Concept explainers

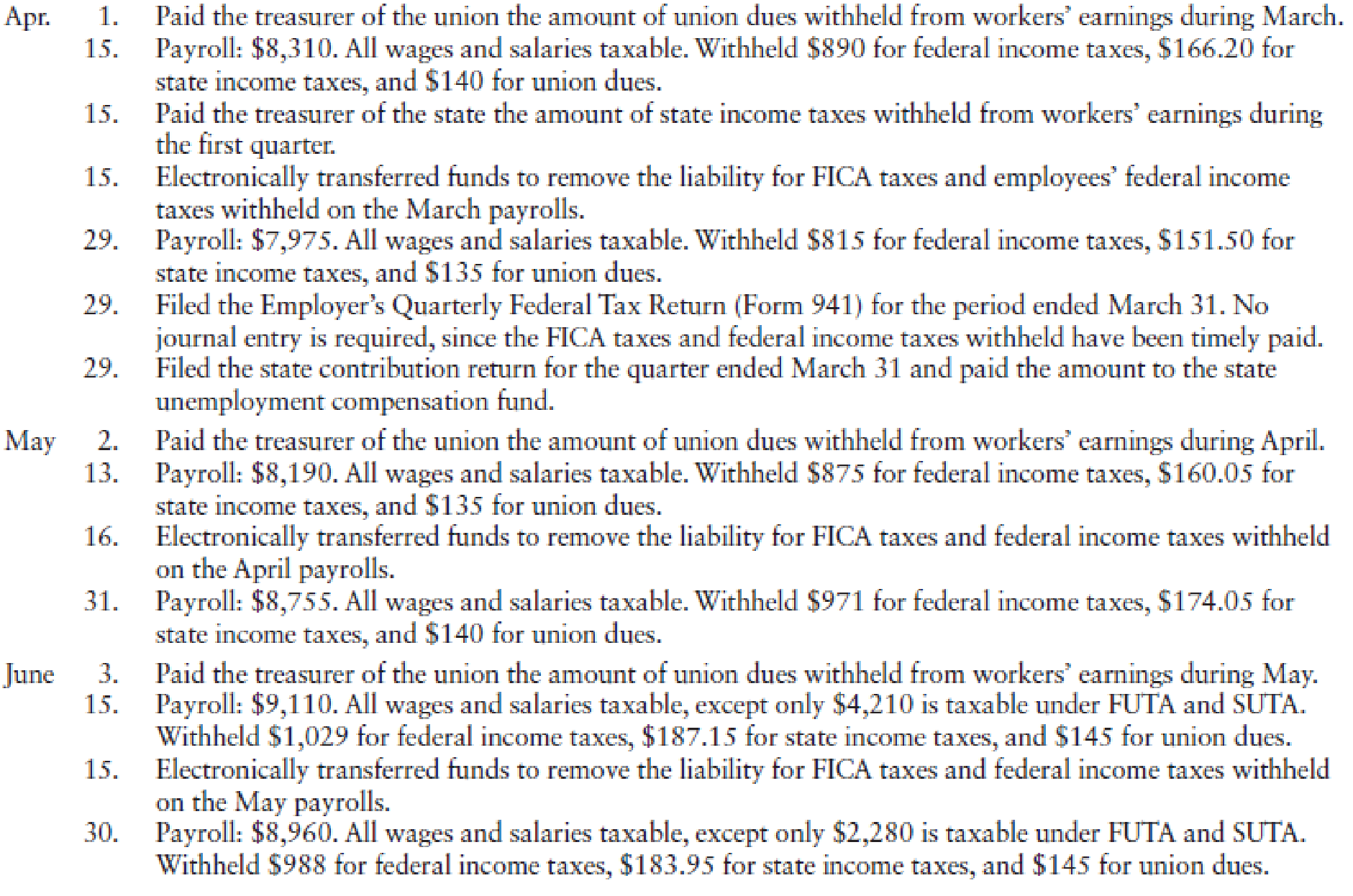

In the Illustrative Case in this chapter, payroll transactions for Brookins Company were analyzed, journalized, and posted for the third quarter of the fiscal year. In this problem, you are to record the payroll transactions for the last quarter of the firm’s fiscal year. The last quarter begins on April 1, 20--.

Refer to the Illustrative Case on pages 6-27 to 6-33 and proceed as follows:

- a. Analyze and journalize the transactions described in the following narrative. Use the two-column journal paper provided on pages 6-73 to 6-77. Omit the writing of explanations in the

journal entries . - b.

Post the journal entries to the general ledger accounts on pages 6-78 to 6-83.

Narrative of Transactions:

- c. Answer the following questions:

- 1. The total amount of the liability for FICA taxes and federal income taxes withheld as of June 30 is................................................................................ $ ________

- 2. The total amount of the liability for state income taxes withheld as of June 30 is................................................................................................................ $ ________

- 3. The amount of FUTA taxes that must be paid to the federal government on or before August 1 (assume July 31 is a Sunday) is........................................ $ ________

- 4. The amount of contributions that must be paid into the state

unemployment compensation fund on or before August 1 is.................................................. $ ________ - 5. The total amount due the treasurer of the union is........................................ $ ________

- 6. The total amount of wages and salaries expense since the beginning of the fiscal year is ................................................................................................... $ ________

- 7. The total amount of payroll taxes expense since the beginning of the fiscal year is ............................................................................................................ $ ________

- 8. Using the partial journal below, journalize the entry to record the vacation accrual at the end of the company’s fiscal year. The amount of Brookins Company’s vacation accrual for the fiscal year is $15,000.

a.

Journalize the given transactions in the books of Company B.

Explanation of Solution

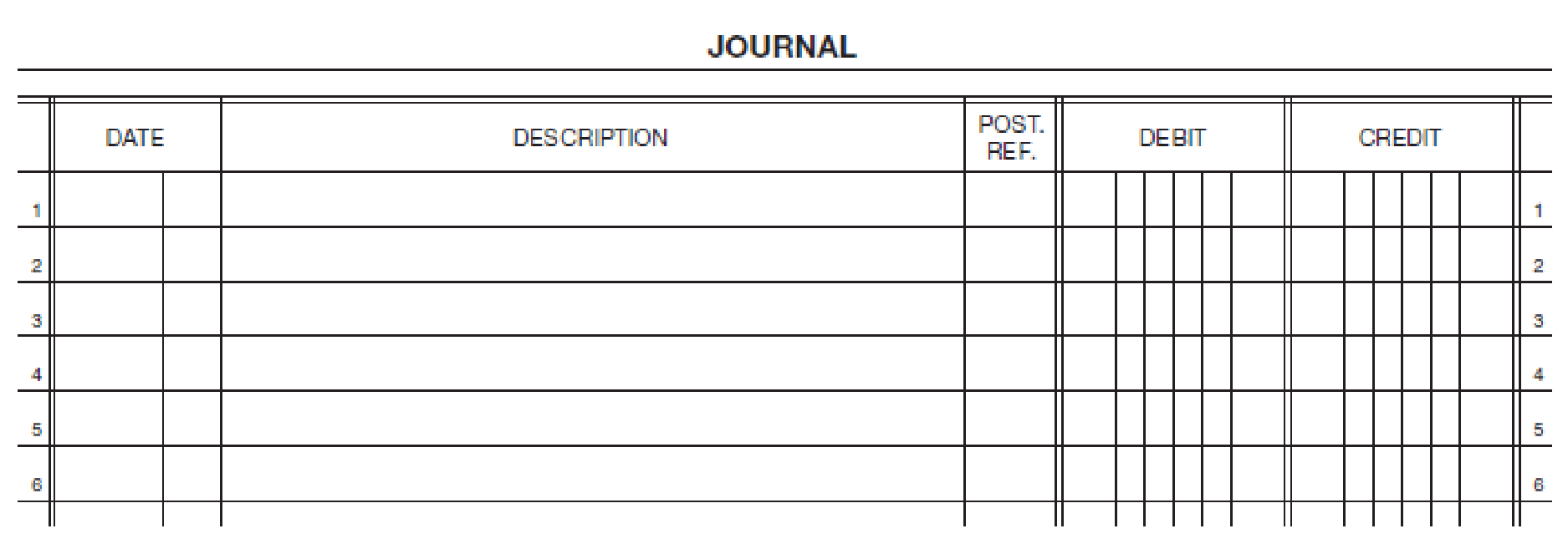

Journal entry: Journal entry is a set of economic events which can be measured in monetary terms. These are recorded chronologically and systematically.

Debit and credit rules:

- Debit an increase in asset account, increase in expense account, decrease in liability account, and decrease in stockholders’ equity accounts.

- Credit decrease in asset account, increase in revenue account, increase in liability account, and increase in stockholders’ equity accounts.

Journalize the given transactions in the books of Company B.

| Page: 19 | ||||||

| Date | Account Titles and Explanations | Post. Ref. | Debit ($) | Credit ($) | ||

| April | 1 | Union Dues Payable | 28 | 100 | ||

| Cash | 11 | 100 | ||||

| (Record cash paid for the union dues) | ||||||

| 15 | Wages and Salaries | 51 | 8,310.00 | |||

| FICA Taxes Payable-OASDI | 20 | 515.22 | ||||

| FICA taxes Payable-HI | 21 | 120.50 | ||||

| Employees FIT Payable | 25 | 890.00 | ||||

| Employees SIT Payable | 26 | 166.20 | ||||

| Union Dues Payable | 28 | 140.00 | ||||

| Cash | 11 | 6,478.08 | ||||

| (Record payment of wages and salaries and the employees’ withheld taxes) | ||||||

| 15 | Payroll Taxes | 55 | 876.71 | |||

| FICA Taxes Payable-OASDI | 20 | 515.22 | ||||

| FICA taxes Payable-HI | 21 | 120.50 | ||||

| FUTA Taxes Payable | 22 | 49.86 | ||||

| SUTA Taxes Payable | 23 | 191.13 | ||||

| (Record payroll taxes and the employer’s withheld taxes) | ||||||

| 15 | Employees SIT Payable | 26 | 546.92 | |||

| Cash | 11 | 546.92 | ||||

| (Record payment of state unemployment taxes) | ||||||

| 15 | FICA Taxes Payable-OASDI | 20 | 1,068.88 | |||

| FICA taxes Payable-HI | 21 | 249.98 | ||||

| Employees FIT Payable | 25 | 1,124.00 | ||||

| Cash | 11 | 2,442.86 | ||||

| (Record payment of taxes withheld on March payrolls) | ||||||

| 29 | Wages and Salaries | 51 | 7,975.00 | |||

| FICA Taxes Payable-OASDI | 20 | 494.45 | ||||

| FICA taxes Payable-HI | 21 | 115.64 | ||||

| Employees FIT Payable | 25 | 815.00 | ||||

| Employees SIT Payable | 26 | 151.50 | ||||

| Union Dues Payable | 28 | 135.00 | ||||

| Cash | 11 | 6,263.41 | ||||

| (Record payment of wages and salaries and the employees’ withheld taxes) | ||||||

| 29 | Payroll Taxes | 55 | 841.37 | |||

| FICA Taxes Payable-OASDI | 20 | 494.45 | ||||

| FICA taxes Payable-HI | 21 | 115.64 | ||||

| FUTA Taxes Payable | 22 | 47.85 | ||||

| SUTA Taxes Payable | 23 | 183.43 | ||||

| (Record payroll taxes and the employer’s withheld taxes) | ||||||

| 29 | SUTA Taxes Payable | 23 | 571.78 | |||

| Cash | 11 | 571.78 | ||||

| (Record payment of SUTA taxes for the quarter ended March 31) | ||||||

| May | 2 | Union Dues Payable | 28 | 275 | ||

| Cash | 11 | 275 | ||||

| (Record cash paid for the union dues withheld in April) | ||||||

| Page: 20 | ||||||

| 13 | Wages and Salaries | 51 | 8,190.00 | |||

| FICA Taxes Payable-OASDI | 20 | 507.78 | ||||

| FICA taxes Payable-HI | 21 | 118.76 | ||||

| Employees FIT Payable | 25 | 875.00 | ||||

| Employees SIT Payable | 26 | 160.05 | ||||

| Union Dues Payable | 28 | 135.00 | ||||

| Cash | 11 | 6,393.41 | ||||

| (Record payment of wages and salaries and the employees’ withheld taxes) | ||||||

| 13 | Payroll Taxes | 55 | 794.05 | |||

| FICA Taxes Payable-OASDI | 20 | 507.78 | ||||

| FICA taxes Payable-HI | 21 | 118.76 | ||||

| FUTA Taxes Payable | 22 | 49.14 | ||||

| SUTA Taxes Payable | 23 | 118.37 | ||||

| (Record payroll taxes and the employer’s withheld taxes) | ||||||

| 16 | FICA Taxes Payable-OASDI | 20 | 2,019.34 | |||

| FICA taxes Payable-HI | 21 | 472.28 | ||||

| Employees FIT Payable | 22 | 1,705.00 | ||||

| Cash | 11 | 4,196.62 | ||||

| (Record payment of taxes withheld on April 15th and 29th payrolls) | ||||||

| 31 | Wages and Salaries | 51 | 8,755.00 | |||

| FICA Taxes Payable-OASDI | 20 | 542.81 | ||||

| FICA taxes Payable-HI | 21 | 126.95 | ||||

| Employees FIT Payable | 25 | 971.00 | ||||

| Employees SIT Payable | 26 | 174.05 | ||||

| Union Dues Payable | 28 | 140.00 | ||||

| Cash | 11 | 6,800.19 | ||||

| (Record payment of wages and salaries and the employees’ withheld taxes) | ||||||

| 31 | Payroll Taxes | 55 | 923.66 | |||

| FICA Taxes Payable-OASDI | 20 | 542.81 | ||||

| FICA taxes Payable-HI | 21 | 126.95 | ||||

| FUTA Taxes Payable | 22 | 52.53 | ||||

| SUTA Taxes Payable | 23 | 201.37 | ||||

| (Record payroll taxes and the employer’s withheld taxes) | ||||||

| Page: 21 | ||||||

| June | 3 | Union Dues Payable | 28 | 275 | ||

| Cash | 11 | 275 | ||||

| (Record cash paid for the union dues withheld during May) | ||||||

| 15 | Wages and Salaries | 51 | 9,110.00 | |||

| FICA Taxes Payable-OASDI | 20 | 564.82 | ||||

| FICA taxes Payable-HI | 21 | 132.10 | ||||

| Employees FIT Payable | 25 | 1,029.00 | ||||

| Employees SIT Payable | 26 | 187.15 | ||||

| Union Dues Payable | 28 | 145.00 | ||||

| Cash | 11 | 7,051.93 | ||||

| (Record payment of wages and salaries and the employees’ withheld taxes) | ||||||

| 15 | Payroll Taxes | 55 | 819.01 | |||

| FICA Taxes Payable-OASDI | 20 | 564.82 | ||||

| FICA taxes Payable-HI | 21 | 132.10 | ||||

| FUTA Taxes Payable | 22 | 25.26 | ||||

| SUTA Taxes Payable | 23 | 96.83 | ||||

| (Record payroll taxes and the employer’s withheld taxes) | ||||||

| 15 | FICA Taxes Payable-OASDI | 20 | 2,101.18 | |||

| FICA taxes Payable-HI | 21 | 491.42 | ||||

| Employees FIT Payable | 25 | 1,846.00 | ||||

| Cash | 11 | 4,438.60 | ||||

| (Record payment of taxes withheld on May 13th and 31st payrolls) | ||||||

| 30 | Wages and Salaries | 51 | 8,960.00 | |||

| FICA Taxes Payable-OASDI | 20 | 555.52 | ||||

| FICA taxes Payable-HI | 21 | 129.92 | ||||

| Employees FIT Payable | 25 | 988.00 | ||||

| Employees SIT Payable | 26 | 183.95 | ||||

| Union Dues Payable | 28 | 145.00 | ||||

| Cash | 11 | 6,957.61 | ||||

| (Record payment of wages and salaries and the employees’ withheld taxes) | ||||||

| 30 | Payroll Taxes | 55 | 751.56 | |||

| FICA Taxes Payable-OASDI | 20 | 555.52 | ||||

| FICA taxes Payable-HI | 21 | 129.92 | ||||

| FUTA Taxes Payable | 22 | 13.68 | ||||

| SUTA Taxes Payable | 23 | 52.44 | ||||

| (Record payroll taxes and the employer’s withheld taxes) | ||||||

Table (1)

Working Notes:

Compute FICA taxes, total deductions, and net pay for April 15th.

| Details | Amount ($) | Amount ($) | Amount ($) |

| Payroll | $8,310.00 | ||

| Deductions: | |||

| Taxable pay for OASDI | $8,310 | ||

| FICA–OASDI tax rate | × 6.2% | $515.22 | |

| Taxable pay for HI | 8,310 | ||

| FICA–HI tax rate | × 1.45% | 120.50 | |

| Federal income taxes withheld | 890.00 | ||

| State income taxes withheld | 166.20 | ||

| Union dues withheld | 140.00 | ||

| Total deductions | (1,831.92) | ||

| Net pay | $6,478.08 |

Table (2)

Compute total employer payroll taxes for April 15th.

| Details | Amount ($) | Amount ($) |

| Gross pay | $8,310 | |

| FICA-OASDI tax rate | × 6.2% | |

| FICA-OASDI tax expense | $515.22 | |

| Gross pay | $8,310 | |

| FICA-HI tax rate | × 1.45% | |

| FICA-HI tax expense | 120.50 | |

| Taxable pay | $8,310 | |

| FUTA tax rate | × 0.6% | |

| FUTA tax expense | 49.86 | |

| Taxable pay | $8,310 | |

| SUTA tax rate (state contribution rate) | × 2.3% | |

| SUTA tax expense | 191.13 | |

| Total employer’s payroll taxes | $876.71 |

Table (3)

Compute FICA taxes, total deductions, and net pay for April 29th.

| Details | Amount ($) | Amount ($) | Amount ($) |

| Payroll | $7,975.00 | ||

| Deductions: | |||

| Taxable pay for OASDI | $7,975 | ||

| FICA–OASDI tax rate | × 6.2% | $494.45 | |

| Taxable pay for HI | 7,975 | ||

| FICA–HI tax rate | × 1.45% | 115.64 | |

| Federal income taxes withheld | 815.00 | ||

| State income taxes withheld | 151.50 | ||

| Union dues withheld | 135.00 | ||

| Total deductions | (1,711.59) | ||

| Net pay | $6,263.41 |

Table (4)

Compute total employer payroll taxes for April 29th.

| Details | Amount ($) | Amount ($) |

| Gross pay | $7,975 | |

| FICA-OASDI tax rate | × 6.2% | |

| FICA-OASDI tax expense | $494.45 | |

| Gross pay | 7,975 | |

| FICA-HI tax rate | × 1.45% | |

| FICA-HI tax expense | 115.64 | |

| Taxable pay | 7,975 | |

| FUTA tax rate | × 0.6% | |

| FUTA tax expense | 47.85 | |

| Taxable pay | 7,975 | |

| SUTA tax rate (state contribution rate) | × 2.3% | |

| SUTA tax expense | 183.43 | |

| Total employer’s payroll taxes | $841.37 |

Table (5)

Compute FICA taxes, total deductions, and net pay for May 13th.

| Details | Amount ($) | Amount ($) | Amount ($) |

| Payroll | $8,190.00 | ||

| Deductions: | |||

| Taxable pay for OASDI | $8,190 | ||

| FICA–OASDI tax rate | × 6.2% | $507.78 | |

| Taxable pay for HI | 8,190 | ||

| FICA–HI tax rate | × 1.45% | 118.76 | |

| Federal income taxes withheld | 875.00 | ||

| State income taxes withheld | 160.05 | ||

| Union dues withheld | 135.00 | ||

| Total deductions | (1,796.59) | ||

| Net pay | $6,393.41 |

Table (6)

Compute total employer payroll taxes for May 13th.

| Details | Amount ($) | Amount ($) |

| Gross pay | $8,190 | |

| FICA-OASDI tax rate | × 6.2% | |

| FICA-OASDI tax expense | $507.78 | |

| Gross pay | 8,190 | |

| FICA-HI tax rate | × 1.45% | |

| FICA-HI tax expense | 118.76 | |

| Taxable pay | 8,190 | |

| FUTA tax rate | × 0.6% | |

| FUTA tax expense | 49.14 | |

| Taxable pay | 8,190 | |

| SUTA tax rate (state contribution rate) | × 2.3% | |

| SUTA tax expense | 118.37 | |

| Total employer’s payroll taxes | $794.05 |

Table (7)

Compute FICA taxes, total deductions, and net pay for May 31st.

| Details | Amount ($) | Amount ($) | Amount ($) |

| Payroll | $8,755.00 | ||

| Deductions: | |||

| Taxable pay for OASDI | $8,755 | ||

| FICA–OASDI tax rate | × 6.2% | $542.81 | |

| Taxable pay for HI | 8,755 | ||

| FICA–HI tax rate | × 1.45% | 126.95 | |

| Federal income taxes withheld | 971.00 | ||

| State income taxes withheld | 174.05 | ||

| Union dues withheld | 140.00 | ||

| Total deductions | (1,954.81) | ||

| Net pay | $6,800.19 |

Table (8)

Compute total employer payroll taxes for May 31st.

| Details | Amount ($) | Amount ($) |

| Gross pay | $8,755 | |

| FICA-OASDI tax rate | × 6.2% | |

| FICA-OASDI tax expense | $542.81 | |

| Gross pay | $8,755 | |

| FICA-HI tax rate | × 1.45% | |

| FICA-HI tax expense | 126.95 | |

| Taxable pay | $8,755 | |

| FUTA tax rate | × 0.6% | |

| FUTA tax expense | 52.53 | |

| Taxable pay | $8,755 | |

| SUTA tax rate (state contribution rate) | × 2.3% | |

| SUTA tax expense | 201.37 | |

| Total employer’s payroll taxes | $923.66 |

Table (9)

Compute FICA taxes, total deductions, and net pay for June 15th.

| Details | Amount ($) | Amount ($) | Amount ($) |

| Payroll | $9,110.00 | ||

| Deductions: | |||

| Taxable pay for OASDI | $9,110 | ||

| FICA–OASDI tax rate | × 6.2% | $564.82 | |

| Taxable pay for HI | 9,110 | ||

| FICA–HI tax rate | × 1.45% | 132.10 | |

| Federal income taxes withheld | 1,029.00 | ||

| State income taxes withheld | 187.15 | ||

| Union dues withheld | 145.00 | ||

| Total deductions | (2,058.07) | ||

| Net pay | $7,051.93 |

Table (10)

Compute total employer payroll taxes for June 15th.

| Details | Amount ($) | Amount ($) |

| Gross pay | $9,110 | |

| FICA-OASDI tax rate | × 6.2% | |

| FICA-OASDI tax expense | $564.82 | |

| Gross pay | $9,110 | |

| FICA-HI tax rate | × 1.45% | |

| FICA-HI tax expense | 132.10 | |

| Taxable pay | $4,210 | |

| FUTA tax rate | × 0.6% | |

| FUTA tax expense | 25.26 | |

| Taxable pay | $4,210 | |

| SUTA tax rate (state contribution rate) | × 2.3% | |

| SUTA tax expense | 96.83 | |

| Total employer’s payroll taxes | $819.01 |

Table (11)

Compute FICA taxes, total deductions, and net pay for June 30th.

| Details | Amount ($) | Amount ($) | Amount ($) |

| Payroll | $8,960.00 | ||

| Deductions: | |||

| Taxable pay for OASDI | $8,960 | ||

| FICA–OASDI tax rate | × 6.2% | $555.52 | |

| Taxable pay for HI | 8,960 | ||

| FICA–HI tax rate | × 1.45% | 129.92 | |

| Federal income taxes withheld | 988.00 | ||

| State income taxes withheld | 183.95 | ||

| Union dues withheld | 145.00 | ||

| Total deductions | (2,002.39) | ||

| Net pay | $6,957.61 |

Table (12)

Compute total employer payroll taxes for June 30th.

| Details | Amount ($) | Amount ($) |

| Gross pay | $8,960 | |

| FICA-OASDI tax rate | × 6.2% | |

| FICA-OASDI tax expense | $555.52 | |

| Gross pay | $8,960 | |

| FICA-HI tax rate | × 1.45% | |

| FICA-HI tax expense | 129.92 | |

| Taxable pay | $2,280 | |

| FUTA tax rate | × 0.6% | |

| FUTA tax expense | 13.68 | |

| Taxable pay | $2,280 | |

| SUTA tax rate (state contribution rate) | × 2.3% | |

| SUTA tax expense | 52.44 | |

| Total employer’s payroll taxes | $751.56 |

Table (13)

b.

Post the journalized transactions in the ledger accounts of the general ledger.

Explanation of Solution

Post the journalized transactions in the ledger accounts of the general ledger.

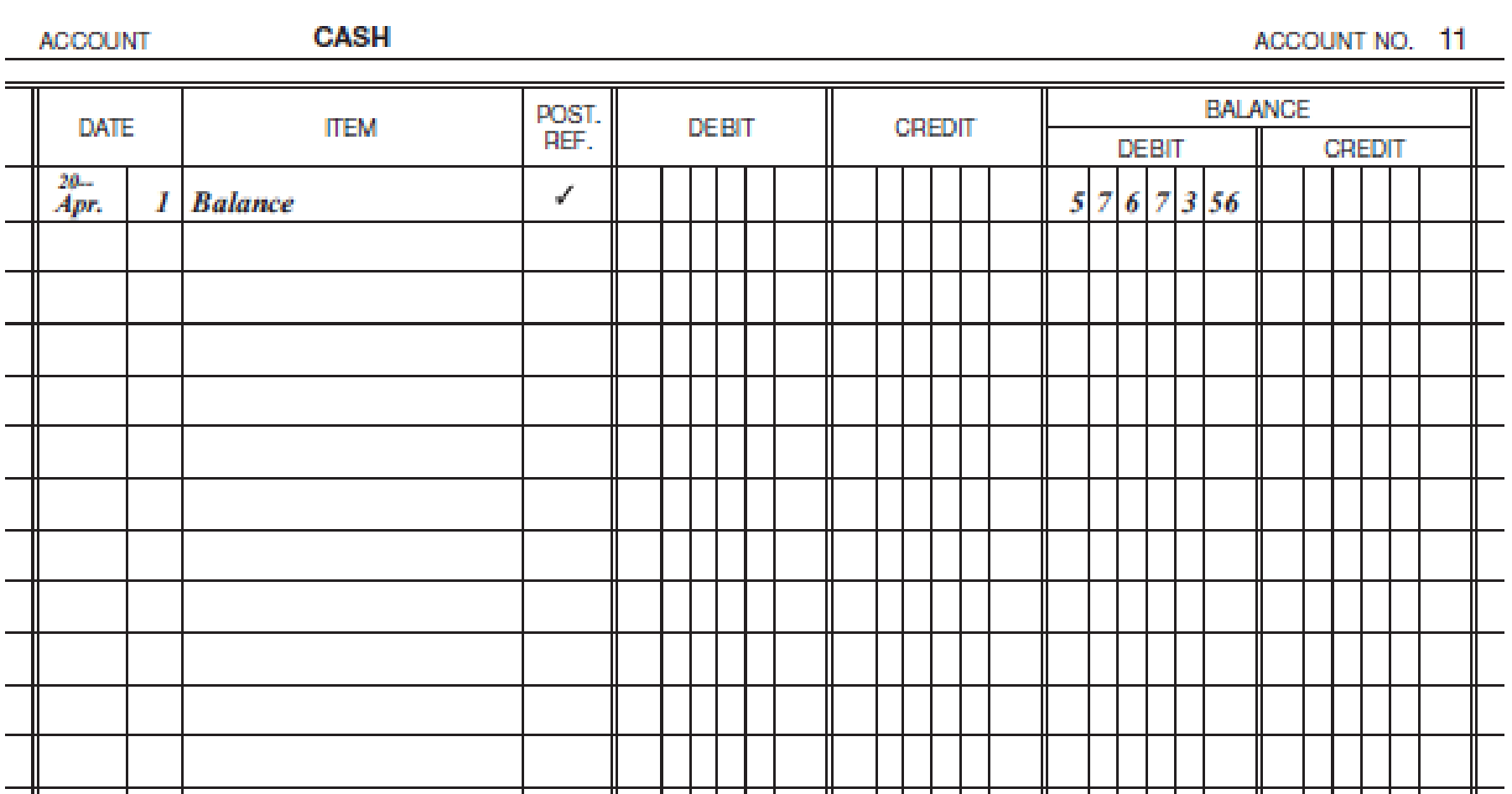

| ACCOUNT CASH ACCOUNT NO. 11 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 57,673.56 | |||

| 1 | J19 | 100.00 | 57,573.56 | ||||

| 15 | J19 | 6,478.08 | 51,095.48 | ||||

| 15 | J19 | 546.92 | 50,548.56 | ||||

| 15 | J19 | 2,442.86 | 48,105.70 | ||||

| 29 | J19 | 6,263.41 | 41,842.29 | ||||

| 29 | J19 | 571.78 | 41,270.51 | ||||

| May | 2 | J19 | 275.00 | 40,995.51 | |||

| 13 | J20 | 6,393.41 | 34,602.10 | ||||

| 16 | J20 | 4,196.62 | 30,405.48 | ||||

| 31 | J20 | 6,800.19 | 23,605.29 | ||||

| June | 3 | J21 | 275.00 | 23,330.29 | |||

| 15 | J21 | 7,051.93 | 16,278.36 | ||||

| 15 | J21 | 4,438.60 | 11,839.76 | ||||

| 30 | J21 | 6,957.61 | 4,882.15 | ||||

Table (14)

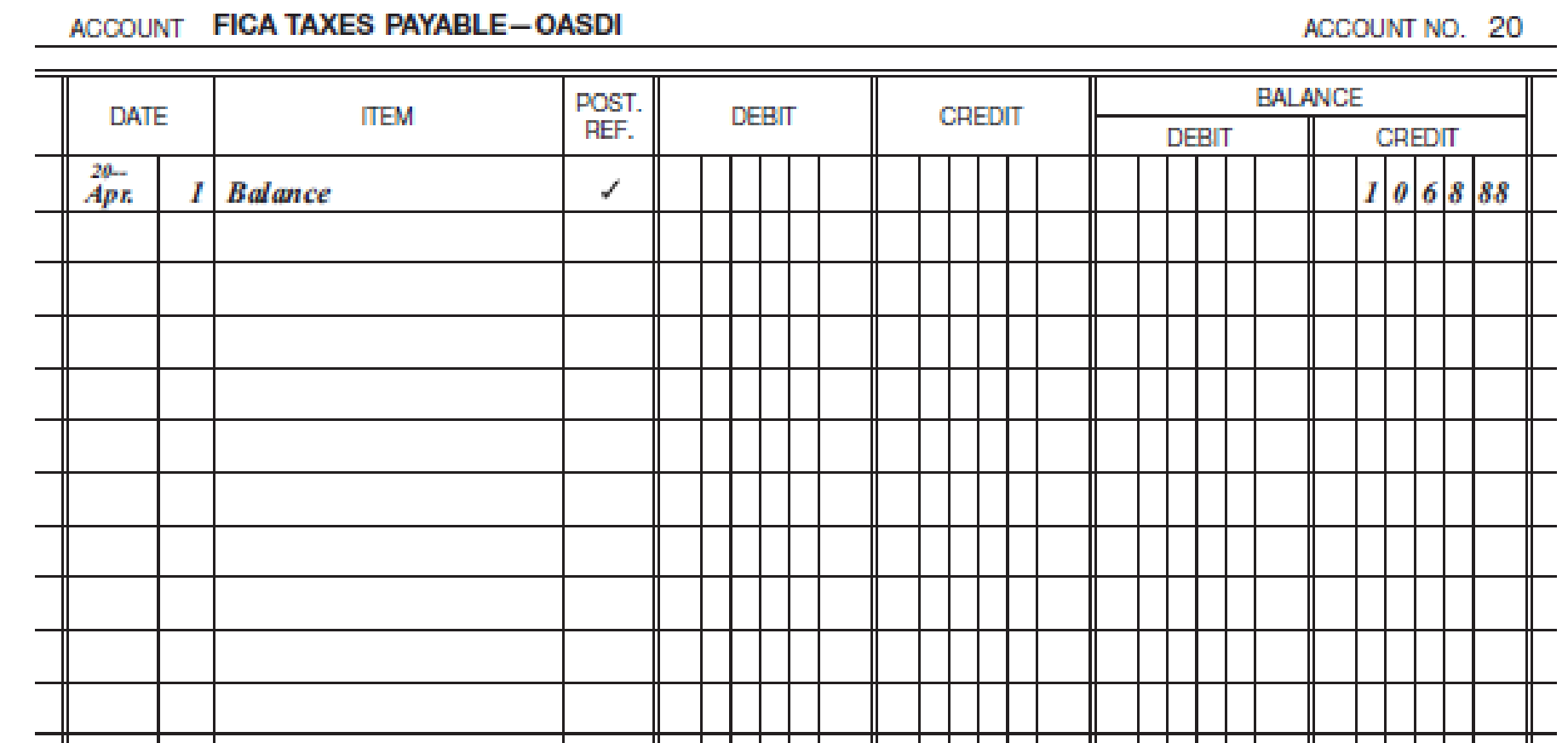

| ACCOUNT FICA TAXES PAYABLE-OASDI ACCOUNT NO. 20 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 1,068.88 | |||

| 15 | J19 | 515.22 | 1,584.10 | ||||

| 15 | J19 | 515.22 | 2,099.32 | ||||

| 15 | J19 | 1,068.88 | 1,030.44 | ||||

| 29 | J19 | 494.45 | 1,524.89 | ||||

| 29 | J19 | 494.45 | 2,019.34 | ||||

| May | 13 | J20 | 507.78 | 2,527.12 | |||

| 13 | J20 | 507.78 | 3,034.90 | ||||

| 16 | J20 | 2,019.34 | 1,015.56 | ||||

| 31 | J20 | 542.81 | 1,558.37 | ||||

| 31 | J20 | 542.81 | 2,101.18 | ||||

| June | 15 | J21 | 564.82 | 2,666.00 | |||

| 15 | J21 | 564.82 | 3,230.82 | ||||

| 15 | J21 | 2,101.18 | 1,129.64 | ||||

| 30 | J21 | 555.52 | 1,685.16 | ||||

| 30 | J21 | 555.52 | 2,240.68 | ||||

Table (15)

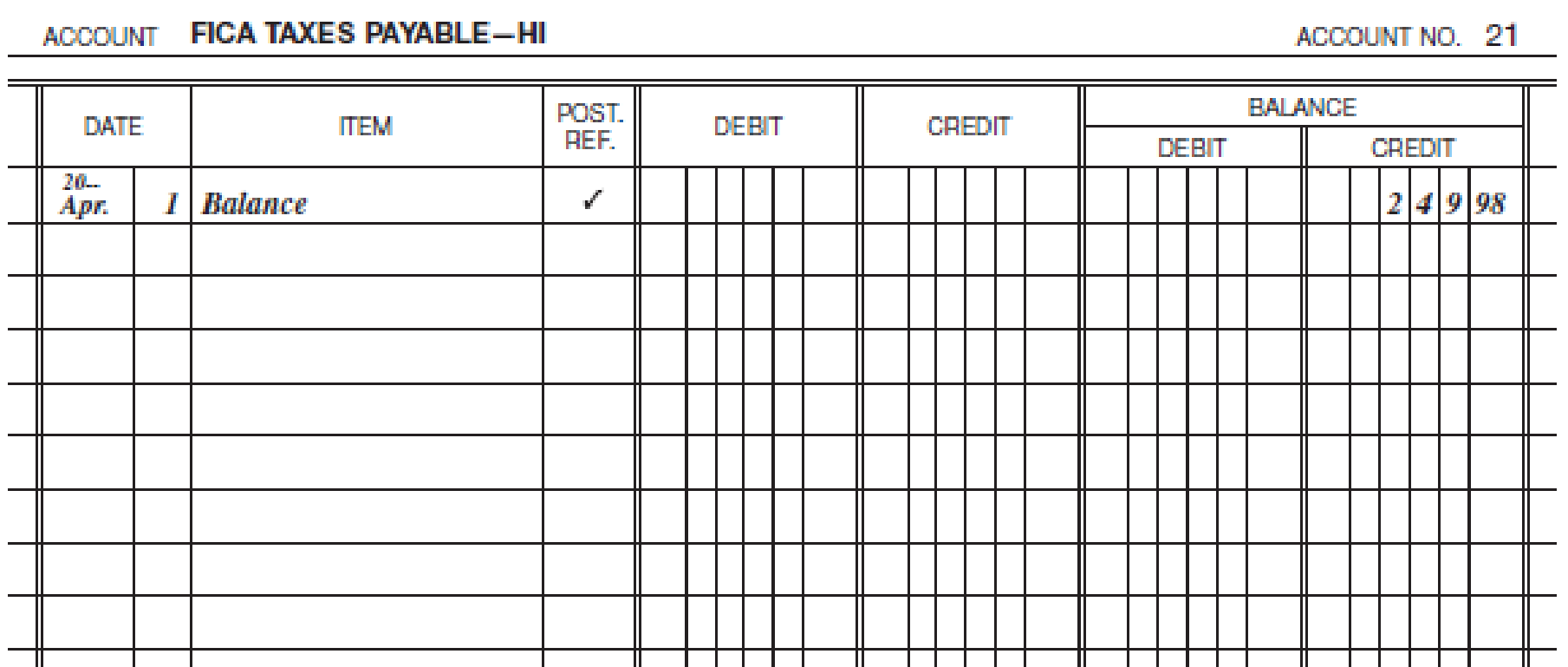

| ACCOUNT FICA TAXES PAYABLE-HI ACCOUNT NO. 21 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 249.98 | |||

| 15 | J19 | 120.50 | 370.48 | ||||

| 15 | J19 | 120.50 | 490.98 | ||||

| 15 | J19 | 249.98 | 241.00 | ||||

| 29 | J19 | 115.64 | 356.64 | ||||

| 29 | J19 | 115.64 | 472.28 | ||||

| May | 13 | J20 | 118.76 | 591.04 | |||

| 13 | J20 | 118.76 | 709.80 | ||||

| 16 | J20 | 472.28 | 237.52 | ||||

| 31 | J20 | 126.95 | 364.47 | ||||

| 31 | J20 | 126.95 | 491.42 | ||||

| June | 15 | J21 | 132.10 | 623.52 | |||

| 15 | J21 | 132.10 | 755.62 | ||||

| 15 | J21 | 491.42 | 264.20 | ||||

| 30 | J21 | 129.92 | 394.12 | ||||

| 30 | J21 | 129.92 | 524.04 | ||||

Table (16)

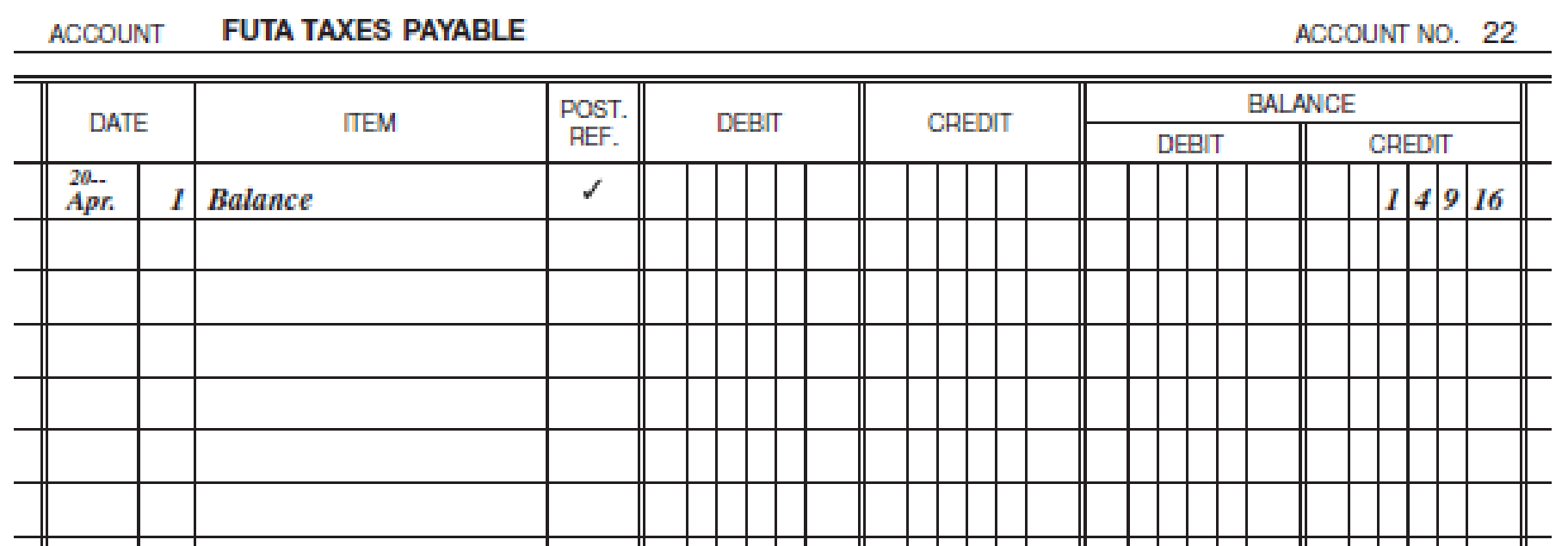

| ACCOUNT FUTA TAXES PAYABLE ACCOUNT NO. 22 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 149.16 | |||

| 15 | J19 | 49.86 | 199.02 | ||||

| 29 | J19 | 47.85 | 246.87 | ||||

| May | 13 | J20 | 49.14 | 296.01 | |||

| 31 | J20 | 52.53 | 348.54 | ||||

| June | 15 | J21 | 25.26 | 373.80 | |||

| 30 | J21 | 13.68 | 387.48 | ||||

Table (17)

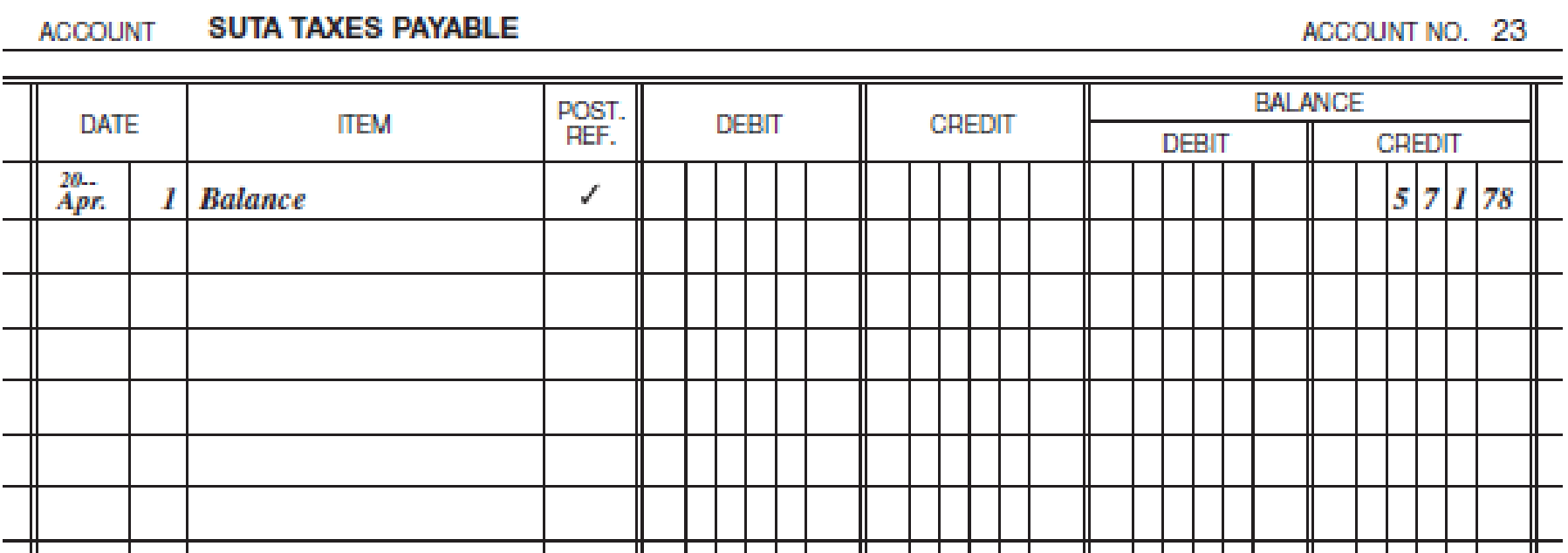

| ACCOUNT SUTA TAXES PAYABLE ACCOUNT NO. 23 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 571.78 | |||

| 15 | J19 | 191.13 | 762.91 | ||||

| 29 | J19 | 183.43 | 946.34 | ||||

| 29 | J19 | 571.78 | 374.56 | ||||

| May | 13 | J20 | 118.37 | 492.93 | |||

| 31 | J20 | 201.37 | 694.30 | ||||

| June | 15 | J21 | 96.83 | 791.13 | |||

| 30 | J21 | 52.44 | 843.57 | ||||

Table (18)

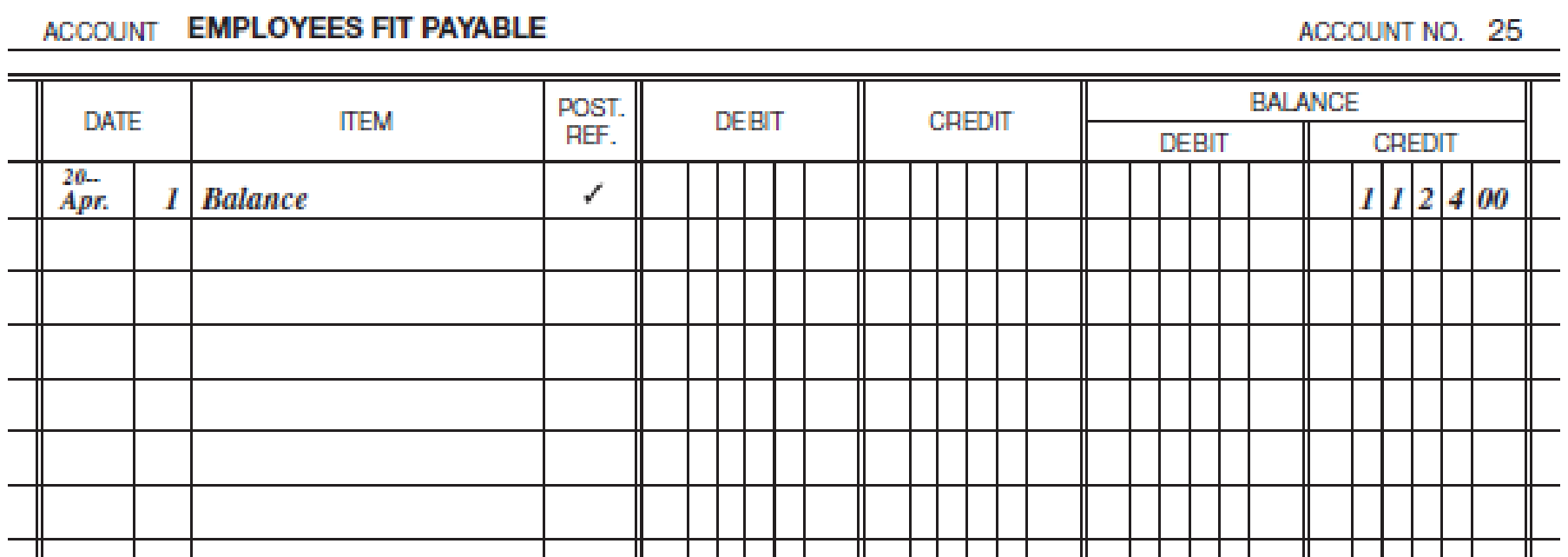

| ACCOUNT EMPLOYEES FIT PAYABLE ACCOUNT NO. 25 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 1,124 | |||

| 15 | J19 | 890 | 2,014 | ||||

| 15 | J19 | 1,124 | 890 | ||||

| 29 | J19 | 815 | 1,705 | ||||

| May | 13 | J20 | 875 | 2,580 | |||

| 16 | J20 | 1,705 | 875 | ||||

| 31 | J20 | 971 | 1,846 | ||||

| June | 15 | J21 | 1,029 | 2,875 | |||

| 15 | J21 | 1,846 | 1,029 | ||||

| 30 | J21 | 988 | 2,017 | ||||

Table (19)

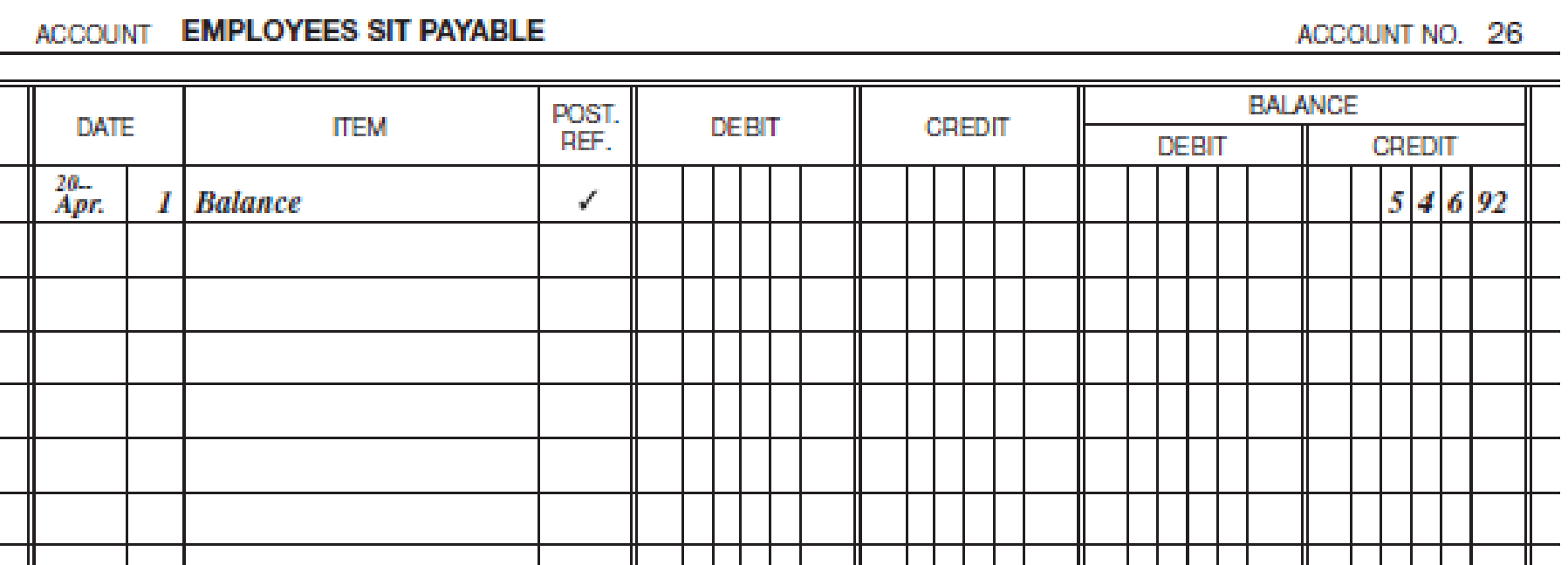

| ACCOUNT EMPLOYEES SIT PAYABLE ACCOUNT NO. 26 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 546.92 | |||

| 15 | J19 | 166.20 | 713.12 | ||||

| 15 | J19 | 546.92 | 166.20 | ||||

| 29 | J19 | 151.50 | 317.70 | ||||

| May | 13 | J20 | 160.05 | 477.75 | |||

| 31 | J20 | 174.05 | 651.80 | ||||

| June | 15 | J21 | 187.15 | 838.95 | |||

| 30 | J21 | 183.95 | 1,022.90 | ||||

Table (20)

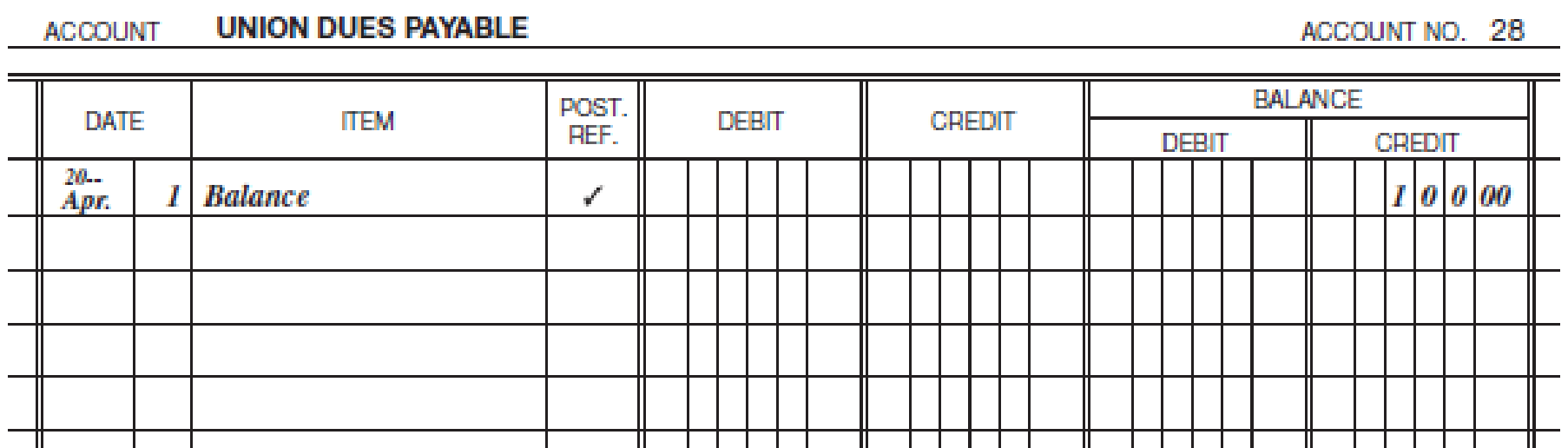

| ACCOUNT UNION DUES PAYABLE ACCOUNT NO. 28 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 100 | |||

| 1 | J19 | 100 | 0 | ||||

| 15 | J19 | 140 | 140 | ||||

| 29 | J19 | 135 | 275 | ||||

| May | 2 | J19 | 275 | 0 | |||

| 13 | J20 | 135 | 135 | ||||

| 31 | J20 | 140 | 275 | ||||

| June | 3 | J20 | 275 | 0 | |||

| 15 | J21 | 145 | 145 | ||||

| 30 | J21 | 145 | 290 | ||||

Table (21)

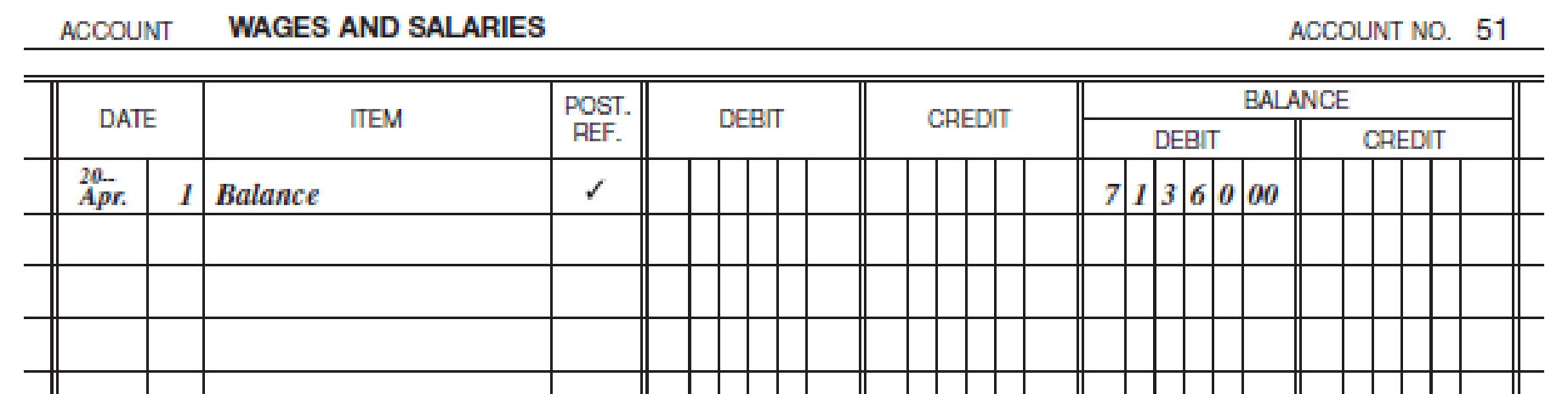

| ACCOUNT WAGES AND SALARIES ACCOUNT NO. 51 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 71,360 | |||

| 15 | J19 | 8,310 | 79,670 | ||||

| 29 | J19 | 7,975 | 87,645 | ||||

| May | 13 | J20 | 8,190 | 95,835 | |||

| 31 | J20 | 8,755 | 104,590 | ||||

| June | 15 | J21 | 9,110 | 113,700 | |||

| 30 | J21 | 8,960 | 122,660 | ||||

Table (22)

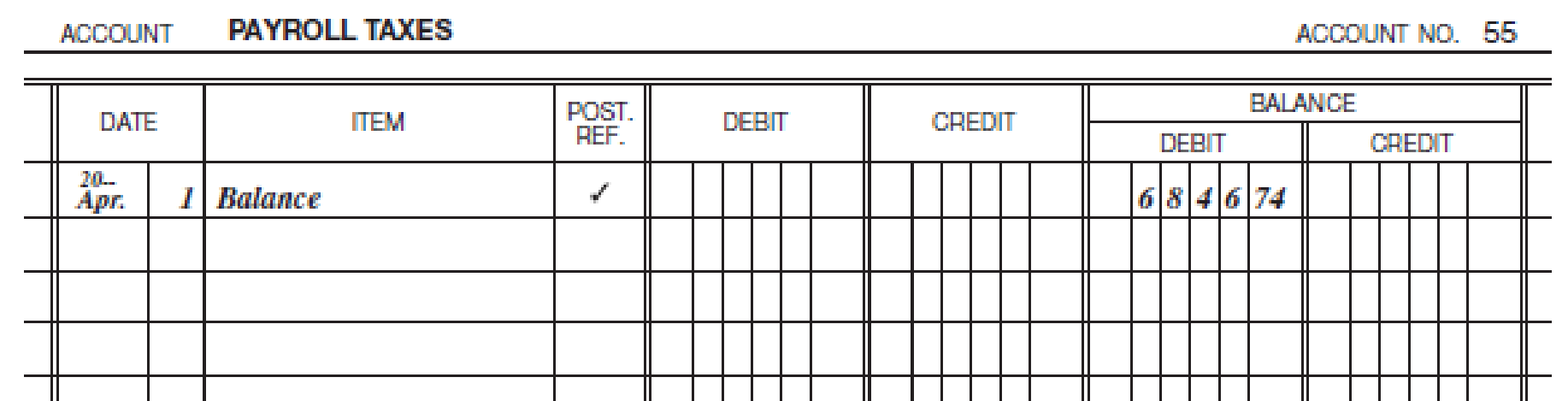

| ACCOUNT PAYROLL TAXES ACCOUNT NO. 55 | |||||||

| Date | Item | Post. Ref. | Debit ($) | Credit ($) | Balance | ||

| Debit ($) | Credit ($) | ||||||

| 20-- | |||||||

| April | 1 | Balance | ✓ | 6,846.74 | |||

| 15 | J19 | 876.71 | 7,723.45 | ||||

| 29 | J19 | 841.37 | 8,564.82 | ||||

| May | 13 | J20 | 794.05 | 9,358.87 | |||

| 31 | J20 | 923.66 | 10,282.53 | ||||

| June | 15 | J20 | 819.01 | 11,101.54 | |||

| 30 | J21 | 751.56 | 11,853.10 | ||||

Table (23)

c.

Indicate the correct answer against the given questions.

Explanation of Solution

Indicate the correct answer against the given questions 1 to 7.

| Question Number | Answer | Reference |

| 1. | $3,019.40 | The balances of FICA-OASDI, FICA-HI, and Employees FIT Payable as on June 30 are $2,240.68, $524.04, and $2,017 respectively. The sum is $4,781.72 (Refer Tables 15, 16, and 19 for the balances as on June 30). |

| 2. | 1,022.90 | Refer Table-20 for the value of state income taxes withheld. |

| 3. | 0 | The balance of FUTA Taxes Payable as on June 30 is $387.48. Since the accumulated amount as on June 30 is less than $500 threshold, the balance need not be deposited. |

| 4. | 843.57 | Refer Table-18 for the value of SUTA Taxes Payable. |

| 5. | 290.00 | Refer Table-21 for the value of Union Dues Payable. |

| 6. | 122,660.00 | Refer Table-22 for the value of wages and salaries expense. |

| 7. | 11,853.10 | Refer Table-23 for the value of payroll taxes expense. |

Table (24)

8.

Journalize the adjusting entry to record the vacation accrual.

| Date | Account Titles and Explanation | Post Ref. | Debit ($) | Credit ($) | ||

| Vacation Benefits Expense | 15,000 | |||||

| Vacation Benefits Payable | 15,000 | |||||

| (Record accrued vacation benefits) | ||||||

Table (25)

Description:

- Vacation Benefits Expense is an expense account. Since expenses and losses decrease equity, equity value is decreased, and a decrease in equity is debited.

- Vacation Benefits Payable is a liability account. The amount to be paid has increased, so liability increased, and an increase in liability is credited.

Want to see more full solutions like this?

Chapter 6 Solutions

PAYROLL ACCT.,2019 ED.(LL)-TEXT

- I need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI need the correct answer to this general accounting problem using the standard accounting approach.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forward

- I am trying to find the accurate solution to this general accounting problem with the correct explanation.arrow_forwardI am searching for the accurate solution to this general accounting problem with the right approach.arrow_forwardPlease provide the correct answer to this general accounting problem using valid calculations.arrow_forward

- Please provide the correct answer to this general accounting problem using valid calculations.arrow_forwardPlease explain the solution to this general accounting problem using the correct accounting principles.arrow_forwardCan you solve this general accounting problem using appropriate accounting principles?arrow_forward

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage Learning College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning

College Accounting (Book Only): A Career ApproachAccountingISBN:9781305084087Author:Cathy J. ScottPublisher:Cengage Learning