EBK MANAGERIAL ACCOUNTING: THE CORNERST

7th Edition

ISBN: 9781337516150

Author: Heitger

Publisher: CENGAGE LEARNING - CONSIGNMENT

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 6, Problem 45E

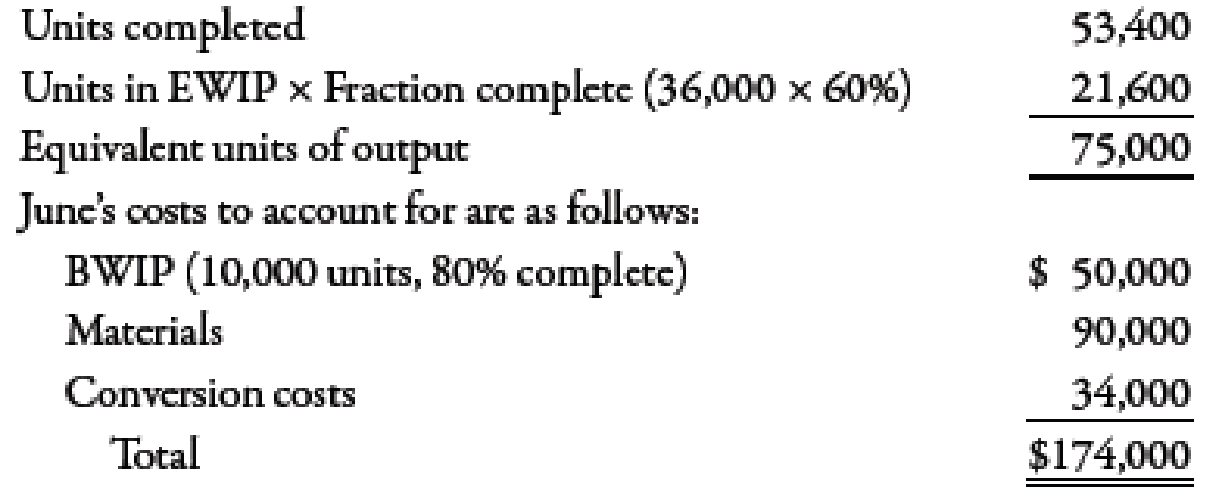

Cassien Inc. manufactures products that pass through two or more processes. During June, equivalent units were computed using the weighted average method:

Required:

- 1. Calculate the unit cost for June using the weighted average method.

- 2. Using the weighted average method, determine the cost of EWIP and the cost of the goods transferred out.

- 3. CONCEPTUAL CONNECTION Cassien had just finished implementing a series of measures designed to reduce the unit cost to $2.00 and was assured that this had been achieved and should be realized for June’s production. Yet, upon seeing the unit cost for June, the president of the company was disappointed. Can you explain why the full effect of the cost reductions may not show up in June? What can you suggest to overcome this problem?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

Fortune Producers manufactures three joint products, JKA, JKB, and JKC, and a by-product, JJD, all in a single process. Results for the month of July 2021 were as follows:

The revenue from the by-product is credited to the sales account. Process costs are appointed on a sales value method. What was the cost per kilo of JKA for the month?

A. 5.72

B. 5.61

C. 5.50

D. 5.20

Apply the Concepts, Cost Reporting

Medco Inc., a manufacturing firm, has four activities: purchasing materials, molding, inspecting molds, and grinding imperfect molds. Purchasing

materials and molding are necessary activities; inspection and grinding are unnecessary. SQ provides the value-added quantity for each activity; AQ is

the actual activity output. The following data pertain to the four activities for the year ending (actual price per unit of the activity driver is assumed to

be equal to the standard price):

Activity Activity Driver

Purchasing Purchasing hours

Molding

Inspecting Inspection hours

Molding hours

Grinding. Number of units

Required:

SQ AQ SP

28,000 34,000 $20

42,000 47,600 121

0 8,400 15

0 6,000

6

1. Prepare a cost report for the year 1 ended that shows value-added costs, non-value-added costs, and total costs for each activity by completing

the following table:

Value-and Non-Value-Added Cost Report for the Year 1 Ended

Activity

Value-Added

Costs

Non-Value-Added…

Merone Company allocates materials handling cost to the company's two products using the below data:

Multiple Choice

Total expected units produced

Total expected material moves

Expected direct labor-hours per unit

The total materials handling cost for the year is expected to be $339,780.

If the materials handling cost is allocated on the basis of direct labor-hours, the total materials handling cost allocated to the profab barns is closest to:

(Round your intermediate calculations to 2 decimal places.)

O

O

O

$154,626.00

250,364.21

$130,340.00

Modular

Homes

6,800

$141,145.98

Prefab

Barns

9,800

680

880

280

380

Chapter 6 Solutions

EBK MANAGERIAL ACCOUNTING: THE CORNERST

Ch. 6 - Describe the differences between process costing...Ch. 6 - Prob. 2DQCh. 6 - What are the similarities in and differences...Ch. 6 - Prob. 4DQCh. 6 - How would process costing for services differ from...Ch. 6 - How does the adoption of a JIT approach to...Ch. 6 - What are equivalent units? Why are they needed in...Ch. 6 - Under the weighted average method, how are...Ch. 6 - Prob. 9DQCh. 6 - Prob. 10DQ

Ch. 6 - Prob. 11DQCh. 6 - How is the equivalent unit calculation affected...Ch. 6 - Prob. 13DQCh. 6 - Prob. 14DQCh. 6 - Process costing works well whenever a....Ch. 6 - Job-order costing works well whenever a....Ch. 6 - Prob. 3MCQCh. 6 - To record the transfer of costs from a prior...Ch. 6 - The costs transferred from a prior process to a...Ch. 6 - During the month of May, the grinding department...Ch. 6 - Use the following information for Multiple-Choice...Ch. 6 - Use the following information for Multiple-Choice...Ch. 6 - Use the following information for Multiple-Choice...Ch. 6 - During May, Kimbrell Manufacturing completed and...Ch. 6 - During June, Kimbrell Manufacturing completed and...Ch. 6 - For August, Kimbrell Manufacturing has costs in...Ch. 6 - For September, Murphy Company has manufacturing...Ch. 6 - During June, Faust Manufacturing started and...Ch. 6 - During July, Faust Manufacturing started and...Ch. 6 - Assume for August that Faust Manufacturing has...Ch. 6 - For August, Lanny Company had 25,000 units in...Ch. 6 - When materials are added either at the beginning...Ch. 6 - With nonuniform inputs, the cost of EWIP is...Ch. 6 - Transferred-in goods are treated by the receiving...Ch. 6 - Basic Cost Flows Gardner Company produces 18-ounce...Ch. 6 - Equivalent Units, No Beginning Work in Process...Ch. 6 - Unit Cost, Valuing Goods Transferred Out and EWIP...Ch. 6 - Weighted Average Method, Unit Cost, Valuing...Ch. 6 - Physical Flow Schedule Golding Inc. just finished...Ch. 6 - Production Report, Weighted Average Manzer Inc....Ch. 6 - Nonuniform Inputs, Weighted Average Carter Inc....Ch. 6 - Transferred-In Cost Powers Inc. produces a protein...Ch. 6 - Use the following information for Brief Exercises...Ch. 6 - Use the following information for Brief Exercises...Ch. 6 - Basic Cost Flows Hardy Company produces 18-ounce...Ch. 6 - Equivalent Units, No Beginning Work in Process...Ch. 6 - Unit Cost, Valuing Goods Transferred Out and EWIP...Ch. 6 - Weighted Average Method, Unit Cost, Valuing...Ch. 6 - Physical Flow Schedule Craig Inc. just finished...Ch. 6 - Production Report, Weighted Average Washburn Inc....Ch. 6 - Nonuniform Inputs, Weighted Average Ming Inc. had...Ch. 6 - Transferred-In Cost Vigor Inc. produces an energy...Ch. 6 - Use the following information for Brief Exercises...Ch. 6 - Use the following information for Brief Exercises...Ch. 6 - Basic Cost Flows Linsenmeyer Company produces a...Ch. 6 - Journal Entries, Basic Cost Flows In December,...Ch. 6 - Equivalent Units, Unit Cost, Valuation of Goods...Ch. 6 - Weighted Average Method, Equivalent Units Goforth...Ch. 6 - Cassien Inc. manufactures products that pass...Ch. 6 - Weighted Average Method, Unit Costs, Valuing...Ch. 6 - Physical Flow Schedule The following information...Ch. 6 - Physical Flow Schedule Nelrok Company manufactures...Ch. 6 - Production Report, Weighted Average Mino Inc....Ch. 6 - Nonuniform Inputs, Equivalent Units Terry Linens...Ch. 6 - Unit Cost and Cost Assignment, Nonuniform Inputs...Ch. 6 - Nonuniform Inputs, Transferred-In Cost Drysdale...Ch. 6 - Transferred-In Cost Goldings finishing department...Ch. 6 - (Appendix 6A) First-In, First-Out Method;...Ch. 6 - (Appendix 6A) First-In, First-Out Method; Unit...Ch. 6 - Basic Flows, Equivalent Units Thayn Company...Ch. 6 - Steps in Preparing a Production Report Recently,...Ch. 6 - Recently, Stillwater Designs expanded its market...Ch. 6 - Equivalent Units, Unit Cost, Weighted Average...Ch. 6 - Production Report Refer to the information for...Ch. 6 - Mimasca Inc. manufactures various holiday masks....Ch. 6 - Use the following information for Problems 6-62...Ch. 6 - Use the following information for Problems 6-62...Ch. 6 - Weighted Average Method, Separate Materials Cost...Ch. 6 - Seacrest Company uses a process-costing system....Ch. 6 - Required: 1. Using the FIFO method, prepare the...Ch. 6 - Benson Pharmaceuticals uses a process-costing...Ch. 6 - (Appendix 6A) First-In, First-Out Method Refer to...Ch. 6 - Golding Manufacturing, a division of Farnsworth...Ch. 6 - AKL Foundry manufactures metal components for...Ch. 6 - Consider the following conversation between Gary...

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Cicleta Manufacturing has four activities: receiving materials, assembly, expediting products, and storing goods. Receiving and assembly are necessary activities; expediting and storing goods are unnecessary. The following data pertain to the four activities for the year ending 20x1 (actual price per unit of the activity driver is assumed to be equal to the standard price): Required: 1. Prepare a cost report for the year ending 20x1 that shows value-added costs, non-value-added costs, and total costs for each activity. 2. Explain why expediting products and storing goods are non-value-added activities. 3. What if receiving cost is a step-fixed cost with each step being 1,500 orders whereas assembly cost is a variable cost? What is the implication for reducing the cost of waste for each activity?arrow_forwardPatterson Company produces wafers for integrated circuits. Data for the most recent year are provided: aCalculated using number of dies as the single unit-level driver. bCalculated by multiplying the consumption ratio of each product by the cost of each activity. Required: 1. Using the five most expensive activities, calculate the overhead cost assigned to each product. Assume that the costs of the other activities are assigned in proportion to the cost of the five activities. 2. Calculate the error relative to the fully specified ABC product cost and comment on the outcome. 3. What if activities 1, 2, 5, and 8 each had a cost of 650,000 and the remaining activities had a cost of 50,000? Calculate the cost assigned to Wafer A by a fully specified ABC system and then by an approximately relevant ABC approach. Comment on the implications for the approximately relevant approach.arrow_forwardDuring the week of August 21, Parley Manufacturing produced and shipped 4,000 units of its machine tools: 1,500 units of Tool SK1 and 2,500 units of Tool SK3. The cycle time for SK1 is 0.73 hour, and the cycle time for SK3 is 0.56 hour. The following costs were incurred: Required: 1. Assume that the value-stream costs and total units shipped apply only to one model (a single-product value stream). Calculate the unit cost, and comment on its accuracy. 2. Assume that Tool SK1 is responsible for 60% of the materials cost. Calculate the unit cost for Tool SK 1 and Tool SK3, and comment on its accuracy. Explain the rationale for using units shipped instead of units produced in the calculation. 3. Calculate the unit cost for the two models, using DBC. Explain when and why this cost is more accurate than the unit cost calculated in Requirement 2.arrow_forward

- Gunnison Company had the following equivalent units schedule and cost information for its Sewing Department for the month of December: Required: 1. Calculate the unit cost for December, using the FIFO method. 2. Calculate the cost of goods transferred out, calculate the cost of EWIP, and reconcile the costs assigned with the costs to account for. 3. What if you were asked for the unit cost from the month of November? Calculate Novembers unit cost and explain why this might be of interest to management.arrow_forwardMorrison Company had the equivalent units schedule and cost information for its Sewing Department for the month of December, as shown on the next page. Required: 1. Calculate the unit cost for December, using the weighted average method. 2. Calculate the cost of goods transferred out, calculate the cost of EWIP, and reconcile the costs assigned with the costs to account for. 3. What if you were asked to show that the weighted average unit cost for materials is the blend of the November unit materials cost and the December unit materials cost? The November unit materials cost is 6.60 (66,000/10,000), and the December unit materials cost is 12.22 (550,000/45,000). The equivalent units in BWIP are 10,000, and the FIFO equivalent units are 45,000. Calculate the weighted average unit materials cost using weights defined as the proportion of total units completed from each source (BWIP output and current output).arrow_forwardMethod of Least Squares, Predicting Cost for Different Time Periods from the One Used to Develop a Cost Formula Refer to the information for Farnsworth Company on the previous page. However, assume that Tracy has used the method of least squares on the receiving data and has gotten the following results: Required: 1. Using the results from the method of least squares, prepare a cost formula for the receiving activity. 2. Using the formula from Requirement 1, what is the predicted cost of receiving for a month in which 1,450 receiving orders are processed? (Note: Round your answer to the nearest dollar.) 3. Prepare a cost formula for the receiving activity for a quarter. Based on this formula, what is the predicted cost of receiving for a quarter in which 4,650 receiving orders are anticipated? Prepare a cost formula for the receiving activity for a year. Based on this formula, what is the predicted cost of receiving for a year in which 18,000 receiving orders are anticipated?arrow_forward

- Larsen, Inc., produces two types of electronic parts and has provided the following data: There are four activities: machining, setting up, testing, and purchasing. Required: 1. Calculate the activity consumption ratios for each product. 2. Calculate the consumption ratios for the plantwide rate (direct labor hours). When compared with the activity ratios, what can you say about the relative accuracy of a plantwide rate? Which product is undercosted? 3. What if the machine hours were used for the plantwide rate? Would this remove the cost distortion of a plantwide rate?arrow_forwardUsing the same data found in Exercise 6.22, assume the company uses the FIFO method. Required: Prepare a schedule of equivalent units, and compute the unit cost for the month of December. Fordman Company has a product that passes through two processes: Grinding and Polishing. During December, the Grinding Department transferred 20,000 units to the Polishing Department. The cost of the units transferred into the second department was 40,000. Direct materials are added uniformly in the second process. Units are measured the same way in both departments. The second department (Polishing) had the following physical flow schedule for December: Costs in beginning work in process for the Polishing Department were direct materials, 5,000; conversion costs, 6,000; and transferred in, 8,000. Costs added during the month: direct materials, 32,000; conversion costs, 50,000; and transferred in, 40,000.arrow_forwardThe following product costs are available for Kellee Company on the production of eyeglass frames: direct materials, $32,125; direct labor, $23.50; manufacturing overhead, applied at 225% of direct labor cost; selling expenses, $22,225; and administrative expenses, $31,125. The direct labor hours worked for the month are 3,200 hours. A. What are the prime costs? B. What are the conversion costs? C. What is the total product cost? D. What is the total period cost? E. If 6.425 equivalent units are produced, what is the equivalent material cost per unit? F. What is the equivalent conversion cost per unit?arrow_forward

- Silven Company has identified the following overhead activities, costs, and activity drivers for the coming year: Silven produces two models of cell phones with the following expected activity demands: 1. Determine the total overhead assigned to each product using the four activity drivers. 2. Determine the total overhead assigned to each model using the two most expensive activities. The costs of the two relatively inexpensive activities are allocated to the two expensive activities in proportion to their costs. 3. Using ABC as the benchmark, calculate the percentage error and comment on the accuracy of the reduced system. Explain why this approach may be desirable.arrow_forwardYoung Company is beginning operations and is considering three alternatives to allocate manufacturing overhead to individual units produced. Young can use a plantwide rate, departmental rates, or activity-based costing. Young will produce many types of products in its single plant, and not all products will be processed through all departments. In which one of the following independent situations would reported net income for the first year be the same regardless of which overhead allocation method had been selected? a. All production costs approach those costs that were budgeted. b. The sales mix does not vary from the mix that was budgeted. c. All manufacturing overhead is a fixed cost. d. All ending inventory balances are zero.arrow_forwardScattergraph, High-Low Method, and Predicting Cost for a Different Time Period from the One Used to Develop a Cost Formula Refer to the information for Farnsworth Company on the previous page. Required: 1. Prepare a scattergraph based on the 10 months of data. Does the relationship appear to be linear? 2. Using the high-low method, prepare a cost formula for the receiving activity. Using this formula, what is the predicted cost of receiving for a month in which 1,450 receiving orders are processed? 3. Prepare a cost formula for the receiving activity for a quarter. Based on this formula, what is the predicted cost of receiving for a quarter in which 4,650 receiving orders are anticipated? Prepare a cost formula for the receiving activity for a year. Based on this formula, what is the predicted cost of receiving for a year in which 18,000 receiving orders are anticipated? Use the following information for Problems 3-60 and 3-61: Farnsworth Company has gathered data on its overhead activities and associated costs for the past 10 months. Tracy Heppler, a member of the controllers department, has convinced management that overhead costs can be better estimated and controlled if the fixed and variable components of each overhead activity are known. One such activity is receiving raw materials (unloading incoming goods, counting goods, and inspecting goods), which she believes is driven by the number of receiving orders. Ten months of data have been gathered for the receiving activity and are as follows:arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage LearningPrinciples of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub

Managerial AccountingAccountingISBN:9781337912020Author:Carl Warren, Ph.d. Cma William B. TaylerPublisher:South-Western College Pub Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Financial And Managerial AccountingAccountingISBN:9781337902663Author:WARREN, Carl S.Publisher:Cengage Learning,

Managerial Accounting: The Cornerstone of Busines...

Accounting

ISBN:9781337115773

Author:Maryanne M. Mowen, Don R. Hansen, Dan L. Heitger

Publisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...

Accounting

ISBN:9781305970663

Author:Don R. Hansen, Maryanne M. Mowen

Publisher:Cengage Learning

Principles of Accounting Volume 2

Accounting

ISBN:9781947172609

Author:OpenStax

Publisher:OpenStax College

Excel Applications for Accounting Principles

Accounting

ISBN:9781111581565

Author:Gaylord N. Smith

Publisher:Cengage Learning

Managerial Accounting

Accounting

ISBN:9781337912020

Author:Carl Warren, Ph.d. Cma William B. Tayler

Publisher:South-Western College Pub

Financial And Managerial Accounting

Accounting

ISBN:9781337902663

Author:WARREN, Carl S.

Publisher:Cengage Learning,

Cost Accounting - Definition, Purpose, Types, How it Works?; Author: WallStreetMojo;https://www.youtube.com/watch?v=AwrwUf8vYEY;License: Standard YouTube License, CC-BY