Concept explainers

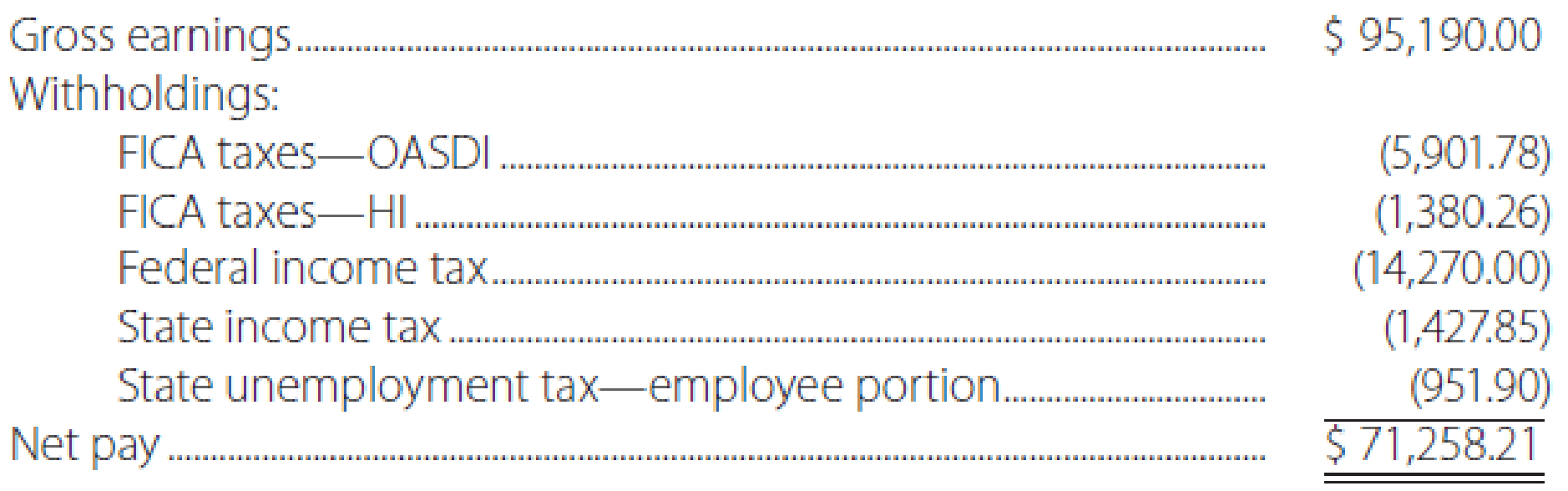

The totals from the payroll register of Olt Company for the week of January 25 show:

Journalize the payroll entry for Company O.

Explanation of Solution

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Federal Insurance Contributions Act (FICA) tax: Federal government imposes taxes on the employees’ pay to provide benefits to retired, old age, orphans, and disabled. This tax is also referred to as Social Security tax because the program is devised to benefit the society. FICA tax includes two components, OASDI (Old age, survivors, and disability insurance), and HI (health insurance). 6.2 % is levied as OASDI component, and 1.45% as HI component. So, the total of FICA tax rate is 7.65%

State unemployment compensation tax (SUTA): This is the compensation provided to the unemployed people by the state government from the taxes collected from the employers, as a percentage based on the state contribution rate on employees’ payrolls.

Journalize the weekly payroll entry for Company O.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Salaries Expense | 95,190.00 | |||||

| FICA Taxes Payable–OASDI | 5,901.78 | |||||

| FICA Taxes Payable–HI | 1,380.26 | |||||

| Employee Federal Income Tax Payable | 14,270.00 | |||||

| Employee State Income Tax Payable | 1,427.85 | |||||

| SUTA Taxes Payable | 951.90 | |||||

| Cash | 71,258.21 | |||||

| (Record payment of weekly pay) | ||||||

Table (1)

Description:

- Salaries Expense is an expense account. Since expenses and losses decrease equity, equity value is decreased, and a decrease in equity is debited.

- FICA Taxes Payable–OASDI is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

- FICA Taxes Payable–HI is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

- Employee Federal Income Tax Payable is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

- Employee State Income Tax Payable is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

- SUTA Taxes Payable is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

- Cash is an asset account. The amount is decreased because cash is paid, and a decrease in asset is credited.

Want to see more full solutions like this?

Chapter 6 Solutions

PAYROLL ACCT.,2019 ED.(LL)-TEXT

- P4.1A Record transactions on accrual basis; convert revenue to cash receipts The following selected data are taken from the comparative financial statements of Yankee Curling Club. The club prepares its financial statements using the accrual basis of accounting. September 30 2022 2021 Accounts receivable for member dues $ 15,000 $ 19,000 Unearned sales revenue 20,000 23,000 Service revenue (from member dues) 151,000 135,000 Dues are billed to members based upon their use of the club's facilities. Unearned sales revenues arise from the sale of tickets to events, such as the Skins Game. Instructions (Hint: You will find it helpful to use T-accounts to analyze the following data. You must analyze these data sequentially, as missing information must first be deduced before moving on. Post your journal entries as you progress,…arrow_forwardFlare Enterprises sells a product in a competitive marketplace. Market analysis indicates that its product would probably sell at $60 per unit. Flare management desires a 15% profit margin on sales. Their current full cost for the product is $52 per unit. In order to meet the new target cost, how much will the company have to cut costs per unit, if any? a. $3 b. $4 c. $5 d. $1 provide answer to this financial accounting questionarrow_forwardWhat is the smartphone divisions capital turnover?arrow_forward

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning

Excel Applications for Accounting PrinciplesAccountingISBN:9781111581565Author:Gaylord N. SmithPublisher:Cengage Learning College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning