Engineering Economy, Student Value Edition (17th Edition)

17th Edition

ISBN: 9780134838137

Author: William G. Sullivan, Elin M. Wicks, C. Patrick Koelling

Publisher: PEARSON

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 45P

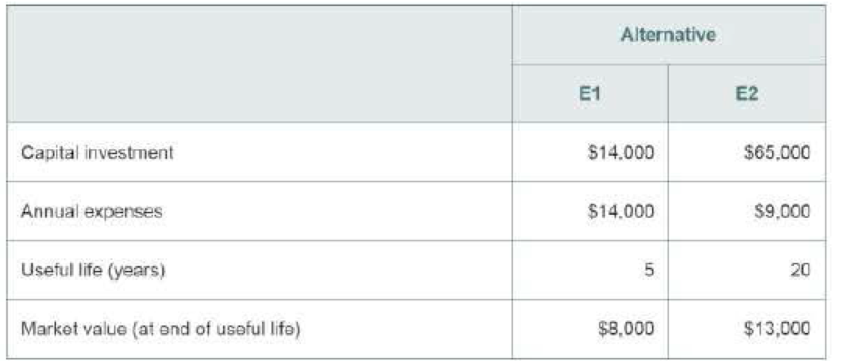

A piece of production equipment is to be replaced immediately because it no longer meets quality requirements for the end product. The two best alternatives are a used piece of equipment (E1) and a new automated model (E2). The economic estimates for each are shown in the accompanying table.

The MARR is 15% per year.

- a. Which alternative is preferred, based on the repeatability assumption? (6.5)

- b. Show, for the coterminated assumption with a five-year study period and an imputed market value for Alternative B, that the AW of B remains the same as it was in Part (a). [And obviously, the selection is the same as in Part (a).] Explain why that occurs in this problem. (6.5)

Expert Solution & Answer

Want to see the full answer?

Check out a sample textbook solution

Students have asked these similar questions

South Africa faces the triple challenge of poverty, inequality and unemployment and the national minimum wage debate has pulled on all three threads to make arguments for and against this policy. Discuss the theoretical implications of a national minimum wage, and touching on each of the three challenges South Africa faces, discuss some arguments for how this policy may affect them.

In the context of the article below, discuss the Minister’s position in light of the principles of fairness as they relate to taxation.

SA's work visa reform plans slowed by tax issues

South Africa’s plan to attract more professionals to its skills-starved economy through the introduction of a so-called nomad visa for remote workers has been slowed by the need to amend tax regulations.

The impediment comes after an initial delay when changes to the visa regime had to be temporarily withdrawn because mandatory public consultation procedures hadn’t been followed. President Cyril Ramaphosa announced his intention to introduce a remote-working visa in his 2022 state-of-the-nation address.

“There is just a tax-related matter that needs to be addressed in the regulations,” Leon Schreiber, the country’s Home Affairs Minister, said in a response to queries. “Once that is done, the department will commence with the rollout.”

South Africa’s byzantine work permit regime, which means…

Assume that an economy has an inflationary gap. Compare the use of fiscal policy with the use of monetary policy to remove the gap. Assume a closed economy. Use graphs to illustrate.

Chapter 6 Solutions

Engineering Economy, Student Value Edition (17th Edition)

Ch. 6 - An oil refinery finds that it is necessary to...Ch. 6 - The Consolidated Oil Company must install...Ch. 6 - One of the mutually exclusive alternatives below...Ch. 6 - Three mutually exclusive design alternatives are...Ch. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Fiesta Foundry is considering a new furnace that...Ch. 6 - Prob. 8PCh. 6 - DuPont claims that its synthetic composites will...Ch. 6 - Prob. 10P

Ch. 6 - Which alternative in the table below should be...Ch. 6 - Prob. 12PCh. 6 - The alternatives for an engineering project to...Ch. 6 - Prob. 14PCh. 6 - Prob. 15PCh. 6 - Prob. 16PCh. 6 - Refer to the situation in Problem 6-16. Most...Ch. 6 - An old, heavily used warehouse currently has an...Ch. 6 - Prob. 19PCh. 6 - Two electric motors (A and B) are being considered...Ch. 6 - Two mutually exclusive design alternatives are...Ch. 6 - Pamela recently moved to Celebration, Florida, an...Ch. 6 - Environmentally conscious companies are looking...Ch. 6 - Prob. 24PCh. 6 - Two 100 horsepower motors are being considered for...Ch. 6 - In the Rawhide Company (a leather products...Ch. 6 - Refer to Problem 6-2. Solve this problem using the...Ch. 6 - Prob. 28PCh. 6 - Prob. 29PCh. 6 - Two electric motors are being considered to drive...Ch. 6 - Prob. 31PCh. 6 - Prob. 32PCh. 6 - Prob. 33PCh. 6 - Potable water is in short supply in many...Ch. 6 - Three mutually exclusive investment alternatives...Ch. 6 - Prob. 36PCh. 6 - A companys MARR is 10% per year. Two mutually...Ch. 6 - Prob. 38PCh. 6 - a. Compare the probable part cost from Machine A...Ch. 6 - A one-mile section of a roadway in Florida has...Ch. 6 - Two mutually exclusive alternatives are being...Ch. 6 - Prob. 42PCh. 6 - IBM is considering an environmentally conscious...Ch. 6 - Three mutually exclusive earth-moving pieces of...Ch. 6 - A piece of production equipment is to be replaced...Ch. 6 - Prob. 46PCh. 6 - Prob. 47PCh. 6 - Prob. 48PCh. 6 - Prob. 49PCh. 6 - Prob. 50PCh. 6 - Prob. 51PCh. 6 - Prob. 52PCh. 6 - Prob. 53PCh. 6 - Use the imputed market value technique to...Ch. 6 - Prob. 55PCh. 6 - Prob. 56PCh. 6 - Prob. 57PCh. 6 - Prob. 58PCh. 6 - Prob. 59PCh. 6 - Prob. 60PCh. 6 - Prob. 61PCh. 6 - Prob. 62PCh. 6 - Prob. 63PCh. 6 - Prob. 64PCh. 6 - Prob. 65PCh. 6 - Prob. 66PCh. 6 - Three models of baseball bats will be manufactured...Ch. 6 - Refer to Example 6-3. Re-evaluate the recommended...Ch. 6 - Prob. 69SECh. 6 - Prob. 70SECh. 6 - Prob. 71SECh. 6 - Prob. 72CSCh. 6 - Prob. 73CSCh. 6 - Prob. 74CSCh. 6 - Prob. 75FECh. 6 - Prob. 76FECh. 6 - Prob. 77FECh. 6 - Complete the following analysis of cost...Ch. 6 - Prob. 79FECh. 6 - For the following table, assume a MARR of 10% per...Ch. 6 - Prob. 81FECh. 6 - Problems 6-82 through 6-85. (6.4) Table P6-82 Data...Ch. 6 - Prob. 83FECh. 6 - Problems 6-82 through 6-85. (6.4) Table P6-82 Data...Ch. 6 - Problems 6-82 through 6-85. (6.4) Table P6-82 Data...Ch. 6 - Consider the mutually exclusive alternatives given...Ch. 6 - Prob. 87FE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- Suppose Person A is looking for a health insurance plan on Oregon's health insurance marketplace and they find one with the following details: Monthly Premium: $331 Deductible: $5,000 Primary care visit to treat injury or illness: $35 copay Imaging (CT/PET Scans MRIs): 40% coinsurance after deductible Ambulance: 40% coinsurance after deductible Inpatient hospital stay: 40% coinsurance after deductible Suppose further that Person A purchases this plan and it takes effect in January 2022. The cost Person A pays per month for this health insurance is equal to _. Person A must pay. before coinsurance kicks in. 0000 $35; $5,000 $35; $331 $331; $5,000 $331; $35 Multiple Choice 1 point Suppose Person A is looking for a health insurance plan on Oregon's health insurance marketplace and you find one with the following details: Monthly Premium: $331 Deductible: $5,000 Primary care visit to treat injury or illness: $35 copay Imaging (CT/PET Scans MRIs): 40% coinsurance after deductible Ambulance:…arrow_forwardUse the figure below to answer the following question. Point X and Y represent two non-ideal contracts that the individual is faced with buying. From this information, you can conclude that if given the option between points B and Y the individual would prefer: Utility A у в 0000 UKI) E[Bp IH point B- the actuarially fair and full contract point Y-the actuarially unfair but full contract point Y- the actuarially fair, but partial contract point B- the actuarially fair, but partial contract incomearrow_forward2. Another issue facing millennials is the growing income and wealth inequality. We will use our model to understand the implications of this issue. A. Begin from the baseline preferences and endowments. Assume Xavier is wealthier than Yuri. Xavier has an endowment of 1100 pounds for each period (E1=E2=1100). Yuri has an endowment of only 900 pounds in each period (E1=E2=900). Note that each period's market supply is unchanged (1100 + 900 = 1000 + 1000 = = 2000). Determine the equilibrium interest rate. r = % B. Begin from the baseline preferences and endowments. Assume Yuri is wealthier than Xavier. Xavier has an endowment of only 900 pounds in each period (E1=E2=900). Yuri has an endowment of 1100 pounds for each period (E1=E2=1100). Note that each period's market supply is unchanged (1100 + 900 = 1000 + 1000 = 2000). Determine the equilibrium interest rate. r = % C. Begin from the baseline preferences and endowments. A third person named Zena joins our economy. Zena is very…arrow_forward

- Use the figure below to answer the following question. Let I represent Income when health, let Is represent income when ill. Let E[I] represent expected income. Point D represents Utility 100000 B у いいつ income есва Ін Is the expected utility from income with no insurance an actuarially fair and partial contract an actuarially fair and full contract an actuarially unfair and full contract an actuarially unfair and partial contractarrow_forwardOutline the principles of opportunity cost and comparative advantage. Describe how these principles can be applied to address the scarcity of resources in a real-world scenario involving a company or industry.arrow_forwardNot use ai pleasearrow_forward

- 3. Consider the case of everyone being wealthier in the future, such as from a positive productivity shock (computers, internet, robotics, AI). A. Begin from the baseline preferences and endowments. Give both people an endowment of 1000 pounds for the first period and 1100 pounds for the second. AI increases the supply of second period goods by 10%. Note that there is now a total of 2000 pounds in the first period and 2200 pounds in the second. Determine the equilibrium interest rate. r = % B. Begin from the baseline preferences and endowments. Give both people an endowment of 1100 pounds for the first and 1100 pounds for the second periods. AI increases the supply in all periods by 10%. Note that there are now 2200 pounds in the first period and 2200 pounds in the second. Determine the equilibrium interest rate. r = % C. Explain how productivity and the real rate are connected. Write at least five sentences.arrow_forwardNot use ai pleasearrow_forwardNot use ai pleasearrow_forward

- Not use ai pleasearrow_forwardJim's Bank Account for the Year to 30 April 2008: We will start by calculating the balance of the business bank account, using the transactions provided. Opening Balance: Jim initially deposited €150,000 into his business bank account on 1 May 2007. Transactions: Receipts: Cash Sales (May 2007 to April 2008): €96,000 Credit Sales (Business customers): €19,600 (Note: This amount is not yet received as it is on credit, but it will be included in the Income Statement and not the bank balance at this stage.) Bank receipts from credit customers (amount owed at 30 April 2008): €6,800 Total Receipts:€96,000 (Cash Sales) + €6,800 (credit customer payments) = €102,800 Payments/Expenditures: Lease Payment (Paid in advance for five years): €50,000 Shop Fitting: €10,000 Assistant’s Wages: €250 per month × 12 months = €3,000 Telephone expenses: €800 Heat & Light expenses: €1,000 Jim’s withdrawals for personal expenditure: €1,000 × 12 months = €12,000 Accounting Fee (after the year-end):…arrow_forwardSolve the problemarrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc

Exploring EconomicsEconomicsISBN:9781544336329Author:Robert L. SextonPublisher:SAGE Publications, Inc Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Microeconomics: Private and Public Choice (MindTa...EconomicsISBN:9781305506893Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...EconomicsISBN:9781305506725Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. MacphersonPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Exploring Economics

Economics

ISBN:9781544336329

Author:Robert L. Sexton

Publisher:SAGE Publications, Inc

Microeconomics: Private and Public Choice (MindTa...

Economics

ISBN:9781305506893

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Economics: Private and Public Choice (MindTap Cou...

Economics

ISBN:9781305506725

Author:James D. Gwartney, Richard L. Stroup, Russell S. Sobel, David A. Macpherson

Publisher:Cengage Learning

Valuation Analysis in Project Finance Models - DCF & IRR; Author: Financial modeling;https://www.youtube.com/watch?v=xDlQPJaFtCw;License: Standard Youtube License