,000 and related...Ch. 6 - For the fiscal year, sales were 191,350,000 and...Ch. 6 - The following expenses were incurred by a...Ch. 6 - One item is omitted in each of the following four...Ch. 6 - On March 31, 2019, the balances of the accounts...Ch. 6 - Identify the errors in the following income...Ch. 6 - Summary operating data for Custom Wire Tubing...Ch. 6 - From the following list, identify the accounts...Ch. 6 - Based on the data presented in Exercise 6-25,...Ch. 6 - On July 31, 2019, the balances of the accounts...Ch. 6 - The Home Depot reported the following data (in...Ch. 6 - Kroger Co., a national supermarket chain, reported...Ch. 6 - Complete the following table by indicating for (a)...Ch. 6 - The following selected transactions were completed...Ch. 6 - Prob. 35ECh. 6 - The following data were extracted from the...Ch. 6 - Prob. 37ECh. 6 - Based on the following data, determine the cost of...Ch. 6 - Identify the errors in the following schedule of...Ch. 6 - United Rug Company is a small rug retailer owned...Ch. 6 - The following selected transactions were completed...Ch. 6 - The following selected transactions were completed...Ch. 6 - Prob. 3PACh. 6 - The following selected transactions were completed...Ch. 6 - The following selected accounts and their current...Ch. 6 - Selected accounts and related amounts for...Ch. 6 - Selected transactions for Capers Company during...Ch. 6 - Selected transactions for Babcock Company during...Ch. 6 - On December 31, 2019, the balances of the accounts...Ch. 6 - The following selected transactions were completed...Ch. 6 - The following selected transactions were completed...Ch. 6 - The following were selected from among the...Ch. 6 - The following selected transactions were completed...Ch. 6 - The following selected accounts and their current...Ch. 6 - Selected accounts and related amounts for Kanpur...Ch. 6 - Selected transactions for Niles Co. during March...Ch. 6 - Selected transactions for Essex Company during...Ch. 6 - On June 30, 2019, the balances of the accounts...Ch. 6 - Palisade Creek Co. is a merchandising business...Ch. 6 - Prob. 1CPCh. 6 - Prob. 2CPCh. 6 - Prob. 4CPCh. 6 - Prob. 5CPCh. 6 - Prob. 6CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- What is the companys plant-wide overhead ratearrow_forwardGet correct answer this financial accounting questionarrow_forwardCalculate the number of units that must be sold in order to realize an operating income of $139,000 when fixed costs are $440,000 and unit contribution margin is $20. a. 30,350 units b. 28,950 units c. 31,550 units d. 29,650 unitsarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage Learning Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

Financial Accounting

Accounting

ISBN:9781337272124

Author:Carl Warren, James M. Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial Accounting

Accounting

ISBN:9781305088436

Author:Carl Warren, Jim Reeve, Jonathan Duchac

Publisher:Cengage Learning

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781305084087

Author:Cathy J. Scott

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY