Concept explainers

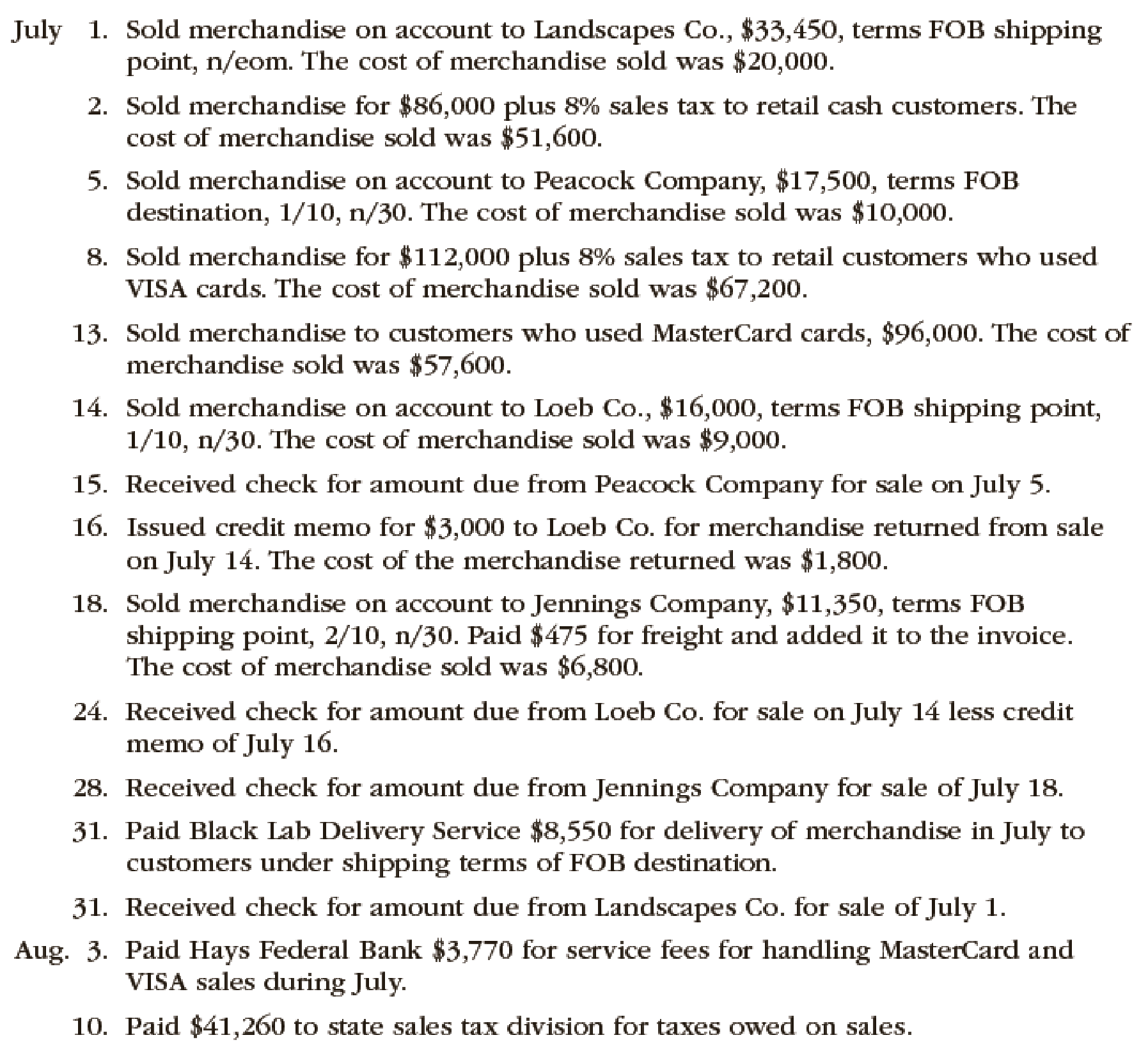

The following selected transactions were completed by Green Lawn Supplies Co., which sells irrigation supplies primarily to wholesalers and occasionally to retail customers:

Instructions

Record the sale transactions of the company.

Explanation of Solution

Sales is an activity of selling the merchandise inventory of a business.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 1 | Accounts receivable | 33,450 | |

| Sales Revenue | 33,450 | ||

| (To record the sale of inventory on account) |

Table (1)

- Accounts Receivable is an asset and it is increased by $33,450. Therefore, debit accounts receivable with $33,450.

- Sales revenue is revenue and it increases the value of equity by $33,450. Therefore, credit sales revenue with $33,450.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 1 | Cost of Merchandise Sold | 20,000 | |

| Merchandise Inventory | 20,000 | ||

| (To record the cost of goods sold) |

Table (2)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $20,000. Therefore, debit cost of merchandise sold account with $20,000.

- Merchandise Inventory is an asset and it is decreased by $20,000. Therefore, credit inventory account with $20,000.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 2 | Cash | 92,880 (2) | |

| Sales Revenue | 86,000 | ||

| Sales Tax Payable | 6,880 (1) | ||

| (To record the sale of inventory for cash) |

Table (3)

- Cash is an asset and it is increased by $92,880. Therefore, debit cash account with $92,880.

- Sales revenue is revenue and it increases the value of equity by $86,000. Therefore, credit sales revenue with $86,000.

- Sales tax payable is a liability and it is increased by $6,880. Therefore, credit sales tax payable account with $6,880.

Working Note (1):

Calculate the amount of sales tax payable.

Sales revenue = $86,000

Sales tax percentage = 8%

Working Note (2):

Calculate the amount of cash received.

Sales revenue = $86,000

Sales tax payable = $6,880 (1)

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 2 | Cost of Merchandise Sold | 51,600 | |

| Merchandise Inventory | 51,600 | ||

| (To record the cost of goods sold) |

Table (4)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $51,600. Therefore, debit cost of merchandise sold account with $51,600.

- Merchandise Inventory is an asset and it is decreased by $51,600. Therefore, credit inventory account with $51,600.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 5 | Accounts receivable | 17,325 (3) | |

| Sales Revenue | 17,325 | ||

| (To record the sale of inventory on account) |

Table (5)

- Accounts Receivable is an asset and it is increased by $17,325. Therefore, debit accounts receivable with $17,325.

- Sales revenue is revenue and it increases the value of equity by $17,325. Therefore, credit sales revenue with $17,325.

Working Note (3):

Calculate the amount of accounts receivable.

Sales = $17,500

Discount percentage = 1%

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 5 | Cost of Merchandise Sold | 10,000 | |

| Merchandise Inventory | 10,000 | ||

| (To record the cost of goods sold) |

Table (6)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $10,000. Therefore, debit cost of merchandise sold account with $10,000.

- Merchandise Inventory is an asset and it is decreased by $10,000. Therefore, credit inventory account with $10,000.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 8 | Cash | 120,960 (5) | |

| Sales Revenue | 112,000 | ||

| Sales Tax Payable | 8,960 (4) | ||

| (To record the sale of inventory for cash) |

Table (7)

- Cash is an asset and it is increased by $120,960. Therefore, debit cash account with $120,960.

- Sales revenue is revenue and it increases the value of equity by $112,000. Therefore, credit sales revenue with $112,000.

- Sales tax payable is a liability and it is increased by $8,960. Therefore, credit sales tax payable account with $8,960.

Working Note (4):

Calculate the amount of sales tax payable.

Sales revenue = $112,000

Sales tax percentage = 8%

Working Note (5):

Calculate the amount of cash received.

Sales revenue = $112,000

Sales tax payable = $8,960 (4)

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 8 | Cost of Merchandise Sold | 67,200 | |

| Merchandise Inventory | 67,200 | ||

| (To record the cost of goods sold) |

Table (8)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $67,200. Therefore, debit cost of merchandise sold account with $67,200.

- Merchandise Inventory is an asset and it is decreased by $67,200. Therefore, credit inventory account with $67,200.

Record the journal entry for the sale of inventory for cash.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 13 | Cash | 96,000 | |

| Sales Revenue | 96,000 | ||

| (To record the sale of inventory for cash) |

Table (9)

- Cash is an asset and it is increased by $96,000. Therefore, debit cash account with $96,000.

- Sales revenue is revenue and it increases the value of equity by $96,000. Therefore, credit sales revenue with $96,000.

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 13 | Cost of Merchandise Sold | 57,600 | |

| Merchandise Inventory | 57,600 | ||

| (To record the cost of goods sold) |

Table (10)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $57,600. Therefore, debit cost of merchandise sold account with $57,600.

- Merchandise Inventory is an asset and it is decreased by $57,600. Therefore, credit inventory account with $57,600.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 14 | Accounts receivable | 15,840 (6) | |

| Sales Revenue | 15,840 | ||

| (To record the sale of inventory on account) |

Table (11)

- Accounts Receivable is an asset and it is increased by $15,840. Therefore, debit accounts receivable with $15,840.

- Sales revenue is revenue and it increases the value of equity by $15,840. Therefore, credit sales revenue with $15,840.

Working Note (6):

Calculate the amount of accounts receivable.

Sales = $16,000

Discount percentage = 1%

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 14 | Cost of Merchandise Sold | 9,000 | |

| Merchandise Inventory | 9,000 | ||

| (To record the cost of goods sold) |

Table (12)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $9,000. Therefore, debit cost of merchandise sold account with $9,000.

- Merchandise Inventory is an asset and it is decreased by $9,000. Therefore, credit inventory account with $9,000.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 15 | Cash | 17,325 | |

| Accounts Receivable | 17,325 | ||

| (To record the receipt of cash against accounts receivables) |

Table (13)

- Cash is an asset and it is increased by $17,325. Therefore, debit cash account with $17,325.

- Accounts Receivable is an asset and it is increased by $17,325. Therefore, debit accounts receivable with $17,325.

Record the journal entry for sales return.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| July 16 | Customer Refunds Payable | 2,970 (7) | ||

| Accounts Receivable | 2,970 | |||

| (To record sales returns) |

Table (14)

- Customer refunds payable is a liability account and it is decreased by $2,970. Therefore, debit customer refunds payable account with $2,970.

- Accounts Receivable is an asset and it is decreased by $2,970. Therefore, credit account receivable with $2,970.

Working Note (7):

Calculate the amount of refund owed to the customer.

Sales return = $3,000

Discount percentage = 1%

Record the journal entry for the return of the merchandise.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 16 | Merchandise Inventory | 1,800 | |

| Estimated Returns Inventory | 1,800 | ||

| (To record the return of the merchandise) |

Table (15)

- Merchandise Inventory is an asset and it is increased by $1,800. Therefore, debit inventory account with $1,800.

- Estimated retunrs inventory is an expense account and it increases the value of equity by $1,800. Therefore, credit estimated returns inventory account with $1,800.

Record the journal entry for the sale of inventory on account.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 18 | Accounts receivable | 11,123 (8) | |

| Sales Revenue | 11,123 | ||

| (To record the sale of inventory on account) |

Table (16)

- Accounts Receivable is an asset and it is increased by $11,123. Therefore, debit accounts receivable with $11,123.

- Sales revenue is revenue and it increases the value of equity by $11,123. Therefore, credit sales revenue with $11,123.

Working Note (8):

Calculate the amount of accounts receivable.

Sales = $11,350

Discount percentage = 2%

- Accounts Receivable is an asset and it is increased by $475. Therefore, debit accounts receivable with $475.

- Cash is an asset and it is decreased by $475. Therefore, credit cash account with $475.

Record the journal entry for freight charges paid.

| Date | Account Title and Explanation |

Post Ref. |

Debit ($) |

Credit ($) |

| July 18 | Accounts Receivable | 475 | ||

| Cash | 475 | |||

| (To record freight charges paid) |

Table (17)

Record the journal entry for cost of goods sold.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 18 | Cost of Merchandise Sold | 6,800 | |

| Merchandise Inventory | 6,800 | ||

| (To record the cost of goods sold) |

Table (18)

- Cost of merchandise sold is an expense account and it decreases the value of equity by $6,800. Therefore, debit cost of merchandise sold account with $6,800.

- Merchandise Inventory is an asset and it is decreased by $6,800. Therefore, credit inventory account with $6,800.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| July 24 | Cash | 12,870 (9) | |

| Accounts Receivable | 12,870 | ||

| (To record the receipt of cash against accounts receivables) |

Table (19)

- Cash is an asset and it is increased by $12,870. Therefore, debit cash account with $12,870.

- Accounts Receivable is an asset and it is increased by $12,870. Therefore, debit accounts receivable with $12,870.

Working Note (9):

Calculate the amount of cash received.

Net accounts receivable = $15,840

Customer refunds payable = $2,970

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| July 28 | Cash | 11,598 (10) | |

| Accounts Receivable | 11,598 | ||

| (To record the receipt of cash against accounts receivables) |

Table (20)

- Cash is an asset and it is increased by $11,598. Therefore, debit cash account with $11,598.

- Accounts Receivable is an asset and it is increased by $11,598. Therefore, debit accounts receivable with $11,598.

Working Note (10):

Calculate the amount of cash received.

Net accounts receivable = $11,123

Freight charges = $475

Record the journal entry for delivery expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| July 31 | Delivery expense | 8,550 | |

| Cash | 8,550 | ||

| (To record the payment of delivery expenses) |

Table (21)

- Delivery expense is an expense account and it decreases the value of equity by $8,550. Therefore, debit delivery expense account with $8,550.

- Cash is an asset and it is decreased by $8,550. Therefore, credit cash account with $8,550.

Record the journal entry for the cash receipt against accounts receivable.

| Date | Accounts and Explanation |

Debit ($) | Credit ($) |

| July 31 | Cash | 33,450 | |

| Accounts Receivable | 33,450 | ||

| (To record the receipt of cash against accounts receivables) |

Table (22)

- Cash is an asset and it is increased by $33,450. Therefore, debit cash account with $33,450.

- Accounts Receivable is an asset and it is increased by $33,450. Therefore, debit accounts receivable with $33,450.

Record the journal entry for credit card expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 3 | Credit card expense | 3,770 | |

| Cash | 3,770 | ||

| (To record the payment of credit card expenses) |

Table (23)

- Credit card expense is an expense account and it decreases the value of equity by $3,770. Therefore, debit credit card expense account with $3,770.

- Cash is an asset and it is decreased by $3,770. Therefore, credit cash account with $3,770.

Record the journal entry for credit card expense.

| Date | Accounts and Explanation | Debit ($) | Credit ($) |

| August 10 | Sales tax payable | 41,260 | |

| Cash | 41,260 | ||

| (To record the payment of credit card expenses) |

Table (24)

- Sales tax payable is a liability account and it is decreased by $41,260. Therefore, debit customer refunds payable account with $41,260.

- Cash is an asset and it is decreased by $41,260. Therefore, credit cash account with $41,260.

Want to see more full solutions like this?

Chapter 6 Solutions

Financial Accounting

- Can you solve this financial accounting problem using accurate calculation methods?arrow_forwardI need help solving this general accounting question with the proper methodology.arrow_forwardPlease provide the correct solution to this financial accounting question using valid principles.arrow_forward

- What is the pansion expense for 2024?arrow_forwardThe cost formula for the maintenance department of Redwood Manufacturing is $18,500 per month plus $7.25 per machine hour used by the production department. Required: Calculate the maintenance cost that would be budgeted for a month in which 5,400 machine hours are planned to be used.arrow_forwardSUBJECT FINANCIAL ACCOUNTINGarrow_forward

- Can you explain this general accounting question using accurate calculation methods?arrow_forwardPlease help me solve this general accounting question using the right accounting principles.arrow_forwardPlease provide the accurate answer to this general accounting problem using appropriate methods.arrow_forward

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

Financial AccountingAccountingISBN:9781337272124Author:Carl Warren, James M. Reeve, Jonathan DuchacPublisher:Cengage LearningPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning

Financial AccountingAccountingISBN:9781305088436Author:Carl Warren, Jim Reeve, Jonathan DuchacPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning