College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

22nd Edition

ISBN: 9781305666160

Author: James A. Heintz, Robert W. Parry

Publisher: Cengage Learning

expand_more

expand_more

format_list_bulleted

Concept explainers

Textbook Question

Chapter 5, Problem 8SEB

POSTING

Expert Solution & Answer

Trending nowThis is a popular solution!

Students have asked these similar questions

correct answer please

Accurate Answer

can you please solve this

Chapter 5 Solutions

College Accounting, Chapters 1-27 (New in Accounting from Heintz and Parry)

Ch. 5 - The matching principle in accounting requires the...Ch. 5 - Prob. 2TFCh. 5 - LO1 As part of the adjustment of supplies, an...Ch. 5 - LO1 Depreciable cost is the difference between the...Ch. 5 - LO1 The purpose of depreciation is to record the...Ch. 5 - LO1 The purpose of depreciation is to (a) spread...Ch. 5 - Prob. 2MCCh. 5 - Prob. 3MCCh. 5 - Prob. 4MCCh. 5 - The first step in preparing a work sheet is to (a)...

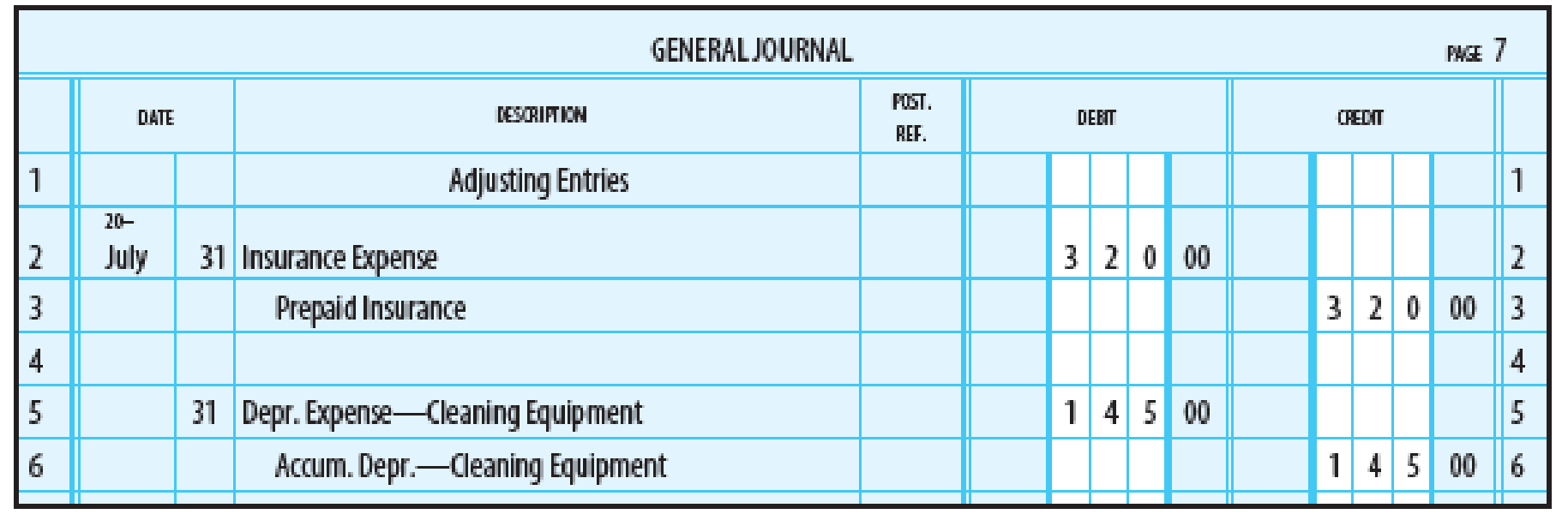

Ch. 5 - On December 31, the trial balance indicates that...Ch. 5 - LO2 When posting adjusting entries to the general...Ch. 5 - Prob. 3CECh. 5 - Prob. 4CECh. 5 - LO5 Using the following partial work sheet...Ch. 5 - Prob. 6CECh. 5 - Prob. 1RQCh. 5 - Prob. 2RQCh. 5 - Prob. 3RQCh. 5 - Prob. 4RQCh. 5 - Prob. 5RQCh. 5 - Prob. 6RQCh. 5 - Prob. 7RQCh. 5 - Prob. 8RQCh. 5 - What is an assets depreciable cost?Ch. 5 - Prob. 10RQCh. 5 - Prob. 11RQCh. 5 - Identify the five major column headings on a work...Ch. 5 - List the five steps taken in preparing a work...Ch. 5 - Prob. 14RQCh. 5 - Explain when revenues are recorded under the cash...Ch. 5 - Prob. 16RQCh. 5 - ADJUSTMENT FOR SUPPLIES On December 31, the trial...Ch. 5 - Prob. 2SEACh. 5 - ADJUSTMENT FOR WAGES On December 31, the trial...Ch. 5 - ADJUSTMENT FOR DEPRECIATION OF ASSET On December...Ch. 5 - CALCULATION OF BOOK VALUE On June 1, 20--, a...Ch. 5 - ANALYSIS OF ADJUSTING ENTRY FOR SUPPLIES Analyze...Ch. 5 - Prob. 7SEACh. 5 - POSTING ADJUSTING ENTRIES Two adjusting entries...Ch. 5 - WORK SHEET AND ADJUSTING ENTRIES A partial work...Ch. 5 - JOURNALIZING ADJUSTING ENTRIES From the...Ch. 5 - Prob. 11SEACh. 5 - ANALYSIS OF NET INCOME OR NET LOSS ON THE WORK...Ch. 5 - CASH, MODIFIED CASH, AND ACCRUAL BASES OF...Ch. 5 - ADJUSTMENTS AND WORK SHEET SHOWING NET INCOME The...Ch. 5 - ADJUSTMENTS AND WORK SHEET SHOWING A NET LOSS...Ch. 5 - JOURNALIZE AND POST ADJUSTING ENTRIES FROM THE...Ch. 5 - Prob. 17SPACh. 5 - ADJUSTMENT FOR SUPPLIES On July 31, the trial...Ch. 5 - ADJUSTMENT FOR INSURANCE On July 1, a six-month...Ch. 5 - ADJUSTMENT FOR WAGES On July 31, the trial balance...Ch. 5 - ADJUSTMENT FOR DEPRECIATION OF ASSET On July 1,...Ch. 5 - CALCULATION OF BOOK VALUE On January 1, 20--, a...Ch. 5 - ANALY SIS OF ADJUSTING ENTRY FOR SUPPLIES Analyze...Ch. 5 - ANALY SIS OF ADJUSTING ENTRY FOR INSURANCE Analyze...Ch. 5 - POSTING ADJUSTING ENTRIES Two adjusting entries...Ch. 5 - WORK SHEET AND ADJUSTING ENTRIES A partial work...Ch. 5 - JOURNALIZING ADJUSTING ENTRIES From the...Ch. 5 - EXTENDING ADJUSTED BALANCES TO THE INCOME...Ch. 5 - Prob. 12SEBCh. 5 - CASH, MODIFIED CASH, AND ACCRUAL BASES OF...Ch. 5 - Prob. 14SPBCh. 5 - Prob. 15SPBCh. 5 - JOURNALIZE AND POST ADJUSTING ENTRIES FROM THE...Ch. 5 - CORRECTING WORK SHEET WITH ERRORS A beginning...Ch. 5 - Delia Alvarez, owner of Delias Lawn Service, wants...Ch. 5 - Prob. 1MPCh. 5 - Prob. 1CP

Knowledge Booster

Learn more about

Need a deep-dive on the concept behind this application? Look no further. Learn more about this topic, accounting and related others by exploring similar questions and additional content below.Similar questions

arrow_back_ios

SEE MORE QUESTIONS

arrow_forward_ios

Recommended textbooks for you

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College

College Accounting, Chapters 1-27AccountingISBN:9781337794756Author:HEINTZ, James A.Publisher:Cengage Learning,Principles of Accounting Volume 1AccountingISBN:9781947172685Author:OpenStaxPublisher:OpenStax College- Century 21 Accounting Multicolumn JournalAccountingISBN:9781337679503Author:GilbertsonPublisher:Cengage

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning

Intermediate Accounting: Reporting And AnalysisAccountingISBN:9781337788281Author:James M. Wahlen, Jefferson P. Jones, Donald PagachPublisher:Cengage Learning College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting (Book Only): A Career ApproachAccountingISBN:9781337280570Author:Scott, Cathy J.Publisher:South-Western College Pub

College Accounting, Chapters 1-27

Accounting

ISBN:9781337794756

Author:HEINTZ, James A.

Publisher:Cengage Learning,

Principles of Accounting Volume 1

Accounting

ISBN:9781947172685

Author:OpenStax

Publisher:OpenStax College

Century 21 Accounting Multicolumn Journal

Accounting

ISBN:9781337679503

Author:Gilbertson

Publisher:Cengage

Intermediate Accounting: Reporting And Analysis

Accounting

ISBN:9781337788281

Author:James M. Wahlen, Jefferson P. Jones, Donald Pagach

Publisher:Cengage Learning

College Accounting (Book Only): A Career Approach

Accounting

ISBN:9781337280570

Author:Scott, Cathy J.

Publisher:South-Western College Pub

The accounting cycle; Author: Alanis Business academy;https://www.youtube.com/watch?v=XTspj8CtzPk;License: Standard YouTube License, CC-BY