EBK ENGINEERING ECONOMY

16th Edition

ISBN: 9780133819014

Author: Koelling

Publisher: YUZU

expand_more

expand_more

format_list_bulleted

Textbook Question

Chapter 6, Problem 34P

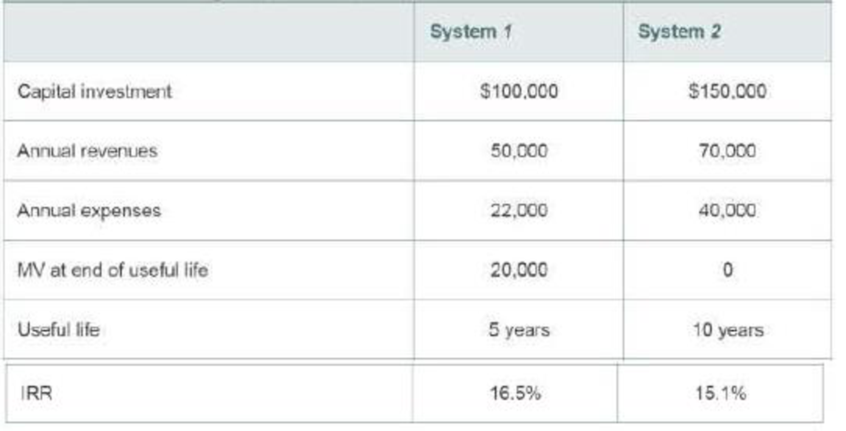

Potable water is in short supply in many countries. To address this need, two mutually exclusive water purification systems are being considered for implementation in China. Doing nothing is not an option. Refer to the data below and state your key assumptions in working this problem. (6.5)

- a. Use the PW method to determine which system should be selected when MARR = 8% per year.

- b. Which system should be selected when MARR = 15% per year?

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

The figure below shows the hypothetical domestic supply and demand for baseball caps in the country of Spain.

Domestic Supply and Demand for Baseball Caps

Price (€ per cap)

10

9

8

7

6

5

4

3

2

1

0

Spain

Dd

10 20 30 40 50 60 70 80 90 100

Baseball caps (thousands per month)

Suppose that the world price of baseball caps is €2 and there are no import restrictions on this product. Assume that Spanish

consumers are indifferent between domestic and imported baseball caps.

Instructions: Enter your answers as whole numbers.

a. What quantity of baseball caps will domestic suppliers supply to domestic consumers?

thousand

b. What quantity of baseball caps will be imported?

thousand

Now suppose a tariff of €1 is levied against each imported baseball cap.

c. After the tariff is implemented, what quantity of baseball caps will domestic suppliers supply to domestic consumers?

thousand

d. After the tariff is implemented, what quantity of baseball caps will be imported?

thousand

May I please have the solutions for the following assignment? as 2025

Response to J.C.

Ethics Statement

Raising our products' global profile requires a firm commitment to doing the right thing by society and the environment. By switching to a more energy-efficient cloud architecture, BillRight Software, Inc. will reduce its carbon footprint while also ensuring the absolute security of all customer data. Fair labor standards, a diverse and inclusive workforce, and giving back to the communities where our employees live and work are some of our core values. Following local regulations, accepting cultural variances, and actively participating in community development projects are all ways our brand and product will uphold our ethical values globally (Corcoran, 2024; Kotler et al., 2023; Kotler & Keller, 2024; Solomon & Russell, 2024).

How MKTG 525 Gets You Together with Classmates?

Different points of view in dealing with classmates from many backgrounds exposes you to many points of view, ideas, and techniques. This variety enriches the learning…

Chapter 6 Solutions

EBK ENGINEERING ECONOMY

Ch. 6 - Prob. 1PCh. 6 - The Consolidated Oil Company must install...Ch. 6 - Prob. 3PCh. 6 - Three mutually exclusive design alternatives are...Ch. 6 - Prob. 5PCh. 6 - Prob. 6PCh. 6 - Fiesta Foundry is considering a new furnace that...Ch. 6 - Prob. 8PCh. 6 - Prob. 9PCh. 6 - Consider the following cash flows for two mutually...

Ch. 6 - Prob. 11PCh. 6 - Prob. 12PCh. 6 - The alternatives for an engineering project to...Ch. 6 - Prob. 14PCh. 6 - Prob. 15PCh. 6 - Prob. 16PCh. 6 - Refer to the situation in Problem 6-16. Most...Ch. 6 - Prob. 18PCh. 6 - Prob. 19PCh. 6 - Prob. 20PCh. 6 - Prob. 21PCh. 6 - Prob. 22PCh. 6 - Prob. 23PCh. 6 - Prob. 24PCh. 6 - Prob. 25PCh. 6 - In the Rawhide Company (a leather products...Ch. 6 - Refer to Problem 6-2. Solve this problem using the...Ch. 6 - Prob. 28PCh. 6 - Prob. 29PCh. 6 - Prob. 30PCh. 6 - Prob. 31PCh. 6 - Prob. 32PCh. 6 - Prob. 33PCh. 6 - Potable water is in short supply in many...Ch. 6 - Prob. 35PCh. 6 - Prob. 36PCh. 6 - In the design of a special-use structure, two...Ch. 6 - Prob. 38PCh. 6 - a. Compare the probable part cost from Machine A...Ch. 6 - Prob. 40PCh. 6 - Two mutually exclusive alternatives are being...Ch. 6 - Prob. 42PCh. 6 - IBM is considering an environmentally conscious...Ch. 6 - Three mutually exclusive earth-moving pieces of...Ch. 6 - A piece of production equipment is to be replaced...Ch. 6 - Prob. 46PCh. 6 - Prob. 47PCh. 6 - Prob. 48PCh. 6 - Prob. 49PCh. 6 - Prob. 50PCh. 6 - Prob. 51PCh. 6 - Prob. 52PCh. 6 - Prob. 53PCh. 6 - Prob. 54PCh. 6 - Prob. 55PCh. 6 - Prob. 56PCh. 6 - Prob. 57PCh. 6 - Prob. 58PCh. 6 - Prob. 59PCh. 6 - Prob. 60PCh. 6 - Prob. 61PCh. 6 - Prob. 62PCh. 6 - Prob. 63PCh. 6 - Prob. 64PCh. 6 - Prob. 65PCh. 6 - Prob. 66PCh. 6 - Three models of baseball bats will be manufactured...Ch. 6 - Refer to Example 6-3. Re-evaluate the recommended...Ch. 6 - Prob. 69SECh. 6 - Prob. 70SECh. 6 - Prob. 71SECh. 6 - Prob. 72CSCh. 6 - Prob. 73CSCh. 6 - Prob. 74CSCh. 6 - Prob. 75FECh. 6 - Prob. 76FECh. 6 - Prob. 77FECh. 6 - Complete the following analysis of cost...Ch. 6 - Prob. 79FECh. 6 - For the following table, assume a MARR of 10% per...Ch. 6 - Prob. 81FECh. 6 - Problems 6-82 through 6-85. (6.4) Table P6-82 Data...Ch. 6 - Prob. 83FECh. 6 - Problems 6-82 through 6-85. (6.4) Table P6-82 Data...Ch. 6 - Problems 6-82 through 6-85. (6.4) Table P6-82 Data...Ch. 6 - Consider the mutually exclusive alternatives given...Ch. 6 - Prob. 87FE

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, economics and related others by exploring similar questions and additional content below.Similar questions

- 3. Case 2) Coal plants exit, and Solar generation enters the market Now, let's consider a scenario where the coal power plant (#1) shuts down and exits the market, and a solar generation facility is constructed. The capacity of the solar generation facility is the same as the coal power plant that went out of business. The generation capacities of this market are shown below, along with their MC. Table 3: Power Plant Capacity and Marginal Cost: Case 2 Plant # Energy Source Capacity (MW) MC (S/MWh) 2 Oil 100 90 3 Natural Gas 500 50 4 Nuclear 600 0 5 Solar 300 5 Note that the solar plant (#5) can generate electricity only from 7 AM until 5PM. During these hours, the plant can generate up to its full capacity (300 MW) but cannot generate any when unavailable. (a) Draw a supply curve for each hourly market (4AM, 10 AM, 2PM, 6PM). (b) Find the market clearing prices and calculate how much electricity each power plant generates in the hourly market (4AM, 10AM, 2PM, and 6PM). (c) Find the…arrow_forwardRespond to L.R. To analyze consumer spending, you must review the macroeconomic indicators of Personal Consumption Expenditures (PCE) and Retail Sales over the past year. Selected Macroeconomic indicators Personal Consumption Expenditures (PCE) measure the value of household goods and services consumed and are a key indicator of consumer spending. - Retail Sales: This tracks the total receipts of retail stores and provides insight into consumer demand and spending trends. - Patterns over the past year: Personal Consumption Expenditures (PCE) Over the past year, PCE has steadily increased, reflecting consumer confidence and willingness to spend. The growth rate has been moderate, driven by wage growth, low unemployment rates, and government stimulus measures. However, inflationary pressures have also impacted real purchasing power, leading to a mixed outlook. - Retail sales have also experienced fluctuations but have generally trended upwards. After a…arrow_forward4. Case 3) Electricity demand increases due to increased EV adoption We will continue using the Case 2 supply curve (with the solar plant in operation) for this analysis. Suppose that electricity consumption from electric vehicles (EV) increases significantly. Consequently, electricity demand in the wholesale market increases at every hour. The new demand levels are shown in Table 5 below. The market operator has backup power plants (using natural gas) ready, with a total capacity of 300 MW and a MC of $100/MWh. Table 5: Hourly Demand (selected hours) Hour Demand (MWh) 4 AM 800 10 AM 1000 ... 2 PM 1100 ... 6 PM 1300 (a) Find the market clearing prices and calculate how much electricity each power plant generates in the hourly market (4AM, 10AM, 2PM, and 6PM). Is there a specific hourly market in which the market operator will need to dispatch backup generation? (b) Compare the Case 2 scenario with the Case 3 scenario in terms of CO2 emissions and average electricity price. Based on…arrow_forward

- 2. Case 1) NG price decreases Now, suppose that the price of natural gas decreased substantially, causing the marginal cost of the NG power plant to decrease to MC = $35/MWh. The demand is the same as in Case 0. (a) Draw a new supply curve that reflects the MC change of the NG power plant. (b) Find the market clearing prices and calculate how much electricity each power plant generates in the hourly market (4AM, 10AM, 2PM, and 6PM). (c) What happened to the coal power plant? (d) Do you think the market outcomes (like average price) and the total CO2 emissions have improved under this Case 1 scenario (use the emissions data provided in the lecture slides)?arrow_forward1. Case 0) Baseline case Table 1: Power Plant Capacity and Marginal Cost: Case 0 Plant # Energy Source Capacity (MW) MC (S/MWh) 1 Coal 300 45 2 Oil 100 90 3 4 Natural Gas Nuclear 500 50 600 0 (a) Calculate the capacity mix of this market by energy source. (b) Draw a supply curve of this wholesale generation market. Table 2 below shows the demand levels for selected hours of a representative day. We will consider only these four hourly markets for our analysis. Note that the 6 PM demand is the highest demand level of the day. Table 2: Hourly Demand (selected hours) Hour Demand (MWh) 4 AM 500 10 AM 700 2 PM 800 6 PM 1000 (c) Find the market clearing prices and calculate how much electricity each power plant generates in the hourly market (4AM, 10AM, 2PM, and 6PM). (d) Find the average price of electricity (by taking a simple average of hourly prices; [P(4am) + P(10AM) + P(2PM) + P(6PM)]/4).arrow_forwardDon't used Ai solutionarrow_forward

- How human recource allocated in an economic?arrow_forwardRespond to B.A. I have chosen Gross Domestic Product (GDP) as the macroeconomic indicator to review and provide a forecast prediction. Based on the current trend I predict a 2% annual GDP growth rate, indicating an unstable economy due to the impact of Donald Trump's tariffs on some countries and other other economic factors. This growth rate is lower than the historical average , indicating a slowdown in economic expansion. Overall, the forecast suggests a modest growth in GDP, but with potential risks and uncertainties ahead. But if he reverse his tariff policies, I think it could possibly result in a strong economic growth. As the removal of tariffs would likely minimize the costs for businesses and consumers and also rise trade and economic activities. Provide feedback/comments this post. You could agreement or disagreement (including why you agree or disagree). Or you could expand on this post by sharing different views and predictions.arrow_forwardCan you show me how to solve this.arrow_forward

- ECON 2106: Microeconomics I Fall - 2023 Algoma University Homework # 2 (Due: October 19, 2023) 1. The market demand for cashmere socks is given by Q = 1,000 + 0.5I – 400P + 200P’ Where, Q = Annual demand in number of pairs I = Average income I dollars per year P = Price of one pair of cashmere shocks P’ = Price of one pair of wool shocks Given that I = ECON 2106: Microeconomics I Fall - 2023 Algoma University Homework # 2 (Due: October 19, 2023) 1. The market demand for cashmere socks is given by Q = 1,000 + 0.5I – 400P + 200P’ Where, Q = Annual demand in number of pairs I = Average income I dollars per year P = Price of one pair of cashmere shocks P’ = Price of one pair of wool shocks Given that I = $20,000, P = $10, and P’ = $5, determine ƐQP, ƐQI, and ƐQP’.arrow_forwardWhat bill are they currently sponsoring? Please provide the answer to the question using www.akleg.gov for Senate Bill 30?arrow_forwardDo they have any specified areas of interest( examples: oil/gas, education, subsistence). Please provide the answer to the question using www.akleg.gov for Senate Bill 30?arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...EconomicsISBN:9781305506381Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. HarrisPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: A Problem Solving ApproachEconomicsISBN:9781337106665Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike ShorPublisher:Cengage Learning

Managerial Economics: Applications, Strategies an...

Economics

ISBN:9781305506381

Author:James R. McGuigan, R. Charles Moyer, Frederick H.deB. Harris

Publisher:Cengage Learning

Managerial Economics: A Problem Solving Approach

Economics

ISBN:9781337106665

Author:Luke M. Froeb, Brian T. McCann, Michael R. Ward, Mike Shor

Publisher:Cengage Learning

Valuation Analysis in Project Finance Models - DCF & IRR; Author: Financial modeling;https://www.youtube.com/watch?v=xDlQPJaFtCw;License: Standard Youtube License