A manager is trying to decide whether to purchase a certain part or to have it produced internally. Internal production could use either of two processes. One would entail a variable cost of $17 per unit and an annual fixed cost of $200,000; the other would entail a variable cost of $14 per unit and an annual fixed cost of $240,000. Three vendors are willing to provide the part. Vendor A has a price of $20 per unit for any volune up to 30,000 units. Vendor B has a price of $22 per unit for demand of 1,000 units or less, and $18 per unit for larger quantities. Vendor C offers a price of $21 per unit for the first 1,000 units, and $19 per unit for additional units.

a)

To determine: The best alternative from a cost standpoint for an annual volume of 10,000 units and 20,000 units.

Introduction: Decision-making is the process that helps to make decision. It is the process of choosing a best alternative by evaluating many alternatives.

Answer to Problem 8P

Explanation of Solution

Given information:

A manager has to decide whether to purchase a product or produce it internally. Internal production consists of two processes. Variable cost and fixed cost of the first process is $17 and $200,000 respectively. Variable cost and fixed cost of the second process is $14 and $240,000 respectively.

There are three vendors available to purchase a product. Vendor A has a price of $20 per unit up to 30,000 units. Vendor B has a price of $22 per unit if the demand is 1,000 units or less and $18 for larger volumes. Vendor C has a price of $21 per unit for first 1,000 units and $19 per unit for additional units.

Determine the best alternative from a cost standpoint for an annual volume of 10,000 units:

Calculate the total cost for the first internal process:

It is calculated by adding the fixed cost with the value attained by multiplying the variable cost and the annual volume. Annual volume is given as 10,000 units. Hence, the total cost for the first internal process is $370,000.

Calculate the total cost for the second internal process:

It is calculated by adding the fixed cost with the value attained by multiplying the variable cost and the annual volume. Annual volume is given as 10,000 units. Hence, the total cost for the first internal process is $380,000.

Calculate the total cost for the Vendor A:

It is calculated by multiplying the price and the annual volume. Hence, the total cost for Vendor A is $200,000.

Calculate the total cost for the Vendor B:

It is calculated by multiplying the price and the annual volume. It is given that the price is $22 if the volume is less than 1,000 and $18 if the volume is larger. As the annual volume is more than 1,000, the price is $18. Hence, the total cost for Vendor B is $180,000.

Calculate the total cost for the Vendor C:

It is calculated by multiplying the price and the annual volume. It is given that the price is $21 for the volume up to 1,000 and $19 for the additional volume. Thus, price is $21 for the 1,000 units and $19 for additional 9,000 units. Hence, the total cost for Vendor C is $192,000.

At the annual volume of 10,000 units, Vendor B has the lowest total cost of ($180,000). Hence, it should be chosen from a cost standpoint.

Determine the best alternative from a cost standpoint for an annual volume of 20,000 units:

Calculate the total cost for the first internal process:

It is calculated by adding the fixed cost with the value attained by multiplying the variable cost and the annual volume. Annual volume is given as 20,000 units. Hence, the total cost for the first internal process is $540,000.

Calculate the total cost for the second internal process:

It is calculated by adding the fixed cost with the value attained by multiplying the variable cost and the annual volume. Annual volume is given as 20,000 units. Hence, the total cost for the first internal process is $520,000.

Calculate the total cost for the Vendor A:

It is calculated by multiplying the price and the annual volume. Hence, the total cost for Vendor A is $400,000.

Calculate the total cost for the Vendor B:

It is calculated by multiplying the price and the annual volume. It is given that the price is $22 if the volume is less than 1,000 and $18 if the volume is larger. As the annual volume is more than 1,000, the price is $18. Hence, the total cost for Vendor B is $360,000.

Calculate the total cost for the Vendor C:

It is calculated by multiplying the price and the annual volume. It is given that the price is $21 for the volume up to 1,000 and $19 for the additional volume. Thus, price is $21 for the 1,000 units and $19 for additional 19,000 units. Hence, the total cost for Vendor C is $382,000.

At the annual volume of 20,000 units, Vendor B has the lowest total cost of ($360,000). Hence, it should be chosen from a cost standpoint.

b)

To determine: The range of the best alternative.

Introduction:Decision-making is the process that helps to make decision. It is the process of choosing a best alternative by evaluating many alternatives.

Answer to Problem 8P

Explanation of Solution

Given information:

A manager has to decide whether to purchase a product or produce it internally. Internal production consists of two processes. Variable cost and fixed cost of the first process is $17 and $200,000 respectively. Variable cost and fixed cost of the second process is $14 and $240,000 respectively.

There are three vendors available to purchase a product. Vendor A has a price of $20 per unit up to 30,000 units. Vendor B has a price of $22 per unit if the demand is 1,000 units or less and $18 for larger volumes. Vendor C has a price of $21 per unit for first 1,000 units and $19 per unit for additional units.

Cost function for each alternative if the annual volume is 1-1,000 units:

First internal process:

Second internal process:

Vendor A:

Vendor B:

Vendor C:

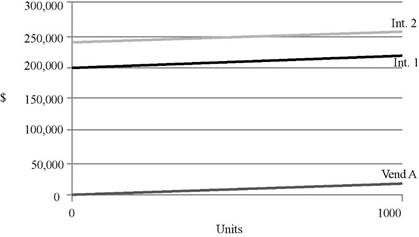

When considering the cost functions, Vendor A would exhibit less cost when compare to Vendor B and Vendor C. Vendor A should be preferred over other alternatives. The graph is as follows:

Cost function for each alternative if the annual volume is more than 1,000 units:

First internal process:

Second internal process:

Vendor A:

Vendor B:

Vendor C:

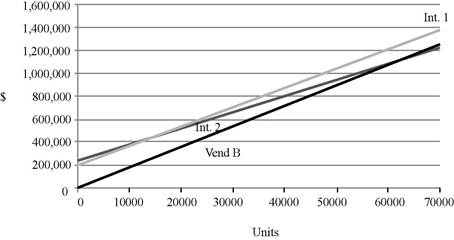

When considering the cost functions, Vendor B would dominate Vendor A and Vendor C. Hence, Vendor A and Vendor C should be eliminated. The graph considering two internal processes and Vendor B is as follows:

Determine the value of Q by equaling two cost equations:

Equal the cost function of second internal process and Vendor B to determine the value of Q.

Calculate the total cost of first internal process:

Substitute the value Q in the cost equation of first internal process. Hence, the total cost is $1,220,000.

Calculate the total cost of second internal process:

Substitute the value Q in the cost equation of second internal process. Hence, the total cost is $1,080,000.

Calculate the total cost of Vendor A:

Substitute the value Q in the cost equation of Vendor A. Hence, the total cost is $1,200,000.

Calculate the total cost of Vendor B:

Substitute the value Q in the cost equation of Vendor B. Hence, the total cost is $1,080,000.

Calculate the total cost of Vendor C:

Substitute the value Q in the cost equation of Vendor C. Hence, the total cost is $1,142,000.

Inference:

- Vendor A should be preferred when the purchasing quantity ranges from 1 to 1,000 units.

- Vendor B should be preferred when the purchasing quantity ranges from 1,001 to 59,999 units.

- There would indifferent between Vendor B and second internal process if the quantity is 60,000 units.

- Second internal process should be preferred if the quantity is more than 60,000 units.

First internal process and Vendor C are never best.

Want to see more full solutions like this?

Chapter 5 Solutions

EBK OPERATIONS MANAGEMENT

- Do the inherent differences between private and public sector objectives—profit versus publicgood—render private sector category management practices unsuitable for public sectorpurchasing, where open tendering is the norm?You have now undergone the Category Management classes and your superiors have requestedfor your input on how to integrate some of the learnings into the public sector policy. Discuss and elaborate what are the activities and governance you would introduce in yourrecommendations without violating the principle of transparency and accountability withinyour organisation. This is based on Singapore context. Pls provide a draft with explanation, examples and useful links for learning purposes. Citations will be good too. This is a module in SUSS called category management and supplier evaluationarrow_forwardTravelling and working internationally can lead to a life of adventure and unique career experiences. For businesses, selecting the right candidates to take on foreign assignments can propel, delay, or deny the success of the international ventures. As an international manager, identify key competencies you would look for in choosing expatriates. What might be some of their concerns in taking on overseas assignments? What are some best practices in supporting expats during and after their assignments?arrow_forwardTravelling and working internationally can lead to a life of adventure and unique career experiences. For businesses, selecting the right candidates to take on foreign assignments can propel, delay, or deny the success of the international ventures. As an international manager, identify key competencies you would look for in choosing expatriates. What might be some of their concerns in taking on overseas assignments? What are some best practices in supporting expats during and after their assignments?arrow_forward

- I need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes.arrow_forwardI need answer typing clear urjent no chatgpt used pls i will give 5 Upvotes. Pls full explanationarrow_forwardCariveh Co sells automotive supplies from 25 different locations in one country. Each branch has up to 30 staff working there, although most of the accounting systems are designed and implemented from the company's head office. All accounting systems, apart from petty cash, are computerised, with the internal audit department frequently advising and implementing controls within those systems. Cariveh has an internal audit department of six staff, all of whom have been employed at Cariveh for a minimum of five years and some for as long as 15 years. In the past, the chief internal auditor appoints staff within the internal audit department, although the chief executive officer (CEO) is responsible for appointing the chief internal auditor. The chief internal auditor reports directly to the finance director. The finance director also assists the chief internal auditor in deciding on the scope of work of the internal audit department. You are an audit manager in the internal audit…arrow_forward

- Cariveh Co sells automotive supplies from 25 different locations in one country. Each branch has up to 30 staff working there, although most of the accounting systems are designed and implemented from the company's head office. All accounting systems, apart from petty cash, are computerised, with the internal audit department frequently advising and implementing controls within those systems. Cariveh has an internal audit department of six staff, all of whom have been employed at Cariveh for a minimum of five years and some for as long as 15 years. In the past, the chief internal auditor appoints staff within the internal audit department, although the chief executive officer (CEO) is responsible for appointing the chief internal auditor. The chief internal auditor reports directly to the finance director. The finance director also assists the chief internal auditor in deciding on the scope of work of the internal audit department. You are an audit manager in the internal audit…arrow_forwardPlease show all steps and answers, thank you!arrow_forwardI am not sure if this is correct, because 8 cannot go directly to 10.arrow_forward

- A practical application in real life to the Critical Path Method is the construction of a bridge with references, give a detailed essay on the stages involved in constructing a bridgearrow_forwardPlease assist in writing a complete reasearch project of the following title: Title of research: Study on the impact of Technology in the Work Place.arrow_forwardIntuition is both an emotional experience and a nonconscious analytic process. One problem, however, is that not all emotions signaling that there is a problem or opportunity represent intuition. Please in your Personal opinion how we would know if our “gut feelings” are intuition or not, and if not intuition, suggest what might be causing them.arrow_forward

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing

Practical Management ScienceOperations ManagementISBN:9781337406659Author:WINSTON, Wayne L.Publisher:Cengage,MarketingMarketingISBN:9780357033791Author:Pride, William MPublisher:South Western Educational Publishing Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning

Purchasing and Supply Chain ManagementOperations ManagementISBN:9781285869681Author:Robert M. Monczka, Robert B. Handfield, Larry C. Giunipero, James L. PattersonPublisher:Cengage Learning Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning

Contemporary MarketingMarketingISBN:9780357033777Author:Louis E. Boone, David L. KurtzPublisher:Cengage Learning