EBK MANAGERIAL ACCOUNTING: THE CORNERST

7th Edition

ISBN: 9781337516150

Author: Heitger

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 46E

Weighted Average Method, Unit Costs, Valuing Inventories

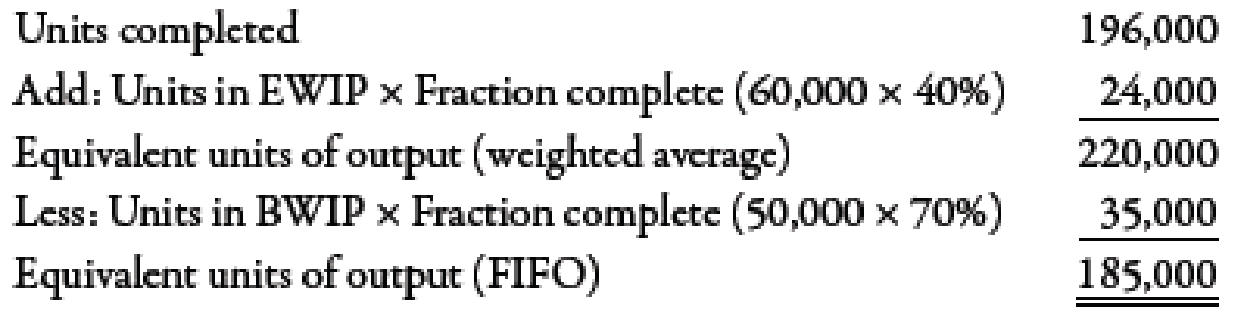

Byford Inc. produces a product that passes through two processes. During November, equivalent units were calculated using the weighted average method:

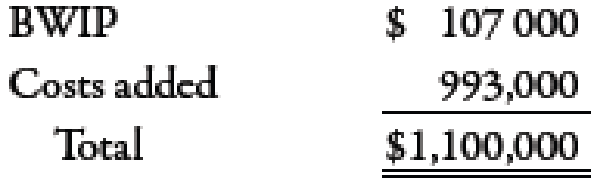

The costs that Byford had to account for during the month of November were as follows:

Required:

- 1. Using the weighted average method, determine unit cost.

- 2. Under the weighted average method, what is the total cost of units transferred out? What is the cost assigned to units in ending inventory?

- 3. CONCEPTUAL CONNECTION Bill Johnson, the manager of Byford, is considering switching from weighted average to FIFO. Explain the key differences between the two approaches and make a recommendation to Bill about which method should be used.

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

provide correct answer

financial accounting

General accounting

Chapter 6 Solutions

EBK MANAGERIAL ACCOUNTING: THE CORNERST

Ch. 6 - Describe the differences between process costing...Ch. 6 - Prob. 2DQCh. 6 - What are the similarities in and differences...Ch. 6 - Prob. 4DQCh. 6 - How would process costing for services differ from...Ch. 6 - How does the adoption of a JIT approach to...Ch. 6 - What are equivalent units? Why are they needed in...Ch. 6 - Under the weighted average method, how are...Ch. 6 - Prob. 9DQCh. 6 - Prob. 10DQ

Ch. 6 - Prob. 11DQCh. 6 - How is the equivalent unit calculation affected...Ch. 6 - Prob. 13DQCh. 6 - Prob. 14DQCh. 6 - Process costing works well whenever a....Ch. 6 - Job-order costing works well whenever a....Ch. 6 - Prob. 3MCQCh. 6 - To record the transfer of costs from a prior...Ch. 6 - The costs transferred from a prior process to a...Ch. 6 - During the month of May, the grinding department...Ch. 6 - Use the following information for Multiple-Choice...Ch. 6 - Use the following information for Multiple-Choice...Ch. 6 - Use the following information for Multiple-Choice...Ch. 6 - During May, Kimbrell Manufacturing completed and...Ch. 6 - During June, Kimbrell Manufacturing completed and...Ch. 6 - For August, Kimbrell Manufacturing has costs in...Ch. 6 - For September, Murphy Company has manufacturing...Ch. 6 - During June, Faust Manufacturing started and...Ch. 6 - During July, Faust Manufacturing started and...Ch. 6 - Assume for August that Faust Manufacturing has...Ch. 6 - For August, Lanny Company had 25,000 units in...Ch. 6 - When materials are added either at the beginning...Ch. 6 - With nonuniform inputs, the cost of EWIP is...Ch. 6 - Transferred-in goods are treated by the receiving...Ch. 6 - Basic Cost Flows Gardner Company produces 18-ounce...Ch. 6 - Equivalent Units, No Beginning Work in Process...Ch. 6 - Unit Cost, Valuing Goods Transferred Out and EWIP...Ch. 6 - Weighted Average Method, Unit Cost, Valuing...Ch. 6 - Physical Flow Schedule Golding Inc. just finished...Ch. 6 - Production Report, Weighted Average Manzer Inc....Ch. 6 - Nonuniform Inputs, Weighted Average Carter Inc....Ch. 6 - Transferred-In Cost Powers Inc. produces a protein...Ch. 6 - Use the following information for Brief Exercises...Ch. 6 - Use the following information for Brief Exercises...Ch. 6 - Basic Cost Flows Hardy Company produces 18-ounce...Ch. 6 - Equivalent Units, No Beginning Work in Process...Ch. 6 - Unit Cost, Valuing Goods Transferred Out and EWIP...Ch. 6 - Weighted Average Method, Unit Cost, Valuing...Ch. 6 - Physical Flow Schedule Craig Inc. just finished...Ch. 6 - Production Report, Weighted Average Washburn Inc....Ch. 6 - Nonuniform Inputs, Weighted Average Ming Inc. had...Ch. 6 - Transferred-In Cost Vigor Inc. produces an energy...Ch. 6 - Use the following information for Brief Exercises...Ch. 6 - Use the following information for Brief Exercises...Ch. 6 - Basic Cost Flows Linsenmeyer Company produces a...Ch. 6 - Journal Entries, Basic Cost Flows In December,...Ch. 6 - Equivalent Units, Unit Cost, Valuation of Goods...Ch. 6 - Weighted Average Method, Equivalent Units Goforth...Ch. 6 - Cassien Inc. manufactures products that pass...Ch. 6 - Weighted Average Method, Unit Costs, Valuing...Ch. 6 - Physical Flow Schedule The following information...Ch. 6 - Physical Flow Schedule Nelrok Company manufactures...Ch. 6 - Production Report, Weighted Average Mino Inc....Ch. 6 - Nonuniform Inputs, Equivalent Units Terry Linens...Ch. 6 - Unit Cost and Cost Assignment, Nonuniform Inputs...Ch. 6 - Nonuniform Inputs, Transferred-In Cost Drysdale...Ch. 6 - Transferred-In Cost Goldings finishing department...Ch. 6 - (Appendix 6A) First-In, First-Out Method;...Ch. 6 - (Appendix 6A) First-In, First-Out Method; Unit...Ch. 6 - Basic Flows, Equivalent Units Thayn Company...Ch. 6 - Steps in Preparing a Production Report Recently,...Ch. 6 - Recently, Stillwater Designs expanded its market...Ch. 6 - Equivalent Units, Unit Cost, Weighted Average...Ch. 6 - Production Report Refer to the information for...Ch. 6 - Mimasca Inc. manufactures various holiday masks....Ch. 6 - Use the following information for Problems 6-62...Ch. 6 - Use the following information for Problems 6-62...Ch. 6 - Weighted Average Method, Separate Materials Cost...Ch. 6 - Seacrest Company uses a process-costing system....Ch. 6 - Required: 1. Using the FIFO method, prepare the...Ch. 6 - Benson Pharmaceuticals uses a process-costing...Ch. 6 - (Appendix 6A) First-In, First-Out Method Refer to...Ch. 6 - Golding Manufacturing, a division of Farnsworth...Ch. 6 - AKL Foundry manufactures metal components for...Ch. 6 - Consider the following conversation between Gary...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning

Principles of Cost AccountingAccountingISBN:9781305087408Author:Edward J. Vanderbeck, Maria R. MitchellPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College PubPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Principles of Cost Accounting

Accounting

ISBN:9781305087408

Author:Edward J. Vanderbeck, Maria R. Mitchell

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY