College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

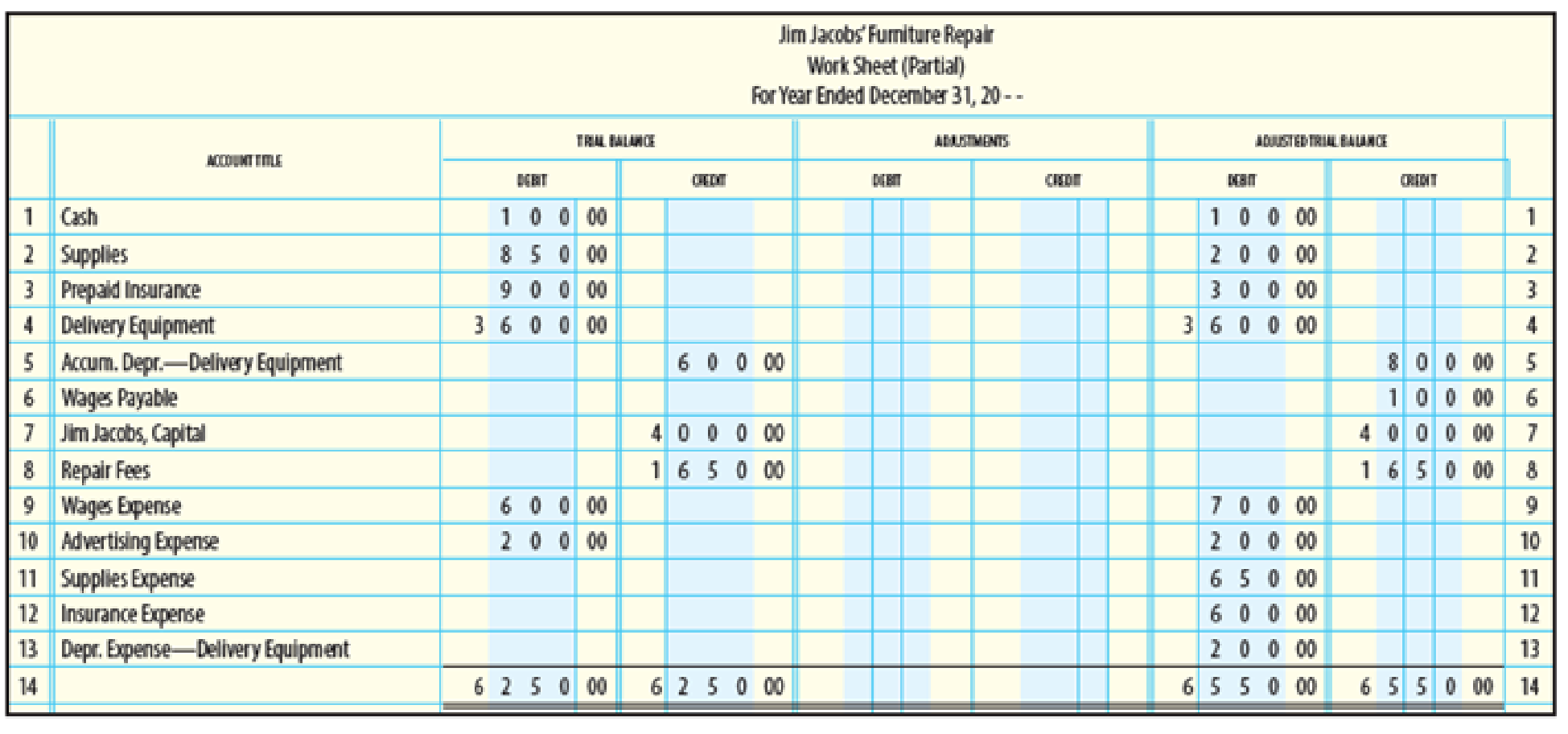

Chapter 5, Problem 9SEA

WORK SHEET AND

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

help me to solve this questions financial accounting

expert of general accounting answer

Need help this question

Chapter 5 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

Ch. 5 - The matching principle in accounting requires the...Ch. 5 - Prob. 2TFCh. 5 - LO1 As part of the adjustment of supplies, an...Ch. 5 - LO1 Depreciable cost is the difference between the...Ch. 5 - LO1 The purpose of depreciation is to record the...Ch. 5 - LO1 The purpose of depreciation is to (a) spread...Ch. 5 - Prob. 2MCCh. 5 - Prob. 3MCCh. 5 - Prob. 4MCCh. 5 - The first step in preparing a work sheet is to (a)...

Ch. 5 - On December 31, the trial balance indicates that...Ch. 5 - LO2 When posting adjusting entries to the general...Ch. 5 - Prob. 3CECh. 5 - Prob. 4CECh. 5 - LO5 Using the following partial work sheet...Ch. 5 - Prob. 6CECh. 5 - Prob. 1RQCh. 5 - Prob. 2RQCh. 5 - Prob. 3RQCh. 5 - Prob. 4RQCh. 5 - Prob. 5RQCh. 5 - Prob. 6RQCh. 5 - Prob. 7RQCh. 5 - Prob. 8RQCh. 5 - What is an assets depreciable cost?Ch. 5 - Prob. 10RQCh. 5 - Prob. 11RQCh. 5 - Identify the five major column headings on a work...Ch. 5 - List the five steps taken in preparing a work...Ch. 5 - Prob. 14RQCh. 5 - Explain when revenues are recorded under the cash...Ch. 5 - Prob. 16RQCh. 5 - ADJUSTMENT FOR SUPPLIES On December 31, the trial...Ch. 5 - Prob. 2SEACh. 5 - ADJUSTMENT FOR WAGES On December 31, the trial...Ch. 5 - ADJUSTMENT FOR DEPRECIATION OF ASSET On December...Ch. 5 - CALCULATION OF BOOK VALUE On June 1, 20--, a...Ch. 5 - ANALYSIS OF ADJUSTING ENTRY FOR SUPPLIES Analyze...Ch. 5 - Prob. 7SEACh. 5 - POSTING ADJUSTING ENTRIES Two adjusting entries...Ch. 5 - WORK SHEET AND ADJUSTING ENTRIES A partial work...Ch. 5 - JOURNALIZING ADJUSTING ENTRIES From the...Ch. 5 - Prob. 11SEACh. 5 - ANALYSIS OF NET INCOME OR NET LOSS ON THE WORK...Ch. 5 - CASH, MODIFIED CASH, AND ACCRUAL BASES OF...Ch. 5 - ADJUSTMENTS AND WORK SHEET SHOWING NET INCOME The...Ch. 5 - ADJUSTMENTS AND WORK SHEET SHOWING A NET LOSS...Ch. 5 - JOURNALIZE AND POST ADJUSTING ENTRIES FROM THE...Ch. 5 - Prob. 17SPACh. 5 - ADJUSTMENT FOR SUPPLIES On July 31, the trial...Ch. 5 - ADJUSTMENT FOR INSURANCE On July 1, a six-month...Ch. 5 - ADJUSTMENT FOR WAGES On July 31, the trial balance...Ch. 5 - ADJUSTMENT FOR DEPRECIATION OF ASSET On July 1,...Ch. 5 - CALCULATION OF BOOK VALUE On January 1, 20--, a...Ch. 5 - ANALY SIS OF ADJUSTING ENTRY FOR SUPPLIES Analyze...Ch. 5 - ANALY SIS OF ADJUSTING ENTRY FOR INSURANCE Analyze...Ch. 5 - POSTING ADJUSTING ENTRIES Two adjusting entries...Ch. 5 - WORK SHEET AND ADJUSTING ENTRIES A partial work...Ch. 5 - JOURNALIZING ADJUSTING ENTRIES From the...Ch. 5 - EXTENDING ADJUSTED BALANCES TO THE INCOME...Ch. 5 - Prob. 12SEBCh. 5 - CASH, MODIFIED CASH, AND ACCRUAL BASES OF...Ch. 5 - Prob. 14SPBCh. 5 - Prob. 15SPBCh. 5 - JOURNALIZE AND POST ADJUSTING ENTRIES FROM THE...Ch. 5 - CORRECTING WORK SHEET WITH ERRORS A beginning...Ch. 5 - Delia Alvarez, owner of Delias Lawn Service, wants...Ch. 5 - Prob. 1MPCh. 5 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

- Financial accountingarrow_forwardGiven the solution and accounting questionarrow_forwardThe following data were selected from the records of Fluwars Company for the year ended December 31, current year: Balances at January 1, current year: Accounts receivable (various customers) $ 111,500Allowance for doubtful accounts 11,200 The company sold merchandise for cash and on open account with credit terms 1/10, n/30, without a right of return. The following transactions occurred during the current year: Sold merchandise for cash, $252,000.Sold merchandise to Abbey Corp; invoice amount, $36,000.Sold merchandise to Brown Company; invoice amount, $47,600.Abbey paid the invoice in (b) within the discount period.Sold merchandise to Cavendish Inc.; invoice amount, $50,000.Collected $113,100 cash from customers for credit sales made during the year, all within the discount periods.Brown paid its account in full within the discount period.Sold merchandise to Decca Corporation; invoice amount, $42,400.Cavendish paid its account in full after the discount…arrow_forward

- Given solution general accountingarrow_forwardanswer plzarrow_forwardThe following data were selected from the records of Fluwars Company for the year ended December 31, current year: Balances at January 1, current year: Accounts receivable (various customers) $ 111,500 Allowance for doubtful accounts 11,200 The company sold merchandise for cash and on open account with credit terms 1/10, n/30, without a right of return. The following transactions occurred during the current year: Sold merchandise for cash, $252,000. Sold merchandise to Abbey Corp; invoice amount, $36,000. Sold merchandise to Brown Company; invoice amount, $47,600. Abbey paid the invoice in (b) within the discount period. Sold merchandise to Cavendish Inc.; invoice amount, $50,000. Collected $113,100 cash from customers for credit sales made during the year, all within the discount periods. Brown paid its account in full within the discount period. Sold merchandise to Decca Corporation; invoice amount, $42,400. Cavendish paid its account in full after the…arrow_forward

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning, College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

College Accounting, Chapters 1-27 (New in Account...AccountingISBN:9781305666160Author:James A. Heintz, Robert W. ParryPublisher:Cengage LearningCentury 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College PubPrinciples of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

College Accounting, Chapters 1-27 (New in Account...

Accounting

ISBN:9781305666160

Author:James A. Heintz, Robert W. Parry

Publisher:Cengage Learning

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY