Concept explainers

Frank Flynn is the payroll manager for Powlus Supply Company. During the budgeting process, Sam Kinder, director of finance, asked Flynn to arrive at a set percentage that could be applied to each budgeted salary figure to cover the additional cost that will be incurred by Powlus Supply for each employee. After some discussion, it was determined that the best way to compute this percentage would be to base these additional costs of payroll on the average salary paid by the company.

Kinder wants this additional payroll cost percentage to cover payroll taxes (FICA, FUTA, and SUTA) and other payroll costs covered by the company (workers’ compensation expense, health insurance costs, and vacation pay).

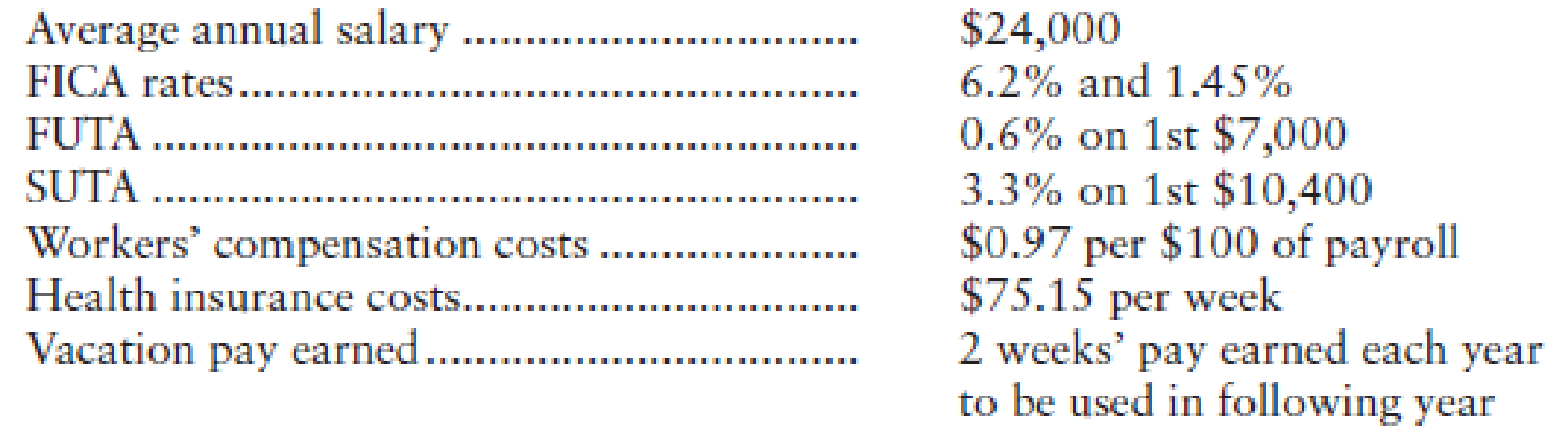

Flynn gathers the following information in order to complete the analysis:

Compute the percentage that can be used in the budget.

Trending nowThis is a popular solution!

Chapter 6 Solutions

PAYROLL ACCT.,2019 ED.(LL)-TEXT

- The matching principle helps ensure:A. Revenues are equal to expensesB. Revenues and related expenses are recorded in the same periodC. Cash is matched to liabilitiesD. Accounts match physical inventoryarrow_forwardCan you solve this general accounting problemarrow_forwardI need help ! A trial balance includes:A. Only revenue and expense accountsB. All accounts with balancesC. Only permanent accountsD. Only assets and liabilitiesarrow_forward

- Accounting question pleasearrow_forwardNo Ai A trial balance includes:A. Only revenue and expense accountsB. All accounts with balancesC. Only permanent accountsD. Only assets and liabilitiesarrow_forwardWhich account is increased with a credit?A. CashB. Salaries ExpenseC. Accounts ReceivableD. Service Revenue need helparrow_forward

- No AI A trial balance includes:A. Only revenue and expense accountsB. All accounts with balancesC. Only permanent accountsD. Only assets and liabilitiesarrow_forwardI need help with this general accounting problem using proper accounting guidelinesarrow_forwardHello Needed Answer of Financial Accounting Question with Correct Methodarrow_forward

- No AI Which account is increased with a credit?A. CashB. Salaries ExpenseC. Accounts ReceivableD. Service Revenuearrow_forwardWhich account is increased with a credit?A. CashB. Salaries ExpenseC. Accounts ReceivableD. Service Revenuearrow_forwardCan you solve this general accounting problem using accurate calculation methods?arrow_forward

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning

Cornerstones of Cost Management (Cornerstones Ser...AccountingISBN:9781305970663Author:Don R. Hansen, Maryanne M. MowenPublisher:Cengage Learning