Concept explainers

Healthway uses a process-costing system to compute the unit costs of the minerals that it produces. It has three departments: Mixing, Tableting, and Bottling. In Mixing, at the beginning of the process all materials are added and the ingredients for the minerals are measured, sifted, and blended together. The mix is transferred out in gallon containers. The Tableting Department takes the powdered mix and places it in capsules. One gallon of powdered mix converts to 1,600 capsules. After the capsules are filled and polished, they are transferred to Bottling where they are placed in bottles, which are then affixed with a safety seal and a lid and labeled. Each bottle receives 50 capsules.

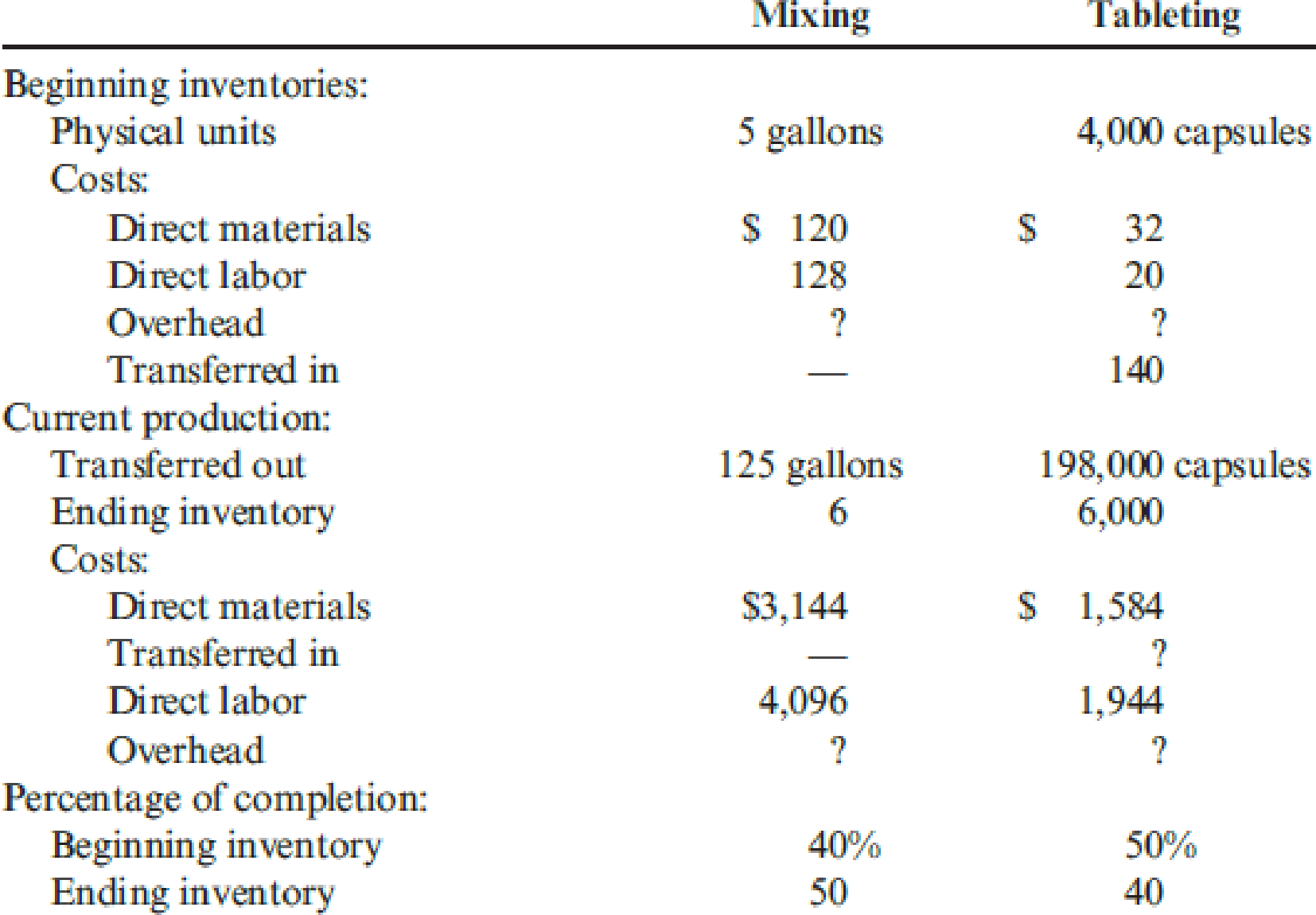

During July, the following results are available for the first two departments (direct materials are added at the beginning in both departments):

Overhead in both departments is applied as a percentage of direct labor costs. In the Mixing Department, overhead is 200 percent of direct labor. In the Tableting Department, the overhead rate is 150 percent of direct labor.

Required:

- 1. Prepare a production report for the Mixing Department using the weighted average method. Follow the five steps outlined in the chapter. Round unit cost to three decimal places.

- 2. Prepare a production report for the Tableting Department. Materials are added at the beginning of the process. Follow the five steps outlined in the chapter. Round unit cost to four decimal places.

Trending nowThis is a popular solution!

Chapter 6 Solutions

Bundle: Cornerstones of Cost Management, Loose-Leaf Version, 4th + CengageNOWv2, 1 term Printed Access Card

- Compute the total cost of the warehouse on these financial accounting questionarrow_forwardDirect Labor Variance Karina will make 5,000 jackets with standard quantity of leather per jacket of 120.03 square inches of material @ $0.25/square inch. The actual quantity of leather per jacket for those 5,000 jackets produced was 122.53 square inches of material @ $0.24/square inch. The standard labor to produce each jacket is one hour for each jacket with a cost of $16.50/hour. The actual labor used to produce each jacket was 1.06 hours at $16/hour. Actual Hours (AH) Actual Rate (AR) Actual Cost (AH * AR) Total Direct = Labor Variance Actual Cost Actual Hours @ Actual Rate Labor Rate Variance Actual Hours @Standard Rate Actual Hours (AH) Standard Rate (SP) Actual Hours @ Standard Rate (AH * SP) Labor Efficiency Variance Standard Cost Standard Hours @ Standard Rate Standard Hours (SQ) Standard Rate (SP) Standard Cost (SQ * SP)arrow_forwardHow much is the firm's ending equity on these financial accounting question?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning

Managerial Accounting: The Cornerstone of Busines...AccountingISBN:9781337115773Author:Maryanne M. Mowen, Don R. Hansen, Dan L. HeitgerPublisher:Cengage Learning