Concept explainers

Comprehensive problem; ABC manufacturing, two products. Hazlett, Inc., operates at capacity and makes plastic combs and hairbrushes. Although the combs and brushes are a matching set, they are sold individually and so the sales mix is not 1:1. Hazlett’s management is planning its annual budget for fiscal year 2018. Here is information for 2018:

Input Prices

| Direct materials | |

| Plastic | $0.30 per ounce |

| Bristles | $0.75 per bunch |

| Direct manufacturing labor | $ 18 per direct manufacturing labor-hour |

Input Quantities per Unit of Output

| Combs | Brushes | |

| Direct materials | ||

| Plastic | 5 ounces | 8 ounces |

| Bristles | — | 16 bunches |

| Direct manufacturing labor | 0.05 hours | 0.2 hours |

| Machine-hours (MH) | 0.025 MH | 0.1 MH |

Inventory Information, Direct Materials

| Plastic | Bristles | |

| Beginning inventory | 1,600 ounces | 1,820 bunches |

| Target ending inventory | 1,766 ounces | 2,272 bunches |

| Cost of beginning inventory | $456 | $1,419 |

Hazlett accounts for direct materials using a FIFO cost flow.

Sales and Inventory Information, Finished Goods

| Combs | Brushes | |

| Expected sales in units | 12,000 | 14,000 |

| Selling price | $ 9 | $ 30 |

| Target ending inventory in units | 1,200 | 1,400 |

| Beginning inventory in units | 600 | 1,200 |

| Beginning inventory in dollars | $ 2,700 | $27,180 |

Hazlett uses a FIFO cost-flow assumption for finished-goods inventory.

Combs are manufactured in batches of 200, and brushes are manufactured in batches of 100. It takes 20 minutes to set up for a batch of combs and 1 hour to set up for a batch of brushes.

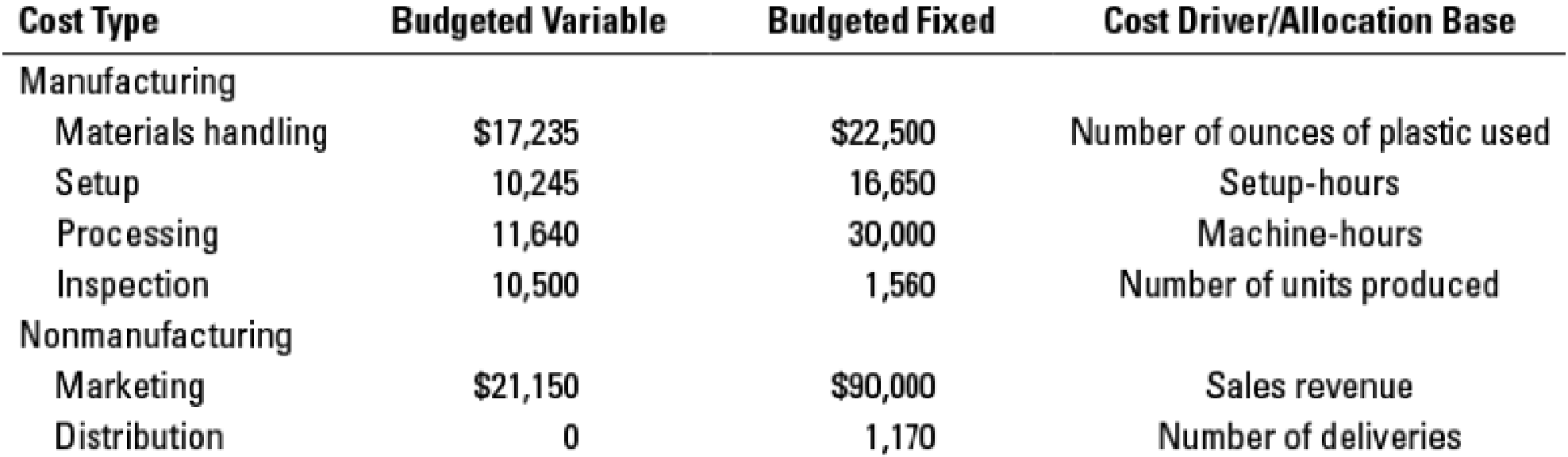

Hazlett uses activity-based costing and has classified all

Delivery trucks transport units sold in delivery sizes of 1,000 combs or 1,000 brushes.

Do the following for the year 2018:

- 1. Prepare the revenues budget.

- 2. Use the revenues budget to:

- a. Find the budgeted allocation rate for marketing costs.

- b. Find the budgeted number of deliveries and allocation rate for distribution costs.

- 3. Prepare the production budget in units.

- 4. Use the production budget to:

- a. Find the budgeted number of setups and setup-hours and the allocation rate for setup costs.

- b. Find the budgeted total machine-hours and the allocation rate for

processing costs. - c. Find the budgeted total units produced and the allocation rate for inspection costs.

- 5. Prepare the direct material usage budget and the direct material purchases budget in both units and dollars; round to whole dollars.

- 6. Use the direct material usage budget to find the budgeted allocation rate for materials-handling costs.

- 7. Prepare the direct

manufacturing labor cost budget. - 8. Prepare the manufacturing overhead cost budget for materials handling, setup, processing, and inspection costs.

- 9. Prepare the budgeted unit cost of ending finished-goods inventory and ending inventories budget.

- 10. Prepare the cost of goods sold budget.

- 11. Prepare the nonmanufacturing overhead costs budget for marketing and distribution.

- 12. Prepare a

budgeted income statement (ignore income taxes). - 13. How does preparing the budget help Hazlett's management team better manage the company?

Want to see the full answer?

Check out a sample textbook solution

Chapter 6 Solutions

REVEL for Horngren's Cost Accounting: A Managerial Emphasis -- Access Card (16th Edition) (What's New in Accounting)

Additional Business Textbook Solutions

Essentials of MIS (13th Edition)

Principles of Operations Management: Sustainability and Supply Chain Management (10th Edition)

Gitman: Principl Manageri Finance_15 (15th Edition) (What's New in Finance)

Financial Accounting, Student Value Edition (5th Edition)

MARKETING:REAL PEOPLE,REAL CHOICES

- financial accountingarrow_forwardWhat is the opereting cash flow at this lavel of output? General accountingarrow_forwardPioneer Manufacturing has fixed costs of $60,000 and variable costs of $40 per unit. If they sell each unit for $100, how many units must be sold to earn a target profit of $40,000? (Round your answer)arrow_forward

- Under full costingarrow_forwardAnnapolis Company completes job #601 which has a standard of 500 labor hours at a standard rate of $19.00 per hour. The job was completed in 600 hours and the average actual labor rate was $19.70 per hour. What is the labor efficiency (quantity) variance?arrow_forward3 POINTSarrow_forward

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,