GOODWEEK TIRES, INC.

After extensive research and development, Goodweek Tires, Inc., has recently developed a new tire, the SuperTread, and must decide whether to make the investment necessary to produce and market it. The tire would be ideal for drivers doing a large amount of wet weather and off-road driving in addition to normal freeway usage. The research and development costs so far have totaled about $10 million. The SuperTread would be put on the market beginning this year, and Goodweek expects it to stay on the market for a total of four years. Test marketing costing $5 million has shown that there is a significant market for a SuperTread-type Lire.

As a financial analyst at Good week Tires, you have been asked by your CFO, Adam Smith, to evaluate the SuperTread project and provide a recommendation on whether to go ahead with the investment. Except for the initial investment that will occur immediately, assume all cash flows will occur at year-end.

Goodweek must initially invest $160 million in production equipment to make the SuperTread. This equipment can be sold for $65 million at the end of four years. Goodweek intends to sell the SuperTread to two distinct markets:

1. The original equipment manufacturer (OEM) market: The OEM market consists primarily of the large automobile companies (like General Motors) that buy tires for new ears. In the OEM market, the SuperTrcad is expected to sell for $41 per tire. The variable cost to produce each tire is $29.

2. The replacement market: The replacement market consists of all tires purchased after the automobile has left the factory. This market allows higher margins; Goodweek expects to sell the SuperTread for $62 per tire there. Variable costs are the same as in the OEM market.

Goodweek Tires intends to raise prices at 1 percent above the inflation rate; variable costs will also increase at 1 percent above the inflation rate. In addition, the SuperTread project will incur $43 million in marketing and general administration costs the first year. This cost is expected to increase at the inflation rate in the subsequent years.

Goodweek’s corporate tax rate is 40 percent. Annual inflation is expected to remain constant at 3.25 percent. The company uses a 13.4 percent discount rate to evaluate new product decisions. Automotive industry analysts expect automobile manufacturers to produce 6.2 million new cars this year and production to grow at 2.5 percent per year thereafter. Each new car needs four tires (the spare tires are undersized and are in a different category). Good week Tires expects the SuperTread to capture 11 percent of the OEM market.

Industry analysts estimate that the replacement tire market size will be 32 million tires this year and that it will grow at 2 percent annually. Goodweek expects the SuperTread to capture an 8 percent market share.

The appropriate

To determine: NPV, payback period, discounted payback period, IRR and PI of the project.

Internal Rate of Return (IRR)

The internal rate of return is the discounting rate of capital budgeting in which the NPV of the cash flow of the project comes equally to zero.

Capital Budgeting:

The decision-related to the investment for long run is called capital budgeting. Capital budgeting includes the investment in the heavy machinery and information technology.

Net Present Value (NPV):

The net present value is a differential amount of the net cash inflow from future investments and net cash outflow in the form of cost that the company has to pay at present as initial cost of the investment.

Explanation of Solution

Solution:

Given,

Cost of the project is $160,000,000.

Working capital investment requirement is $9,000,000.

Selling price of per tire is $41.

Market captured by the company is 11%.

Expected car sold is 6,200,000.

Requirement of tires for each car is 4.

Market grow rate is 2.5%.

Annual sale in replacement market is 32,000,000 tires.

Company capture in replacement market is 8%.

Market grow rate in replacement market is 2%.

Variable cost is $29.

Tax rate is 40%.

Discount rate is 13.4%.

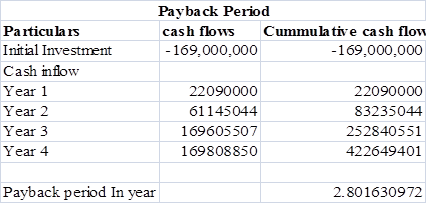

Calculation of the payback period,

Table (1)

Formula to calculate the profitability index of project:

Substitute, $211,363,957 for the present cash flow and $169,000,000 for the Initial investment,

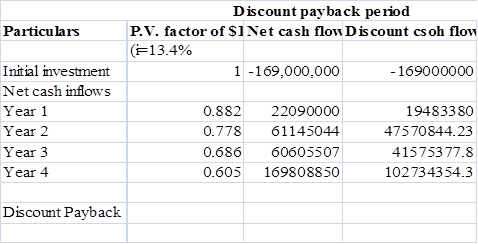

Calculate the discount payback period of the project,

Table (2)

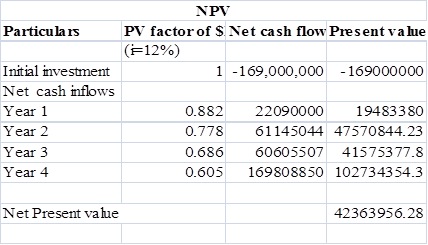

Calculate the net present value of the project,

Table (3)

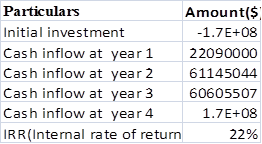

Calculate the Internal rate of return,

Table (4)

Working notes:

Calculate the nominal growth rate:

Calculate the number of cars sold in automobile market in 2nd year,

Calculate the number of cars sold in automobile market in 3rd year:

Calculate the number of cars sold in automobile market in 4th year:

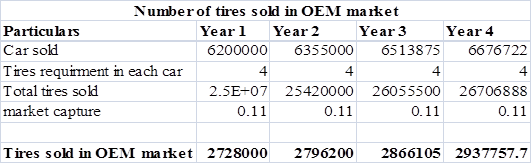

Calculate the tires sold by the company in OEM market,

Table (5)

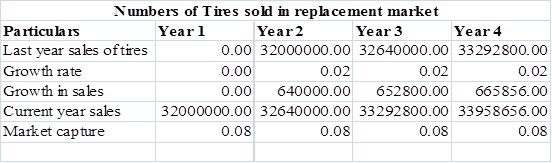

Calculate the number of the tires sold in replacement market,

Table (6)

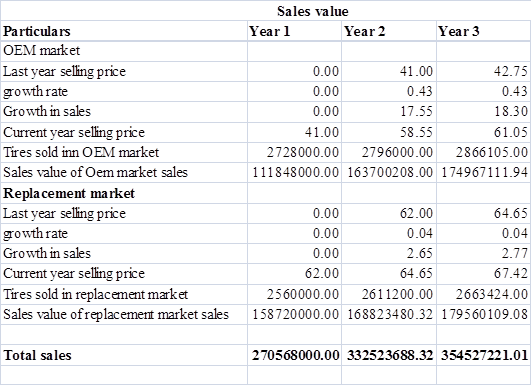

Calculate the total sales value of tires in both the market,

Table (7)

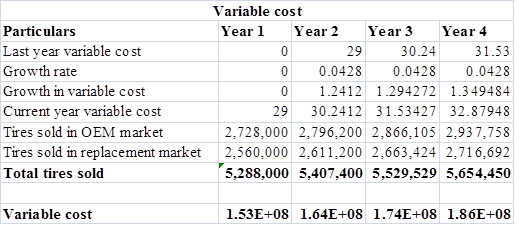

Calculate the variable cost of tire

Table (8)

Calculate the depreciation for the 1st year by using the depreciation table:

Calculate the depreciation for the 2nd year by using the depreciation table:

Calculate the depreciation for the 3rd year by using the depreciation table:

Calculate the depreciation for the 4th year by using the depreciation table:

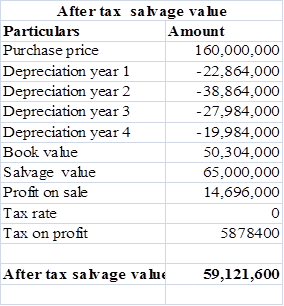

Calculate the value of the salvage value after tax,

Table (9)

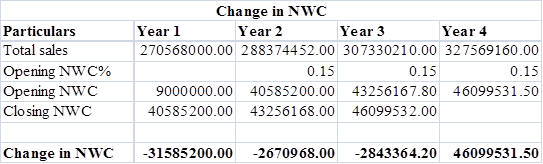

Calculate the change in the working capital,

Table (10)

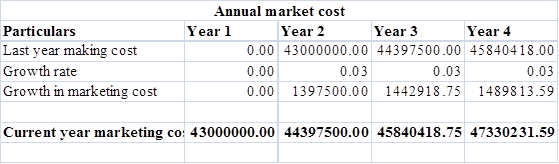

Calculate the annual market cost,

Table (11)

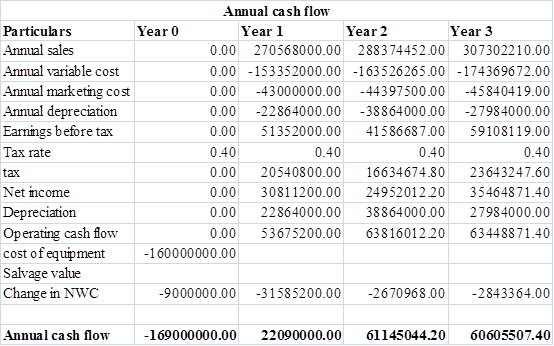

Calculate the annual cash flow,

Table (12)

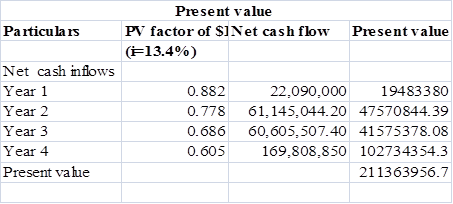

Calculate the present value of the cash flow

Table (13)

Hence, the NPV is positive and Profitability index is more than 1. So the project should be accepted.

Want to see more full solutions like this?

Chapter 6 Solutions

UPENN: LOOSE LEAF CORP.FIN W/CONNECT

- Explain why financial institutions generally engage in foreign exchange tradingactivities. Provide specific purposes or motivations behind such activities.arrow_forwardA. In 2008, during the global financial crisis, Lehman Brothers, one of the largest investment banks, collapsed and defaulted on its corporate bonds, causing significant losses for bondholders. This event highlighted several risks that investors in corporate bonds might face. What are the key risks an investor would encounter when investing in corporate bonds? Explain these risks with examples or academic references. [15 Marks]arrow_forwardTwo companies, Blue Plc and Yellow Plc, have bonds yielding 4% and 5.3%respectively. Blue Plc has a credit rating of AA, while Yellow Plc holds a BB rating. If youwere a risk-averse investor, which bond would you choose? Explain your reasoning withacademic references.arrow_forward

- B. Using the probabilities and returns listed below, calculate the expected return and standard deviation for Sparrow Plc and Hawk Plc, then justify which company a risk- averse investor might choose. Firm Sparrow Plc Hawk Plc Outcome Probability Return 1 50% 8% 2 50% 22% 1 30% 15% 2 70% 20%arrow_forward(2) Why are long-term bonds more susceptible to interest rate risk than short-term bonds? Provide examples to explain. [10 Marks]arrow_forwardDon't used Ai solutionarrow_forward

- Don't used Ai solutionarrow_forwardScenario one: Under what circumstances would it be appropriate for a firm to use different cost of capital for its different operating divisions? If the overall firm WACC was used as the hurdle rate for all divisions, would the riskier division or the more conservative divisions tend to get most of the investment projects? Why? If you were to try to estimate the appropriate cost of capital for different divisions, what problems might you encounter? What are two techniques you could use to develop a rough estimate for each division’s cost of capital?arrow_forwardScenario three: If a portfolio has a positive investment in every asset, can the expected return on a portfolio be greater than that of every asset in the portfolio? Can it be less than that of every asset in the portfolio? If you answer yes to one of both of these questions, explain and give an example for your answer(s). Please Provide a Referencearrow_forward

- Hello expert Give the answer please general accountingarrow_forwardScenario 2: The homepage for Coca-Cola Company can be found at coca-cola.com Links to an external site.. Locate the most recent annual report, which contains a balance sheet for the company. What is the book value of equity for Coca-Cola? The market value of a company is (# of shares of stock outstanding multiplied by the price per share). This information can be found at www.finance.yahoo.com Links to an external site., using the ticker symbol for Coca-Cola (KO). What is the market value of equity? Which number is more relevant to shareholders – the book value of equity or the market value of equity?arrow_forwardFILE HOME INSERT Calibri Paste Clipboard BIU Font A1 1 2 34 сл 5 6 Calculating interest rates - Excel PAGE LAYOUT FORMULAS DATA 11 Α΄ Α΄ % × fx A B C 4 17 REVIEW VIEW Alignment Number Conditional Format as Cell Cells Formatting Table Styles▾ Styles D E F G H Solve for the unknown interest rate in each of the following: Complete the following analysis. Do not hard code values in your calculations. All answers should be positive. 7 8 Present value Years Interest rate 9 10 11 SA SASA A $ 181 4 $ 335 18 $ 48,000 19 $ 40,353 25 12 13 14 15 16 $ SA SA SA A $ Future value 297 1,080 $ 185,382 $ 531,618arrow_forward

- Principles of Accounting Volume 2AccountingISBN:9781947172609Author:OpenStaxPublisher:OpenStax College

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT

EBK CONTEMPORARY FINANCIAL MANAGEMENTFinanceISBN:9781337514835Author:MOYERPublisher:CENGAGE LEARNING - CONSIGNMENT