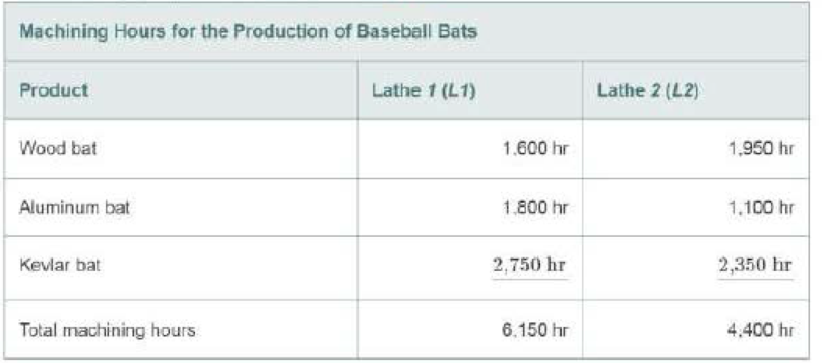

Three models of baseball bats will be manufactured in a new plant in Pulaski. Each bat requires some manufacturing time at either Lathe 1 or Lathe 2, according to the following table. Your task is to help decide which type of lathe to install. Show and explain all work to support your recommendation. (6.5)

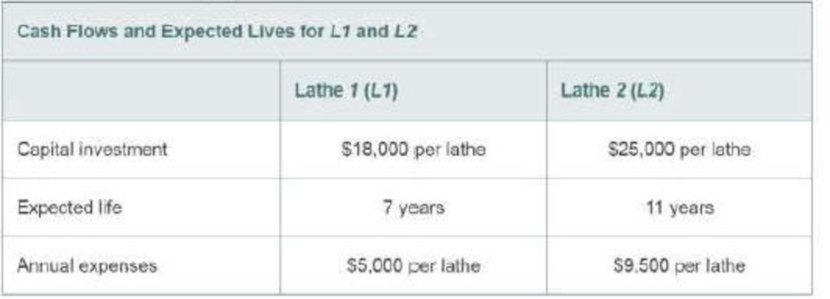

The plant will operate 3,000 hours per year. Machine availability is 85% for Lathe 1 and 90% for Lathe 2. Scrap rates for the two lathes are 5% versus 10% for L1 and L2, respectively. Cash flows and expected lives for the two lathes are given in the following table.

Annual operating expenses are based on an assumed operation of 3,000 hours per year, and workers are paid during any idle time of L1 and L2. Upper management has decided that MARR = 18% per year.

- a. How many type L1 lathes will be required to meet the machine-hour requirement?

- b. What is the CR cost of the required type L2 1athes?

- c. What is the annual operating expense of the type L2 lathes?

- d. Which type of lathe should be selected on the basis of lowest total equivalent annual cost?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

Engineering Economy, Student Value Edition (17th Edition)

- How can Rent-to-own industries avoid the restrictions on interest rates? Explain.arrow_forwardExplain why rent-to-own operations are so attractive to so many people compared to saving the money to buy the desired item or going to a thrift store to acquire the item?arrow_forwardExplain the business practices of the rent-to-own industry.arrow_forward

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning